September 2024

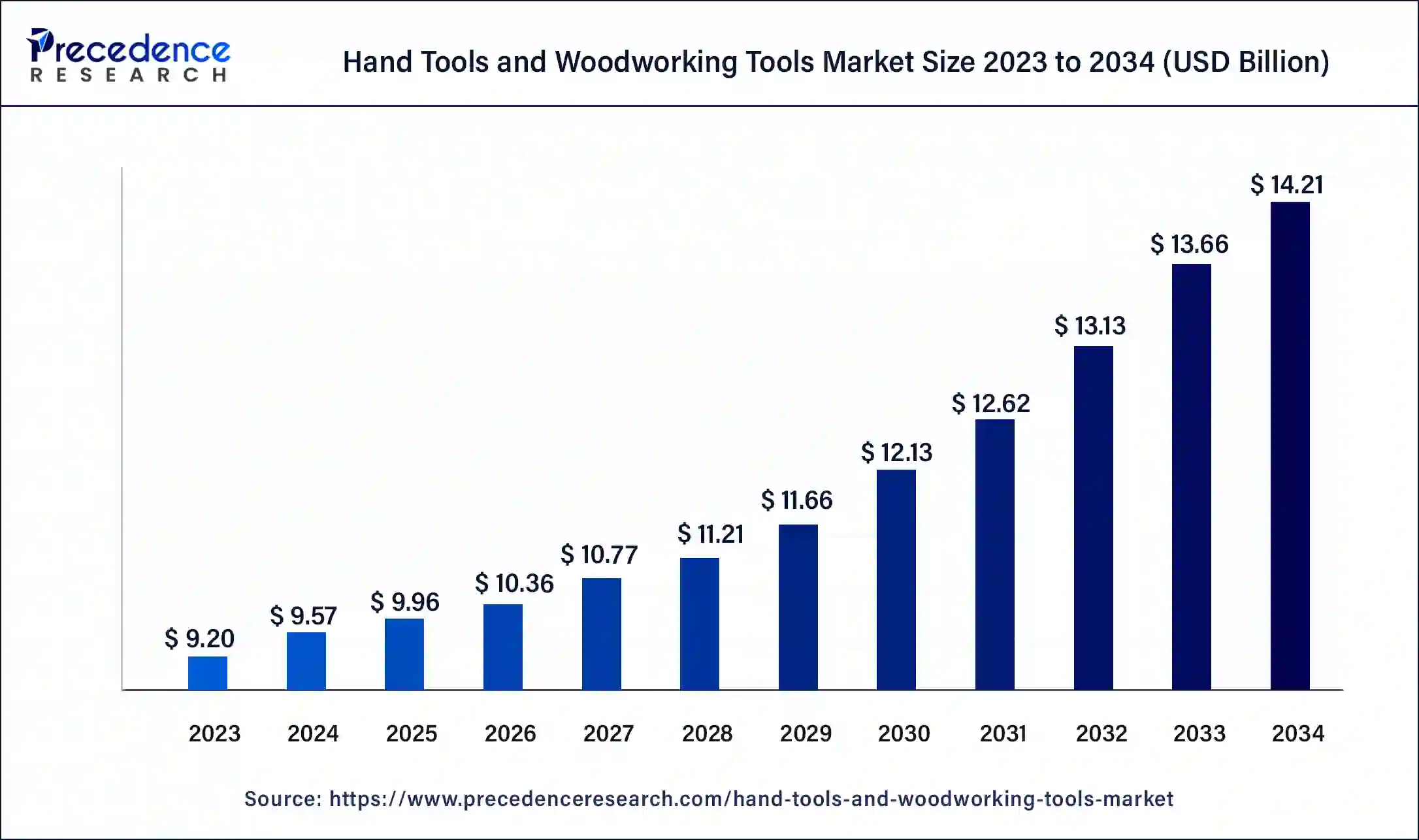

The global hand tools and woodworking tools market size surpassed USD 9.20 billion in 2023 and is estimated to increase from USD 9.57 billion in 2024 to approximately USD 14.21 billion by 2034. It is projected to grow at a CAGR of 4.03% from 2024 to 2034.

The global hand tools and woodworking tools market size is anticipated to reach around USD 14.21 billion by 2034 from USD 9.20 billion in 2024, at a CAGR of 4.03% from 2024 to 2034. The hand tools and woodworking tools market is growing due to an increase in construction and infrastructure projects.

Hand tools don’t require electricity and are commonly used in gardening, agriculture, and framing. Since these tools are manually operated, they are suited for specific tasks and skills. Woodworking tools, which include manually operated equipment for tasks like plumbing, carpentry, servicing, and maintenance, are used across various sectors such as construction, oil & gas, and automotive industries. These tools are available for purchase through a variety of channels, including wholesalers, retail stores, authorized dealers, company websites, and e-commerce platforms. The demand for woodworking tools is high due to their durability and affordability.

