December 2024

Green Building Materials Market (By Application: Framing, Insulation, Roofing, Exterior Siding, Interior Finishing, Other Applications; By End-use Industry: Residential, Commercial, Industrial and Institutional, Infrastructure) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

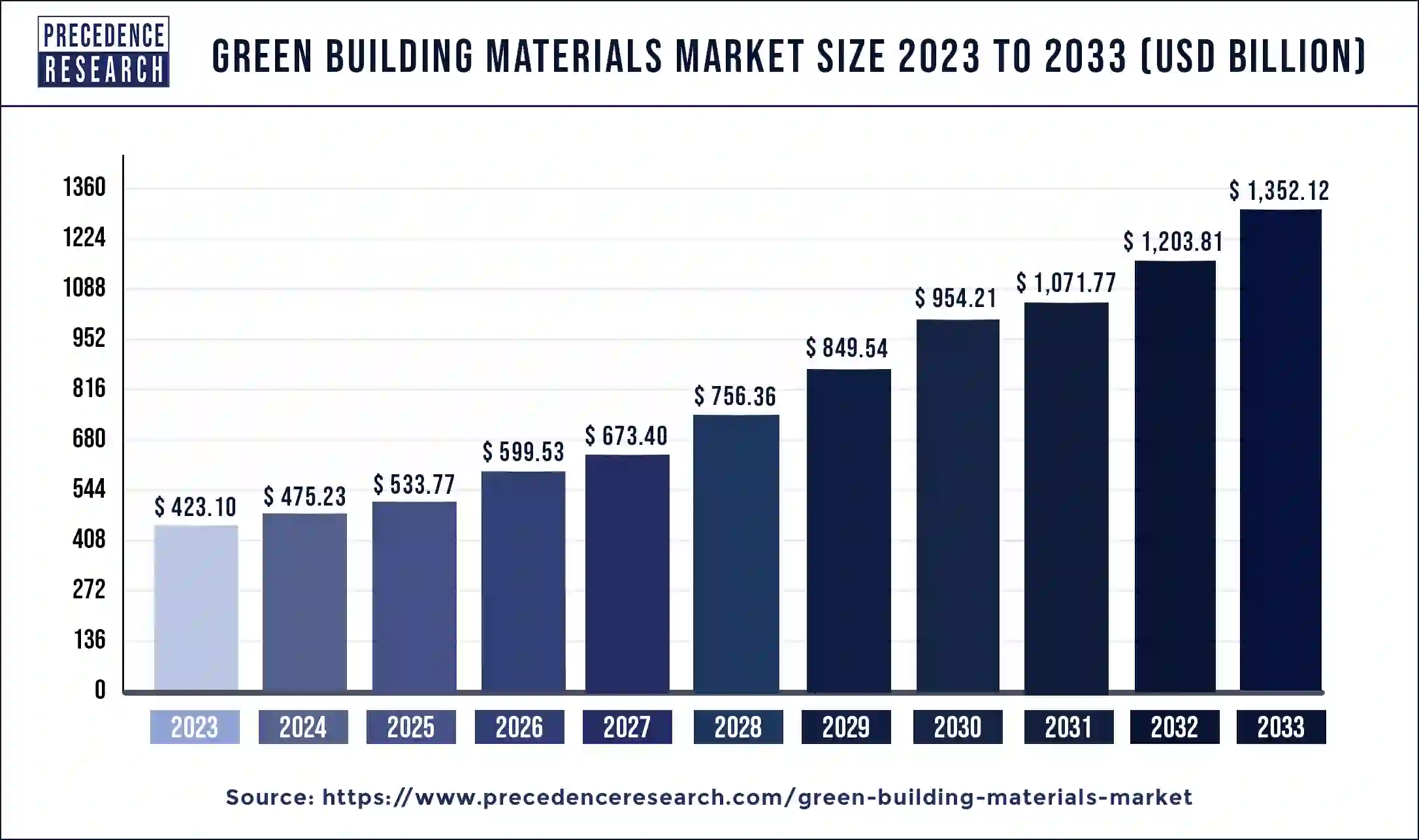

The global green building materials market size was valued at USD 423.10 billion in 2023 and is anticipated to reach around USD 1352.12 billion by 2033, growing at a CAGR of 12.32% from 2024 to 2033. The increasing awareness about energy conservation coupled with rising demand for green building materials in residential and commercial buildings is expected to accelerate the green building materials market’s growth in the coming years.

