January 2025

Glioblastoma Multiforme Treatment Market (By Treatment: Surgery, Radiation Therapy, Chemotherapy, Targeted Therapy, Tumor Treating Field (TTF) Therapy, Immunotherapy; By Drug Class: TMZ, Carboplatin, Cisplatin, Bevacizumab, Others; By End-user: Hospitals, Clinics, Ambulatory Surgical Centers) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

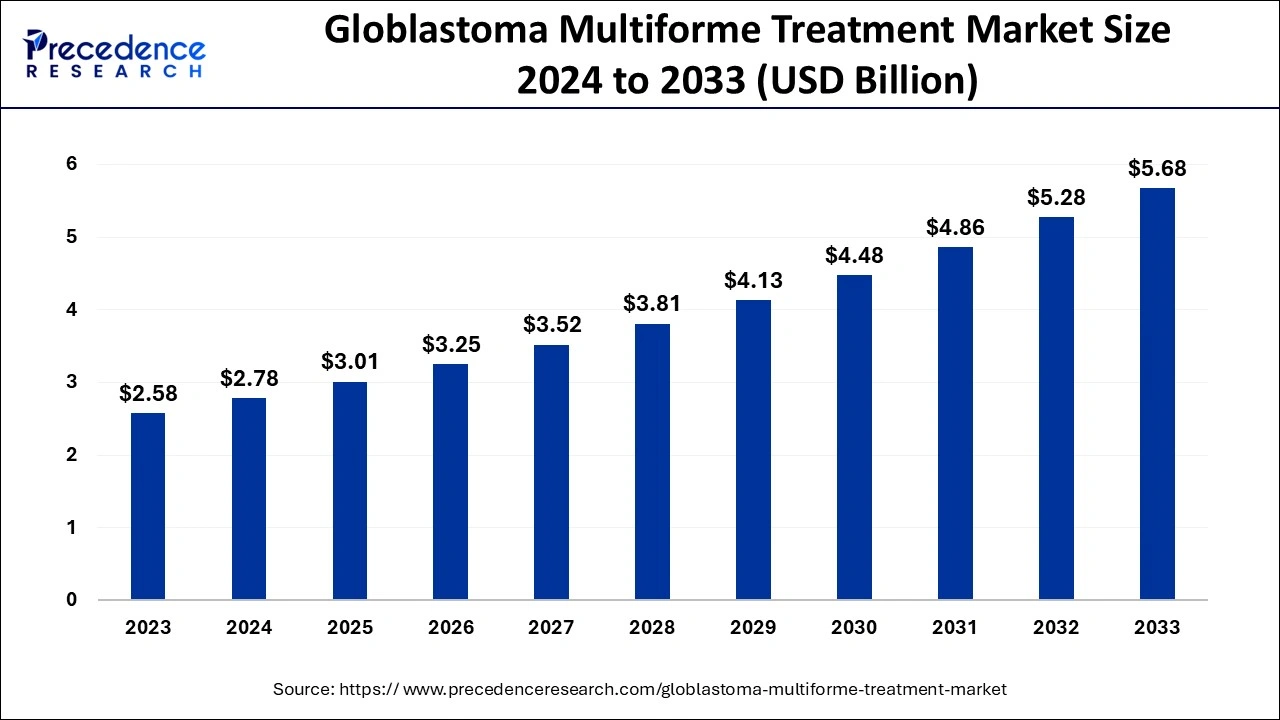

The global glioblastoma multiforme treatment market size was valued at USD 2.58 billion in 2023 and is anticipated to reach around USD 5.68 billion by 2033, growing at a CAGR of 8.23% from 2024 to 2033. The glioblastoma multiforme treatment market is driven by an increasing incidence of glioblastoma multiforme.

