August 2024

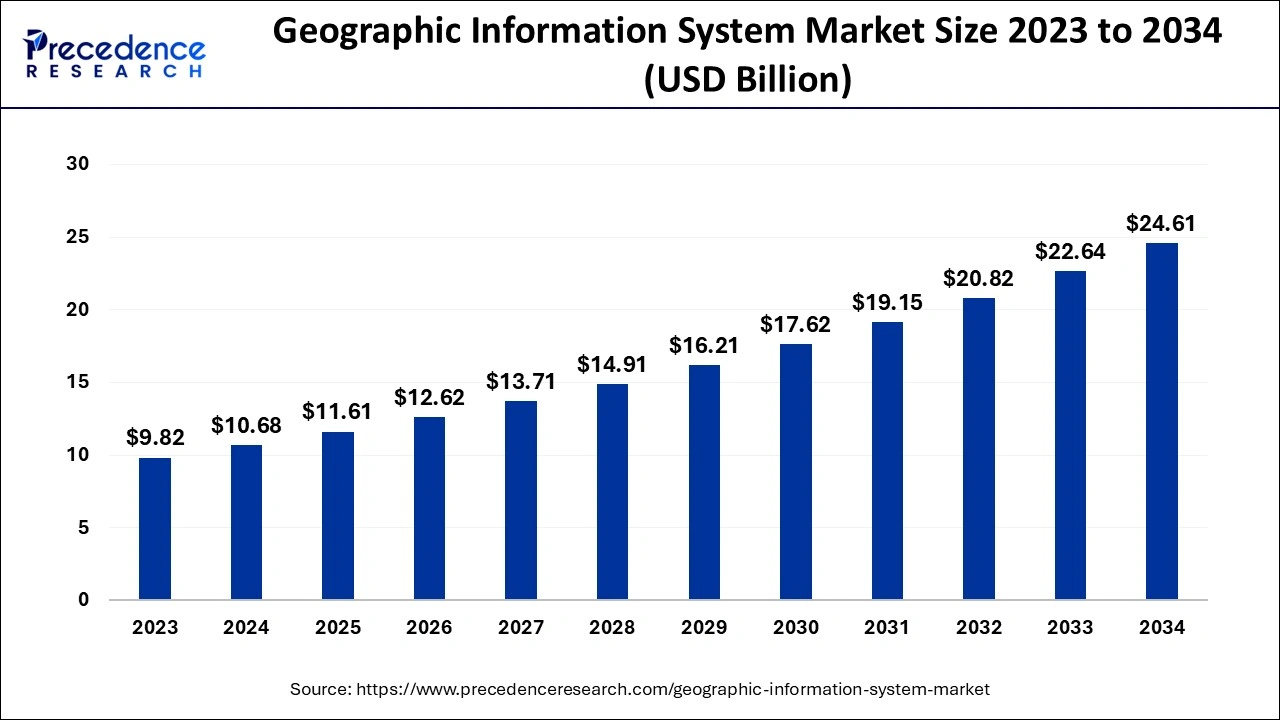

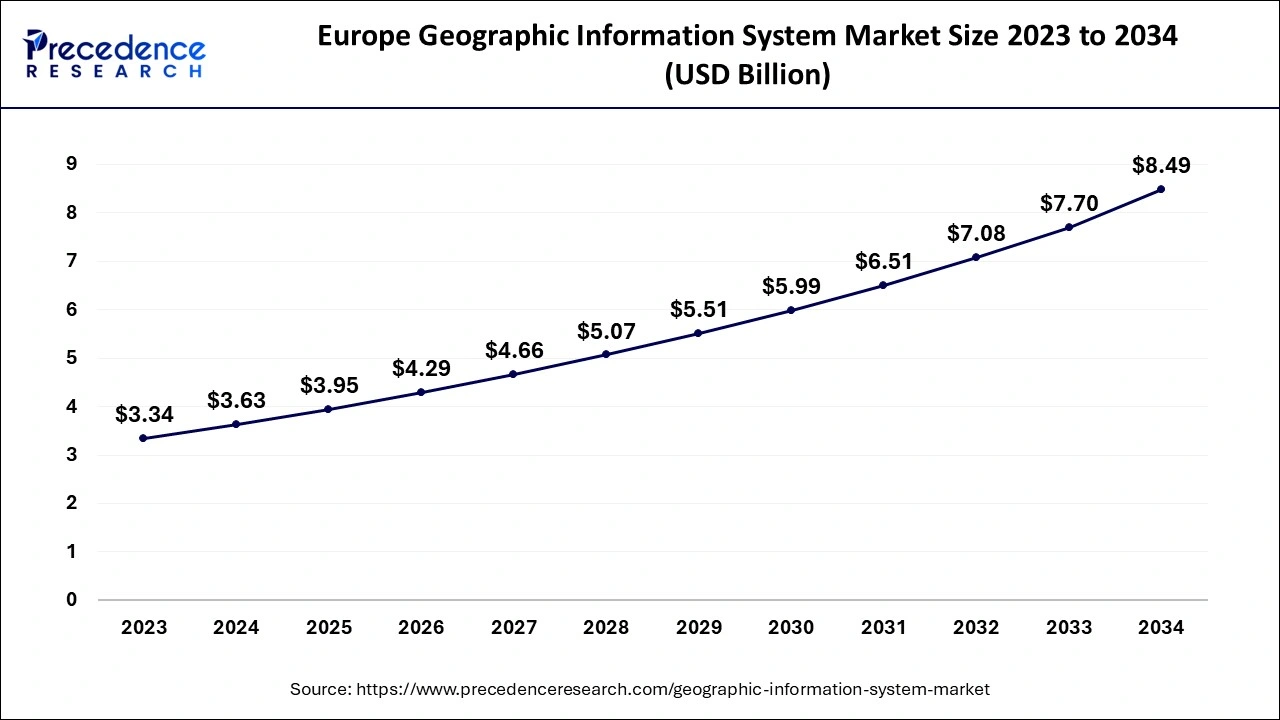

The global geographic information system market size accounted for USD 10.68 billion in 2024, grew to USD 11.61 billion in 2025 and is expected to be worth around USD 24.61billion by 2034, registering a CAGR of 8.71% between 2024 and 2034. The Europe geographic information system market size is evaluated at USD 3.63 billion in 2024 and is expected to grow at a CAGR of 8.85% during the forecast year.

The global geographic information system market size is calculated at USD 10.68 billion in 2024 and is projected to surpass around USD 24.61 billion by 2034, expanding at a CAGR of 8.71% from 2024 to 2034. Rising investments in urban infrastructure, such as smart city projects, are key factors driving market growth. Also, increasing applications of the geographic information system (GIS) in different sectors, along with the rising health concerns globally, can fuel market growth shortly.

The Europe geographic information system market size is exhibited at USD 3.63 billion in 2024 and is predicted to be worth around USD 8.49 billion by 2034, growing at a CAGR of 8.85% from 2024 to 2034.

