August 2024

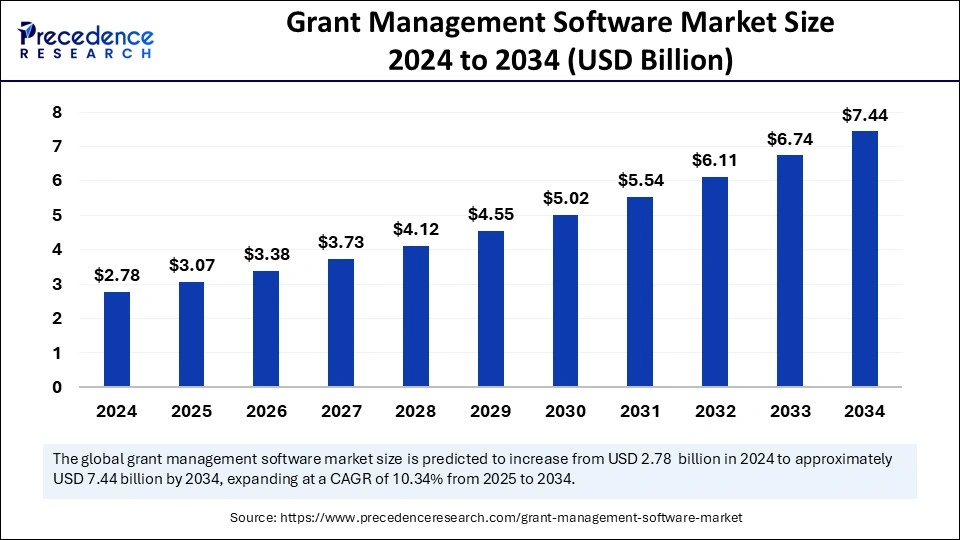

The global grant management software market size is evaluated at USD 3.07 billion in 2025 and is forecasted to hit around USD 7.44 billion by 2034, growing at a CAGR of 10.34% from 2025 to 2034. The North America market size was accounted at USD 0.97 billion in 2024 and is expanding at a CAGR of 10.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global grant management software market size was calculated at USD 2.78 billion in 2024 and is predicted to increase from USD 3.07 billion in 2025 to approximately USD 7.44 billion by 2034, expanding at a CAGR of 10.34% from 2025 to 2034.The market growth is attributed to the increasing need for streamlined, transparent, and data-driven grant allocation processes among public, private, and nonprofit organizations.

Grant management software receives a fundamental transformation from artificial intelligence, which boosts both speed and accuracy. Grant administrators benefit from AI automation, which handles routine operations between vendors, so they dedicate their time to strategic work. AI can automate routine tasks like data entry, freeing up grant managers to focus on other key areas. AI-driven analytics assist organizations in determining their proposal success potential and recognizing meaningful projects. Moreover, the application review procedure greatly benefits from NLP by scanning extensive text information, further facilitating validation and regulatory compliance.

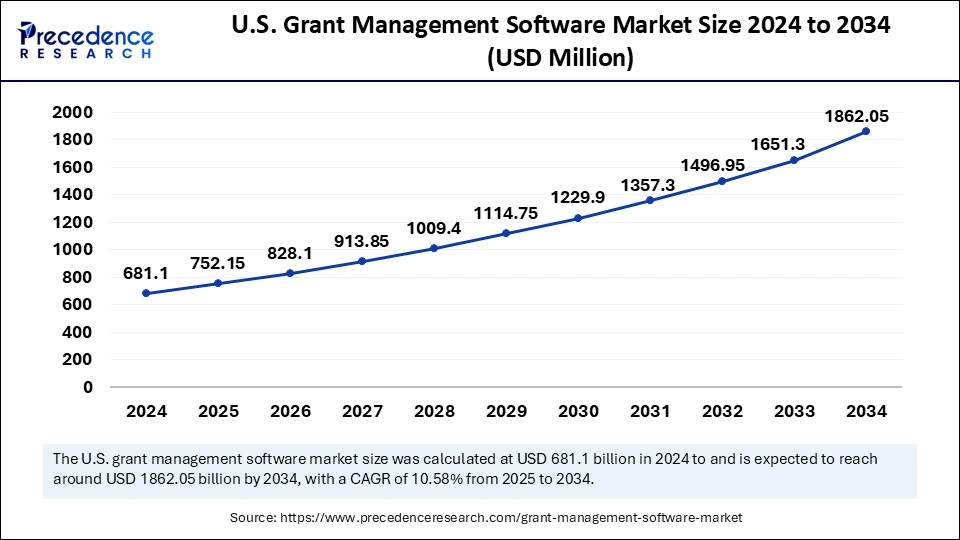

The U.S. grant management software market size was evaluated at USD 681.10 million in 2024 and is projected to be worth around USD 1862.05 million by 2034, growing at a CAGR of 10.58% from 2025 to 2034.

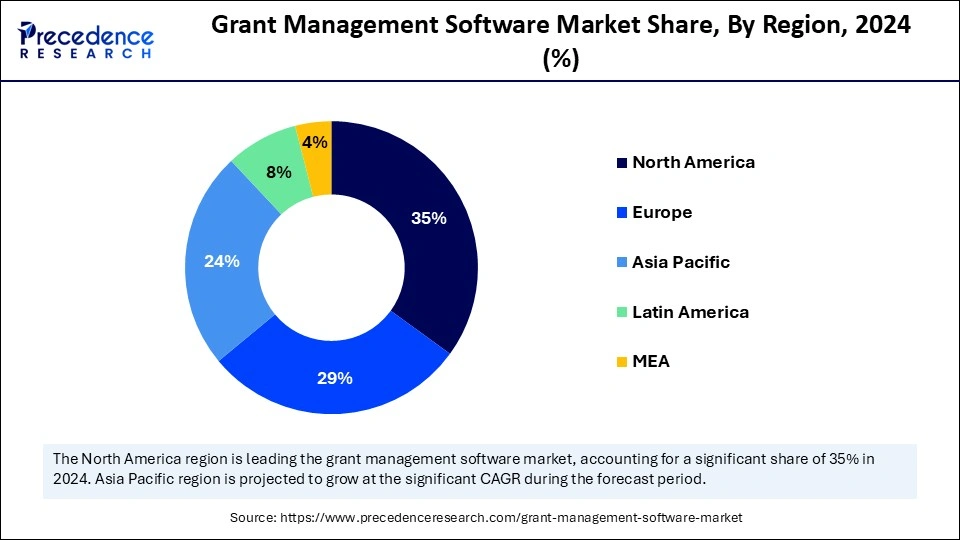

North America led the grant management software market in 2024, capturing the largest market share. This is mainly due to the increased number of grants by public health agencies and nonprofit organizations. The increased research funding also bolstered regional market growth. In 2023, NIH committed over USD 48 billion in funding to medical research in America, boosting the urgency for platforms that handle extensive applicant numbers. Furthermore, the CDC Foundation implemented digital grant management practices in all public health departments across Georgia, California, and Illinois, propelling the market in this region.

Asia Pacific is expected to witness the fastest growth in the coming years. The regional market growth can be attributed to the rising public and government grant programs to support the educational and healthcare sectors. The rising government funding for R&D programs further contributes to market growth. In addition, governments around the region are promoting digitalization and encouraging the adoption of advanced technologies in every field, supporting market growth in the region.

Europe is considered to be a significantly growing area. The growth of the grant management software market in Europe is attributed to the rising public-private cooperation and changing EU’s grant standards. The European governments are allocating significant funds for R&D, leading to a rise in grant applications. This, in turn, boosts the need for efficient grant management solutions. Moreover, the majority of institutions throughout Germany, France, and the Netherlands are adopting unified management systems for handling funding programs and supporting regional market growth.

