March 2025

Graphene Market (By Product Type: Graphene Nanoplatelets, Graphene Oxide, Reduced Graphene Oxide, Other Product Types; By End-user: Electronics and Telecommunication, Composites, Energy, Aerospace and Defense, Other End-user Industries) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

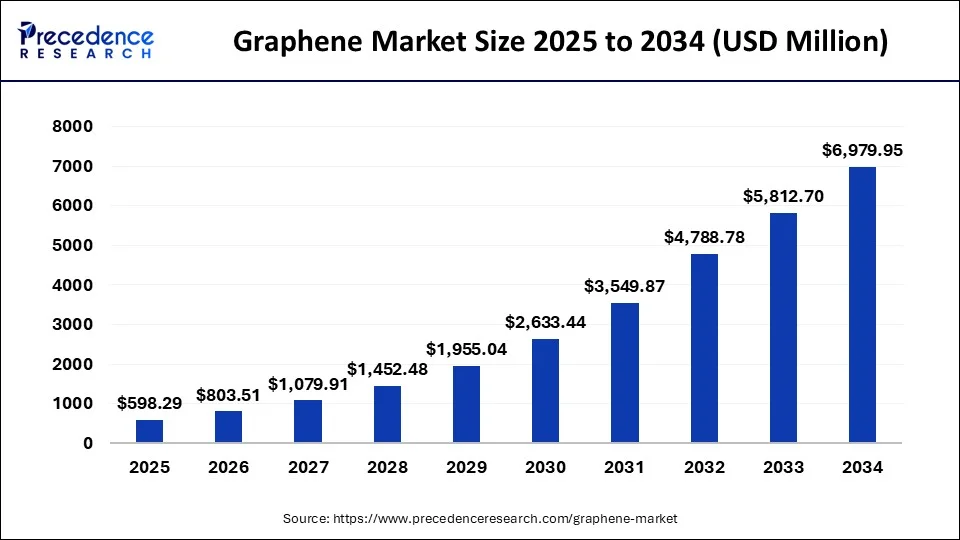

The global graphene market size was USD 332.45 million in 2023, accounted for USD 445.82 million in 2024, and is expected to reach around USD 6,979.95 million by 2034, expanding at a CAGR of 31.7% from 2024 to 2034. The North America graphene market size reached USD 152.93 million in 2023.

