March 2025

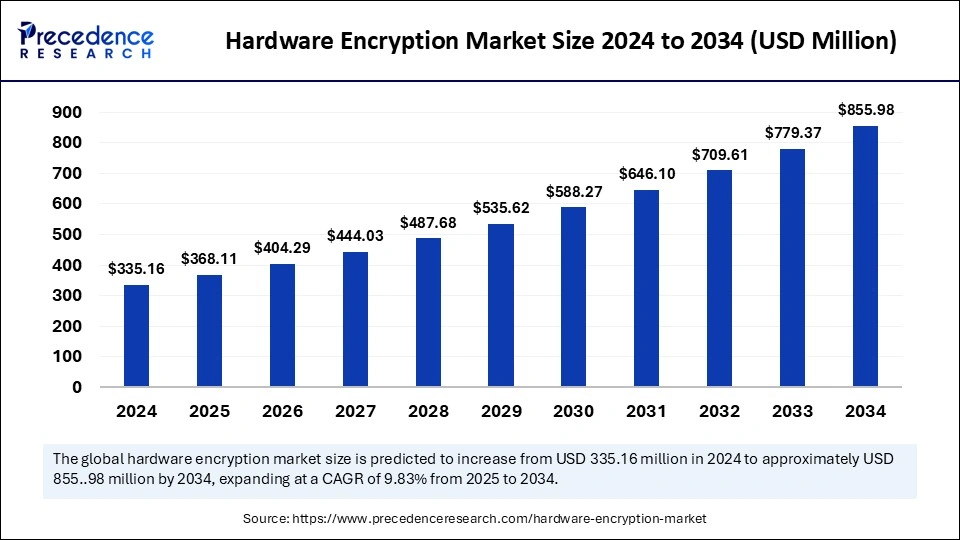

The global hardware encryption market size is calculated at USD 368.11 billion in 2025 and is forecasted to reach around USD 855.98 billion by 2034, accelerating at a CAGR of 9.83% from 2025 to 2034. The North America market size surpassed USD 134.06 billion in 2024 and is expanding at a CAGR of 9.96% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hardware encryption market size was estimated at USD 335.16 billion in 2024 and is predicted to increase from USD 368.11 billion in 2025 to approximately USD 855.98 billion by 2034, expanding at a CAGR of 9.83% from 2025 to 2034. The increased demand for high-performance encryption solutions in industries like banking, finance, healthcare, and defence is significantly driving the global hardware encryption market. The growing need for secure data storage is fuelling the market growth.

Artificial intelligence integration has become a significant tool to advance hardware encryption solutions with improved security, performance, and efficiency. AI is enabling the simplification of key management and optimizing encryption processes. AI algorithms have proven significant efforts in the detection of cyber threats. AI algorithms help to advance overall performance and enable access to novel applications. The increasing need for advanced, efficient, and secure encryption solutions is the major trend driving the implementation of AI in hardware encryption solutions.

Additionally, an emphasis on the integration of AI in hardware encryption solutions is enabling the development of emerging technologies such as quantum-resistant encryption, homomorphic encryption, and AI-powered key management. AI indication with hardware encryption solutions is projected to witness transformative growth adoption in various industries, making a favorable impact on the hardware encryption market.

