What is the Gift Cards Market Size?

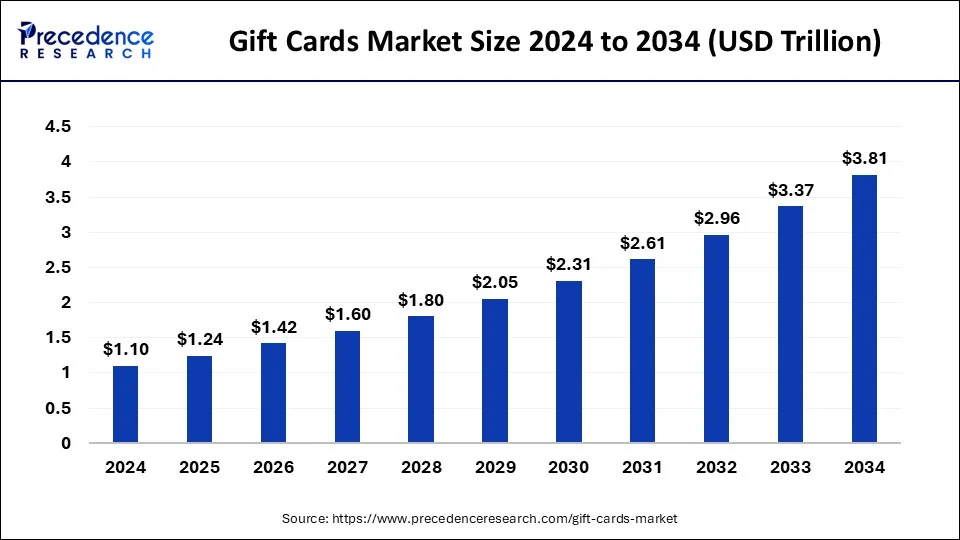

The global gift cards market size was estimated at USD 1.24 trillion in 2025 and is predicted to increase from USD 1.42 trillion in 2026 to approximately USD 4.23 trillion by 2035, expanding at a CAGR of 13.06% from 2026 to 2035.

Market Highlights

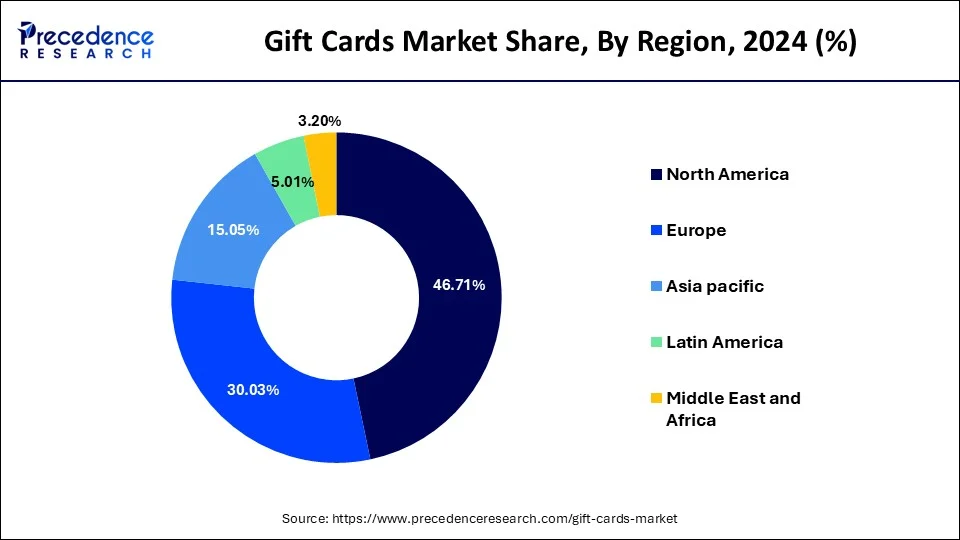

- North America dominated the global market with the largest market share of 46.71% in 2025.

