June 2024

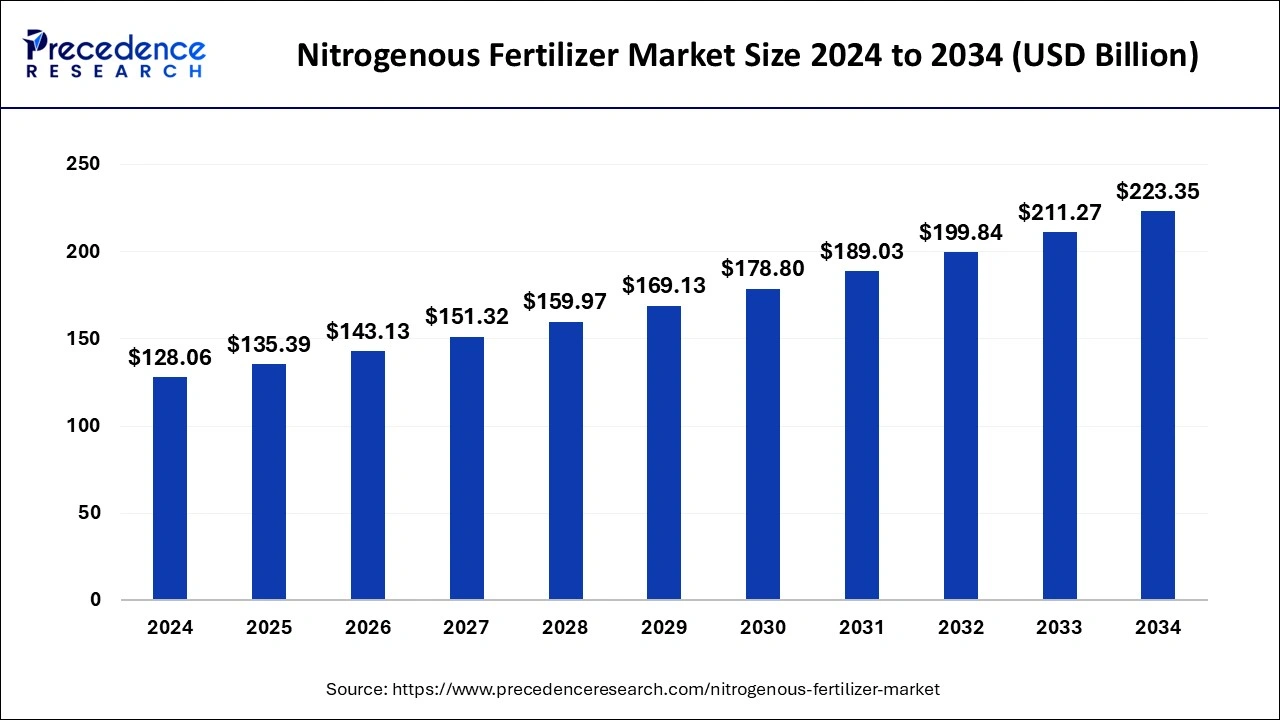

The global nitrogenous fertilizer market size is calculated at USD 135.39 billion in 2025 and is forecasted to reach around USD 223.35 billion by 2034, accelerating at a CAGR of 5.72% from 2025 to 2034. The Asia Pacific nitrogenous fertilizer market size surpassed USD 86.21 billion in 2024 and is expanding at a CAGR of 5.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nitrogenous fertilizer market size was worth around USD 128.06 billion in 2024 and is anticipated to reach around USD 223.35 billion by 2034, growing at a CAGR of 5.72% from 2025 to 2034. The growing population demands more food, which increases the demand for agriculture, ultimately promoting the growth of the nitrogenous fertilizer market.

Unsuitable nitrogen (N) management has been blamed for rising nitrate levels in groundwater. The rates, timing, and techniques of N fertilization and irrigation are crucial management tools that impact the destiny and behavior of nitrogen in soil-plant systems. Optimizing fertilizer usage is one of the major uses of AI in agriculture. AI can assist stop environmental harm and cut down on fertilizer waste. Artificial intelligence (AI) algorithms are able to assess crop needs and soil nutrient levels to calculate the precise quantity of fertilizer needed.