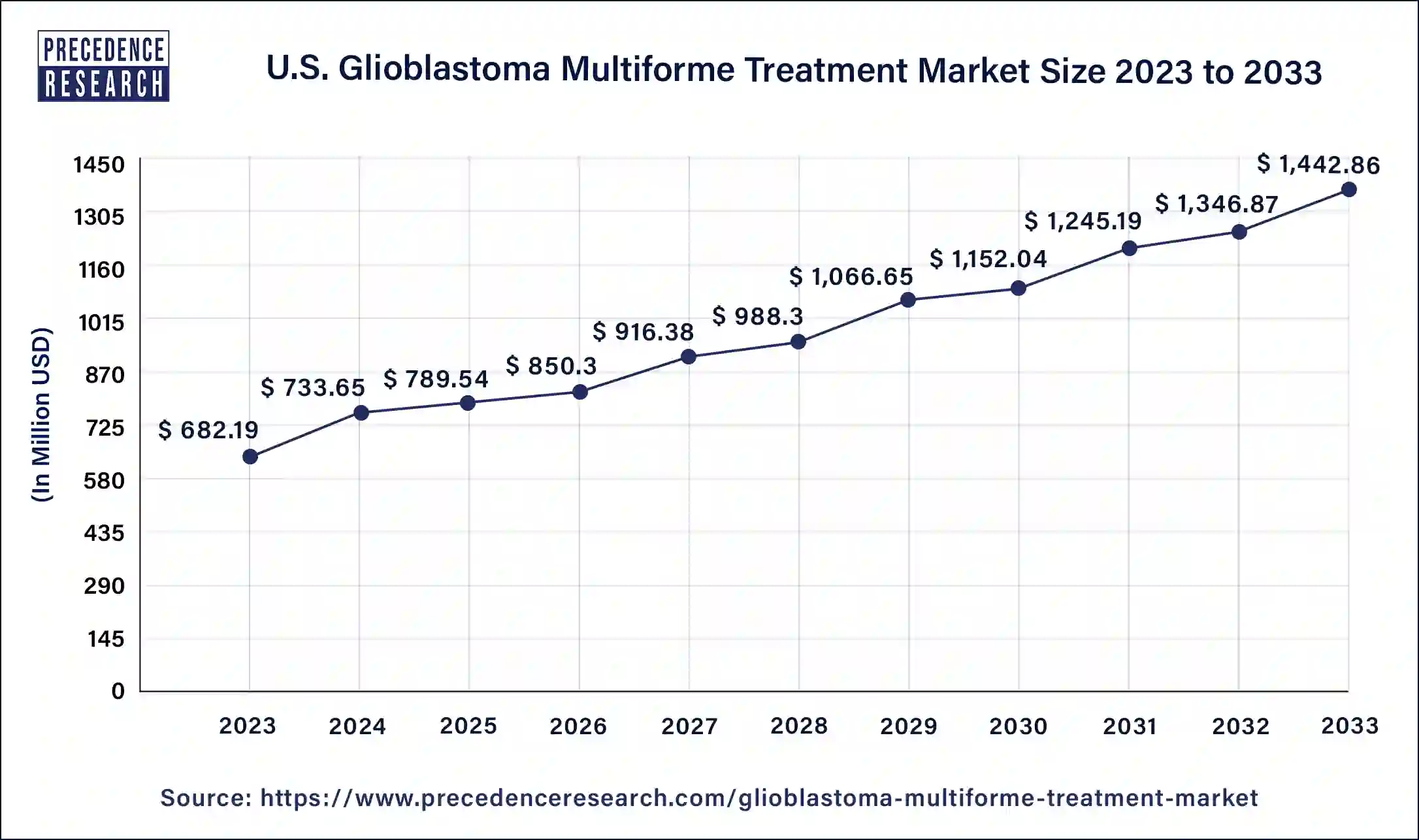

The U.S. glioblastoma multiforme treatment market size was estimated at USD 682.19 million in 2023 and is predicted to be worth around USD 1,442.86 million by 2033 with a CAGR of 7.80% from 2024 to 2033.