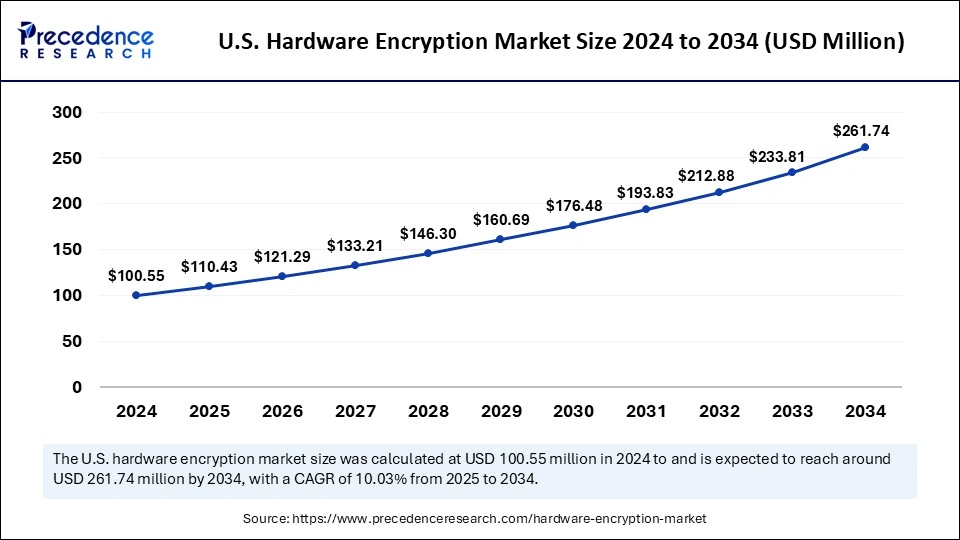

The U.S. hardware encryption market size was exhibited at USD 100.55 billion in 2024 and is projected to be worth around USD 261.74 billion by 2034, growing at a CAGR of 10.03% from 2025 to 2034.

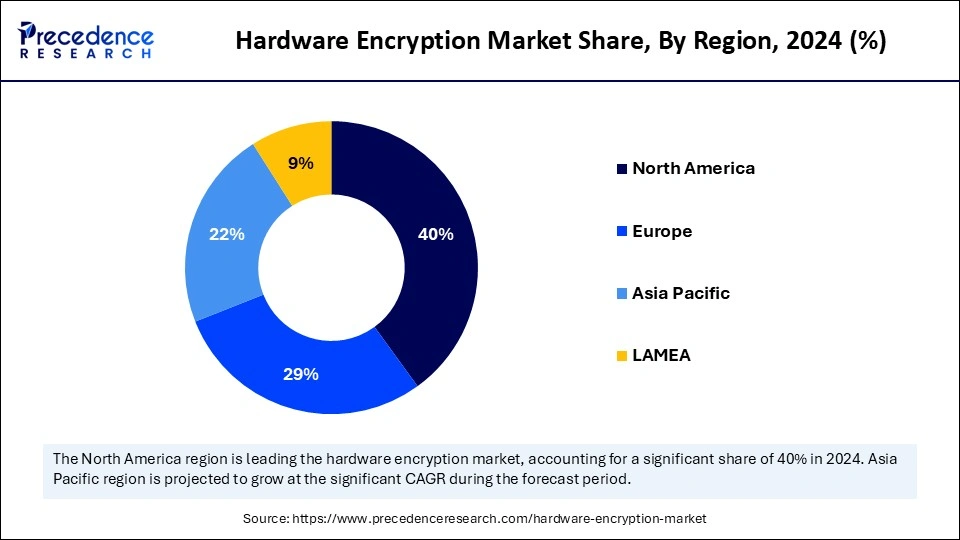

North America held the largest share of the hardware encryption market in 2024. This dominance is majorly attributed to the region's strict regulatory requirements, the presence of key vendors, and high demand for cutting-edge technologies. The demand for cloud services and secure data storage is extreme in North America. The advanced IT infrastructure in the region boosts the high level of digital transformation, which is driving demand for security solutions. Expanding IT industries and government and regulatory support for the adoption of edge technologies and services to reduce risk of cyber threats plays a favorable role in the growth site.

U.S. Hardware Encryption Market Trends

The United States is the major shareholder in North America because of the presence of key market vendors and the major demand for cloud services. Expanded and advanced industries like finance banking and healthcare are driving high demand for secure data storage and compliance with regulatory requirements. United States home adapter for IoT devices and other cutting-edge technologies such as quantum computing and artificial intelligence, which fuels the highest contribution in the adoption of hardware encryption solutions.

Asia Pacific is observed to grow at the fastest rate during the forecast period. Growing urbanization and the development of smart cities are the major factors leading to increased demand for data security and protection, which drives the adoption of hardware encryption solutions in the region. The major factors like sustainable practices, digital transformation, and investment in R&D are trending the market in Asia Pacific. Rising government support for infrastructure development and urbanization is filling the market.