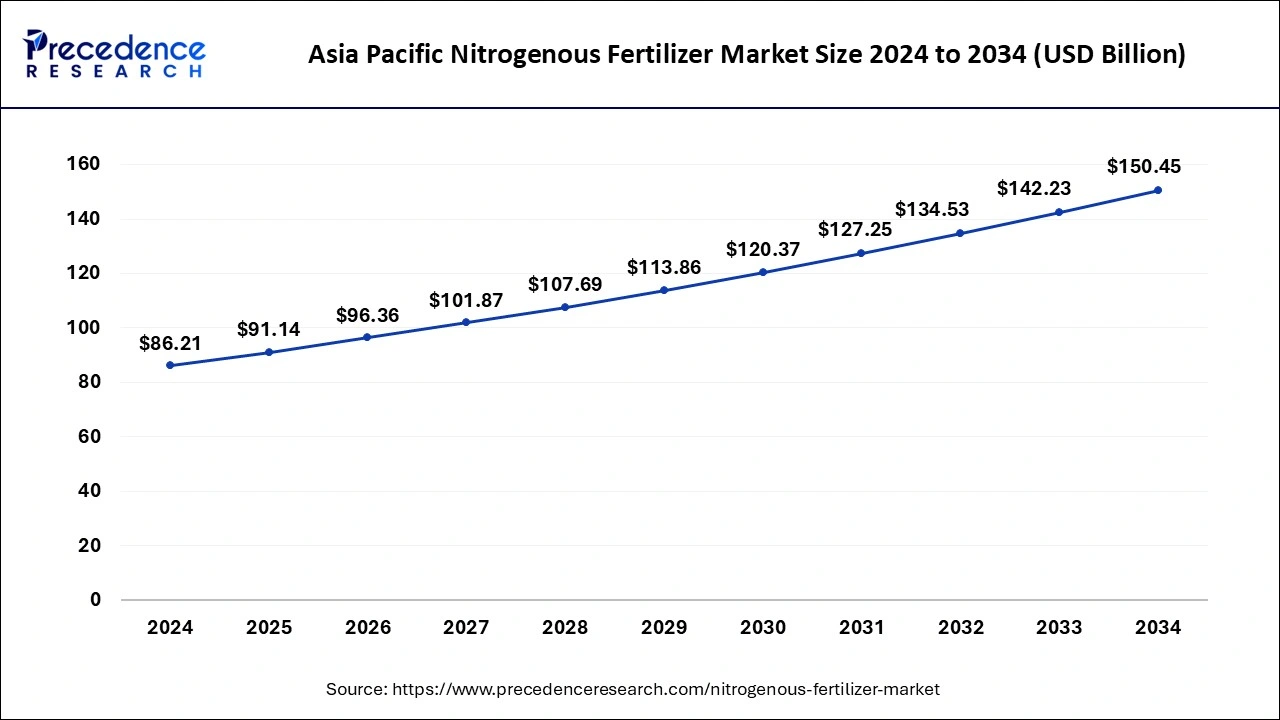

The Asia Pacific nitrogenous fertilizer market size was evaluated at USD 86.21 billion in 2024 and is predicted to be worth around USD 150.45 billion by 2034, rising at a CAGR of 5.73% from 2025 to 2034.