How Can AI Be Integrated into the Hand tools and woodworking tools Market?

AI in the hand tools and woodworking tools market enables smooth project completion with exceptional accuracy. The effectiveness of AI depends on identifying specific tasks it can improve, such as precise measurements for framing or achieving clean cuts in lumber. For AI technology to work effectively, accurate input data is needed. Woodworking machines with AI rely on detailed user specifications to perform high-precision tasks. In design and planning, AI-driven tools like automated CAD/CAM systems transform the conceptualization of projects, supporting creative processes that allow for the creation of complex and custom woodwork designs.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.21 Billion |

| Market Size in 2023 | USD 9.20 Billion |

| Market Size in 2024 | USD 9.57 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Types, End-user, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing woodworking hobbyists

There has been a significant increase in hobbyists turning to traditional woodworking methods. This trend highlights a rising appreciation for craftsmanship and manual skills, with many enthusiasts favoring hand tools over power. Moreover, this shift underscores a preference for precision, artistry, and a more personal engagement with the woodworking process. Hence, the hand tools and woodworking tools market is seeing a growing demand for high-quality hand tools to meet the needs of this expanding group of woodworking enthusiasts.

Competition from substitute products

The hand tools and woodworking tools market faces competition from substitute products like power tools, automated machinery, and other equipment. These alternatives are especially rare in large-scale industrial operations. Although hand tools are valued for their convenience, durability, and cost-effectiveness, the presence of these substitutes can affect their demand in industrial environments. To stand out, manufacturers must highlight the distinctive benefits of hand tools and invest in innovative approaches to set their products apart.

Introduction of ergonomically designed

The operational side of industrial as well as commercial facilities. There have been various advancements in the design and features of hand tools like lawn and garden tools. Companies are also focusing on designing hand tools that can improve. Furthermore, they are also emphasizing manufacturing equipment that is ergonomically designed. Also, people utilizing this equipment, such as electricians, are seeking ergonomically designed hand tools. This can create opportunities in the hand tools and woodworking tools market.

The wrenches segment held the largest share of the hand tools and woodworking tools market in 2023. The growing trend of DIY home improvement projects has led to increased sales of hand tools, including wrenches. Homeowners and hobbyists often require wrenches for assembling furniture, fixing appliances, and other household tasks. Advances in wrench design, such as ergonomic handles, ratcheting mechanisms, and improved torque control, have enhanced their efficiency and user-friendliness. These innovations make wrenches more appealing to users, boosting their market share.

The retail segment dominated the hand tools and woodworking tools market in 2023. It comprises the key players: suppliers, distributors, dealers, and wholesalers. The segment also consists of many logistical and transportation operations where hand tools are carried from manufacturer to retailer. Hardware shops and tools are stores in the retail market that can drive market growth.

The online segment is projected to show the fastest growth in the hand tools and woodworking tools market over the forecast period. This segment provides customers with various benefits, such as door-to-door delivery of products of different brands to choose from their online e-commerce platforms. The online platform has allowed manufacturers to sell their products directly to consumers.

The professional segment led the hand tools and woodworking tools market in 2023. Rising population and infrastructural development globally, applications such as electrification, plumbing, and carpentry have registered notable growth. Moreover, growth in industries like electronics, oil and gas, aerospace, and mining also contributed to the segment expansion throughout the forecast period.

The DIY segment is expected to grow at the fastest rate in the hand tools and woodworking tools market during the projected period. The growth can be attributed to the customers trying to be more independent and self-reliant. Factors such as higher labor costs and frequent availability with the lower cost of hand tools have induced the utilization of hand tools for DIY purposes. This key trend can fuel segment growth further.

Asia Pacific dominated the hand tools and woodworking tools market in 2023. The growth is driven by rising construction activities, DIY trends, and increasing emphasis on craftsmanship. The market is also driven by technological development, including the adoption of automated equipment and power tools. Furthermore, countries like China, Japan, and India are experiencing substantial demand for these tools, which can boost market growth further in the future.

North America is expected to grow at the fastest rate in the hand tools and woodworking tools market during the forecast. The growth can be linked to advancements in tools, which have led to the development of innovative products like power tools with lithium-ion batteries and efficient woodworking machines. With new precision capabilities.

In North America, particularly in the U.S., the demand for this equipment is driving because of the increase in the number of manufacturing plants in the region. Additionally, these setups need various types of equipment based on their requirements, which is further propelling the market growth in the region.

| Region | 2020 |

| World | 4,058,931 |

| South America | 844,186 |

| Oceania | 185,248 |

| North America and Central America | 752,710 |

| Europe (excluding Russia) | 202,149 |

| Asia (including Russia) | 1,437,999 |

| Africa | 636,639 |

Segments Covered in the Report

By Types

By End-user

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

October 2024

August 2024