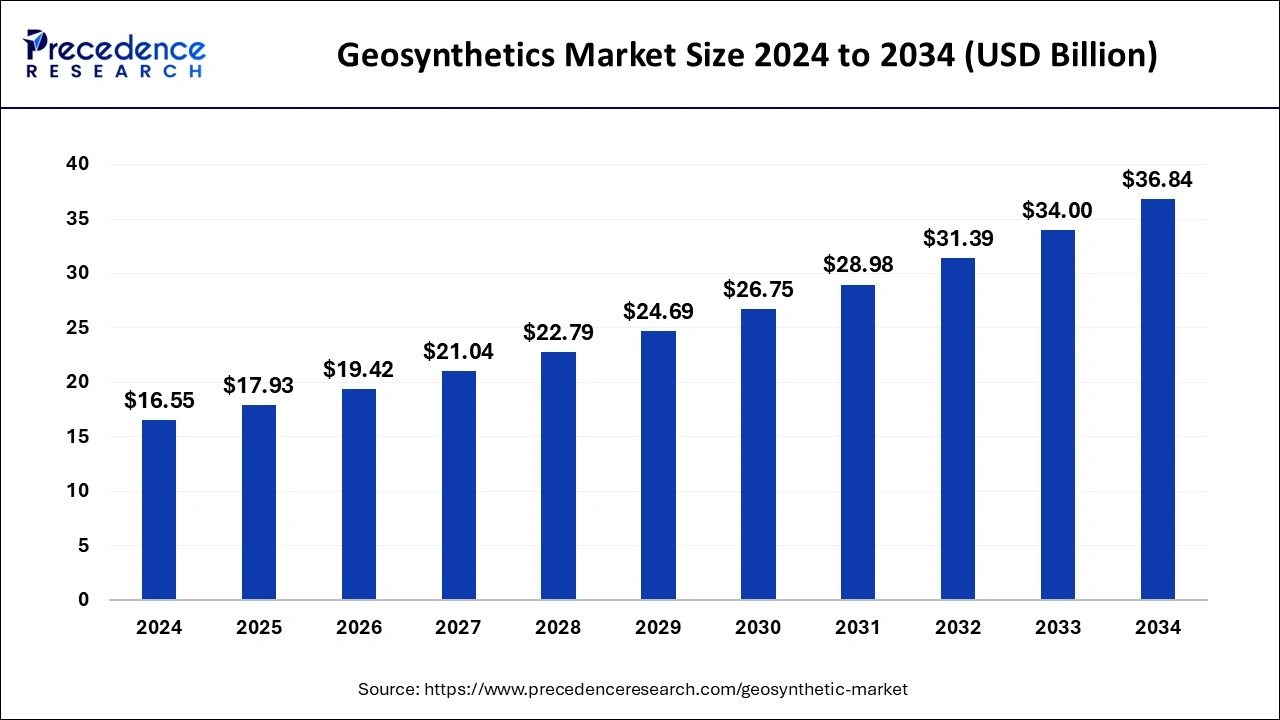

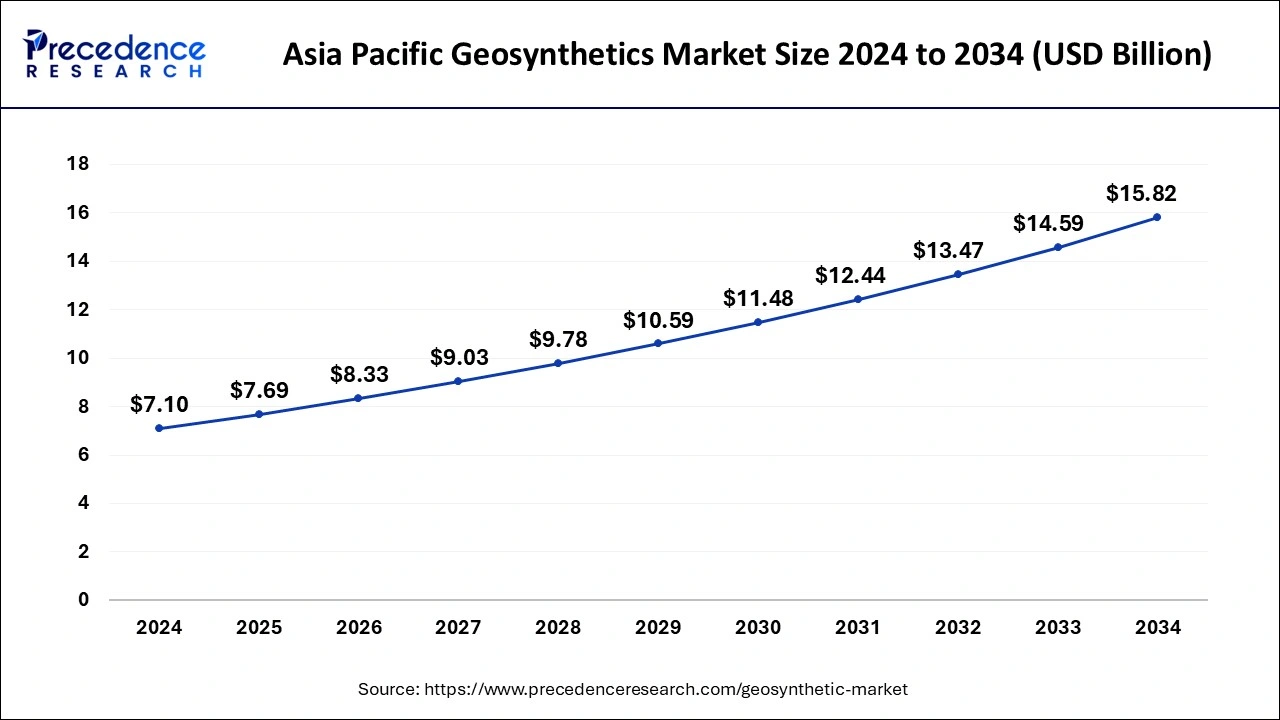

The global geosynthetics market size is calculated at USD 17.93 billion in 2025 and is forecasted to reach around USD 36.84 billion by 2034, accelerating at a CAGR of 8.33% from 2025 to 2034. The Asia Pacific geosynthetics market size surpassed USD 7.69 billion in 2025 and is expanding at a CAGR of 8.34 % during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global geosynthetics market size was accounted for USD 16.55 billion in 2024 and is anticipated to reach around USD 36.84 billion by 2034, growing at a CAGR of 8.33% from 2025 to 2034.

The Asia Pacific geosynthetics market size was evaluated at USD 7.10 billion in 2024 and is predicted to be worth around USD 15.82 billion by 2034, rising at a CAGR of 8.34 % from 2025 to 2034.

APAC will rule the geosynthetics industry in 2021. The region is expanding more quickly, which supports the geosynthetics industry's rapid expansion. China, India, and other APAC nations' rising markets are expanding, which is fostering regional market expansion. The constantly growing population, urbanization, and industrialization in the area are the main drivers of market expansion. The need for waste management systems and growing investments in infrastructural development are the main factors boosting geosynthetics consumption in the area.

