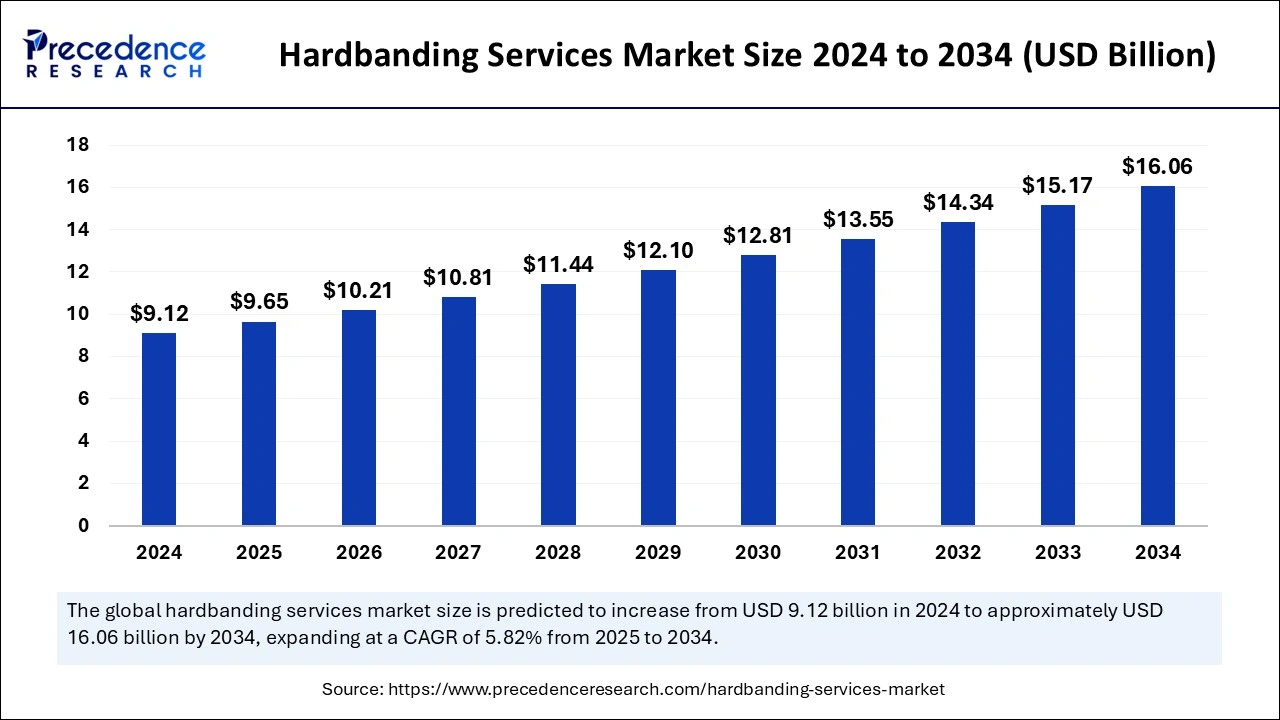

The global hardbanding services market size is calculated at USD 9.65 billion in 2025 and is forecasted to reach around USD 16.06 billion by 2034, accelerating at a CAGR of 5.82% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hardbanding services market size was estimated at USD 9.12 billion in 2024 and is predicted to increase from USD 9.65 billion in 2025 to approximately USD 16.06 billion by 2034, expanding at a CAGR of 5.82% from 2025 to 2034. The expanding oil and gas exploration and production driving demand of hardbanding services. The demand for pipeline protections driving the global hardbanding services market. Additionally, the development of sustainable hardbanding services is shaping the market.

Artificial Intelligence is playing a crucial role in the transformation of every niche sector; The hardbanding services market is no exception. AI has significantly proven its benefits in industries due to its predictive maintenance, data-driven process optimization, quality control improvement, material selection, process management, real-time monitoring, and decision-making ability, as well as novel technology integrations. AI improves raw material efficiency, hardening equipment hardness, quality, and methodology.