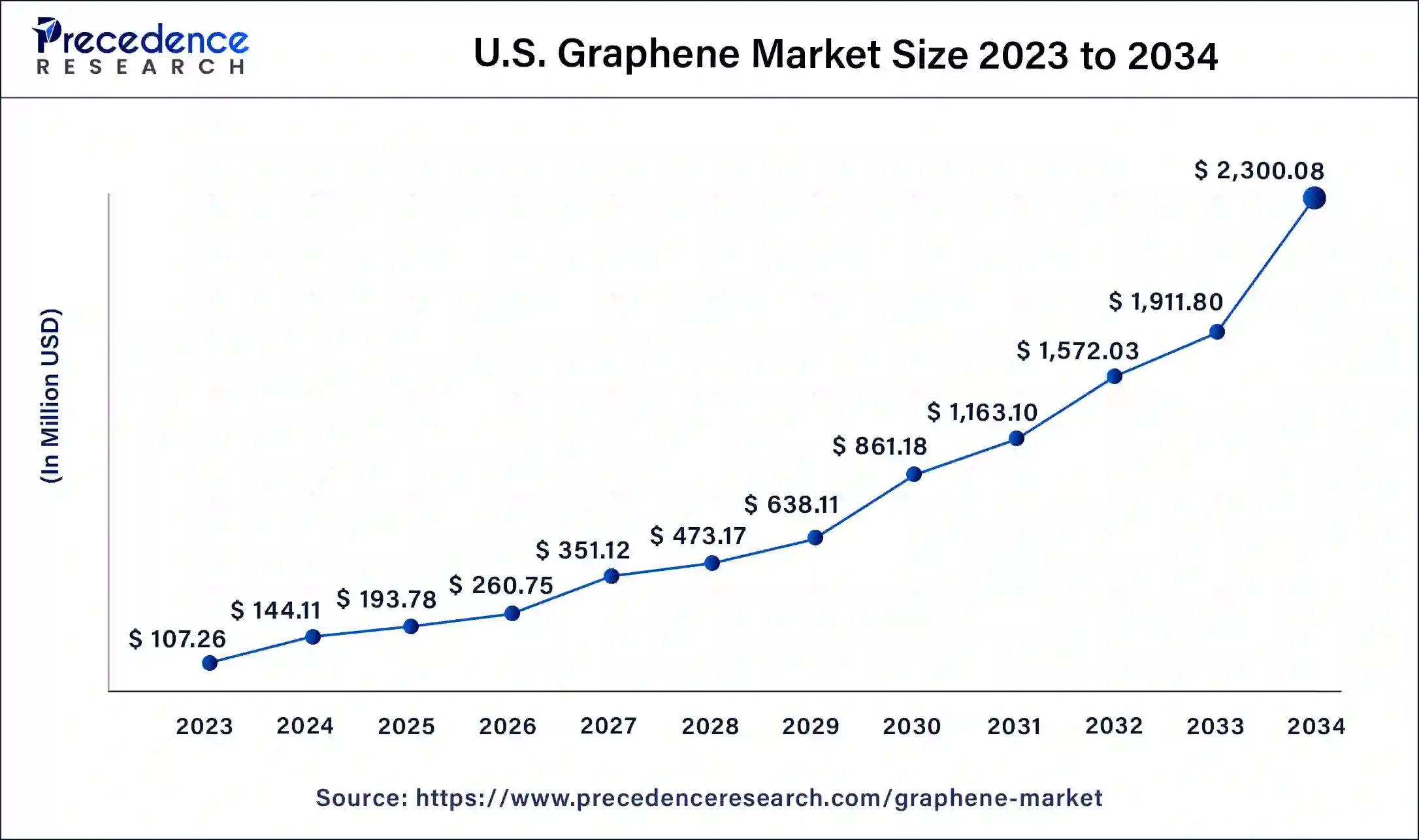

The U.S. graphene market size was estimated at USD 107.26 million in 2023 and is predicted to be worth around USD 2,300.08 million by 2034, at a CAGR of 31.9% from 2024 to 2034.