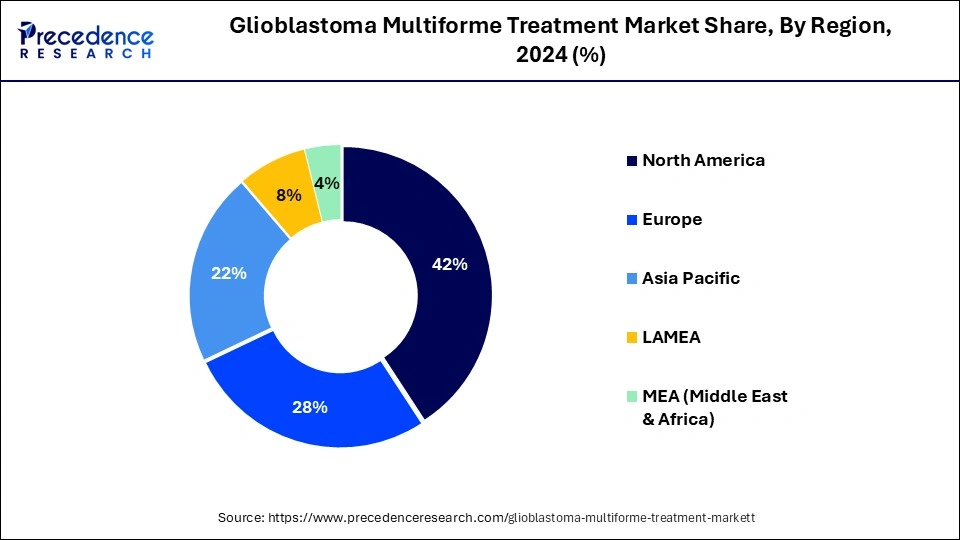

North America had largest market share in 2023 in the glioblastoma multiforme treatment market. North America held the most significant revenue share in the global market for glioblastoma multiforme treatment. This can be attributed to the government's increased investments and programs aimed at enhancing human health and helping the area prevent and eradicate cancer.

For example, the U.S. Health Resources and Services Administration stated in May 2022 that community health centers will be able to collect $5 million to support impartial access to possibly life-saving cancer screenings. President Joe Biden's Unity Agenda and his call for action on early cancer diagnosis and screening are supported by this financing, which is by the Administration's Cancer Moonshot pledge to end cancer.

Asia-Pacific is observed to be the fastest growing in the glioblastoma multiforme treatment market during the forecast period. In Asia-Pacific, glioblastoma multiforme is becoming more common due to advancements in diagnosis and an aging population. This growth is influencing the need for efficient therapies. Governments and nonprofit groups are educating the public about brain cancers, such as glioblastoma, through awareness campaigns. Early diagnosis and treatment have improved patient outcomes. Asian nations are working more closely with multinational pharmaceutical corporations to introduce cutting-edge GBM therapies to the area. Clinical trials, technology transfer, and local treatment production are frequently a part of these partnerships.

The Asia Pacific glioblastoma multiforme treatment market size was calculated at USD 558.46 million in 2023 and is projected to expand around USD 1,302.16 million by 2033, poised to grow at a CAGR of 8.86% from 2024 to 2033.

| Forecast Year | Market Size in USD |

| 2023 | $ 558.46 Million |

| 2024 | $ 606.62 Million |

| 2025 | $ 659.39 Million |

| 2026 | $ 717.25 Million |

| 2027 | $ 780.75 Million |

| 2028 | $ 850.48 Million |

| 2029 | $ 927.11 Million |

| 2030 | $ 1,011.38 Million |

| 2031 | $ 1,104.13 Million |

| 2032 | $ 1,206.28 Million |

| 2033 | $ 1,302.16 Million |

Glioblastoma Multiforme Treatment Market Overview

Glioblastoma is a severe form of cancer that can arise in the brain or spinal cord. Glioblastoma growth originates from the astrocytes that sustain nerve cells. It can occur at any age but frequently strikes older people. Possible side effects include increased headaches, seizures, vomiting, and nausea. Glioblastoma, commonly known as glioblastoma multiforme, can be extremely difficult to treat and often has no approved treatment.

Glioblastoma Multiforme Treatment Market Data and Statistics

| Report Coverage | Details |

| Glioblastoma Multiforme Treatment Market Size in 2023 | USD 2.58 Billion |

| Glioblastoma Multiforme Treatment Market Size in 2024 | USD 2.78 Billion |

| Glioblastoma Multiforme Treatment Market Size by 2033 | USD 5.68 Billion |

| Glioblastoma Multiforme Treatment Market Growth Rate | CAGR of 8.23% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Treatment, Drug Class, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Increasing incidence of brain tumors

Advances in neurosurgical methods improve tumor resection results. Thanks to developments like intensity-modulated radiation therapy (IMRT) and stereotactic radiosurgery (SRS), more accurate targeting of tumor cells is possible. To increase the survival rates and quality of life for GBM patients, new targeted therapeutics and chemotherapeutic drugs, including bevacizumab and temozolomide, are being developed and improved. New GBM treatments can enter the market more quickly when granted fast-track, orphan drug classification, or priority evaluation by regulatory bodies such as the FDA and EMA. This drives the growth of the glioblastoma multiforme treatment market.

Rise in awareness about chemotherapy treatment

Due to the proliferation of digital media and easy access to internet medical information, patients and caregivers are becoming increasingly informed about GBM and its treatment choices. Their heightened consciousness enables patients to pursue cutting-edge therapies, such as chemotherapy, and to stand up for themselves or their loved ones. Cancer awareness is a common topic of public health campaigns, highlighting the value of early detection and treatment. These advertisements emphasize the part chemotherapy plays in treating GBM, which helps increase demand and acceptance for it.