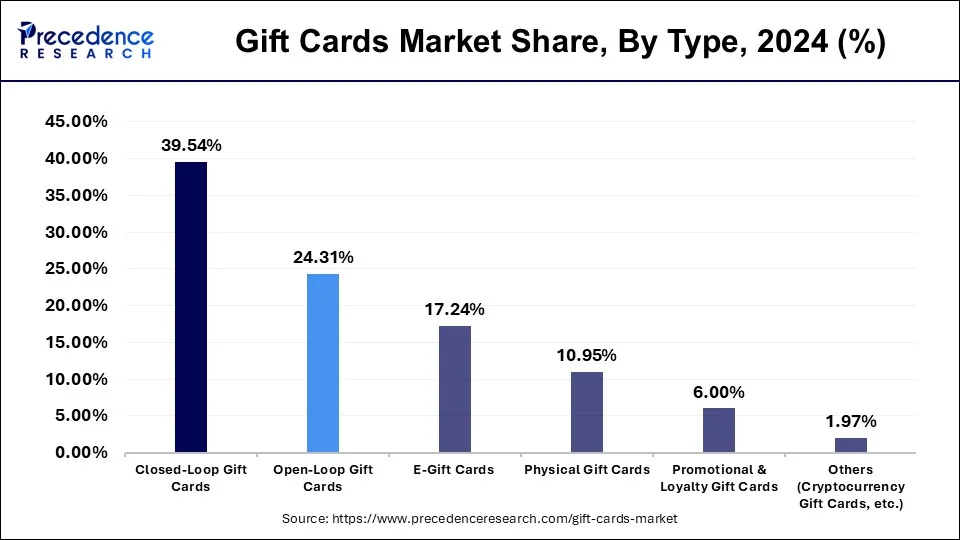

- By type, the closed-loop gift cards segment contributed the highest market share of 39.54% in 2025.

- By type, the e-gift cards segment is expected to grow at a solid CAGR of 16.23% during the forecast period.

- By application, the closed-loop gift cards segment captured the biggest market share of 27.88% in 2025.

- By application, the e-gift cards segment is projected to grow at a solid CAGR of 15.42% during the forecast period.

- By type of consumer, the individuals (B2C) segment generated a major market share of 59.10% in 2025.

- By type of consumer, the businesses/corporate (B2B) segment is expected to expand at a solid CAGR of 14.61% during the forecast period.

- By distribution channel, the online sales segment has held the largest market share of 61.35% in 2025.

- By distribution channel, the offline sales segment is expected to expand at a solid CAGR of 9.18% during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 1.24 Trillion

- Market Size in 2026: USD 1.42 Trillion

- Forecasted Market Size by 2035: USD 4.23Trillion

- CAGR (2026 to 2035): 13.06%

- Largest Market in 2025: North America

What are the Gift Cards?

The gift cards market is an industry that revolves around the offering of prepaid cards or certificates to replace cash while buying at shops or establishments. Usually, these cards have a pre-loaded cash value that the bearer can use to buy products or services from the network of the issuing merchant. Gift cards are a business income stream because they are usually purchased in advance, even if the recipient doesn't use them immediately. As a result, sales during periods when consumer demand is highest, like the holidays, may increase.

Gift cards are popular for personal use as gifts for birthdays, holidays, and other occasions. They allow recipients the flexibility to choose their own gifts while still providing a thoughtful gesture from the giver. Retailers benefit from the sale of gift cards by generating revenue upfront, even if the recipient does not redeem the full value of the card. Additionally, gift cards can drive foot traffic to stores and encourage additional spending beyond the card's value.

- In May 2023, the gift card consulting division of Powerhouse Brands, one of the top consulting firms for the closed-loop gift card market, was acquired by TOTUS, a North American gift card issuer and program manager.

How is AI Contributing to the Gift Card Process?

AI personalizes gift card selection while it enhances fraud detection, and it streamlines the buying process. The system provides brand recommendations while it helps users manage their budgets and automates the distribution process for businesses, creates personalized messages, and enables real-time transaction monitoring, which improves the gifting experience for both consumers and businesses.

Gift Cards Market Growth Factors

- Consumers favor easy options such as purchasing digital gift cards in-person or online.

- Gift cards for services like entertainment or vacation are more tempting since consumers are increasingly choosing experiences over material goods.

- Open-loop gift cards may become more popular in the market and be accepted by many businesses.

- Targeted marketing strategies catering to certain demographics can increase gift card sales, this acts as a driver for the gift cards market.

- Companies use gift cards with loyalty programs and incentives to attract and keep consumers.

- The industry can grow further by integrating digital payment platforms and mobile wallets.