China & India Hardware Encryption Market Trends

Countries like China, India, Japan, and South Korea are significantly impacting the regional market growth. China and India are the major leaders of the hardware encryption market in Asia Pacific due to rapid digitalization, increasing data security concerns, and the expansion of IT infrastructure. Government initiatives for promoting awareness across various industries are taking place due to increasing data breaches and cyber threats. The implementation of stringent data protection laws and policies is fulfilling the demand for secure storage solutions, making significant room for the adoption of hardware encryption solutions.

Europe is observed to grow at a considerable growth rate in the upcoming period. Factors like increased adoption of cloud services, IoT technology advancements, and the presence of key manufacturers are driving the hardware encryption market. Robust government agencies and defense organizations play a pivotal role in the advancements in the hardware encryption market in the region. Robust finance & banking, and government organizations in Europe drive the requirement of secure data storage and compliance with regulatory requirements, making essential adoption of hardware encryption solutions among these industries.

Germany Hardware Encryption Market Trends

Germany dominates the regional market with countries expanding the IT and telecommunications industry. The high adoption of Internet of Things devices, edge technologies, and cloud-based encryption in countries with broad IT and telecommunication industries are the extreme market developer factors. Germany refers to the high utilization of secure cloud computing platforms, mobile devices, and network infrastructure, ensuring the confidentiality, integrity, and availability of digital assets and communications, making it essential for the adoption of hardware encryption solutions.

The hardware encryption market refers to the adoption of hardware-based encryption solutions to ensure data security, protection, and encryption for industries like banking, finance, healthcare, government, and defense. The high utilization of consumer electronics such as mobile phones, laptops, tablets, and smartwatches is the major adapter of hardware encryption solutions. The market growth is furthered by the increase in adoption of mobile devices and cloud-based services. Furthermore, growing need for large security and integration of artificial intelligence and machine learning with existing systems, a driving need for hardware-based encryption solutions for the protection of sensitive data, and robust security solutions.

The increased compliance with cybersecurity and threats are the major concerns driving a shift toward the adoption of hardware encryption solutions. Government and regulatory promotions for promoting awareness of cybersecurity and emphasis play a pivotal role in the increased demand for these solutions. Regulatory initiatives including the United States’ Commercial National Security Algorithm (CNSA) 2.0, the European Union’s Network and Information Security (NIS) 2, Digital Operational Resilience Act (DORA) are ensuring compliance of the need for IT infrastructure modernization with the post-quantum cryptographic encryption algorithms and zero trust architecture for enterprises.

| Report Coverage | Details |

| Market Size by 2034 | USD 855.98 Billion |

| Market Size in 2025 | USD 368.11 Billion |

| Market Size in 2024 | USD 335.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Regulatory Compliance

The regulatory compliance associated with data security, privacy, sensitive recording, and the cost-effectiveness of hardware encryption is the major driver of the hardware encryption market. A decrease in concern about data security from cyber threats and data breaches is driving demand for advanced hardware encryption solutions. The regulatory framework has initiated some regulations, such as the General Data Protection Regulation, the Health Insurance Portability and Accountability Act, and the Payment Card Industry Data Security Standards, to reduce cybersecurity threats and improve sensitivity to protections by advancing in demand for hardware encryption solutions. Furthermore, the collaborative approaches between regulatory frameworks and key market companies are leveraging advancements in hardware encryption solutions.

Limited Scalability

A large organization requires hardware encryption implementation with a high upfront investment in specialized hardware components. Limited scalability requires frequent hardware upgrades, maintenance, and support, which causes an increase in cost and a decrease in profitability. The lack of scalability can hamper the adoption rate of hardware encryption solutions in small and medium-sized businesses, which are cost-conscious resources. The limited scalability of hardware encryption causes a delay and a reduction in performance in the solutions. Additionally, integrating hardware encryption with existing infrastructure can cause complexity, which requires scalable solutions, and can reduce its popularity.