Restraints

Diversity within tumors can lead to the development of treatment-resistant cells and complicate the design of therapies

Genes can be amplified, or new mutations can be acquired by tumor cells to help them avoid the effects of drugs. For instance, EGFR gene mutations are frequently seen in GBM, and distinct mutations may result in differing degrees of EGFR drug resistance. Tumor cells can survive chemotherapy or radiation therapy by changing the expression of specific genes through modifications to DNA methylation and histone modifications.

High investment required for the treatment of glioblastoma multiforme treatment

Due to their knowledge, neurosurgeons, oncologists, radiologists, and other specialized healthcare workers command substantial wages. Comprehensive patient care necessitates multidisciplinary teams that include nurses, rehabilitation therapists, and support personnel, which drives up prices even more.

The availability of pricey GBM treatments may be restricted by financial constraints faced by healthcare providers and public health services. High expenses force difficult choices about how best to allocate resources, which may impact the availability and standard of care for GBM patients. This limits the growth of the glioblastoma multiforme treatment market.

Opportunity

Tumor-treating fields to broaden market prospects

The effectiveness of TTFields in extending progression-free and overall survival in patients with GBM has been shown in clinical trials. In the EF-14 phase III experiment, for example, patients who received TTFields in addition to temozolomide had a median overall survival of 20.9 months. In contrast, patients who received temozolomide alone had a median survival of 16 months. Moreover, TTFields are generally well tolerated; mild to severe skin irritation at the application site is the most frequent side effect. For many patients, including those who might not be able to withstand harsh treatments, TTFields is a good alternative due to its favorable safety profile.

Glioblastoma Multiforme Treatment Market Revenue ($ Million), by Treatment 2020 to 2023

| By Treatment | 2020 | 2021 | 2022 | 2023 |

| Surgery | 688.04 | 739.14 | 794.62 | 854.83 |

| Radiation Therapy | 456.91 | 493.3 | 532.99 | 576.25 |

| Chemotherapy | 430.13 | 466.24 | 505.77 | 549 |

| Targeted Therapy | 268.01 | 286.76 | 307.04 | 328.98 |

| Tumor Treating Field (TTF) Therapy | 83.22 | 89.23 | 95.73 | 102.78 |

| Immunotherapy | 133.69 | 144.98 | 157.29 | 170.7 |

The surgery segment dominated in 2023 with a 33.10% market share in the glioblastoma multiforme treatment market. If the tumor can be completely removed, reoperation should be suggested; if not, adjuvant therapy should be administered if the patient's prognosis warrants a second operation. A third procedure could not be helpful in cases of glioblastoma recurrence. In the US, primary malignant tumors of the brain and spinal cord were expected to affect 24,810 people in 2023.

The radiation therapy segment is observed to be the fastest growing in the glioblastoma multiforme treatment market during the forecast period. It is anticipated that radiation therapy will rule the market. Radiation therapy is often administered for six weeks after glioblastoma multiforme surgery. The patient receives oral chemotherapy and minimal daily radiotherapy. Experts state that individuals who undergo both surgery and radiation therapy have better outcomes and live longer than those who merely receive surgery. This phenomenon fosters the expansion of the radiation therapy market and creates a need for radiation therapy. Since radiation treatment was initially utilized to treat GBM a few years ago, its techniques have significantly improved.

Previously, the entire brain was treated when neurological cancer occurred. Radiation therapy has, however, improved treatment protocols, leading to more precise and selective targeting of essential brain areas. This phenomenon elevates the rise of radiation therapy.

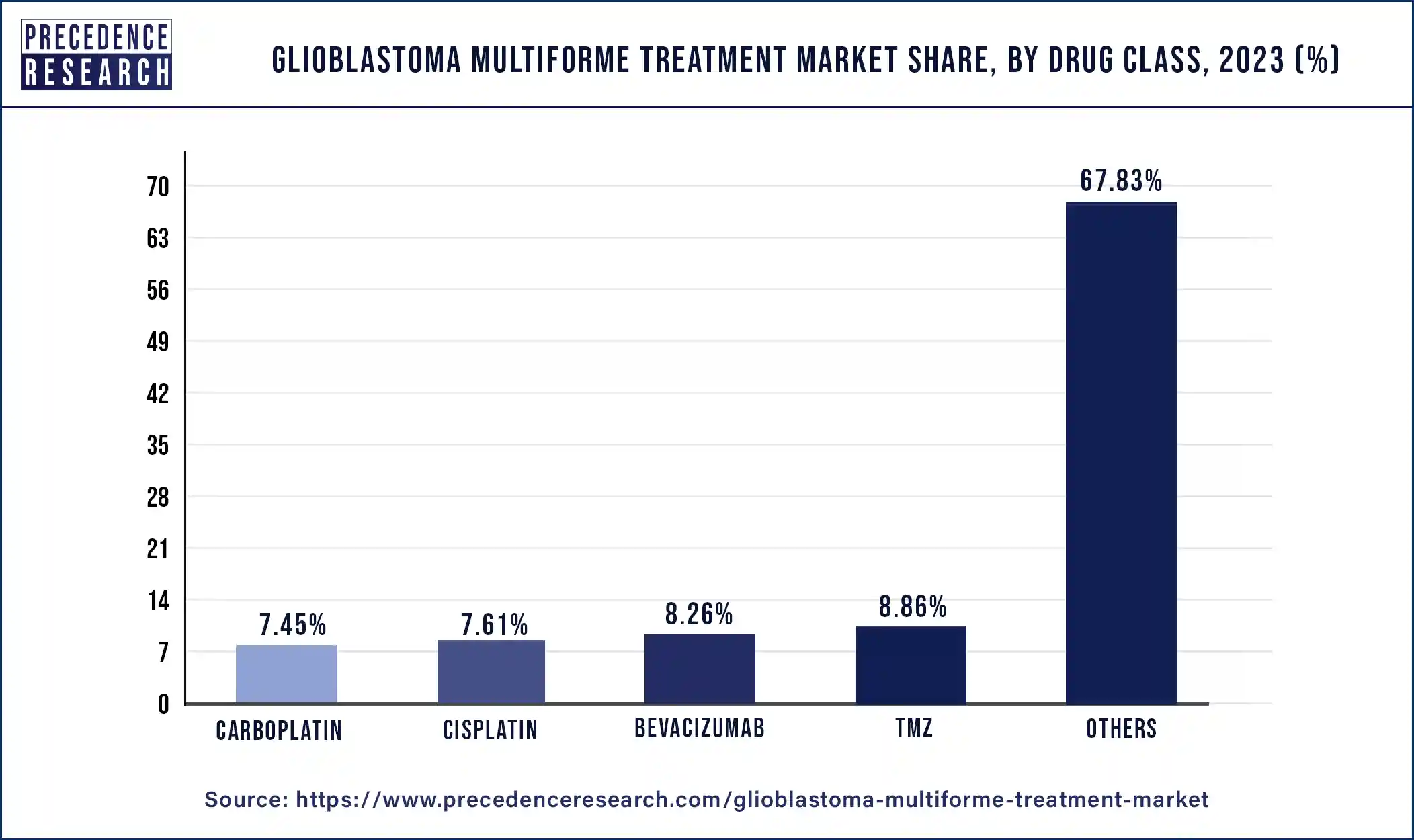

The TMZ segment dominated in the glioblastoma multiforme treatment market in 2023. A standard treatment for glioblastoma multiforme is Temozolomide (TMZ). The FDA approval of Temozolomide in the therapeutic management of glioblastoma multiforme has improved patient survival compared to radiation therapy alone. Furthermore, the discovery and study of combination medicines, such as Temozolomide, is intriguingly stimulating the growth of the TMZ market. In one study, for example, vaccines were administered in addition to radiation therapy and Temozolomide in a study on the function of vaccine treatment in glioblastoma published by Frontiers Media S.A.

Moreover, partnerships between clinical development and pharmaceutical companies dramatically quicken the TMZ segment's expansion. For instance, to develop NMS-293, Nerviano Medical Sciences and Merck KGaA, located in Darmstadt, Germany, established a licensing arrangement and collaboration. In Phase I trials, NMS-293 is being studied as a monotherapy for patients with BRCA-mutated cancers and in combination with temozolomide to treat recurrent glioblastoma.

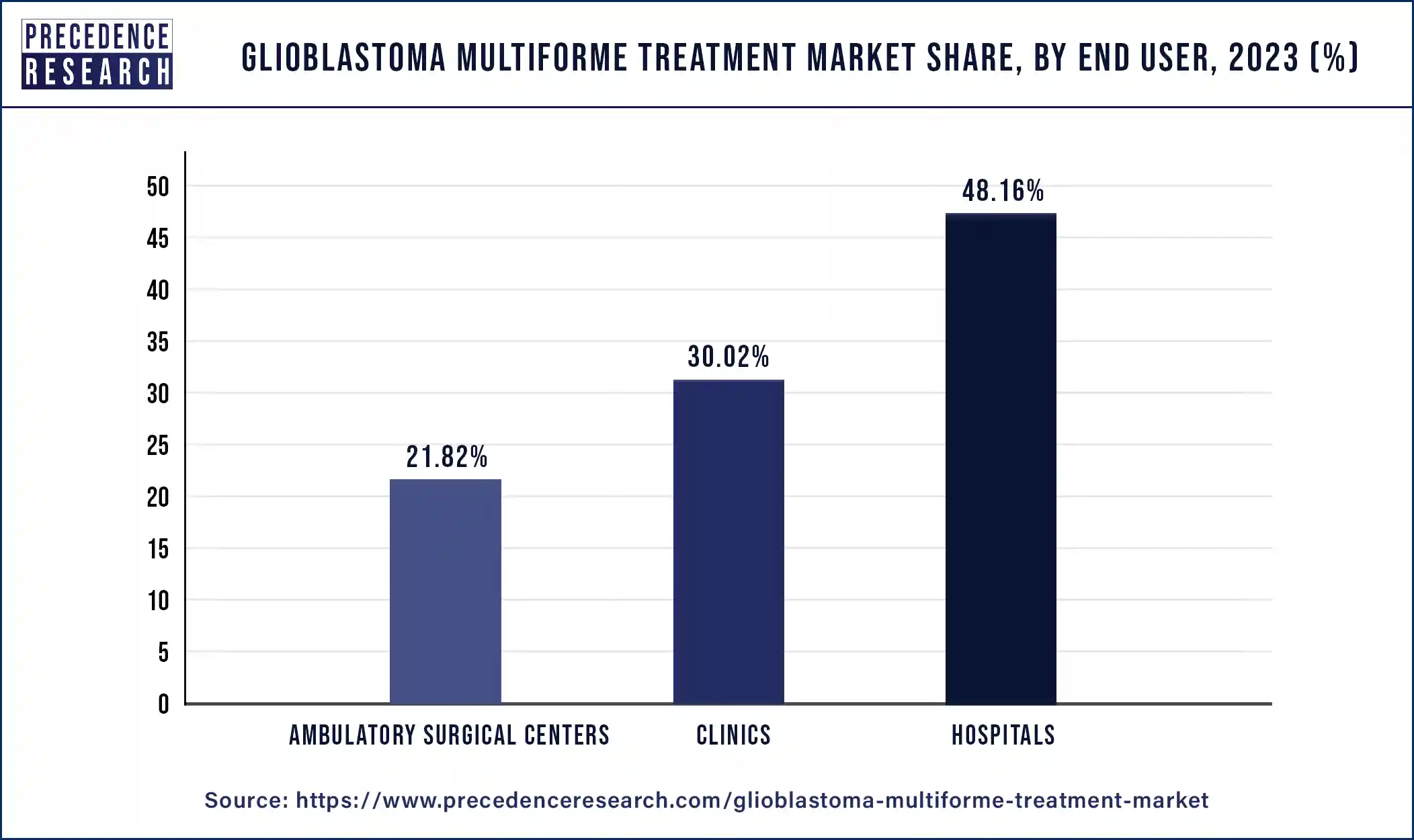

The hospitals segment dominated in 2023 with 48.16% market share in the glioblastoma multiforme treatment market. With more cases of GBM patients, there is a greater need for glioblastoma multiforme procedures, which propels the expansion of the hospital segment. For example, as previously said, around 14,000 new cases of glioblastoma are diagnosed in the United States each year. This increases demand for surgical operations, radiation therapy, and chemotherapy, further driving the segment's growth.

The clinics segment was the second largest with 30.14% market share in 2023 in the glioblastoma multiforme treatment market. Clinics usually have access to the newest technologies and treatment procedures. This covers sophisticated surgical methods, the latest imaging technology, and innovative radiation treatments, including proton therapy and stereotactic radiosurgery. Clinics may be able to treat patients more precisely and successfully thanks to these capabilities, which could lead to better patient outcomes. Particularly for individuals residing in suburban or rural areas, clinics are frequently more accessible than large hospitals. Due to its geographic accessibility, patients can more easily receive follow-up care and frequent treatments without having to travel far, which can be especially difficult for individuals with severe medical disorders like GBM.

Segments Covered in the Report

By Treatment

By Drug Class

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

February 2025

September 2024