Market Outlook

- Industry Growth Overview: The advancement of digital gifting, the growth of e-commerce, and corporate rewarding drive the uptake of customized, adaptable gift card solutions.

- Sustainability Trends: Brands make a focus on digital cards and materials that do not harm the environment in order to minimise the use of plastic.

- Major Investors: Blackhawk Network, InComm Payments, Fiserv, Apple, Amazon, American Express, PayPal, and Pine Labs.

Gift Cards Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.24 Trillion |

| Market Size in 2026 | USD 1.42 Trillion |

| Market Size by 2035 | USD 4.23 Trillion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.06% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Consumer Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rising popularity of personalized gift options

Gift cards frequently have customized designs in addition to personalized messages. This option enables gift givers to choose themes, pictures, or graphics that complement the recipient's preferences or the occasion. With these design options, gift givers can further customize the gift card to fit the recipient's style and tastes, enhancing the overall presentation and impact of the gift. These possibilities include a festive holiday motif, a colorful flower pattern, or a sleek and modern look. Thereby, the rising popularity of personalized gift solutions acts as a driver for the gift cards market.

Popular choice for last-minute gifts

Even though gift cards come pre-loaded with a predetermined amount, there is still room for customization. To add a personal touch to the gift-giving process, givers can pick a card from a merchant with special meaning for the receiver or choose a design that suits the occasion. Some gift cards now come with customizable features like personalized phrases or packaging to further increase their attractiveness as a personalized gift option. The popularity of this gifting practice has been further encouraged by the advent of digital gift cards. The introduction of e-gift cards has made it unnecessary for customers to buy and ship physical cards because they can send and receive presents quickly via email or mobile devices. Tech-savvy consumers find this digital convenience appealing, and it fits nicely with the expanding trend of online purchasing.

Restraint

Lack of reliability

Gift cards are prone to theft and fraud, particularly if they don't have the correct activation procedures or security features. In the absence of sufficient consumer protection, people could become victims of fraud or theft, losing the value recorded on their card and having no way to get it back. This danger discourages purchases and weakens customer confidence in the gift card market. Technical glitches or errors in the activation, redemption, or balance checking process can result in frustration for both gift card purchasers and recipients. If consumers encounter difficulties using or redeeming their gift cards, they may be less likely to purchase them in the future or recommend them to others.

Opportunity

Growing demand for e-gift cards

In today's fast-paced world, people highly prize rapid gratification. This need is met by e-gift cards, which may be sent to recipients immediately via email or mobile device. Because e-gift cards are delivered instantly, there are no waiting periods like traditional gift cards, making them the perfect option for last-minute or impulsive purchases. E-gift cards are advantageous for retailers from a sustainability and cost-efficiency standpoint. The expenditures of printing, packaging, and shipping physical cards are removed with digital delivery, which reduces overhead and has a positive environmental impact. Because they are so affordable, shops are encouraged to highlight e-gift cards as the best alternative for giving, which will increase market acceptance. Thereby, the rising demand for e-gift cards acts as an opportunity for the gift cards market.

Segments Insights

Type Insights

The e-gift cards segment is anticipated to expand at the highest CAGR during the forecast period. The segment growth can be attributed to the rising demand for convenient gifting options. E-gift cards provide more advantages over traditional cards, such as instant delivery, more choices, easy tracking options, fewer errors, more reward choices, automatic delivery, and no plastic waste. Digital e-gift cards are cost-effective, reducing the need for physical gifts. These cards are readily accessible through mobile apps, making them more convenient and popular.

Application Insights

The consumer gifting segment dominated the gift cards market with the largest share in 2025. Consumer gifting helps to strengthen relationships, build trust, and increase loyalty with actionable working strategies. Moreover, gifting improves consumer engagement at every stage of a program: before, during, and after. Corporate gifts help express gratitude and appreciation and also draw the attention of new joiners.

The healthcare and wellness segment is anticipated to expand at the fastest rate during the projection period. Wellness gifts are gaining immense traction in the corporate sector. Appreciating employees with wellness gifts is a great way to improve overall morale. These gifts help build good relations among the employees. Such healthy practices will improve productivity and employee engagement. Moreover, consumers are increasingly focusing on health and wellness, making healthcare & wellness gifts a popular option to gift someone, especially health-conscious people.

