September 2024

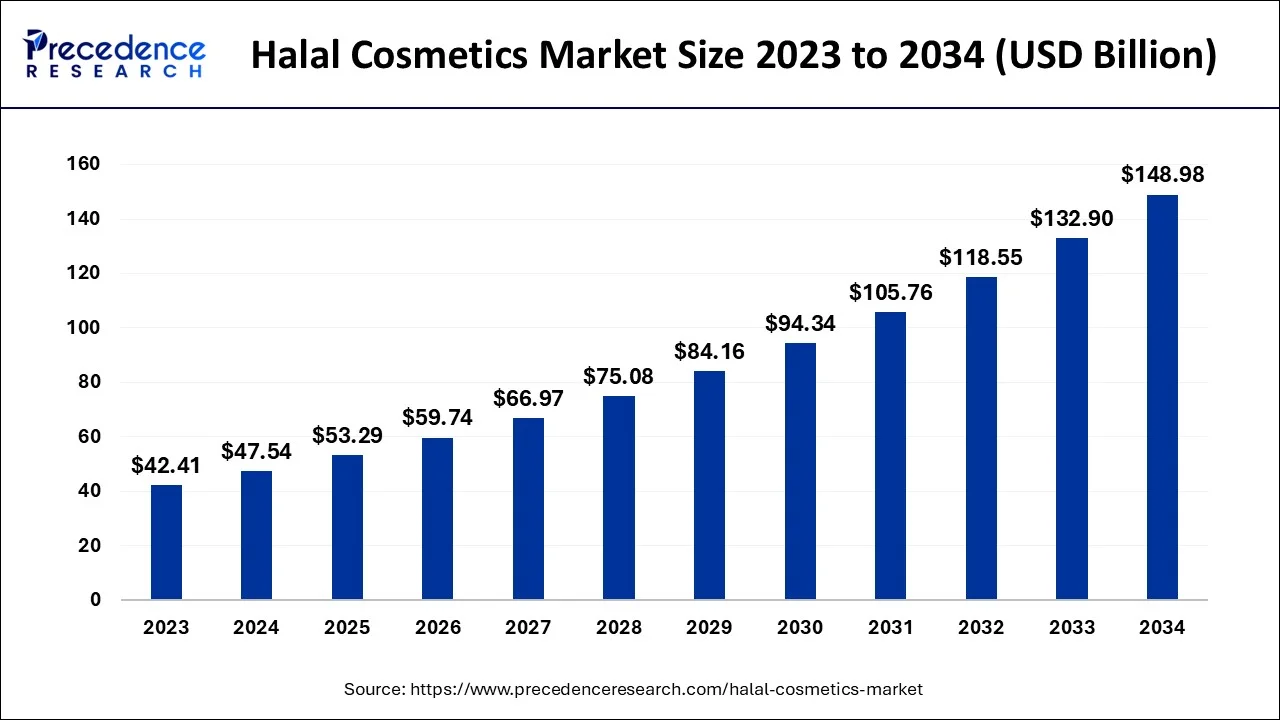

The global halal cosmetics market size accounted for USD 47.54 billion in 2024, grew to USD 53.29 billion in 2025 and is predicted to surpass around USD 148.98 billion by 2034, representing a healthy CAGR of 12.10% between 2024 and 2034.

The global halal cosmetics market size is accounted for USD 47.54 billion in 2024 and is anticipated to reach around USD 148.98 billion by 2034, growing at a CAGR of 12.10% from 2024 to 2034.