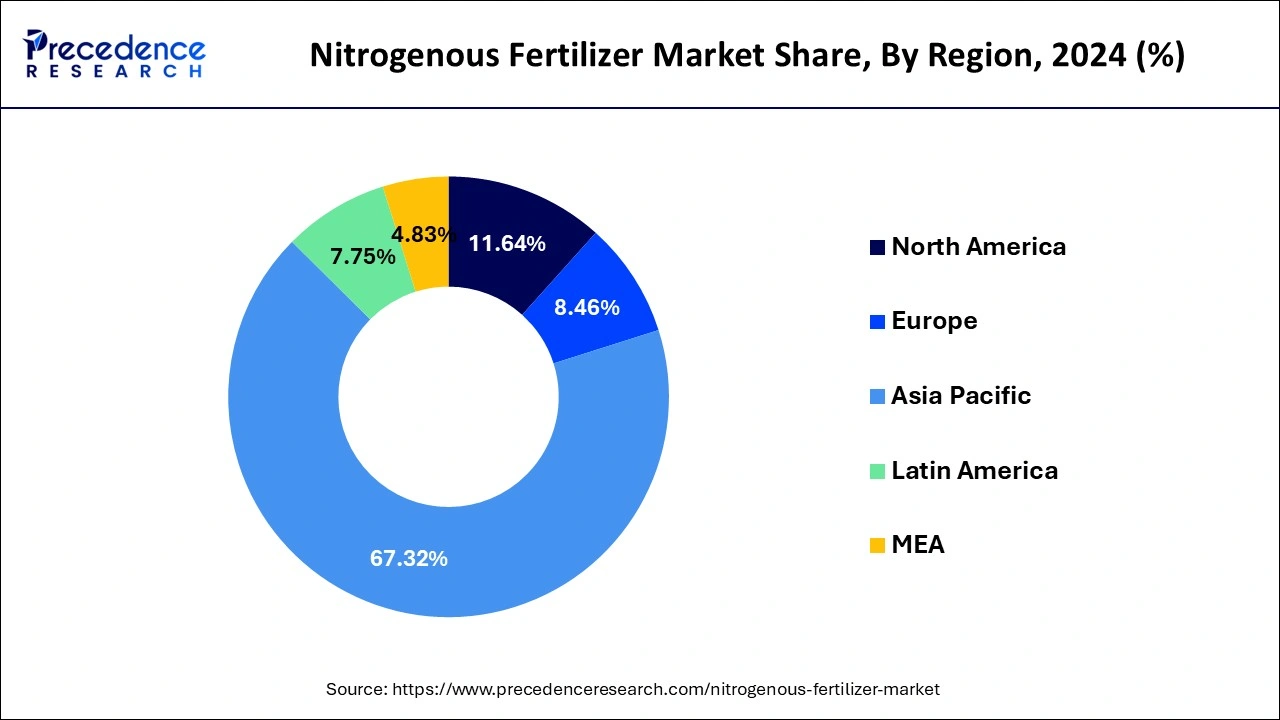

Region-wise, Asia Pacific was the market leader in the global nitrogenous fertilizers market that captured a market share of around 67.32% in 2024. The presence of numerous economies that are highly dependent on agriculture is a major reason behind the burgeoning demand for the nitrogenous fertilizers. The presence of huge agricultural lands along with the majority of the population engaged in agricultural activities has boosted the growth of the Asia Pacific nitrogenous fertilizer market. Asia Pacific has the world’s largest population and the various government initiatives to boost the agricultural yields and improve the condition of the farmers has led to the adoption of various policies under which the farmers were given easy loans at minimal or no interest rates and various other subsidies. Various countries like China, India, Myanmar, Philippines, and Indonesia are some of the major agriproducts manufacturers. Therefore, the demand for the nitrogenous fertilizers is primarily driven by these economies in the Asia Pacific region. Moreover, the rising initiatives by the local companies to educate and aware the farmers regarding the accurate and proper use of fertilizers is another major factor that is fueling the volume of yields and driving the demand for the nitrogenous fertilizers across Asia Pacific region.

Europe captured the second place in the global nitrogenous fertilizer market and is expected to grow at a significant CAGR of 5.4% during the forecast period. The rising focus of the European nations towards improving agriculture and the upgradation of the nitrate plants in Europe has significantly driven the growth of the Europe nitrogenous fertilizer market. However, the growing demand for the organic food across Europe is expected to be a major restraint that may hamper the growth of the nitrogenous fertilizer market in Europe.

