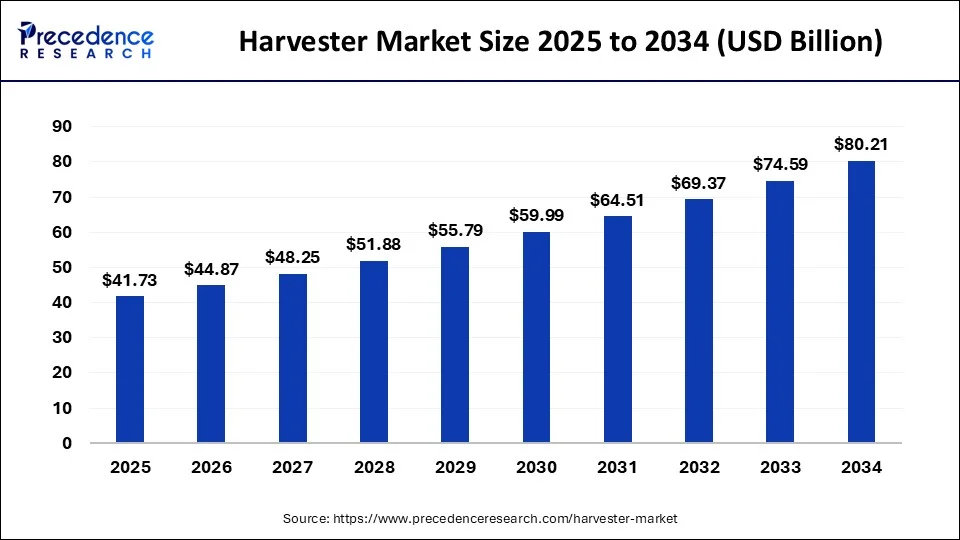

The global harvester market size accounted for USD 38.81 billion in 2024, grew to USD 41.73 billion in 2025 and is expected to be worth around USD 80.21 billion by 2034, registering a CAGR of 7.53% between 2024 and 2034. The Asia Pacific harvester market size is evaluated at USD 15.14 billion in 2024 and is expected to grow at a CAGR of 7.65% during the forecast year.

The global harvester market size is calculated at USD 38.81 billion in 2024 and is projected to surpass around USD 80.21 billion by 2034, expanding at a CAGR of 7.53% from 2024 to 2034. The harvester market is growing due to the growth in mechanization, technological enhancements, and relatively high cost of labor. Recent innovations in harvester technology include smart sensors, real-time data analytics, solar-powered harvesting drives, and volume-controlled harvesting.

