December 2023

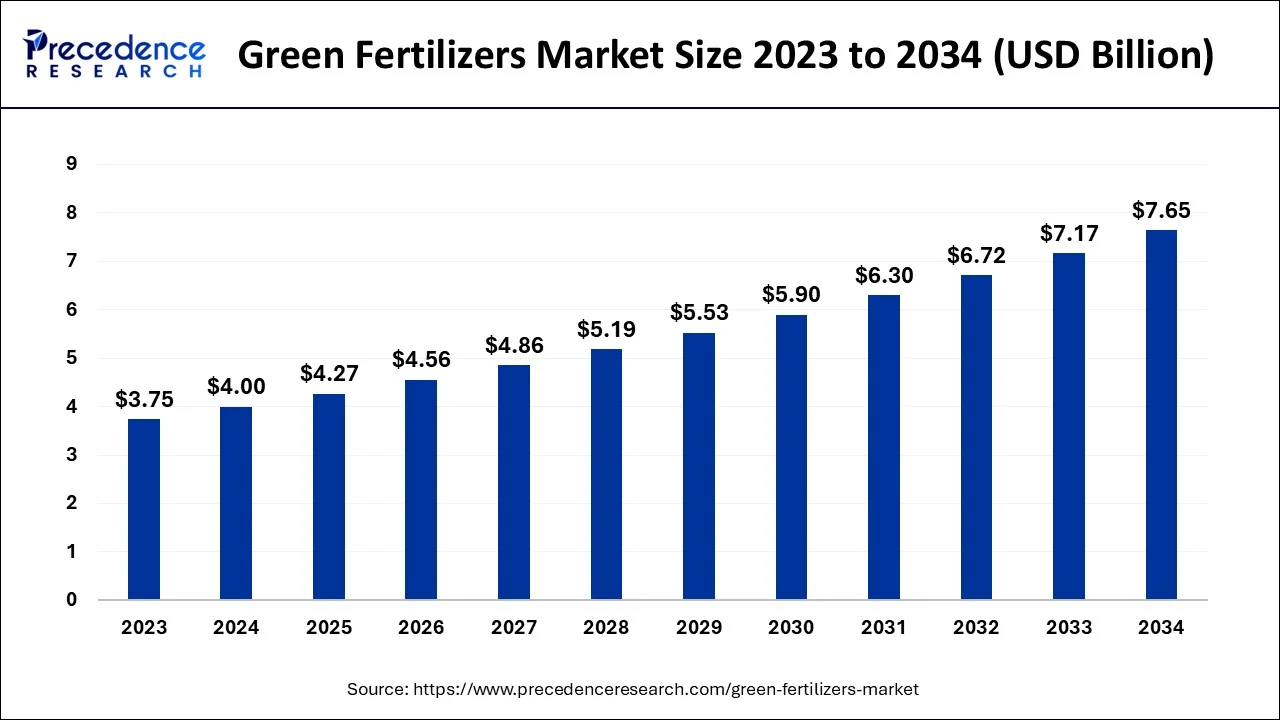

The global green fertilizers market size accounted for USD 4 billion in 2024, grew to USD 4.27 billion in 2025 and is predicted to surpass around USD 7.65 billion by 2034, representing a healthy CAGR of 6.70% between 2024 and 2034.

The global green fertilizers market size is estimated at USD 4 billion in 2024 and is anticipated to reach around USD 7.65 billion by 2034, expanding at a CAGR of 6.70% from 2024 to 2034.

The fertilizer industry has identified the most promising green fertilizer technologies. The challenge is to develop a business case for low-carbon products. This can be accomplished by driving down costs and addressing supply-side technical challenges while also creating a market for premium food products with a low carbon footprint. Mineral fertilizers now allow for 50% of global food production. However, its production is energy-intensive, with ammonia production accounting for about 5% of global gas consumption. To reduce the carbon footprint of this process, the fossil fuels used to produce ammonia (a key component of mineral fertilizers) must be replaced with renewable energy. Green ammonia, also known as low-carbon fertilizer, has the potential to help decarbonize food production.

Nitrogen fertilizer production today is energy intensive. Ammonia production in the world is primarily based on natural gas as a raw material and steam methane reforming (SMR) as the primary technology. The first step is to split the natural gas molecules using steam and high temperatures to produce hydrogen and CO2. This hydrogen is then combined with nitrogen from the air in a subsequent step to produce ammonia. Despite being the least carbon-intensive technology available today, SMR produces a significant amount of CO2.

Green fertilizers are mineral fertilizers based on nitrates that have the same chemical and physical composition as fertilizers produced with fossil fuels (natural gas, coal, oil), but with a much lower carbon footprint because they are produced with renewable electricity (hydro, wind, solar). That is, green fertilizers are a non-fossil, low-impact, and simple way to decarbonize food production. Ammonia is the foundation of all mineral fertilizers. Ammonia is now produced using hydrogen derived from fossil fuels. The hydrogen required to produce green fertilizers will be obtained from the water via electrolysis using renewable electricity. All other processes will remain unchanged after the hydrogen is extracted to produce green ammonia. This includes employing a best available technology (BAT) catalytic process that reduces glasshouse gas emissions (GHG) during manufacturing.