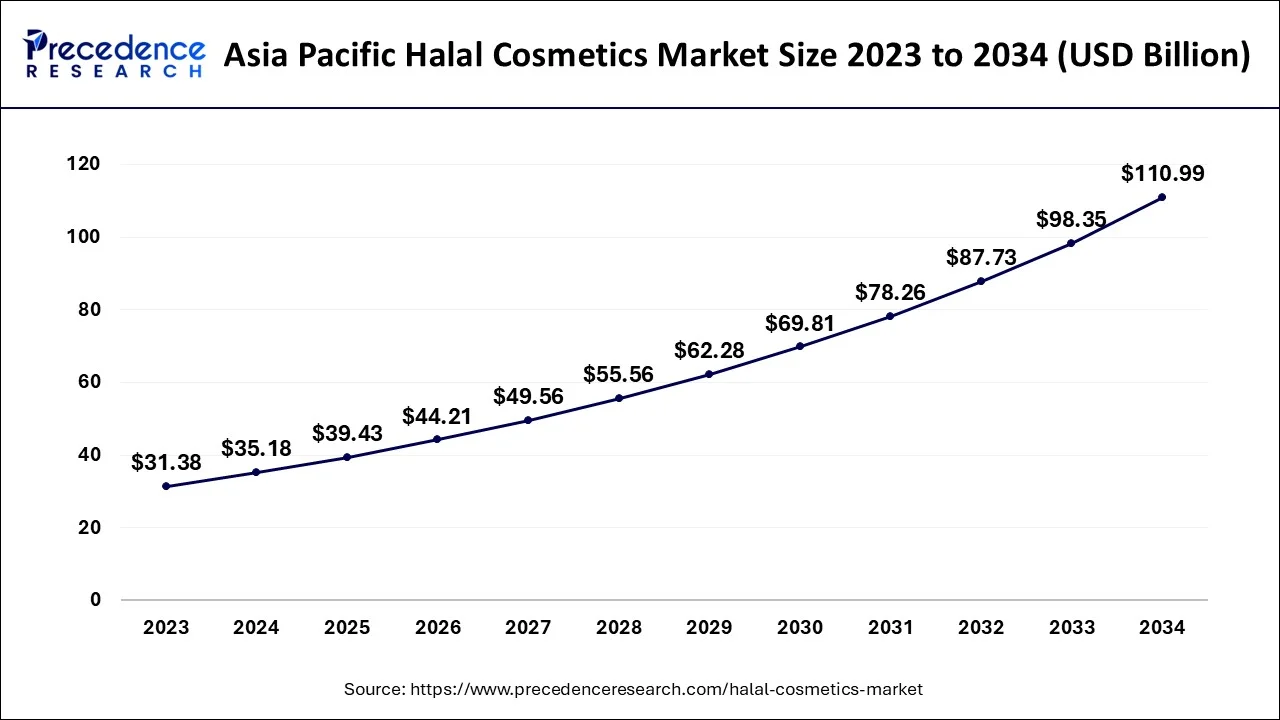

The Asia Pacific halal cosmetics market size is evaluated at USD 35.18 billion in 2024 and is predicted to be worth around USD 110.99 billion by 2034, rising at a CAGR of 12.17% from 2024 to 2034.

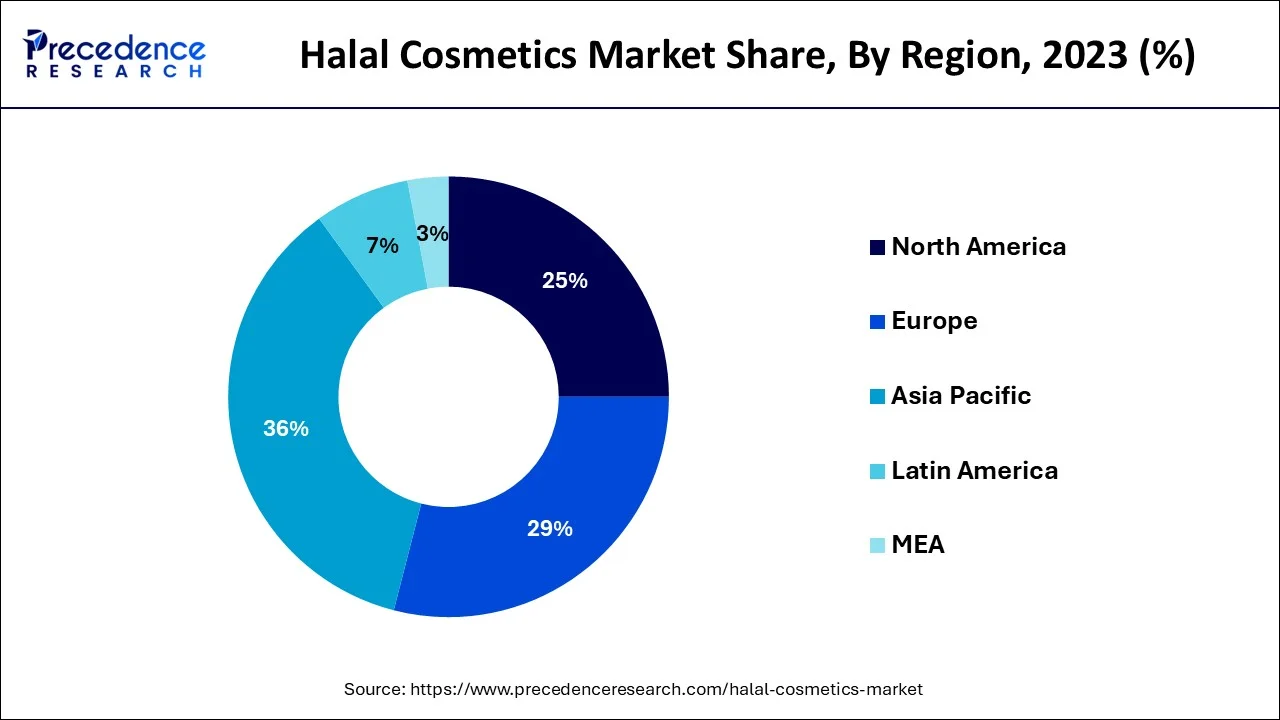

There's a great demand for halal cosmetics in developing as well as developed nations worldwide. Many countries in North America, Europe, and the Asia Pacific are having a great demand for halal cosmetics. The North American region dominates the market for halal cosmetics. The halal cosmetics market is providing a large amount of product base in order to capture the market worldwide. Multinational players are also entering the halal cosmetics range as they see great growth opportunities in various regions.