Ammonium nitrate, urea, nitric acid, and synthetic ammonia are all produced as part of the nitrogenous fertilizer market. In order to produce ammonium nitrate and urea fertilizers, synthetic ammonia and nitric acid are typically utilized as intermediates. Nitrogen is a crucial ingredient for agriculture, as crops rely heavily on it for health. In order to provide nitrogen, which is necessary for plant development, a variety of nitrogen-based fertilizers are frequently utilized.

Each of the several kinds of these fertilizers is designed to satisfy certain agricultural needs. Chlorophyll, the pigment needed for photosynthesis, proteins, and amino acids all depend on nitrogen. Enough nitrogen is necessary for the growth of colorful leaves, the general structure of plants, and the synthesis of vital substances that support plant health.

| Report Coverage | Details |

| Market Size in 2025 | USD 135.39 Billion |

| Market Size by 2034 | USD 223.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.72% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Crop Type, Form, Mode of Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing population

As of November 15, 2022, there were more over 8 billion people on the planet. The World Population Prospects 2022 project states that it would increase to 8.5 billion people by 2030 and 9.7 billion by 2050. Global demand for food goods is expanding quickly due to population growth. Therefore, in order to guarantee greater crop yields that might meet the world's population's food needs, the need for nitrogenous fertilizers is growing sharply worldwide. As the world's population grows, there will likely be a greater need for nitrogenous fertilizer. The use of optimal nitrogen fertilizers is anticipated to unlock the crop's high producing potential. Due to the reduction of acreage and the development in precision farming techniques like drip and sprinkler irrigation, this industry is expected to grow.

Negative impact on environment

A major factor in the negative perception of chemical fertilizers is their overuse. As it is used more frequently, the soil gets more acidic, making it impossible to plant in it again, at least not for a long time. Both our health and future agricultural output may be harmed by them as they can penetrate the root and get to the groundwater. Acid rain is one example of an environmental phenomenon that can happen when sunshine and nitrogen dioxide from chemical fertilizers combine.

Focus on sustainability

Due to the necessity of fertilizers, their high cost in energy and nonrenewable resources, and the effects of the greenhouse gas emissions produced during production, efforts are being made to make fertilizer usage and production more sustainable. The production and transportation of fertilizer use resources and energy, and they are a major source of CO2 emissions worldwide. Lowering the energy and environmental costs of fertilizer production is a prerequisite for its sustainability.

Based on the product, the urea segment garnered a revenue share of around 40% and dominated the global nitrogenous fertilizer market in 2024. This growth is attributed to the extensively usage and rising popularity of urea. The high nitrogen content and low cost of urea are the major factors that has significantly boosted the growth of the urea segment across the globe. Urea has around 46 % of nitrogen content and is applied to the bare soil. Extensive usage of urea may harm the growth of the seeds and hence, proper knowledge regarding the use of urea is necessary.

Ammonia segment captured a revenue share of 22% in 2024 and was the second largest segment in the market. The higher leaching loss resistance and higher solubility are the crucial features of ammonia that has spurred the demand for ammonia among the farmers across the globe. Ammonia can either be applied directly to the soil surface or it can be mixed with other fertilizers and used to get desired results. Ammonia is said to be the foundation of the nitrogen in the global fertilizer industry.

Based on the crop type, the cereals and grains segment dominated the market, accounting for around 45% of the market share in 2024. Cereals and grains are the most cultivated and the most consumed crops across the globe. It requires utmost care for generating higher yields and increase profitability of the farmers. Therefore, the demand for the nitrogenous fertilizers is higher for the cultivation of cereals and grains. Urea, ammonium nitrate, and anhydrous ammonia are some of the most preferred fertilizers used in yielding the cereals and grains.

The oilseed and pulses segment accounted for second largest market share and is expected to grow at a CAGR of around 4.8% from 2023 to 2032. The growing needs for enhancing the germination of seeds and ensuring the adequate growth of the pulse canopies is anticipated to augment the demand for the nitrogenous fertilizers during the forecast period.

By Product

By Crop Type

By Form

By Mode of Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

October 2024