The increased need for industry to comply with regulatory standards is a crucial reason for AI integration, as AI not only helps with procedure implementation and productivity enhancement but also helps to improve technology quality, efficiency, and effectiveness. With the surge in work, along with sustainability concerns, AI is becoming an essential tool in the hardbanding services market. Furthermore, the integration of AI is beneficial to prevent the accurate and essential need of hardbanding in specific areas of drilling equipment, making them lifesavers for the oil and gas industry.

Hardbanding is the process of coating or layering hard metal equipment in areas of abrasion. The increased need for pipeline protection from corrosion and wear and tear is driving demands for the hardbanding services market services. Rising mining, construction, and oil and gas production is driving demands for improved drilling equipment to improve performance and resistance capabilities, which makes it essential for the adoption of hardbanding services. Additionally, the utilization of advanced materials, including tungsten carbide, chromium carbide, titanium carbide, niobium boride, and titanium boride, is shaping the development of novel and innovative hardbanding applications.

Growing deep-water ventures have surged due to demands for high-pressure/high-temperature reservoirs. Hardbanding services can provide exceptional wear resistance and protection in the drilling process, which is emerging in the market. Furthermore, the market is shifting toward success due to increased stringent regulatory compliance and industry safety standards, making it essential for the development of innovative sustainable practices. With ongoing research and development, we are improving prior advanced raw materials to improve wear resistance, adhesion, and durability of the hardening services.

| Report Coverage | Details |

| Market Size by 2024 | USD 9.12 Billion |

| Market Size in 2025 | USD 9.65 Billion |

| Market Size in 2034 | USD 16.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.82% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Drilling Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increased oil and gas production and exploration

The oil and gas sector is the major adopter of the hardbanding services market. The rapidly growing oil and gas productions and explorations require wear-resistant coatings and pipeline protections. The need for pipeline integrity maintenance is driving the need for hardening applications. The utilization of drill pipes and other drilling equipment needs to enhance integrity maintenance, efficiency, and lifespan; hardbanding services help to enhance the durability of the equipment.

The complexity of oil and gas production is driving demand for specialized services, including hardbanding. Additionally, the advancement of hardbanding techniques to improve the effectiveness and efficiency of equipment makes them the prior choice for the oil and gas sector. With the growing oil and gas sector and investment of government and non-government organizations in production and exploration, there is a significant increase in the need for hardbanding services, leading to an expansion of the market.

Regulatory compliance

The regulatory compliance regarding the environmental impacts of hardbanding on soil and water quality is majorly hampering the growth of the hardbadning services market. The regulatory safety standards lead to the complexity and cost of the hardbanding services. Additionally, the lengthy process of permitting and licensing makes it difficult to promote novel advanced hardbanding applications.

Regulatory approvals, such as industries' strict safety requirements and environmental restrictions, hinder the hardbanding industry. The growing surge of sustainability is restraining the adoption of traditional hardbanding services. However, innovation and development of eco-friendly applications can help the market comply with regulatory requirements.

Technology advancements

The rising need for the hardbanding services market services in drilling processes is surging with advancements to improve their efficiency and durability. The integration of cutting-edge technologies, including automation, advanced protection methods, cutting-edge materials, and predictive maintenance, is improving to enhance productivity. The leverage of advanced materials and coatings is leading to enhanced wear resistance and lifespan of the hardening applications.

The growing demand for sustainable applications and products is encouraging the development of innovative technologies to comply with regulatory requirements, making further impact on the expansion of the hardbanding service market. Moreover, with government support and investments, the market is gaining ways for novel innovations and developments of the cutting-edge hardbanding technologies.

The tungsten carbide segment registered a maximum hardbanding services market share in 2024 due to its properties of hardness and great resistance. Tungsten carbide is majorly utilized to prevent erosion and abrasion during the drilling process. Due to its expectational harness and abrasive formations, it is mostly adopted for hardbanding services in drilling settings. Moreover, abrasive formations of tungsten carbide powders make them highly applicable in the oil and gas sector.