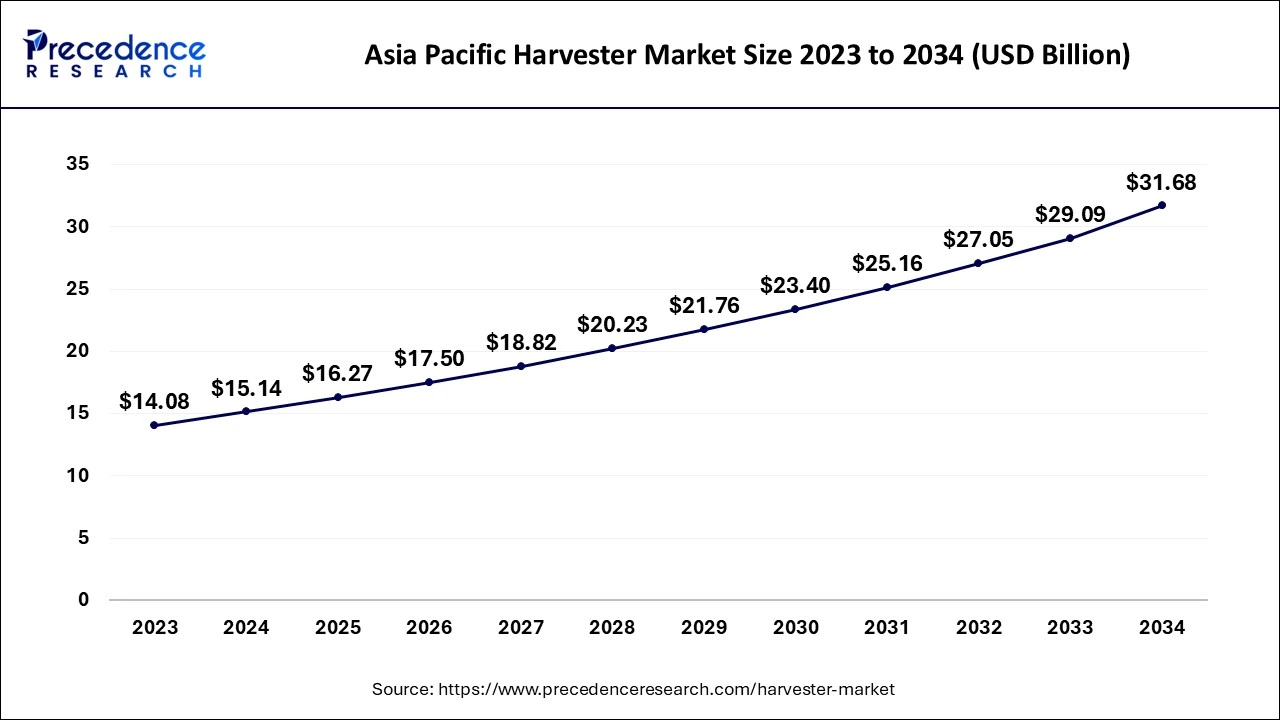

The Asia Pacific harvester market size is exhibited at USD 15.14 billion in 2024 and is anticipated to reach around USD 31.68 billion by 2034, growing at a CAGR of 7.65% from 2024 to 2034.

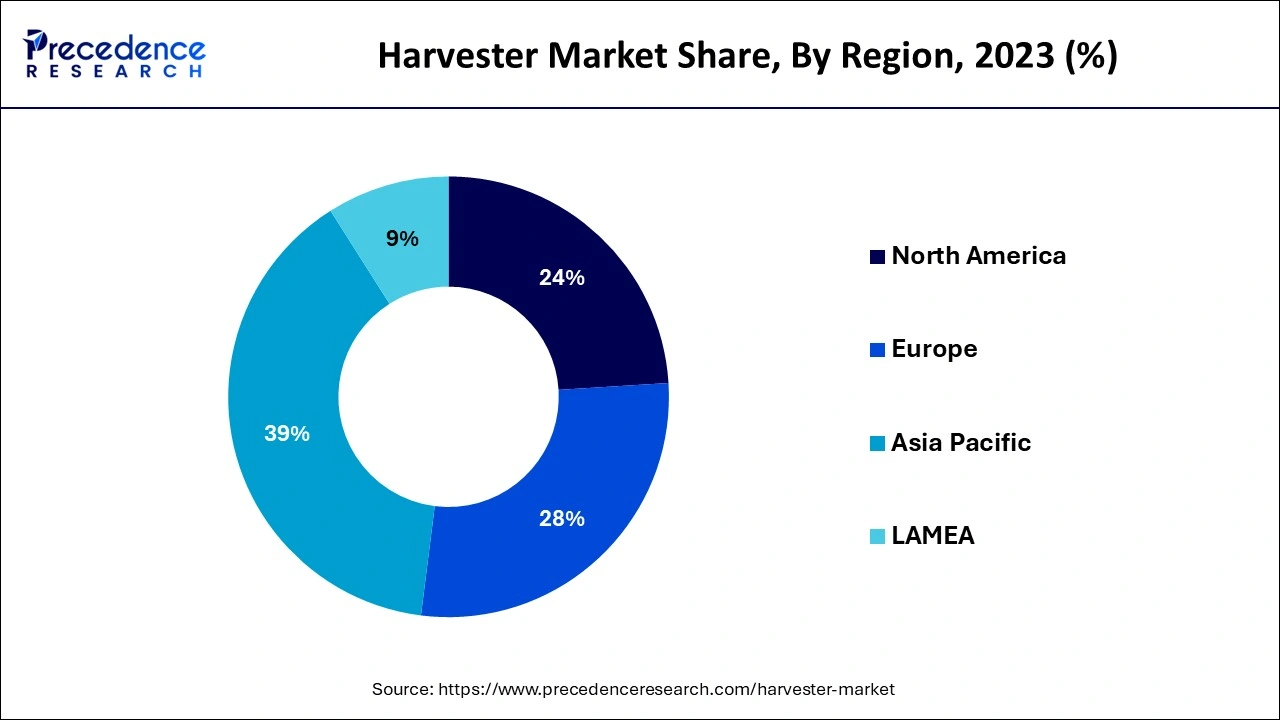

Asia Pacific led the harvester market in 2023. The dominance of the region is stimulated by the exponential growth in the trends of mechanization of agricultural people in developing countries such as India and China in recent years with a strong backbone of well-established agricultural sector. Due to the increased use of modern tools in harvesting, the region changed from labor-intensive farming to capital and mechanical farming.