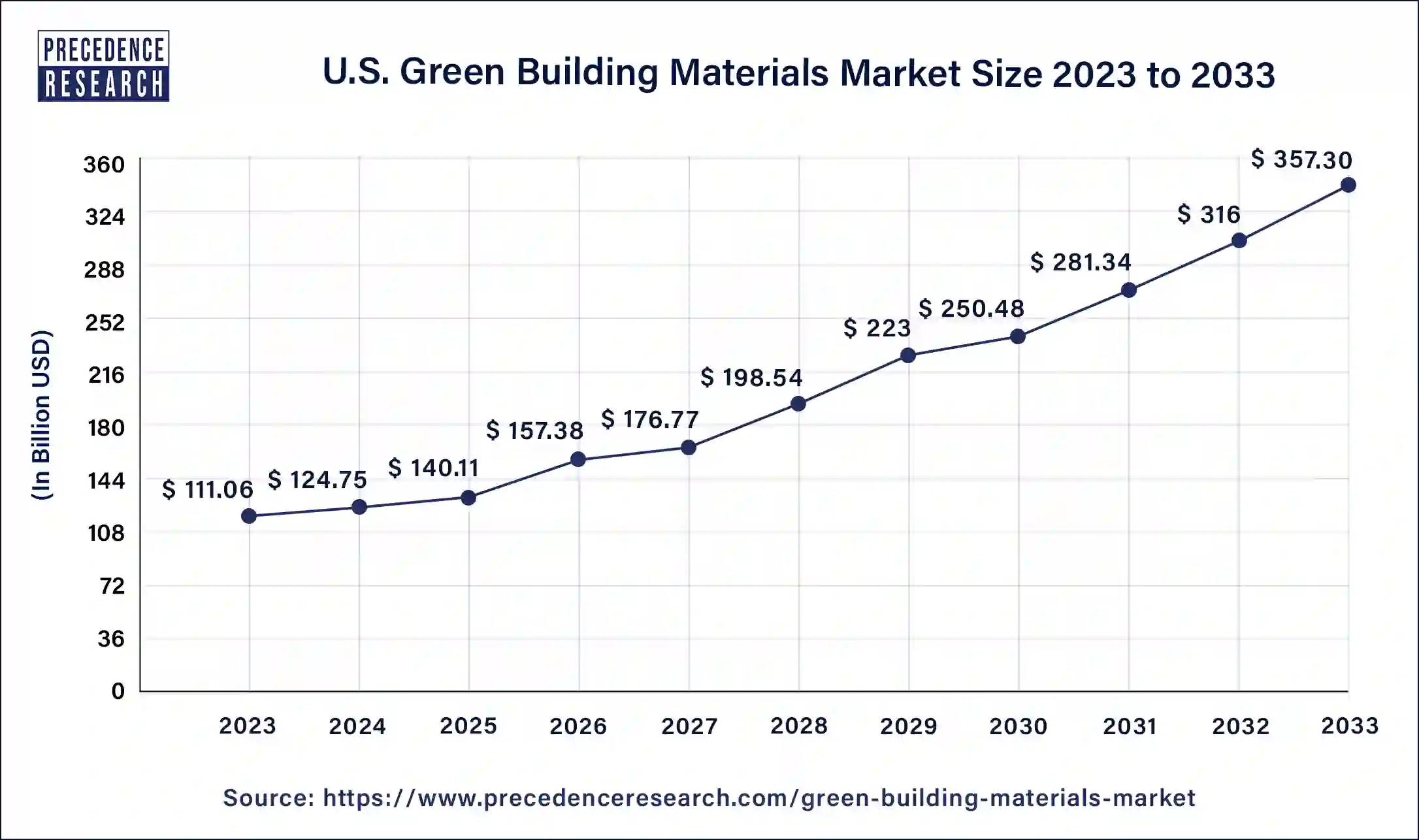

The U.S. green building materials market size was estimated at USD 111.06 billion in 2023 and is predicted to be worth around USD 357.30 billion by 2033, at a CAGR of 12.39% from 2024 to 2033.

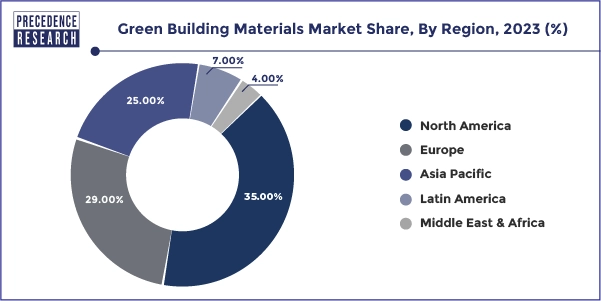

North America held the dominant share of the green building materials market in 2023. The region is observed to witness prolific growth during the forecast period. The region’s growth due to the increasing construction activities, increasing energy demand, rapid urbanization, rising demand for environmentally friendly materials, increasing preference for these materials over conventional construction materials, rising efforts to reduce carbon emissions, and rising awareness regarding the benefits of green building materials. The robust growth of the construction industry in the United States and Canada has considerably increased the demand for green building materials due to the diverse climatic conditions including cold winters and humid summers.

Asia Pacific is observed to expand at a rapid pace during the forecast period in the green building materials market owing to the presence of prominent market participants, rising use of eco-friendly materials in the construction industries, increasing focus to reduce maintenance and operational costs of the structure, increasing use of renewable products, growing awareness about energy conservation. The growth of the region is attributed to the rapid pace of urbanization in developing countries such as China, Japan, and India, Moreover, rising investment in the infrastructure sector by the government coupled with the construction of residential houses and buildings, is expected to drive the growth of the green building materials market during the forecast period.