On the other hand, the chromium carbide segment is anticipated to grow at a remarkable CAGR between 2025 and 2034. The segment growth is accounted for due to the rising utilization of chromium carbide in various industries, including mining, construction, and oil and gas, due to high hardness, corrosion resistance, high-temperature resistance, and low-friction coefficient properties. Furthermore, chromium carbide materials are cost-effective compared to other hardening materials. High wear resistance makes them popular for equipment with heavy wear and tear.

The open-hole segment held the largest hardbanding services market share in 2024. This growth is leveraged due to its extended use in hardbanding applications to improve drill string efficiency and lifespan by its increased wear, abrasive contact, and protection characteristics. Open-hole drilling is used in the early drilling stage, and explorations are used to improve drilling durability. The increased demands of open-hole hardbanding applications for the protection of rill pipes and equipment fueled the segment expansion.

On the other hand, the cased hole segment is expected to grow at the fastest CAGR over the projected period due to the utilization of hardbanding applications for tool joints of drill pipes or other equipment. Closed holes are preferred for sealing and not actively being drilled to improve the durability of drilling equipment and resistance from mitigating wear and tear. Closed-hole hardenings are applied by utilizing welding techniques, creating a tough, wear-resistant layer.

The drill pipe segment registered the maximum hardbanding services market share in 2024 due to the wide use of drill pipes in the drilling process. Drill pipes play a major role in the drilling process. Drill pipes are convenient for constant movement, rotation, and resistance for abrasive materials, which makes them a priority in the drilling process to reduce wear-related issues. The extreme use of drill pipes leads to the utilization of hardbanding services to prevent integrity and improve the efficiency of drill pipes. Hardbanding applications help to reduce maintenance downtime of drill pipes. Ongoing technology advancements to improve the efficiency of drill pipes further enhance the need for hardbanding services.

However, the tool joint segment is projected to witness significant growth in the forecast period due to its high demand to protect drill pipes from leakage. Tool joints are strong and reliable to connect two pipes. The increased utilization of tools and joints in oil and gas, petrochemicals, and power generation contributes to its higher demands. Tool joints are primary solutions to enhance the durability of drill strings by resisting wear and abrasion. Tool joints are easier to install and cost-effective compared to other hardbanding methods.

Asia Pacific led the global hardbanding services market with the highest share in 2024 due to an expanded oil and gas sector. Asia Pacific is the home region for the production and exploration of oil and gas. The oil and gas sector makes essential adoption of hardbaning services in Asia to improve operational efficiency, drilling, and equipment life. The increased requirement for drill pipes is contributing to the regional market growth. Countries like China, India, and Indonesia are well-known for producing oil and gas. China is leading the regional market due to the country's production and exploration of oil and gas. Moreover, government investments in oil and gas explorations encourage key companies to improve their research and developments.

India is the second largest country leading the regional market. This growth is attributed to countries broad oil and gas sector and investments in the development of specialized drilling techniques. The government allowance for 100% foreign direct investment (FDI) in upstream and private sector refining projects in India is further contributing to market growth. The increased demand for fuels has drawn this activity. With a growing population and adoption of automotive and government investments, India is expected to dominate the market in the forecast period.

North America is projected to witness growth in the hardbanding services market over the forecast period due to its well-established logistics sector and transportation of drill pipes and other equipment. The regional market is further seeking growth due to increased consumer demand for sustainability and cost-effective products. The availability of cutting-edge technologies makes it easier for North America to play in favor of the market expansion. The United States is leading the regional market due to the presence of key market players in the country. Top companies integrate cutting-edge technologies such as production techniques and sustainable practices. Canada is contributing spectacular market share with countries that have advanced raw material extraction, milling, and drilling technologies.

By Type

By Drilling Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client