Global population and economic growth, combined with rapid urbanization, will result in a significant Today, the effects of climate change on domestic agriculture can be seen in the form of droughts, wildfires, heavy rains, and increased pest occurrences. Greenhouse gas emissions from agricultural processes account for 9% of total US glasshouse gas emissions and have increased by 11% since 1990. As the United States joins the rest of the world in responding to climate change, the agricultural sector will face the dual challenge of reducing emissions while also increasing resilience to climate change. This will necessitate more sustainable agricultural practices, also known as climate-smart agriculture. In Paris in December 2015, 196 governments agreed to work together to address the threat of climate change. Although the Paris Agreement does not explicitly outline agriculture's role in reducing global emissions, it does present opportunities for both mitigation and adaptation, and its preamble states that the global community must address climate change's effects on agriculture in order to build resilience and improve global food security. The agreement specifically commits to "keeping the increase in global average temperature to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 degrees Celsius."

All mineral nitrogen fertilizers begin with ammonia, which acts as a link between the nitrogen in the air and the food we eat. Around 70% of ammonia is used in the production of fertilizers, with the remainder being used in a variety of industrial applications such as plastics, explosives, and synthetic fibers. In the future, ammonia could be used as a low-carbon energy vector, but this application is not included in the core analytical scope of this technology roadmap. Ammonia production accounts for approximately 2% of total final energy consumption and 1.3% of total energy system CO2 emissions. A growing and affluent global population will increase ammonia production at a time when governments all over the world have declared that emissions must be reduced. More ammonia will be required in the future but with fewer emissions. A growing and affluent global population will drive up ammonia demand at a time when governments all over the world have declared that emissions from the energy system must fall to Net Zero.

Concerning the natural gas price spike, much of the natural gas production was interrupted or shifted away from regular uses during the February freeze throughout Texas and pushed to Texas due to the demand spike. This forced US ammonia plants in Oklahoma, Texas, and Louisiana, which account for roughly 60% of total production, to shut down during this time, resulting in a 250,000-ton reduction in output. Then Hurricane Ida hit, and production was halted once more. Among these production halts, COVID-delayed plant turnarounds were again halted, just as plants were attempting to catch up. This resulted in more production disruptions, either for much-needed regular maintenance or problems caused by delayed maintenance. All these factors are contributing to green fertilizer market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 4 Billion |

| Market Size by 2034 | USD 7.65 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.70% |

| Largest Market | Europe |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| By Technology |

|

| By Fertilizer |

|

| Regions Covered |

|

Alkaline water electrolysis (AWE) is expected to grow at the fastest rate during the forecast period due to its well-known, dependable, and traditional method of electrolysis. Alkaline water electrolysis is a type of electrolyzing with two electrodes that operate in a liquid electrolyte solution of potassium or sodium hydroxide. Because of the lower cost of catalysts and higher gas purity, it is increasingly being used in the production of green ammonia. Furthermore, alkaline water electrolysis has higher durability due to an exchangeable electrolyte and lower anodic catalyst dissolution, which is expected to drive segment growth. When the total energy consumption and power required for the ammonia electrolytic and water electrolyzers at different hydrogen production rates are compared, the total energy consumption and power required by the water electrolyzer is much higher (up to 65% higher) than for the ammonia electrolytic cell. As a result, the ammonia electrolytic cell may be able to operate by stealing some of the energy from a PEM hydrogen fuel cell. Furthermore, the ammonia electrolytic cell's lower energy consumption when compared to a water electrolyzer suggests that it can be powered by renewable energy sources to produce hydrogen on demand.

Nitrate-based fertilizers such as ammonium nitrate and calcium ammonium nitrate are suited for European soils for suitable climatic conditions. The ammonium nitrate fertilizer will have higher demand as Plants absorb ammonium (NH4 + ) directly at low rates. The positively charged ion is less mobile than nitrate (NO3) and fixes to soil minerals. Plant roots must therefore grow towards the ammonium. Soil microbes convert the majority of the ammonium into nitrate. This nitrification process is temperature dependent and can take one to several weeks. Another part of the ammonium is immobilized by soil microbes and released over time, thereby increasing soil organic matter.

Europe will lead the worldwide market in the upcoming years. Overall, the European fertilizer industry has made significant improvements in the energy efficiency of ammonia production. Because of the physicochemical limitations of current technology, future investments are only likely to improve efficiency marginally. New plants are generally very efficient, but despite their average age, Europe's ammonia plants are still the most energy efficient in the world and have the lowest CO2 emissions.

European fertilizer producers are the only region in the world that has drastically reduced N2O emissions from production. Going beyond current production technology necessitates significant advancements in energy infrastructure, green energy price competitiveness, scientific breakthroughs, and markets for low-carbon products.

During the forecast period, the United States is expected to remain one of the world's fastest-growing markets for the production and consumption of green fertilizer. By 2033, the country is expected to hold a significant share of the global green fertilizer market. Green fertilizer market growth in the United States is being influenced by the presence of leading green fertilizer manufacturing companies and key technology providers, the implementation of stringent regulations, and the growing trend of using green fertilizers.

By Technology

By Fertilizer

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2023

January 2025

January 2025

October 2024