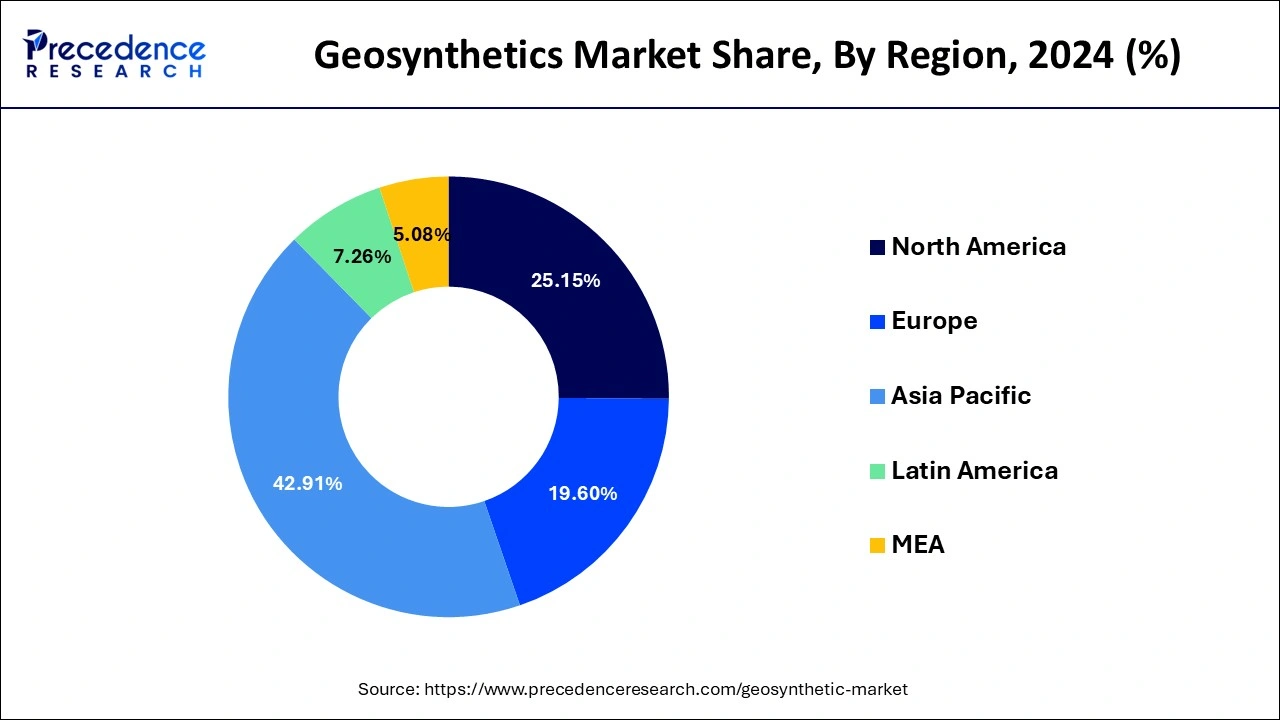

Asia Pacific dominated the global geosynthetics market with the largest market share of 42.91% in 2024. Over the projected period, the regional industry is anticipated to be driven by the increased demand for oil reinforcing in the initial work of residential properties in the expanding countries of India and China. Due to several construction directives, including M/107 or 89/106/EEC European Union, that have required the use of geosynthetics for construction projects, Europe accounted for a sizable portion of the market. Moreover, the municipal and commercial waste management techniques were subject to strict controls from the German government. Over the projected period, rising infrastructure projects in Central and South American developing economies, especially Brazil, are likely to increase geosynthetics utilization. The regional market is anticipated to increase as a result of increasing product utilization in water management procedures. The booming offshore industry for oil and gas in Brazil, Venezuela, and Argentina is another factor propelling the regional market. Geosynthetics are finding growing demand in the Middle East and Africa. Over the projection period, rising commercial and civil building projects in the area, including the building of hotels and stadiums, are projected to increase the demand for hybrid building materials like geosynthetics.

Over the forecast timeframe, it is expected that emerging markets like India and Brazil will accelerate infrastructure construction. Infrastructure improvements were stopped as a result of the implementation of a shutdown by the ruling authorities to stop the disease from spreading in 2020 resulting in the COVID-19 epidemic. Due to supply network obstacles, market participants noticed a decrease in demand for modern office buildings and other infrastructures. Companies within the industry are encouraged to enhance output by the raw material availability like Polypropylene (PP), which is made possible by the widespread presence of petrochemical compounds owned by corporations like ExxonMobil, Chevron Phillips, Shell, and BP.