While being the dominating one, it is forecasted that Asia Pacific will show high growth because its countries, especially India, China, and other countries, have their main population dependent on farming for their livelihood. The governments are aiming at several approaches that may enhance production to meet the needs of the growing population.

North America is observed to grow at the fastest rate in the harvester market during the forecast period. The region is observed to witness an increasing tendency towards high-capacity harvesters suitable to large areas such as fields in the U.S. and Canada. The U.S. market is gradually experiencing the use of autonomous and AI-operated harvesters, especially when farming large fields of grain. The market players in the region are investing heavily in the research and development of new harvesters, these factors are seen to supplement the region to expand in the upcoming period.

The harvester market is moving upward with the expanding market for agricultural production, innovative technologies, and the scarcity of labor in the farms. With increased consumption and use of food, fiber, and other products, there is always a high demand for harvesters to assist in reaping crops. Many countries, including the U.S., Britain, and Australia, are currently experiencing a lack of agricultural workforce. As a result, farmers have no option but to adopt mechanization practices like the use of combined harvesters.

How AI Impacts on the Harvester Market

By integrating historical and ‘real-time’ information, the harvester market products and services can improve surrounding irrigation timing and, in the process, cut fresh water usage and decrease the negative effects of farming. AI is now shifting the features of the agriculture machinery market with opportunities by increasing productivity at higher and faster rates. AI solutions have been applied in tasks related to enhancing the usage of resources and reducing resource utilization in the agriculture sector. These robots are used to select and package crops while evaluating the quality of crops and finding weeds. These robots can also solve challenges that point by agricultural laborers face.

| Report Coverage | Details |

| Market Size by 2034 | USD 80.21 Billion |

| Market Size in 2024 | USD 38.81 Billion |

| Market Size in 2025 | USD 41.73 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.53% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Automation Level, Propulsion Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising mechanization in agriculture

The penetration of mechanical systems in agriculture is affecting the harvester market. For farmers to increase productivity and efficiency, the market for more effective harvesting equipment is gradually growing. This is because new developments in the design and operation of harvesters, specifically involving automation and precision agriculture, synergize market expansion. Activities of the government that promote the process of modernization of the agricultural sector are stimulating investments into mechanized models. The market for harvesters is expected to grow to modernize the agricultural industry.

High associated costs

The high initial cost of modern harvesters and, therefore, small-medium farms cannot afford to purchase the new technology. Moreover, constant maintenance and repair expenses also play a role against the farmers. The scarcity of skilled workforce that can drive sophisticated mechanisms for harvesting is one of the challenges that have hindered the development of the equipment within the agriculture sector. This is because, as harvesting technology advances, the expertise of the operators is required.

Rising demand for eco-friendly harvesting solutions

With the growing applications of the harvester market related to the environmental concern of reducing the use of non-renewable resources for the mechanization of agricultural production and the subsequent harvesting of produce, the agricultural machinery market is gradually evolving. The market for manufacturers is constantly pushing towards the creation of improved minimal-impact energy harvesters. The eco-friendly harvesters are anticipated to grow by global sustainability and food security objectives.

Some of them are electric and HEV (Hybrid engines) that provide low emissions and low fuel requirements. This trend is driven by consumers' and farmers' increased consciousness of environment-friendly farming forms and the concept of caring for natural resource bases and maintaining biodiversity. Also, policies and promotion of sustainable farming by the government push the manufacturers to consider environmentally friendly technologies.

The forage harvester segment contributed the largest share of the harvester market in 2023. A forage harvester, a silage harvester, or a chopper is a farm machinery used to harvest and chop forage crops to make silages. It is simply grass, corn, or hay that has been cut and packed tightly into a storage silo, silage bunker, or silage bags. It is an essential feed in animal production. The shift to sustainable farming practices is also impacting the market for forage harvesters, with manufacturers tailoring equipment to be more sustainable. These forage harvesters are fast, and farmers can get more work done. It can assist farmers to optimize resources and boost total production and effectiveness in terms of profitability.

The combine harvester segment is expected to show considerable growth in the harvester market over the forecast period. Reaping, threshing, and winnowing are three operations of harvesting that are combined in a method called a combine harvester. They are the most economical tools in the modern world to save the workforce, especially in the agricultural sector. Farmers continue to use combine harvesters mainly because of the cutting down of both time and cost. Technological developments, the shift to meeting performance criteria, and increasing reliability all enhance the status of the equipment as an indispensable component of modern agriculture.