Gift Cards Market Revenue, By Application 2022-2024 (USD Billion)

| Application | 2022 | 2023 | 2024 |

| Consumer Gifting | 237.56 | 270.04 | 306.69 |

| Corporate Gifting & Incentives | 183.87 | 217.66 | 258.39 |

| Online Shopping & E-Commerce | 148.70 | 176.41 | 209.88 |

| Travel & Hospitality | 69.06 | 80.96 | 95.19 |

| Food & Beverages | 55.79 | 65.67 | 77.52 |

| Entertainment & Media | 53.34 | 62.20 | 72.76 |

| Healthcare & Wellness | 33.44 | 39.98 | 47.98 |

| Others (Charity & Donation, etc.) | 22.78 | 26.82 | 31.59 |

Consumer Type Insights

The individuals (B2C) segment held the largest share of the market in 2025. The segment growth is mainly driven by the increasing preference for personalized gift cards. Thoughtful gifts make a positive emotional bond between the business and the customer, leading to healthier relationships. The flexibility and convenience of gift cards make them popular for various functions.

The businesses/corporate (B2B) segment is likely to register the fastest growth in the coming years. This segment involves the distribution of gift cards among clients, employees, prospects, or business partners on behalf of an organization. Gifting increases customer loyalty because employees who obtain gifts are more likely to continue doing business with the same organization. The rising awareness among entrepreneurs about the benefits of reward programs is expected to support segmental growth. Gifting gift cards as a reward is a thoughtful way to show appreciation to employees, clients, and partners. Gift cards are also used as a marketing tool to attract new customers.

Gift Cards Market Revenue, By Consumer Type, 2022-2024 (USD Billion)

| Type of Consumer | 2022 | 2023 | 2024 |

| Individuals (B2C) | 484.01 | 560.35 | 650.08 |

| Businesses/Corporate (B2B) | 284.50 | 336.96 | 399.86 |

| Institutional/Non-Profit Organizations | 36.03 | 42.42 | 50.06 |

Distribution Channel Insights

The online sales segment dominated the market in 2025 and is expected to grow at the fastest rate in the upcoming period. The expansion of e-commerce has increased the popularity of online gift cards. Online sales provide advantages such as flexibility and convenience for both recipients and buyers and can potentially increase brand sales. Online gift cards are easily accessible through mobile apps, email, or any digital platform, making them widely accessible. With these online gift cards, consumers can visit a particular website and redeem the payment against one or more purchases. The rising trend of online shopping makes online gift cards more popular, contributing to segmental growth.

Gift Cards Market Revenue, By Distribution Channel, 2022-2024 (USD Billion)

| Distribution Channel | 2022 | 2023 | 2024 |

| Online Sales | 476.94 | 568.67 | 674.87 |

| Offline Sales | 327.59 | 371.06 | 425.13 |

Regional Insights

What is the U.S. Gift Cards Market Size?

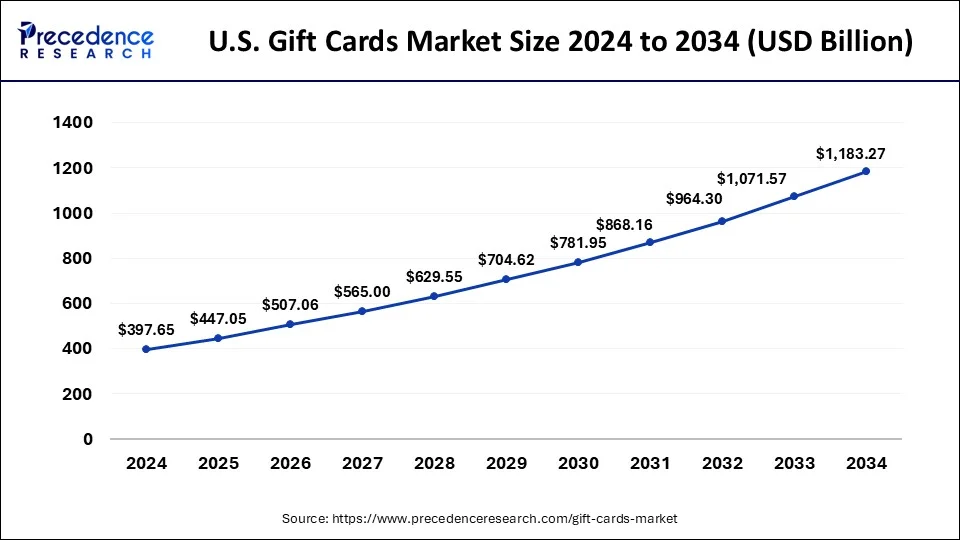

The U.S. gift cards market size was estimated at USD 447.05 billion in 2025 and is predicted to surpass around USD 1,292.02 billion by 2035 with a remarkable CAGR of 11.20% from 2026 to 2035.