Halal cosmetics are products that are made of ingredients that are not nonpermissible by Islamic law. All cosmetics are free from any animal products or genetically modified organisms ingredients. The increasing Muslim population has led to a rapid rise in the market for halal cosmetics. An increasing number of women, especially Muslim women entering into the cosmetics and fashion industry, becoming professionals are all leading the way for the demand for halal cosmetics products. These products are free from animal cruelty. Due to a growing trend for personal grooming and the use of beauty products that adhere to the religious norms of the Muslim community, there is a growth in the use of these products. Products like the lipstick Lip Balms Foundation, skin care products, creams, moisturizers, lotions, and products of personal hygiene and personal care are all manufactured under this domain.

The market for halal cosmetics is expanding, especially in regions dominated by the Muslim population. In countries like Saudi Arabia, UAE, Indonesia, Turkey, and Malaysia, there's a growing demand for halal cosmetics. Since Muslims constitute a great part of the global population. This cosmetic industry is expected to grow. There's an increase in the production of Sharia-compliant products. India ranks third in terms of the high Islamic population. Growing standard of living and rapid urbanization has boosted the halal cosmetics market growth in India. There's an increasing demand for Sharia-compliant products or halal-certified products.

The halal cosmetics market was also hit by the COVID-19 pandemic. Look cosmetics market was largely affected as new products were needed like hand sanitizers and eye care. As wearing the mask was a social norm the cosmetics products market had become sluggish.

The compliance with halal certification and the increase in the population of the Muslim community, there is a group in the demand for halal cosmetics. Major market players in the cosmetics industry are also entering the halal cosmetics market. The high cost, which is associated with these cosmetics hampers the market. The increased purchasing power of the growing women Muslim population is expected to increase the demand for halal cosmetics. As young Muslim women are taking interest in fashion and makeup there is growth in this market. There's growth in the fragrances market due to a desire for personal grooming.

The market is expected to grow due to the growing concern among people about animal welfare and their living rights. The trend for veganism is also gaining attention and many people are boycotting animal-based products, so all of these factors are expected to help in the growth of the market. Earlier, the choice of halal cosmetics was extremely timid, but in recent years due to the increased portfolio of various companies, there is an increase in the range of products that are provided.

Many halal-certified cosmetic manufacturers have entered the market. Halal products are not just in demand because of the muslin population but as they symbolize cleanliness, hygiene, and safety non-Muslim women or men are also resorting to halal cosmetic products. Not just the production, but the packaging of these products also require hygiene. All of these reasons are helping in driving the demand for these products in many non-Muslim countries also.

| Report Coverage | Details |

| Market Size in 2024 | USD 47.54 Billion |

| Market Size by 2034 | USD148.98 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis of the product, the halal cosmetics market is segmented into Fragrance, color cosmetics, and personal care. Personal care is sub-segmented into hair care and skincare.

On the basis of the product, personal care products hold the largest market share and it is driven by the number of Muslim women population, which are increasingly using such products. These products are a combination of personal hygiene and religious observances. Halal cosmetics market has a vast product portfolio and a great application in the consumer's lives. Most halal cosmetics do not cause any skin irritation and also do not have any long-term side effects on health. With the increased disposable income and the adoption of modern lifestyles, it is expected that the market shall grow during the forecast period. For the non-Muslim population, varieties of vegan products are proving to be a good skin care segment.

On the basis of application, the hair care segment has the largest market share and is expected to remain the same during the forecast. Hair massage creams, shampoo conditioners, hair oil, hair gels, etc. are all the products that come under the Hair care segment. The hair care segment has grown in the previous years, and it is expected to grow during the forecast period due to specific interest and desire for healthy hair among Muslim women.

On the basis of distribution channels, there are two modes, online mode, and offline mode. Halal cosmetics are majorly distributed across the globe with the help of offline channels like Specialty Stores, brand stores, boutiques, and brand outlets. Post COVID-19pandemic e-commerce activities have also increased across the world. Due to the pandemic, there has been the involvement of e-commerce with halal cosmetics. The distribution of halal cosmetics through hypermarkets and supermarkets or even convenience stores is doing well. The store-based segment is expected to have the highest share and is expected to grow well during the forecast.

By Product Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

November 2024

November 2024