January 2025

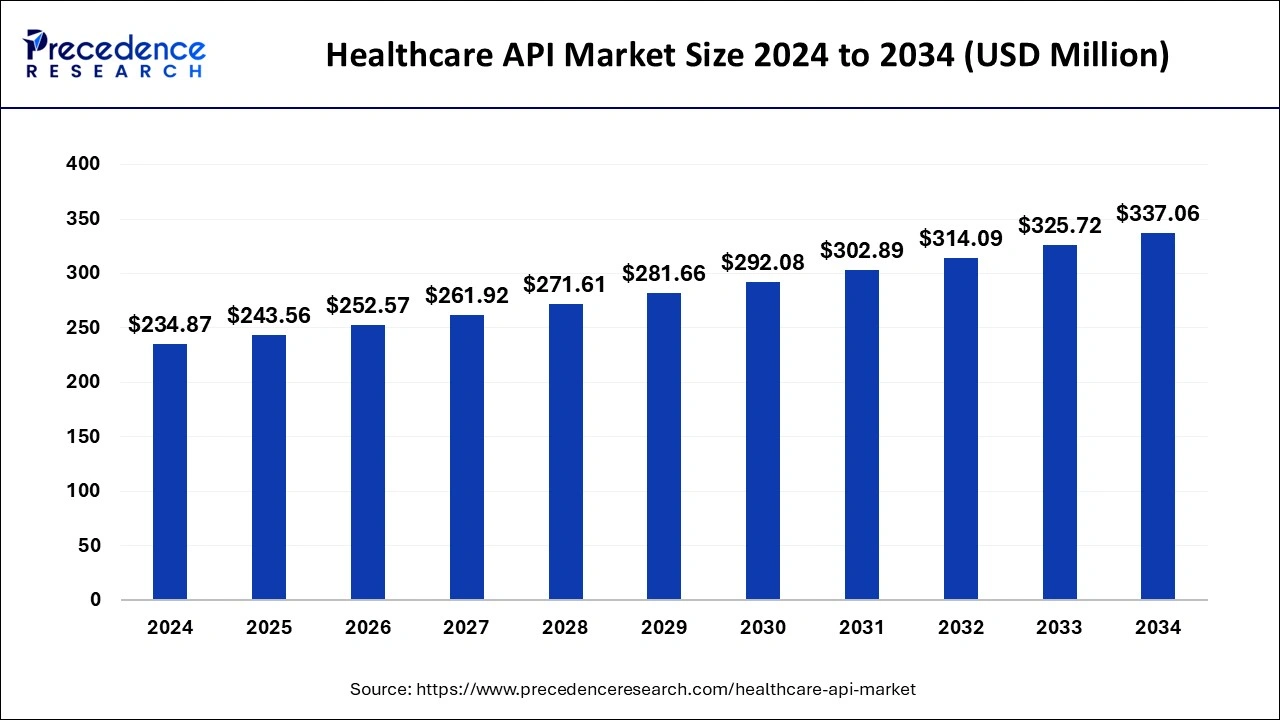

The global healthcare API market size is calculated at USD 243.56 million in 2025 and is forecasted to reach around USD 337.06 million by 2034, accelerating at a CAGR of 3.68% from 2025 to 2034. The North America healthcare API market size surpassed USD 86.90 million in 2024 and is expanding at a CAGR of 3.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare API market size was accounted for USD 234.87 million in 2024, and is expected to reach around USD 337.06 million by 2034, expanding at a CAGR of 3.68% from 2025 to 2034.