North America held the largest share in 2025 in the gift cards market and is observed to sustain the position throughout the predicted timeframe. With its strong consumer culture, gift-giving is common in North America for various occasions, including graduations, weddings, holidays, and birthdays. Gift cards are becoming popular for these occasions because of their adaptability and simplicity. Retailers and companies frequently use gift card promotions and loyalty programs to attract customers. Retailers and gift card issuers profit from these schemes, encouraging consumers to buy and utilize gift cards.

The U.S. is a major contributor to the North American gift cards market. The increasing popularity of online services and mobile payment options has considerably increased the adoption of digital gift cards in the U.S. The increasing gift-giving trends and traditions in the U.S. reflect a transformation in the country's values, particularly during the holidays and special occasions. Businesses in the country are increasingly focusing on improving employee engagement, boosting the demand for gift cards for incentive programs to boost employee loyalty.

The U.S. gift card sector is the largest and most developed, and is over USD 200 billion with continued growth. Digital gift cards are now widely accepted and adapted by consumers and mobile apps and e-wallets have drastically changed consumer behavior. The digital gift card competition is biased to Amazon, Walmart, and Target with corporate gifting also playing a significant part in the gifting industry. The demand also has significant seasonal peaks during Black Friday, Cyber Monday, and Christmas.

The primary driver of the UK gift card market is a strong retail ecosystem and increasing preference for contactless payments, likely for more than £8 billion annually. The bulk of the market centers on B2B gifting (ex. employee reward/recognition birthday gifts, customer incentives, etc). There is a digital transformation occurring that includes e-gift card demand, e-gift cards have exploded with increased fintech innovation and the expansions of mobile wallets. The pandemic accelerated the shift to digital formats and since then numerous brands like Tesco, John Lewis, and Marks & Spencer have salmoned many options for e-gift card alternatives. Another consideration for the gift card market is other regulatory initiatives that are further enhancing the gift card market and modifying issues relating to consumer protection like expiry, rights to cancellation, and transparency to consumers.

Asia-Pacific is observed to be the fastest-growing in gift cards market during the forecast period. Consumer behavior is shifting in favor of digital transactions and convenience. Gift cards are a practical way to give something special to someone since they let the receiver select the goods or services they want. This is in line with the tastes of the region's tech-savvy consumers, especially the younger set, who are more favoring digital payment methods. The retail environment in Asia-Pacific has completely changed with the introduction of e-commerce platforms. Online shopping is increasingly popular among consumers as smartphones and internet connectivity become more widely used. The market for gift cards is expanding because e-commerce platforms frequently include gift cards in their promotional campaigns.

India is expected to have a stronghold on the Asia Pacific gift cards market. There is a high demand for flexible and personalized gifts. The rise in consumer disposable income has increased the trend of gift-giving, especially during festive seasons like Diwali. With the rise of e-commerce, consumers in the region are increasingly preferring to send gifts electronically, boosting the demand for e-gift cards.

- In September 2024, Tata Neu launched a "Gift Card Store” ahead of the festive season in India. This gift store provides customers with a variety of gifting options. The store features over 100 brands from various categories, including both Tata and non-Tata brands.

The Indian gift card market is surging with a CAGR of 15+% projected to 2030. The growth of e-commerce players, including Flipkart and Amazon India, combined with the deep penetration of smartphones and digital payment adoption (via UPI) has spurred demand for gift cards. Corporate gifting for employee recognition, corporate engagements as festive rewards, and collaborations with influencers are a few of the growth drivers. Furthermore, fintech startups and neo-banking platforms are utilizing gift cards as a way to acquire customers and engage as new channels, which is leading to India becoming one of the fastest-growing digital gift card markets in Asia.