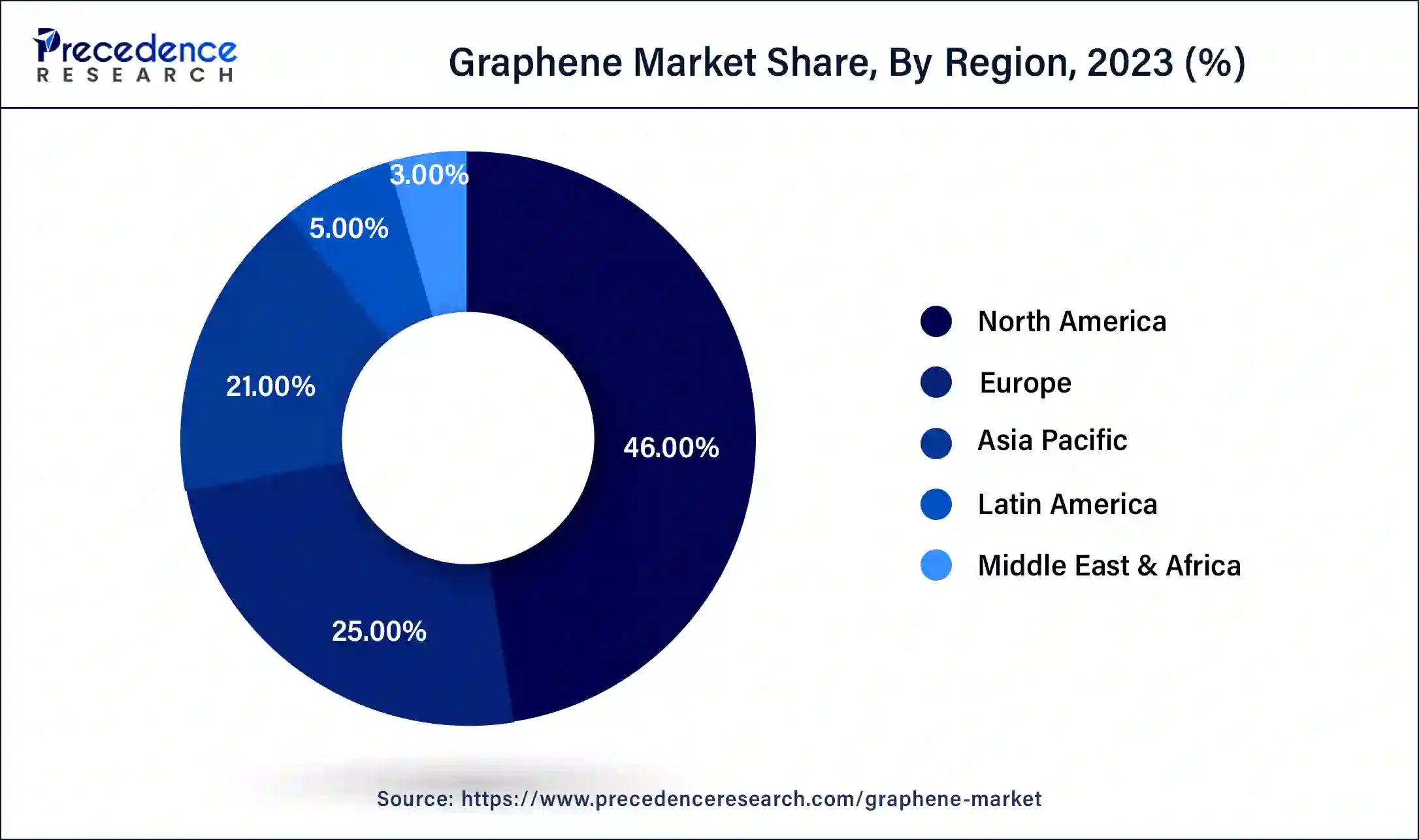

North America has held the largest revenue share 46% in 2023. The graphene market in North America is witnessing substantial growth, driven by robust investments in research and development, particularly in the United States. The region's advanced technological infrastructure and focus on innovation contribute to the adoption of graphene in various industries. Collaborations between academic institutions, research organizations, and industry players further propel the development and commercialization of graphene-based products, creating a dynamic market landscape.

As the automotive industry continues to prioritize lightweight and innovative materials, graphene plays a crucial role in driving advancements, making vehicles more efficient, sustainable, and technologically advanced.

Europe is estimated to observe the fastest expansion. Europe is at the forefront of graphene research and commercialization. The European Union has invested significantly in graphene-related projects, fostering a dynamic market. Research institutions and industries in countries like the United Kingdom and Germany are actively exploring graphene's potential across various sectors, including electronics, automotive, and energy storage. Government initiatives and a supportive innovation ecosystem position Europe as a key player in the global graphene market.

Asia-Pacific is a key player in the global graphene market, marked by substantial growth in countries like China, Japan, and South Korea. Robust industrialization, coupled with a focus on emerging technologies, fuels the demand for graphene in applications ranging from electronics to energy storage. Government initiatives supporting graphene research, coupled with a thriving electronics sector, contribute to the region's prominence in driving advancements and innovation in the graphene market.

The graphene market revolves around the material graphene, a single layer of carbon atoms arranged in a hexagonal lattice. This advanced material exhibits remarkable properties, including exceptional strength, electrical, and thermal conductivity. As a versatile nanomaterial, graphene holds immense potential for innovations and advancements in diverse technological domains, driving research, development, and commercial activities in the global graphene market.

Graphene, hailed as a "wonder material," finds applications in flexible electronics, high-performance batteries, conductive inks, and advanced coatings. Its unique properties, such as transparency, flexibility, and strength, contribute to its widespread adoption across industries, fostering continuous exploration of its potential in emerging technologies and fostering a dynamic landscape in the graphene market. The market involves graphene's production, application, and commercialization across various industries such as electronics, energy, automotive, and healthcare.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 31.7% |

| Market Size in 2023 | USD 332.45 Million |

| Market Size in 2024 | USD 445.82 Million |

| Market Size by 2034 | USD 6,979.95 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Material advancements, automotive surge and energy storage solutions

Material advancements and breakthroughs in graphene applications have played a pivotal role in surging market demand. Graphene, with its exceptional characteristics such as high electrical conductivity, mechanical strength, and flexibility, has become a compelling material across diverse industries. Ongoing advancements in the creation of graphene-based composites, coatings, and functional materials have broadened its applications in key sectors, including electronics, aerospace, and healthcare. This continual innovation underscores graphene's versatility and positions it as a transformative element driving progress and applications in multiple industries.

Graphene has emerged as a crucial driver in the energy sector, particularly in energy storage solutions. The utilization of graphene in batteries and supercapacitors has showcased outstanding performance attributes, including accelerated charging times and heightened energy density. With the increasing demand for efficient and sustainable energy storage solutions, the significance of graphene in elevating the performance of these devices has grown substantially. This dynamic contribution positions graphene as a key catalyst propelling the market forward in response to the evolving needs of the energy industry. The ongoing pursuit of innovative graphene applications and its integration into emerging technologies contribute to sustained market expansion.