The need for automated grant process handling has become the main reason for the expansion of the grant management software market. Business entities actively search for solutions that enable workflow optimization while enhancing transparency in fund distribution processes. Grant management software allows entities to track and manage grant documents through comprehensive functionalities. The National Institutes of Health (NIH) implemented AI-based tools in 2023 to distribute applications across appropriate staff members while handling their record of 75,000 applications. The growing importance of data-driven decision-making and the rising number of grant applications are expected to boost the growth of the market in the coming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.44 Billion |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size in 2024 | USD 2.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.34% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Function, Deployment Mode, Platform, Organization, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Public and Nonprofit Funding Initiatives to Drive the Demand for Digital Grant Management Solutions

Increasing government and nonprofit funding initiatives are driving the growth of the grant management software market. Strategic public funding from governments and nonprofit institutions drives demand for digital solutions to handle grants. Educational, research, and healthcare institutions receive more grants than ever from the public and nonprofit organizations. Digital solutions make possible real-time tracking, automated workflows, and centralized documentation. This streamlines the management of multiple grants simultaneously. Additionally, digital solutions provide connectivity to current grant-making systems, enhancing decision-making.

Data Privacy and Security Concerns

Data privacy and security concerns are anticipated to restrain the growth of the grant management software market. Grant management software stores sensitive data related to funding alongside applicant information, leading to increased susceptibility to data breaches and cyberattacks. Data breaches and misuse incidents lead to reputational harm and legal penalties for entities. Additionally, integrating grant management software in existing systems is complex, limiting the growth of the market.

The increasing popularity of cloud-based solutions is expected to create immense opportunities for vendors who deliver scalable and secure grant management platforms. Cloud deployment has become the preferred choice for organizations. They offer several benefits, such as cost-saving and simple integration, and enable the use of flexible reporting features. Organizations now increasingly use cloud-based platforms, as they help them maintain data availability during necessary audits and funding reviews while also conducting disaster recovery. The Centers for Disease Control and Prevention (CDC) launched its cloud-based grant reporting system in 2024 as a way to ease data submissions between public health departments at state and local levels. Furthermore, cloud solutions help worldwide organizations execute big grant management tasks while keeping track of performance and operational excellence.

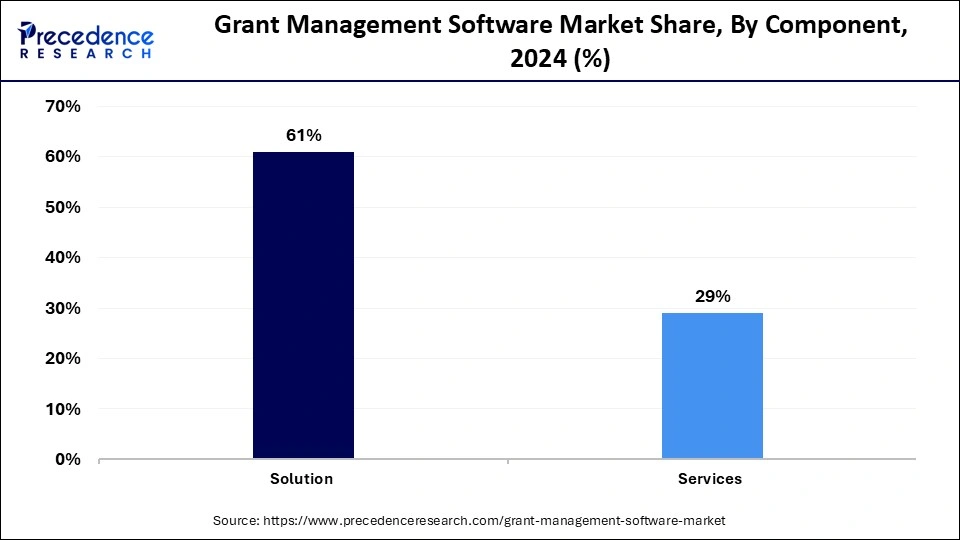

The solutions segment dominated the grant management software market with the largest share in 2024. This is mainly due to the increased demand for automation solutions among organizations to track applications and meet transparency requirements. The need for comprehensive digital solutions has increased as funding programs become more complex. Furthermore, the increase in the number of grant programs bolstered the segmental growth. The National Institutes of Health (NIH) handled more than 60,000 grant applications in 2024, which highlighted the necessity for efficient solutions for tracking grant applications.