Europe is observedt to witness a significant growth in the gift cards market during the forecast period. Gift card issuers and retailers now have more opportunities to reach a wider audience due to the expansion of cross-border e-commerce inside Europe. Gift cards are a practical way to send gifts overseas without requiring physical delivery or currency translation. With the growth of international e-commerce, gift cards are becoming an increasingly popular payment option.

Gift Cards Market Companies

- Amazon.com, Inc.: Offers physical and online gift cards that can be reused throughout its marketplace, individual gifting, and scalable corporate reward delivery with integrated APIs.

- Walmart: Provides both physical and digital gift cards that can be used in the shops and online, which include the purchase of groceries and other essential items, as well as purchases of merchandise in general.

- Starbucks Coffee Company: Offers reloadable digital gift cards that are closely integrated with its mobile application, which allows it to make payments easily, provide loyalty bonuses, and engage its customers through personalization.

Other Major Key Players

- McDonald's Corporation

- Target Corporation

- Netflix Inc.

- Spotify AB

- Microsoft

- Sony Corporation

- Marriott International, Inc.

- Airbnb, Inc.

- Zalando

- Walgreen Co.

- H&M Group

- InComm Payments

- American Express Company

- Blackhawk Network

- Other

Industry Leader Announcement

- In March 2025, Razorpay introduced Engage Gift Cards at the 6th edition of its flagship event, Razorpay FTX'25. Engage Gift Cards is the India's first intelligent, customisable gift card platform designed to redefine customer loyalty and engagement. Arpit Chug, CFO of Razorpay, said, “We envisioned a smarter way for businesses to engage their customers, beyond just discounts and ads. With Engage Gift Cards Platform, businesses are in complete control, allowing them to customize discounts for different customer and design gift cards for specific products or services.”

Recent Developments

- In January 2026, Mana Minds partners with Wanda Exchange to launch the Wanda Crypto Gift Card, utilizing a licensed VASP infrastructure. This collaboration enables retailers to enter the cryptocurrency gift card market through a compliant and regulated distribution network. (Source: https://chainwire.org )

- In November 2025, Klarna expanded its partnership with Blackhawk Network to enhance gift card purchasing options ahead of the holidays. This collaboration allows flexible payments on Giftcards.com, catering to the rising demand for gift cards, projected to reach a market value of $447 billion by 2025. (Source: https://financialit.net )

- In October 2025, Blackhawk Network (BHN) partnered with Google Play to launch a gift card mall within the Play Store. Users can now purchase and send gift cards from leading brands, including BHN's Originals, with secure delivery via email or text directly in the Play Store. (Source: https://www.businesswire.com )

- In October 2024 (Oct?24,?2024), Hallmark introduced its innovative “Gift Card Greetings”, merging traditional greeting cards with embedded QR?coded digital gift cards. Priced at $4.99 and available via Hallmark's Gold Crown stores and website, this hybrid solution combines tangible sentiment with the convenience of digital gifting, redeemable at over 100 major retailers. (Source: https://www.theverge.com)

- In February 2024, Roblox, a worldwide immersive platform for communication and engagement, and Blackhawk Network (BHN) have teamed up to provide digital gift cards in the following currencies: Austrian (EUR), Belgian (EUR), Swiss Franc (CFH), and Brazilian Real (BRL) on Roblox's gift card website, Roblox.com/giftcards. Customers in each nation can now use local currencies to purchase Roblox digital gift cards.

- In July 2024, Air India launched Air India Gift Cards for both domestic and international flights. These cards provide a great way for travelers to gift traveling experiences to their loved ones. These cards are available from Rs 1,000 to Rs 200,000.

Segments Covered in the Report

By Type

- Closed-Loop Gift Cards

- Open-Loop Gift Cards

- E-Gift Cards

- Physical Gift Cards

- Promotional & Loyalty Gift Cards

- Others (Cryptocurrency Gift Cards, etc.)

By Application

- Consumer Gifting

- Corporate Gifting & Incentives

- Online Shopping & E-Commerce

- Travel & Hospitality

- Food & Beverages

- Entertainment & Media

- Healthcare & Wellness

- Others (Charity & Donation, etc.)

By Type of Consumer

- Individuals (B2C)

- Businesses/Corporate (B2B)

- Institutional/Non-Profit Organizations

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting