May 2024

Global Cosmetic Ingredients Market (By Ingredient Type: Surfactant, Humectant, Actives, Powders, Oils, Others; By Ingredient Function: Emulsifier, Emollient, Preservatives, Antioxidants, Others; By Application: Facial Makeup, Eye Makeup, Nail Products, Fragrances, Lip Products, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032

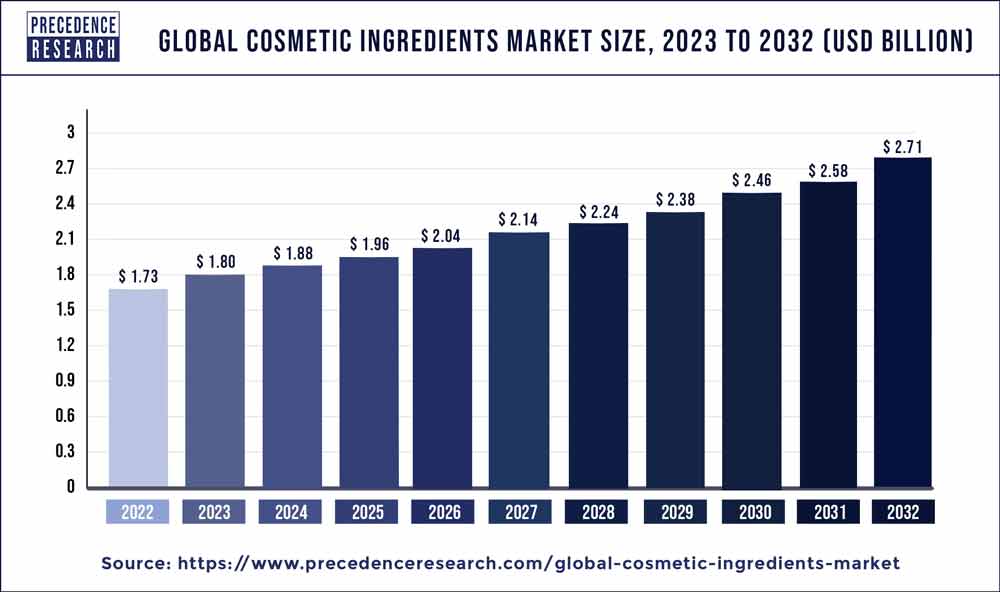

The global cosmetic ingredients market size was exhibited at USD 1.73 billion in 2022 and is projected to hit around USD 2.71 billion by 2032 with a registered CAGR of 4.65% during the forecast period 2023 to 2032. With the rising disposable incomes, the willingness to spend on premium cosmetic products is observed to act as a major driver for the cosmetic ingredients market.

Key Takeaways

The cosmetic ingredients market revolves around the production and supply of multiple chemical compounds and natural substances used for the formulation of cosmetic and personal care products. Cosmetic ingredients play a crucial role in developing skincare, haircare and other beauty products, contributing to their texture and appearance. The rising popularity of clean beauty, natural and organic products and the emergence of advanced technologies for product formulation influence the expansion of the cosmetic ingredients market. As consumers increasingly seek products that enhance their physical appearance and align with their values, the cosmetic ingredients market has witnessed a remarkable shift.

Driver: Expansion of e-commerce businesses

The expansion of e-commerce websites as well as applications across the globe is observed to act as a major driver for the market. E-commerce allows cosmetic ingredient suppliers to reach a global audience. Online businesses easily showcase and sell their products to customers around the world, expanding their market beyond geographical boundaries. E-commerce platforms cater to a diverse customer base. Different demographics and regions may have varying skincare and cosmetic needs. E-commerce businesses leverage data analytics to understand consumer preferences and tailor their offerings, accordingly, driving demand for a wide range of cosmetic ingredients.

Restraint: Stringent government regulations

Strict norms and regulations are enforced by governments across the globe to guarantee the safety and effectiveness of cosmetic goods. These rules provide requirements for the composition, labelling, and general safety of cosmetics and address the usage of different components in them. For cosmetic ingredient manufacturers, complying with these requirements frequently necessitates significant testing and documentation, which can be costly and time-consuming. It becomes difficult to meet these strict regulations, especially for smaller businesses with tighter budgets. Furthermore, firms may be required to reformulate their products in response to updates and changes in rules, which could result in extra expenses and possible delays in releasing new items. Strict adherence to legal requirements can stifle creativity, raise manufacturing costs, and erect obstacles to entrance into the cosmetic ingredient market.

Opportunity: Rising demand for customized beauty products

Customers, especially the younger ones with the requirement for customized beauty products are observed to supplement the market’s growth with their views on everything, including the value of self-care, the concept of sustainability, and the role of influencers and essential opinion leaders. Personalized skincare and cosmetic products that meet individuals' requirements and preferences are becoming increasingly popular. Cosmetic producers have responded to consumer demand for customization by creating goods with unique formulas, textures, and characteristics. A greater variety and inventiveness of cosmetic substances are required to provide these customized beauty solutions. Research and development efforts are being pushed by this trend, which is changing the cosmetics industry, to offer a wide variety of components that may be customized to fit individual skin concerns, preferences, and lifestyle choices of individual customers.

Segment Insights

The surfactant segment held the largest market share of 25.2% in 2022 owing to their characteristic of versatile compounds that help reduce surface tension between different substances, allowing them to mix more effectively. In cosmetics, surfactants are commonly used in products such as cleansers, shampoos, and shower gels to create a stable and uniform mixture of water and oil-based ingredients. The ability of surfactants to create stable emulsions enhances the overall quality and shelf life of cosmetic formulations has made them a significant ingredient to produce shampoos, lotions and other emulsion-based products.

On the other hand, the powders segment is observed to expand at the fastest CAGR of 4.79% during the forecast period. Due to their ability to absorb oil, several powdered substances can be used in formulas for oil control and mattifying powders. Customers with mixed or oily skin may find this very captivating. Cosmetic products' texture may be influenced by powdered components. They can add to the product's entire sensory experience by improving spread ability.

The emulsifier segment dominated the cosmetic ingredients market with 29.0% market share in 2022. Many cosmetic formulations contain active ingredients that provide specific benefits to the skin. Emulsifiers facilitate the even distribution and delivery of these active ingredients, enhancing their efficacy. Owing to their versatility, emulsifiers can be found in many different types of cosmetic formulations, such as lotions, serums, creams, and even some hair care products. Because of their adaptability, they are a basic component of many cosmetic formulas.

On the other hand, the emollient segment is observed to expand at a CAGR of 4.86% during the forecast period. Emollients support the maintenance of a healthy skin barrier, assist seal in moisture, and shield the skin from external stresses. This is especially crucial for people whose skin is sensitive or dry.

The facial makeup segment held the share of 23.7% while dominating the cosmetic ingredients market in 2022. The rise of social media platforms has significantly impacted the beauty industry. Makeup tutorials, beauty influencers, and product reviews on these platforms drive consumer awareness and contribute to the popularity of facial makeup products. Improved compositions for face makeup products have been made possible by developments in the technology of cosmetic ingredients. Their appeal is further increased by the long-lasting formulas, skincare-beneficial items, and products that work for different skin types. An abundance of personalization is available with facial cosmetic products, letting users select items according to their own preferences, skin types, and concerns. Consumer interaction with face makeup products has increased as a result of this customization trend.

The nail products segment is observed to expand at a CAGR of 4.82% during the forecast period. Nail art and manicures have become increasingly popular as a form of self-expression and fashion. The demand for a wide variety of nail colors, finishes, and decorative elements has driven growth in the nail product segment.

Asia Pacific held the largest market of the market while contributing over 33.12% in 2022. The expansion of e-commerce businesses in Asian countries is observed to reflect in a positive way on the cosmetic ingredients market. A larger audience can now obtain beauty items more easily as a result of the expansion of e-commerce platforms. The demand for cosmetic ingredients is being driven by consumers' ease of access to a wide range of skincare and cosmetic goods through online exploration and purchase.

Substantial research and development spending in the Asia Pacific cosmetics business has resulted in the creation of novel and cutting-edge cosmetic ingredients. The market has grown as a result of innovations in formulations and ingredients, especially those sourced from natural sources. Grooming and appearance have become more important due to urbanisation and changing lifestyles. The need for a range of cosmetic ingredients has been fuelled by the desire for skincare and cosmetic solutions that address certain requirements and preferences.

Ingredient Type

By Ingredient Function

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

August 2023

November 2024

November 2024