Increased adoption of cloud services

The use of cloud services has taken place. Major organizations are transforming their data to cloud solutions, which is driving a need for advanced data protection and compliance with regulations for the use of hardware encryption to protect sensitive data. Cloud-based data requires secure storage solutions and encryption. The growing adoption of a hybrid cloud environment further generates opportunities for hardware encryption solutions for data security in multiple cloud environments. Several cloud-based encryption solutions, like cloud-based hardware security models and cloud-based encryption gateways, are enabling organizations to protect their data in cloud services. The ongoing advancements in scalability and flexibility of cloud-based hardware encryption solutions are likely to revolutionize hardware encryption solutions.

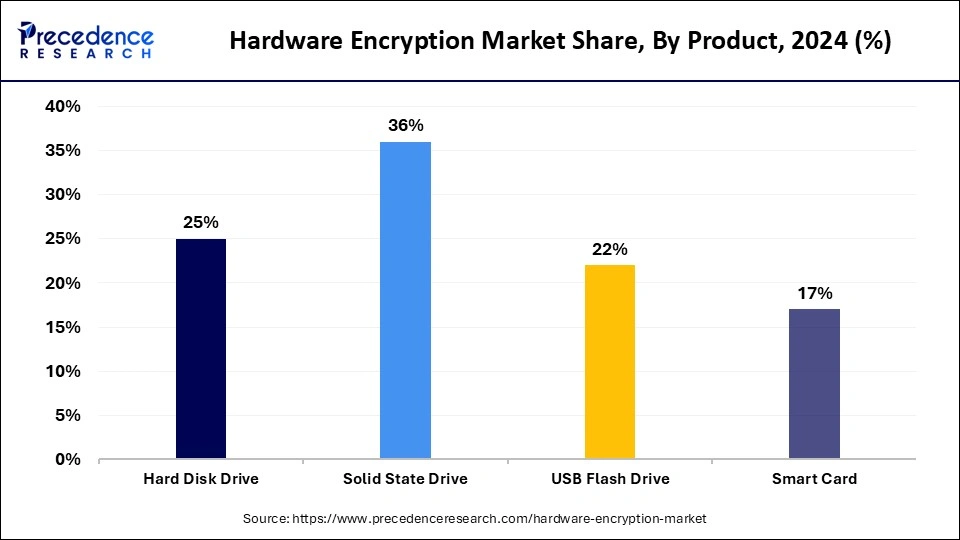

Based on the product, the solid-state drive segment dominated the hardware encryption market. The segment growth is attributed to the demand for high-performance, reliable, and energy-efficient hardware encryption solutions. This solid-state drive transfers high-speed data has more reliability and durability, and low latency compared to traditional hardware products. The ability of solid-state drives to consume low power makes them ideal for energy-conscious applications. The PCIe Gen5 products are rapidly gaining traction across diverse applications, and the increasing demand for advanced SSDs for PCIe is emerging in the market.

On the other hand, the smart card segment accounted for the fastest-growing segment of the market. Increasing the need for a review of secure features is the major trend driving growth of this segment. Smart cards provide secure authentication and identification, which drives their adoption in payment cards, identity cards, and data access control. The product plays a vital role in protecting sensitive data storage and transforms it through cards. Smart cards are widely adaptable in industries like banking and finance, transportation and logistics, government and healthcare.

Based on end use, the consumer electronics segment accounted for the largest market share in 2024. The high adoption of consumer devices such as smartphones, laptops, tablets, and smartwatches are driving the need for data security features. The increased demand for secure devices and the use of connected devices are driving demand for hardware encryption for the protection of sensitive data. Furthermore, ongoing organizations' "Bring Your Device" (BYOD) policy is trending to further segment growth. Technological advancements like the development of more efficient and affordable hardware encryption solutions are encouraging the adoption rate and its integration with personal devices.

However, the aerospace & defense segment is projected to witness significant growth in the forecast period. The segment growth is accounted for due to the increased demand for advanced hardware encryption solutions in aerospace & defense. The sensitive data of the industry requires advanced hardware encryption. The regulatory compliance regarding data security and protection makes hardware encryption solutions more popular for aerospace & defense. Furthermore, the growing integration of military systems with other devices to ensure data security across networks is leveraging the segment growth.

By Product

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

November 2024

February 2025

July 2024