December 2024

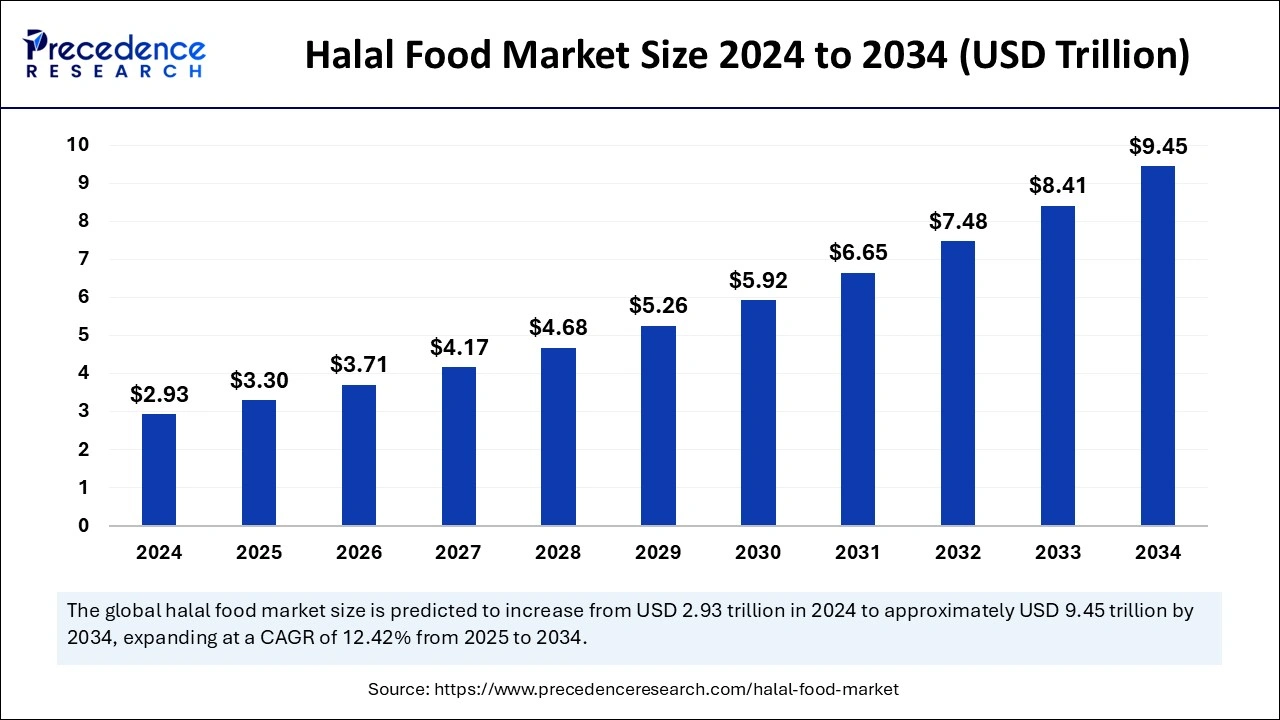

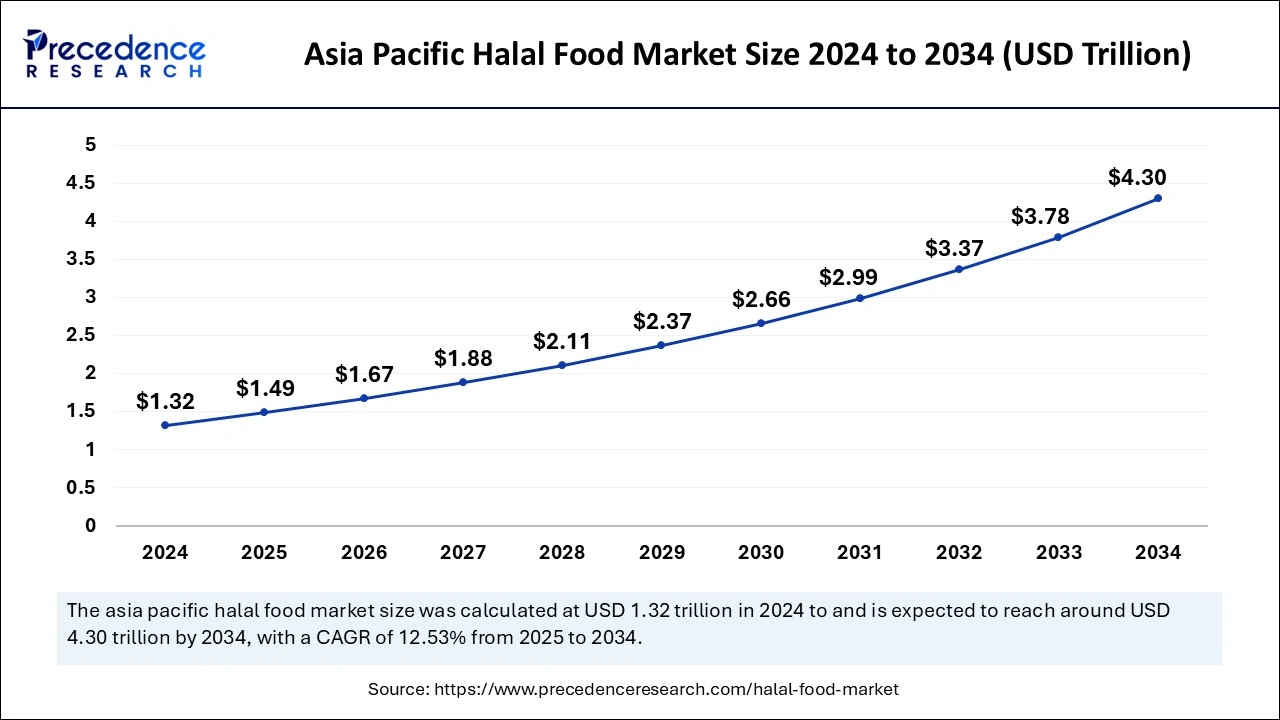

The global halal food market size is accounted at USD 3.30 trillion in 2025 and is forecasted to hit around USD 9.45 trillion by 2034, representing a CAGR of 12.42% from 2025 to 2034. The Asia Pacific market size is estimated at USD 1.49 trillion in 2025 and is expanding at a CAGR of 12.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global halal food market size was calculated at USD 2.93 trillion in 2024 and is predicted to reach around USD 9.45 trillion by 2034, expanding at a CAGR of 12.42% from 2025 to 2034. The halal food market expansion is attributed to clean hygiene followed for meat processes; it is free from harmful additives, preservatives, and chemicals, and the blood from meat is completely drained out, which makes it risk-free from foodborne illnesses.

The integration of artificial intelligence in the halal food industry has the potential to improve the safety, quality, and transparency of halal products. AI helps ensure that the food product meets the strict halal standard regulations by consumers and regulators. Artificial intelligence technology has revolutionized the halal industry by connecting with the audience and creating campaigns with more target-specific, efficient, and data-driven insights. Furthermore, AI in the meat industry is proving to improve production efficiency and product quality in the processing stage. Implementation of AI algorithms provides accuracy, classifies carcasses, automates various processing tasks, and detects meat quality with higher accuracy.

The Asia Pacific halal food market size was exhibited at USD 1.32 trillion in 2024 and is projected to be worth around USD 4.30 trillion by 2034, growing at a CAGR of 12.53% from 2025 to 2034.