In the automotive sector, graphene's lightweight and robust characteristics make it a sought-after material for advancing vehicle technologies. The integration of graphene into automotive components, such as lightweight composites and conductive coatings, enhances overall vehicle performance, fuel efficiency, and durability. As the automotive industry continues to prioritize lightweight and innovative materials, graphene plays a crucial role in driving advancements, making vehicles more efficient, sustainable, and technologically advanced.

Production challenges and regulatory hurdles

The graphene market faces challenges related to production processes. Scaling up graphene production to meet commercial demands remains a significant hurdle. The intricate methods for producing high-quality graphene in large quantities involve complex techniques like chemical vapor deposition or liquid-phase exfoliation. These processes encounter difficulties in achieving consistent quality, hampering mass production. Additionally, the cost-effectiveness of large-scale production remains a concern, impacting the overall accessibility of graphene-based products.

Regulatory hurdles also pose challenges. The nanoscale nature of graphene raises safety and environmental concerns, necessitating clear regulatory frameworks. Uncertainty in regulatory standards and the absence of universally accepted guidelines hinder the seamless integration of graphene into various industries. Addressing these challenges requires collaboration between industry stakeholders, regulatory bodies, and research institutions to establish standardized production methods and comprehensive safety regulations, ensuring the sustainable growth of the graphene market.

Medical applications, electronic devices and wearables

Graphene's unique properties enable the development of smaller, faster, and more energy-efficient electronic components. It serves as a promising material for next-generation transistors, conductive inks, and flexible displays. As consumer electronics continue to evolve, incorporating graphene into the manufacturing processes contributes to enhanced device performance and durability. The electronics and semiconductor industry's increasing reliance on graphene reflects the material's pivotal role in advancing technological capabilities and meeting the escalating demands for more sophisticated and efficient electronic products.

Moreover, the demand for graphene is amplified by its incorporation into electronic devices and wearables. The increasing integration of graphene into consumer electronics and wearables propels market demand, reflecting the material's pivotal role in advancing technological innovation.

Additionally, the lightweight and flexible nature of graphene contributes to advancements in wearable technology, leading to the development of thinner, lighter, and more durable devices. The growing consumer preference for innovative and high-performance electronics fuels the demand for graphene in this market segment.

According to the product type, the graphene nanoplatelets segment has held a 59% revenue share in 2023. Graphene Nanoplatelets (GNPs) are two-dimensional nanomaterials consisting of multiple graphene layers. These platelets exhibit excellent thermal and electrical conductivity, making them valuable in various applications. The trend in the Graphene market for GNPs involves their utilization in composites, coatings, and energy storage devices. Their large surface area and mechanical strength contribute to enhanced material properties, leadig to increased demand in industries seeking advanced materials for improved performance.

The Graphene Oxide (GO) segment is anticipated to expand at a significantly CAGR of 38.1% during the projected period. Graphene Oxide (GO) is a derivative of graphene, featuring oxygen-containing functional groups. GO exhibits unique properties, including good water dispersibility and tunable surface chemistry. In the Graphene market, the trend for graphene oxide involves its use in biomedical applications, sensors, and energy storage. The functional groups make it suitable for applications like drug delivery systems and biosensors. The evolving trends in both Graphene Nanoplatelets and Graphene Oxide highlight their versatility and applicability across diverse industries, driving innovation in materials science and technology.

In 2023, the composites segment had the highest market share of 52% based on the end user. Graphene, as a key component in composite materials, is revolutionizing various industries. In composites, graphene enhances mechanical strength, conductivity, and thermal properties. The aerospace sector is increasingly adopting graphene composites for lightweight, strong materials, improving fuel efficiency. Automotive and construction industries also leverage graphene composites for durable and high-performance components, contributing to the trend of developing advanced materials with superior properties.

The energy segment is anticipated to expand at the fastest rate over the projected period. In the energy sector, graphene plays a pivotal role in advancing battery technology and energy storage. Graphene batteries offer higher energy density, faster charging times, and longer lifespan compared to traditional batteries. This trend is particularly prominent in electric vehicles and portable electronic devices.

Additionally, graphene-based supercapacitors are gaining traction for their quick charging capabilities. The energy sector's adoption of graphene aligns with the broader trend of seeking more efficient and sustainable solutions in power storage and utilization.

Segments Covered in the Report

By Product Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

April 2025