The semi-automatic segment accounted for the largest share of the harvester market in 2023. The rise in the cost of labor and the availability of farm labor are key factors that militate the demand for semi-automatic harvesters. A semi-automatic harvester is an assembly that can perform many harvesting operations fully automatically and can be used for, for example, eggs, crops, and timber. They change incrementally with features like GPS-directed systems, yield mapping, and real-time data processing, which was characteristic of only these machines.

The automatic segment is anticipated to witness significant growth in the harvester market over the studied period. These machines replace human input and capital, which is getting more costly by the day. AI and machine learning enable farmers to maximize and increase their harvest and improve the quality of the yields obtained during the harvest. An automatic harvester can be defined as a tool that is utilized in the harvesting process to exert some effort in addition to that provided by the farmer. They employ sensors, cameras, and robots to detect and harvest crops without causing harm to them.

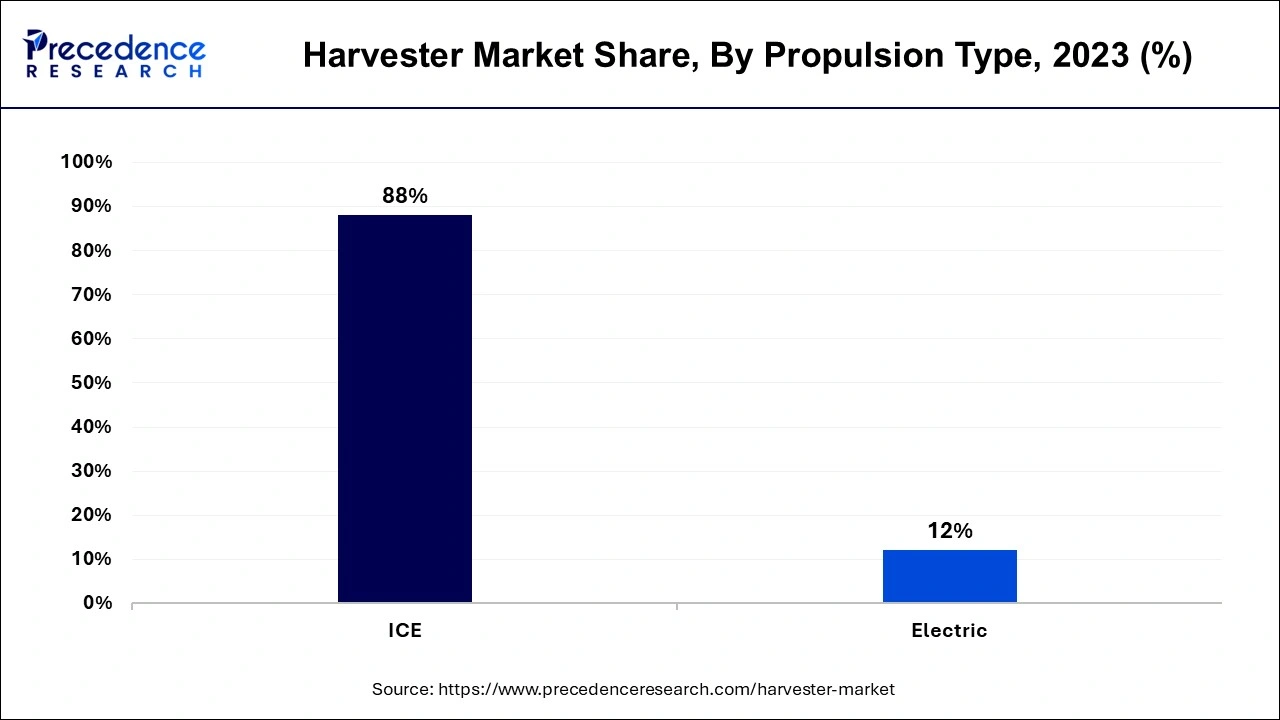

The ICE segment has contributed the largest share of the harvester market in 2023. The diesel fuel infrastructure has been developed, and farmers, especially in rural areas, prefer ICE harvesters because the fueling infrastructure has already been developed. Moreover, capital investment is needed to enhance engine technology's fuel efficiency and reduce emissions.

The electric segment is expected to show considerable growth in the harvester market over the forecast period. This segment has also experienced higher innovations and has attracted manufacturers as well as farmers. One of the most important factors is the expansion of battery power systems, which can give longer work times.

Segments Covered in the Report

By Type

By Automation Level

By Propulsion Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client