The Asia Pacific green building material market size was calculated at USD 105.78 billion in 2023 and is projected to expand around USD 344.79 billion by 2033, poised to grow at a CAGR of 12.54% from 2024 to 2033.

| Year | Market Size (USD Billion) |

| 2023 | 105.78 |

| 2024 | 118.81 |

| 2025 | 133.44 |

| 2026 | 149.88 |

| 2027 | 168.35 |

| 2028 | 189.09 |

| 2029 | 212.39 |

| 2030 | 238.55 |

| 2031 | 267.94 |

| 2032 | 300.95 |

| 2033 | 344.79 |

Green building materials are eco-friendly construction materials that have a low environmental impact. A sustainable architecture uses energy and natural resources. They are generally composed of renewable resources rather than non-renewable resources. Green building materials are widely used due to their energy efficiency, and ecologically beneficial qualities, and produce a lower carbon footprint during their entire life cycle.

The use of green building materials improves a building structure's sustainability and efficiency in terms of construction, maintenance, design, and renovation. These materials are durable, reusable, or recyclable materials. These materials can be wood, cork, bamboo, soil, adobe, sawdust, straw, recycled plastic, straw bales, and others, which are not adversely affected by heat, cold, or humidity. Green building materials offer various benefits including reduced maintenance costs, energy conservation, flexibility for greater design, and improved occupant health and productivity.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.32% |

| Green Building Material Market Size in 2023 | USD 423.10 Billion |

| Green Building Material Market Size in 2024 | USD 475.23 Billion |

| Green Building Material Market Size by 2033 | USD 1352.12 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application and By End-use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Increasing focus on environmental sustainability

The rising environmental awareness is expected to boost the growth of the green building materials market during the forecast period. The use of green building materials reduces the burden on natural resources and increases the use of renewable products to curb carbon emissions. The significance of green building materials enables greater design flexibility, low maintenance cost, energy conservation, and others. Several environmental issues such as air pollution, freshwater resource contamination, biodiversity loss resource depletion, and others can be resolved by the utilization of eco-friendly and sustainable building materials.

Bamboo, cork, and other recycled materials are highly used to maintain environmental sustainability as they have a low impact on the environment. Therefore, pollution, emissions, and the depletion of natural resources increase the use of renewable resources and promote the development of a more circular economy.

Restraint: High cost

The high cost of green building materials is projected to hamper the growth of the green building materials market. The high cost associated with green building materials may result in reducing the adoption of green building materials in construction activities in middle-lower income countries. In addition, the lack of awareness among builders and contractors regarding the benefits of green building materials particularly in undeveloped countries is also likely to limit the expansion of the global green building materials market during the forecast period.

Opportunity: Robust growth of the construction sector

The rise in the number of construction activities across the globe is projected to offer a lucrative opportunity for the growth of the green building materials market during the forecast period. Green building materials are well-suited replacements for traditional construction materials due to various benefits. Environmentally friendly construction materials are critical in mitigating global warming. In the construction sector, developers and consumers are emphasizing environmentally friendly, cost-saving, and energy-efficient structures.

The energy efficiency of buildings is improved by the use of these materials as they can regulate the temperature inside, reflective surfaces, offer insulating properties, and others. In addition, favorable government measures to promote the use of green building materials in the construction industry are likely to contribute to the growth of the market. Furthermore, advancements in technology and innovation in materials science have significantly increased the development of new green building materials with improved performance and durability. Thus, the massive shift towards renewable green building materials is expected to bolster the market’s expansion in the coming years.

The insulation segment accounted for the dominating share in 2023 in the green building materials market. The segment’s growth is attributed to the owing to the ongoing construction activities in emerging economies, particularly the residential and commercial sectors. Wool is a considered reliable insulator and a rapidly renewable resource. It is commercially available and is abundant in nature. These eco-friendly insulations are made from renewable resources or recycled materials and aim to reduce energy costs significantly by improving home insulation.

The roofing segment is expected to witness a significant share during the forecast period in the green building materials market owing to the increasing use of green roof infrastructure in buildings. This roofing has a positive impact on the environment. In addition, the rising popularity of non-toxic recycled rubber roofing due to its weather resistance and superior durability properties is expected to propel the segment’s growth.

The residential segment held the largest share of the green building materials market in 2023, the residential segment is expected to sustain the position throughout the forecast period. The growth of the segment is driven by the increasing construction of residential buildings. Residential green building materials prefer products that consume less energy, water, and have a lower environmental impact as well as offer a healthy interior environment. Governments in various countries are offering green housing incentives to promote the construction of green residential projects. Such factors drive the segment’s growth.

The commercial segment is expected to grow significantly during the forecast period owing to the rising use of green building materials in commercial buildings to reduce emissions and maintenance costs. Green buildings can reduce emissions by 35% and maintenance costs by 20%. The use of green building materials has a lower environmental impact when it is installed and maintained as well as ensures an overall improvement in sustainability. The U.S. Green Building Council calls these materials environmentally preferable products for their Leadership in Energy and Environmental Design (LEED) program and as part of their ESG Green Buildings criteria.

Segments Covered in the Report

By Application

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

November 2024

November 2023