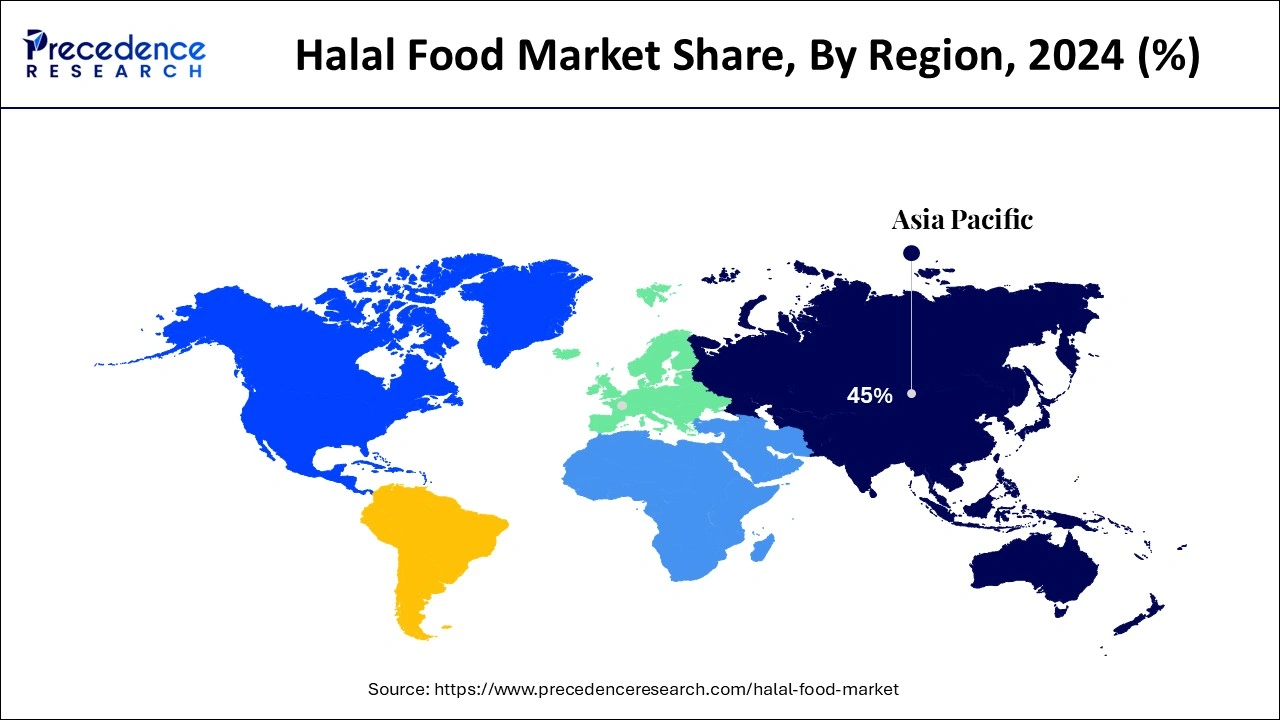

Asia Pacific dominated the halal food market with the highest share in 2024. The dominance of this region is credited to the growing number of consumers, the integration of halal certification, and diverse cuisines. The Organization of Islamic Cooperation (OIC) plays a critical role in implementing trends within countries such as Singapore, the Philippines, and South Korea, making an agreement with OIC countries, and offering various broad partnerships for the import and export of halal products and services.

The Malaysian government is working towards creating a Halal Hub a reality within a few years. Malaysia is expanding in the halal market due to factors such as special tax incentives for Halal products and companies investing in the halal food market, obtaining halal certification from the Department of Malaysia.

Halal food encompasses animal meat accepted for consumption and slaughtered according to Islamic law. Halal food is generally considered cleaner, pure, and healthier because of the strict Zabihah slaughtering process. The meat processing method ensures that the blood is completely drained from the veins during slaughter. The halal food market is often associated with higher-quality and organic ingredients. Among the consumers, it is driven by the multifaced concerns it offers, such as being natural, environmentally friendly, eco-ethical, non-cruelty to animals (mercy kill), socially responsible, and reducing over-consumption. All typical slaughterhouses must own a Halal certificate, which is a legitimate recognition by a credible organization that the food product, ingredient, and process involved in the creation of food is followed by Islamic dietary laws.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.93 Trillion |

| Market Size in 2025 | USD 3.30 Trillion |

| Market Size in 2034 | USD 9.45 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.42% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Halal regulation drives global trade

The predominating factor driving the halal food market is credited with gaining consumer trust, which strengthens the market. Halal regulations are mandated for all halal product providers, and they have the authority to promote halal products locally and internationally. The implementation of mandatory regulations has provided the government with greater control and management over trade and production. This includes the integrated halal product codification and trade data system, which aims to enhance traceability and logistics for maintaining consumer trust.

Risk management

Within halal food product production, a strict risk identification process must be implemented to mitigate the potential risks that could compromise the halal integrity of the food product. The halal ethic of a product is a function of its supply chain; if there is a breakage in the integrity of the halal, the supply chain is disturbed. Most companies have a passive halal integrity, it is limited to the compliance of suppliers and own operations based on requirements of the halal certification body and standards.

Blockchain technology

The halal food market is anticipated to have a gradual integration of blockchain technology. This encompasses tracking food from the source to the consumer, which improves food safety and transparency. Blockchain is expected to offer a decentralized and tamper-proof system for tracking and verifying halal food products; the blockchain will be recording every stage of the supply chain, sourcing raw materials till the final product; this practice will eliminate fraud and build consumer trust by providing verifiable proof of halal products.

The meat and poultry segment dominated the global halal food market in 2024. This segment is greatly driven by the halal technique of slaughter, the demand for draining all the blood from the carcass. These practices are as painless kill and are conducted with consideration to animal welfare practices. Animals killed in a halal are cut through their windpipe, carotid artery, and jugular vein, which causes instant death. Along with this, the animal slaughtered must be alive and healthy at the time of killing.

The dairy products segment is estimated to grow rapidly during the forecast period. The growth of this segment is only considered when dairy products are received from halal animals, including cows, goats, and sheep. Products such as milk, yogurt, and cheese are highly considered halal food. Food must not contain any non-halal additives or processing aids, such as rennet from non-halal sources.

The supermarket and hypermarket segment captured the biggest halal food market share in 2024. The presence of Halal marks or Arabic writing on the products purchased from supermarkets and hypermarkets contributes to the growth of the halal food market. Purchasing a product from a supermarket allows easy access to the identification of halal food, such as checking ingredients for animal derivatives, production of products, and any component prohibited by Islamic law.

The traditional retainer segment is expected to grow at a significant CAGR during the forecast period. The growth of this segment is experienced due to the guaranteed higher quality meat it has to offer to the consumers. The retailers stock fresh products and locally sourced meat. Additionally, traditional retailers offer custom cuts depending on the user’s usage, ultimately bringing customer satisfaction.

By Product Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

January 2025

September 2024