The application tracking segment held the largest share of the grant management software market in 2024. The number of grant applications has increased in the last few years, boosting the need for structured evaluation frameworks. Grant management software enables faster application reviews, streamlining the overall process. Furthermore, the increased demand for trackable application systems that meet audit requirements bolstered segmental growth.

The reporting segment is anticipated to grow at the highest CAGR in the coming years. The growth of the segment can be attributed to the increasing need for reporting transparency for recent changes. Organizations often require real-time reporting solutions for analyzing fund utilization and program performance. There is a high demand for sophisticated reporting solutions among large enterprises to ensure compliance and improve decision-making, contributing to the segment’s growth.

The on-premises segment led the grant management software market in 2024. Organizations in government, healthcare, and finance heavily preferred on-premises grant management solutions due to their flexibility. On-premises deployment offers more control over data. Internal hosting became a priority choice for these organizations for data security. This deployment method enables organizations to manage data within their own server, reducing the risk of data breaches and cyberattacks.

The cloud segment is projected to expand rapidly in the upcoming period, as organizations are seeking solutions with better scalability and remote accessibility. Through centralized data access, cloud-based grant management software allows globally distributed teams to enhance their efficiency in grant management across multiple locations. Moreover, worldwide organizations now implement flexible cloud-based systems for digital transformation goals. In addition, cloud deployment offers greater accessibility, enabling users to access grant management software from anywhere, fostering collaboration between teams, and optimizing operations.

The web segment held the largest share of the grant management software market in 2024. This is mainly due to the widespread accessibility and integration flexibility of web-based solutions. These solutions are more cost-effective and scalable than mobile-based, making them a preferred option for organizations, especially those seeking to optimize grant management processes without investing heavily in developing IT infrastructure. Organizations often choose web platforms for browser-accessible interfaces, which let them centralize procedures and automate grant management processes. In 2023, the National Institutes of Health (NIH) and the U.S. Agency for International Development (USAID) maintained web-based grant portals to oversee their significant health research and development grant operations.

The mobile segment is projected to grow at the fastest rate in the market in future years as organizations now use mobile-first approaches with the expanding necessity for real-time access to grant management systems. Organizations are increasingly shifting toward mobile-based platforms to execute their real-time grant work. These platforms enhance user engagement, deliver real-time updates, and reduce security concerns.

The large enterprises segment led the grant management software market in 2024. Large enterprises often receive a large number of grant applications, boosting the demand for efficient solutions for managing grants. Grant management software helps large enterprises with application evaluation and fraud detection. These enterprises required advanced solutions to manage multi-million-dollar grants across departments or countries.

The SMEs segment is projected to grow at a rapid pace during the forecast period. The growth of the segment can be attributed to the rising demand for affordable and advanced grant management solutions among non-profit or small organizations. Outcome reporting and audit preparedness requirements encourage more SMEs to adopt digital grant lifecycle management systems to enhance operational efficiency.

The educational institutes segment held the largest share of the grant management software market in 2024, as they received more grants from the government and public organizations for scientific research. The National Institutes of Health (NIH) and the U.S. Department of Education funded thousands of education-based grants in 2023, creating the need for unified systems to handle big-scale applications and reporting requirements. Additionally, the campus-wide grant management system became more necessary among university researchers who accepted funding through international research programs like the WHO Special Programme for Research and Training in Tropical Diseases (TDR).

The corporations segment is anticipated to grow at the fastest rate during the forecast period, owing to the growing corporate social responsibility programs and innovation funding activities. Market demand for structured grant management systems has increased for businesses. They provide financial support for social impact programs while conducting community development efforts and performing internal research and development (R&D).

By Component

By Function

By Deployment Mode

By Platform

By Organization

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

September 2024

November 2024