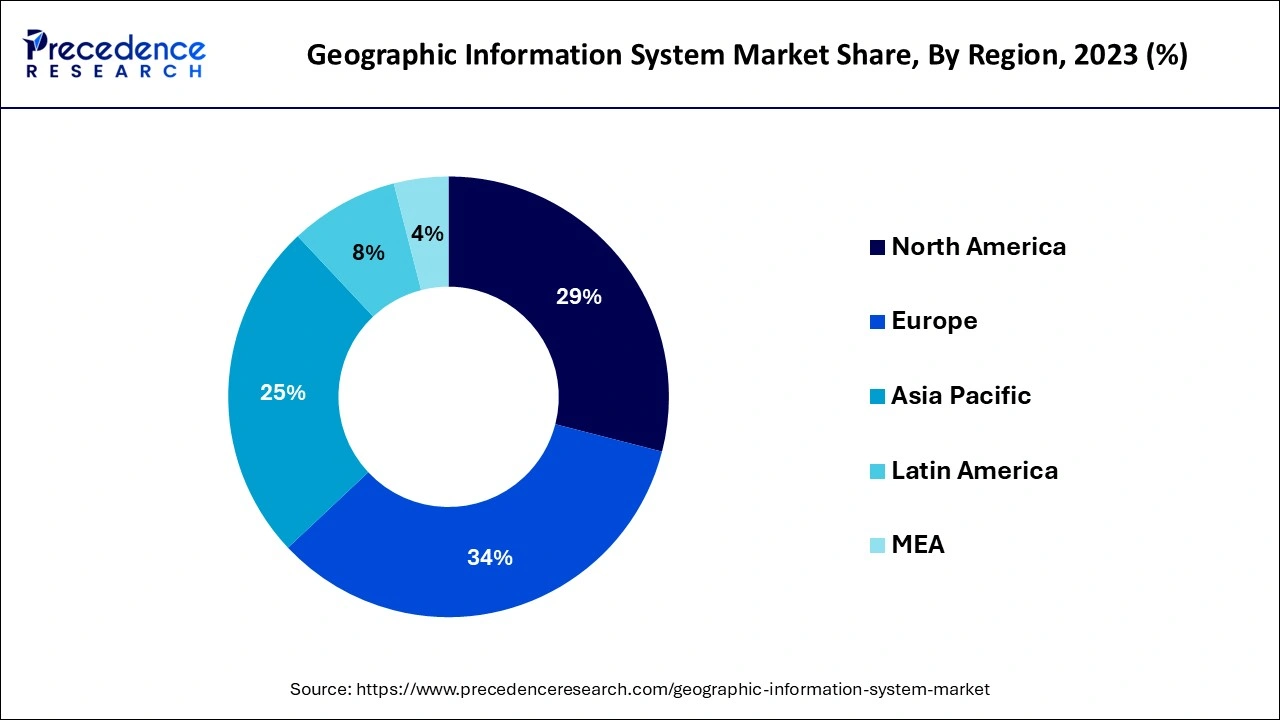

North America dominated the geographic information system market in 2023. The dominance of the segment can be attributed to the increasing adoption of advanced technology and the strong presence of market players. Furthermore, the region's embrace of advanced technologies has propelled advancements in real-time data processing and spatial analysis. Hence North America stands out as a leading market for GIS in the world.

The Asia Pacific market is anticipated to grow at the fastest rate over the forecast period. The growth of the region can be credited to the regions undergoing urban growth due to the presence of developing economies like India and China. Moreover, technological developments in the region and the rising use of GIs in resource management and urban development plans are the key factors propelling the region's geographic information system market growth.

A Geographic Information System (GIS) is a computer that generates a system for managing, storing, collecting, analyzing, and visualizing geographic data. It also combines software, technology, and other data to guide users in understanding geographical correlations GIS provides an extensive range of applications in various sectors, like in urban planning, it aids in land use management, decreasing adverse impacts on the environment while promoting growth.

Role of AI in the Geographic Information System Market

The integration of artificial intelligence (AI) with geographic information systems is expected to create new opportunities for the market. Key players are integrating artificial intelligence (AI) because of technological advancements. Furthermore, the utilization of geospatial artificial intelligence, which deploys AI to collect data from geographical data sets, has aided governments in designing smart cities and urban infrastructure.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.61 Billion |

| Market Size in 2024 | USD 10.68 Billion |

| Market Size in 2025 | USD 11.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.71% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Usage, Devices, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for GIS in disaster management

Environmental change-related natural calamities are increasing frequently stimulating the adoption of GIS for emergency response and risk assessment. Additionally, GIS technology is crucial for analyzing climatic data and predicting potential dangers along with controlling disaster response activities. The combination of Internet of Things technology with GIS can further promote the use of this system in disaster management.

Inconsistent data quality

The accuracy and dependability of the geographical data processed by GIS are important to its efficacy. Enterprises can struggle with improperly arranged data, which can result in incorrect decisions and assessments. Moreover, this problem is caused by various factors like gaps in data-gathering methods and less uniformity among datasets that affect utilization and integration.

Rising demand for cloud-based GIS solutions

Cloud technology offers flexibility, scalability, and cost-effectiveness, allowing businesses to access GIS applications from remote locations while reducing the requirement for wide on-premises infrastructure. Furthermore, the conversion to cloud-based systems stimulates real-time data cooperation and exchange across stakeholders, which is crucial for strong decision-making. Which in turn can create geographic information system market opportunities in the future.

The services segment led the geographic information system market in 2023 and is anticipated to grow at the fastest rate over the forecast period. The dominance and growth of the segment can be attributed to the rising adoption of GIS systems and other activities by market players to grow across the globe. Additionally, the increasing partnerships among the top companies in the market to enhance the GIS system can further contribute to the segment expansion.

The navigation segment dominated the geographic information system market in 2023. The dominance of the segment can be linked to the features offered by the GIS system, such as analyzing spatial data, enabling users to assess patterns, visualize routes, and optimize travel times. The GIS systems can gather real-time data related to the routes taken, locations, and fuel consumption of a specific vehicle. It can further help organizations to adjust routes and analyze traffic patterns.

The surveying segment is anticipated to grow at the fastest rate in the geographic information system market during the forecast period. The growth of the segment can be driven by the increasing use of surveyors in many industries. Surveyors also utilize different kinds of tools to process and deliver data accurately. However, the growing government collaborations with various surveyors across the globe aim at validating and developing GIS-based land acquisition plans can drive the segment's growth in the market.