Throughout the projection period, the abovementioned elements are predicted to fuel the desire for geosynthetic items in the United States. In the building of ponds, embankments, streets, and tunnels, geotextiles remain working as covering systems. Additionally, because they make it easier to separate layers of soil from the subsurface without obstructing the movement of groundwater, these materials are also utilized in the construction of a rail network. To safeguard the shoreline and encourage vegetative development, connectivity options and geocells are essential. This prevents soil erosion. Additionally, the market is anticipated to be driven by current soil preservation programs in several countries, like Canada, South Africa, Spain, and India.

Geosynthetics have recently become prevalent in several industries. In drainage channels, geosynthetics are employed as filtration components that produce continuous polyethylene threads, improving filtering effectiveness. To assure that the most dangerous particles are retained and not released into the atmosphere in bodies of water & soils, such textiles are used as filtering systems. By adding rigidity and strengthening the asphalt, geosynthetics are also combined with asphalt to boost resistance to cracking during road building. These are used in the dam construction process to lower the risk for coastal erosion when water runs over the geonet, extending the life of a barrier.

In contrast side, geomembranes are polymer sheeting that is used to line landfills, canals, and tunnels trod to keep the upper layer in position and prevent the dumping of debris. As a result, it plays a crucial role in making these places safe for human usage and extending life. Due to their capacity to disperse loads over a broader area, geocells are used in construction projects to limit degradation on steep slopes, as retaining walls, and as a sub-base reinforcement for road bases, railway tracks, etc. The development of the construction and construction industry has stayed enhanced by the upsurge in management disbursement to progress amenities in numerous countries in the effort to raise living standards, along with the rise in urbanization. Additionally, the need for Geosynthetics has been positively influenced by rising environmental precautions that aim to decrease sediment management and soil degradation. The industry for geosynthetic materials is expanding as a result of these causes and their numerous advantages.

| Report Coverage | Details |

| Market Size in 2025 | USD 17.93 Billion |

| Market Size by 2034 | USD 36.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.33% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing expenditures in the management of waste in developing nations can be attributed to the enlargement of the geosynthetics market

Growing Use of Geotextiles in a Variety of Applications Would Boost Sales

Polypropylene's Growth Furled by Attractive Features

Raw material costs change as a result of crude oil price swings

Increasing oil and gas and mining industry demand: One of the biggest users of geosynthetics is still the resource sector. The mining sector is anticipated to be driven by the Asian need for minerals and metals. Chinese is the world's top producer of metals, rare earth metals, copper, gold, coal, and gypsum, whereas India has seen major investments in the sector. Furthermore, significant international mining companies are increasingly choosing to engage in mining in South America. Huge mining capacity exists in important nations like Peru, Brazil, and Chile, where during the last five years there has been a rise in foreign company investment. The geosynthetics market is anticipated to grow throughout the projected time frame as a result of the expanding use of improved separation techniques in mining operations.

Geotextiles are constructed fabrics created using fibers that are permeable, long-lasting, and non-biodegradable. In geotechnical engineering uses like major construction, hydrogeology, building, paving, and environmental science, geotextiles are being used. Along with pavement maintenance and repairs, embankments, soil reinforcement & stabilization, asphalt replacements, and other uses, they also were utilized for draining and eroding management.

Due to its superior functionality and practical benefits over other substances, the segment dominated the market. PP, polyamide, and polyethylene polyester are the synthetic fibers used to make geotextiles. Due to growing awareness of such products' use as floater coverings for the reservoirs to regulate evaporating, decrease Volatile Organic Components (VOC) emissions, and reduce the need for draining and maintenance, geomembranes are predicted to grow at a stable CAGR in terms of profits from 2022 to 2030.

The highest sales volume belongs to resource disposal. Waste management uses geosynthetics to serve a variety of purposes, including drainage, filtration, separation, barriers, and reinforcement. industrial, Residential, and commercial garbage must be collected, moved, treated, recycled, and disposed of appropriately. Preventing the leaking of polluted liquids and gases into aquifers, freshwater, rivers, and other aquatic resources requires the use of geotextiles. During the projection period, there will likely be a greater need for waste management initiatives as a result of urbanization, population growth, and industrialization.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client