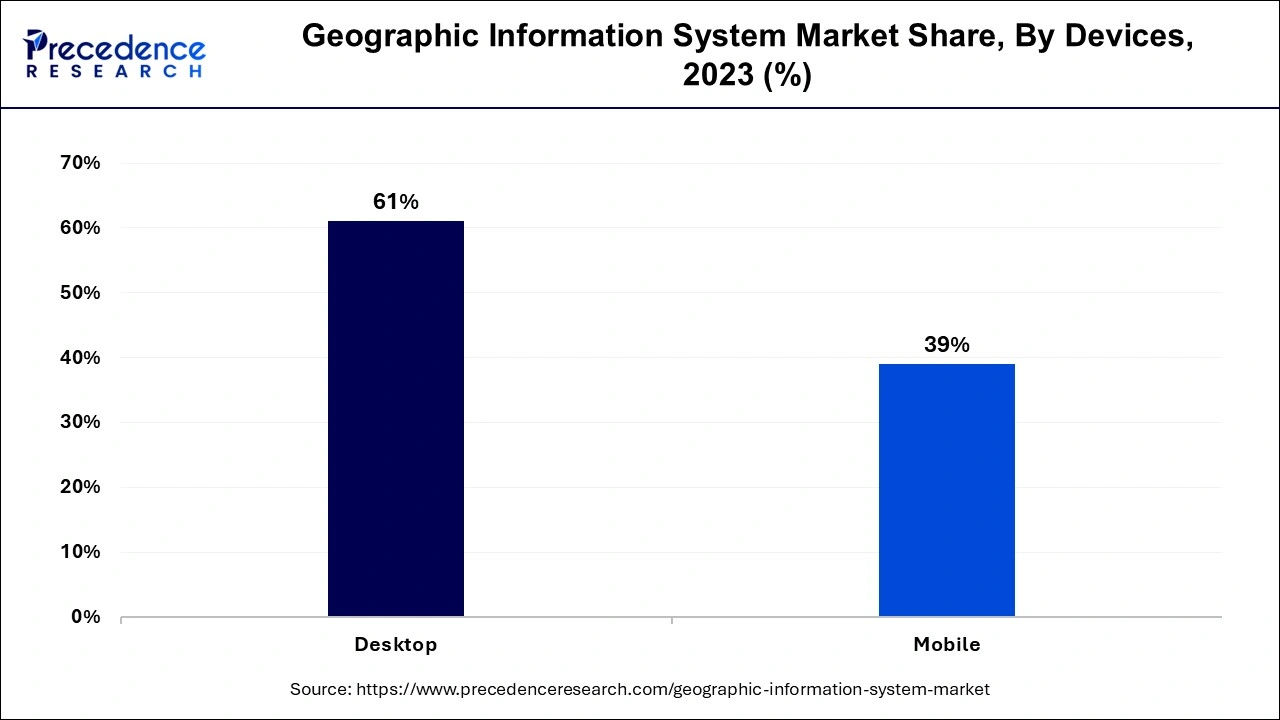

In 2023, The desktop segment dominated the geographic information system market by holding the largest market share. This is because Desktop applications enable end users to leverage innovative tools for data analysis, create detailed maps, and perform intricate spatial analyses. These features are primarily available in the desktop versions, which fuel their demand.

The mobile segment is anticipated to grow at the fastest rate in the geographic information system market over the projected period. The growth of the segment can be linked to the increasing development of innovative mobile features and applications for use in different industries. Also, the increase in demand for location-based services in a wide range of sectors, such as transportation, urban planning, and environmental management, is boosting market growth shortly.

The utilities segment led the geographic information system market in 2023. The dominance of the segment can be driven by growing urbanization across the world and the increase in demand for innovative sewage, water, telephone lines, and power lines. Furthermore, the utility segment offers critical visualization capabilities that enable keen analysis and firm decision-making.

The construction segment is estimated to grow at the fastest rate over the studied period. This is due to the sector has embraced GIS for its integral role in supplies, resource management, and personnel. Construction companies use GIS to stimulate resource allocation which results in cost effectiveness and more catered project schedules. Additionally, the segment is ready to play an important role in fuelling the expansion of the Geographic Information System market.

Segments Covered in The Report

By Component

By Usage

By Devices

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

March 2025

September 2024

August 2024