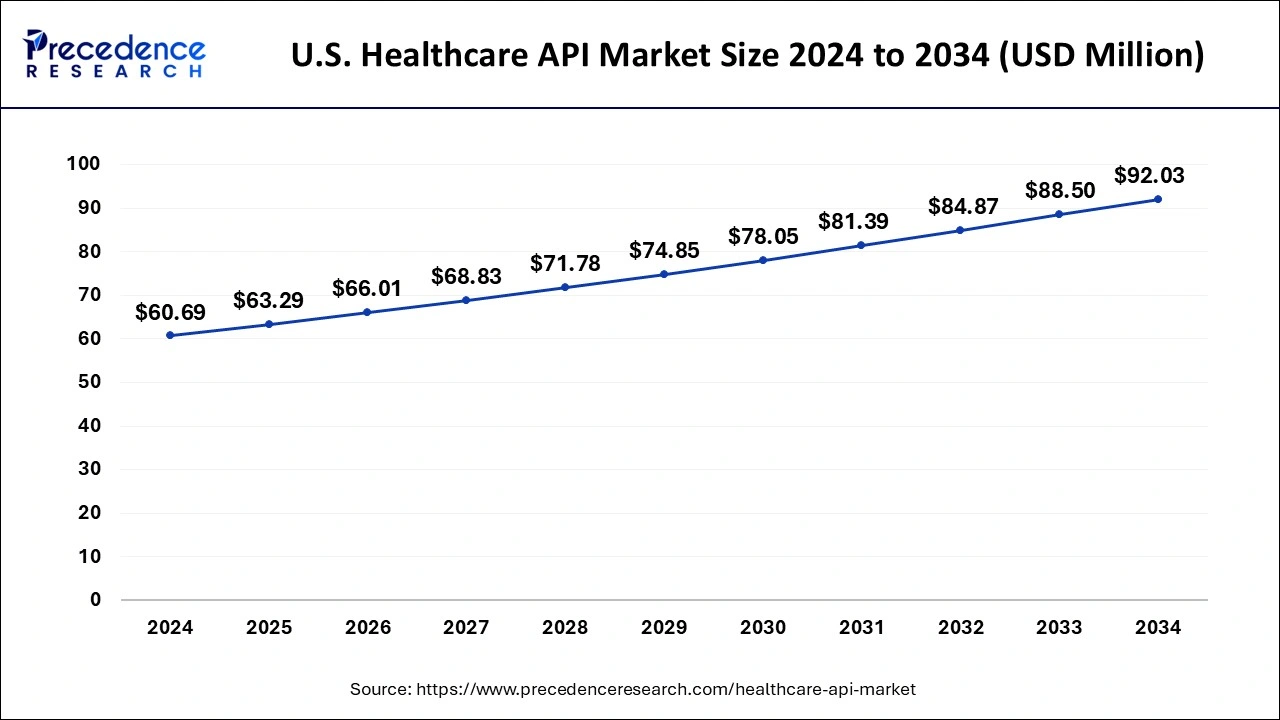

The U.S. healthcare API market size was estimated at USD 60.69 million in 2024 and is predicted to be worth around USD 92.03 million by 2034, at a CAGR of 4.25% from 2025 to 2034.

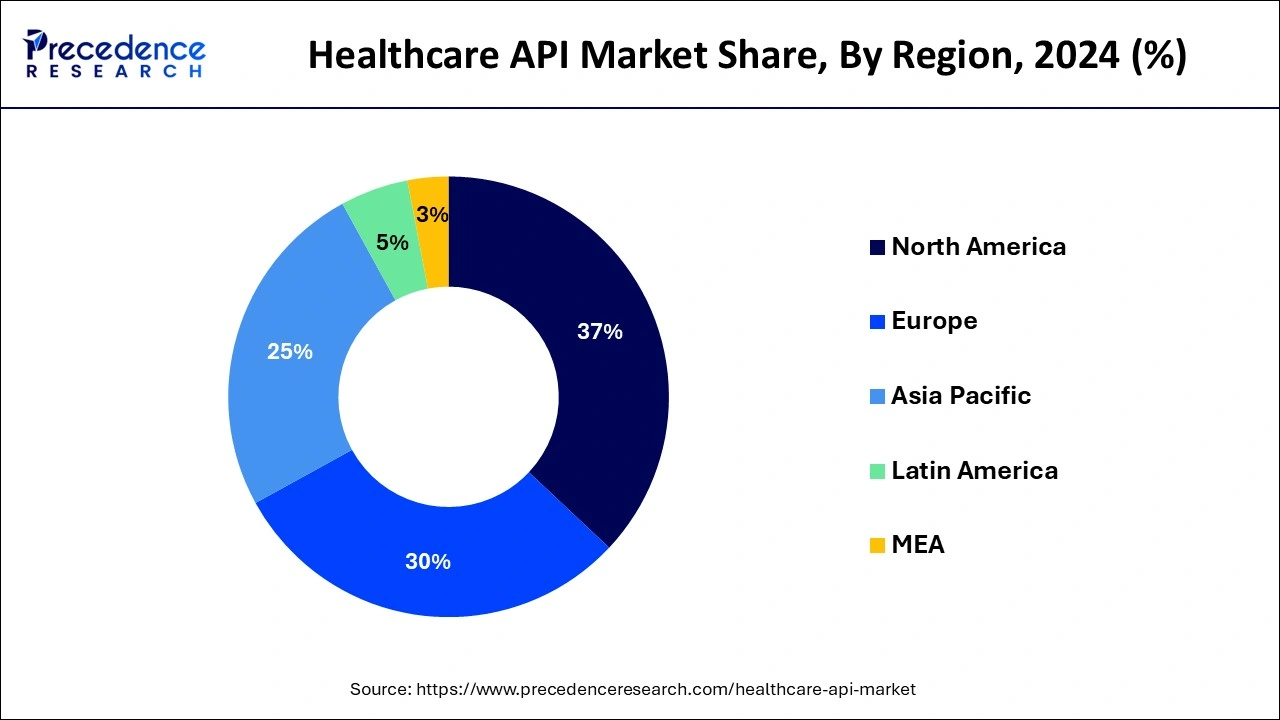

Based on region, North America dominates the market with a revenue share of 37% in 2024. Due to high rates of digital literacy rate and supportive policies for the use of healthcare APIs. Moreover, another significant growth-promoting aspect for the industry is the existence of established healthcare infrastructure with integrated patient EHR. Greater adoption by large HCOs in the US is expected to increase regional demand.

Due to its existing healthcare infrastructure, the emergence of the Internet of Things (IoT), and other associated technologies, Europe is expected to witness the highest CAGR throughout the projection period. A regulation on data privacy and protection known as the General Data Protection Regulation (GDPR) became effective in the European Union on May 25th, 2018. The rule, which handles the transfer of personal data outside of the European Union, is stricter than HIPAA in the United States and is expected to lead to a rise in the use of healthcare API.

The market is growing as a result of an increase in the use of Electronic Health Records (EHRs) with integrated Application Programming Interfaces (APIs), which offer simplicity and convenience of access to healthcare data. Furthermore, the market is booming due to improvements in patient outcomes, patient satisfaction, and treatment quality. In addition, the need is being driven by the growing need for healthcare integration.

One of the main factors driving the adoption of healthcare APIs is the incorporation of new processes between payers and providers, apps that can access data from EHRs, wearables and associated services, and seamless care flow. To make patient data accessible more simply, internal standardization for multiple products or workflows is recommended. For example, in June 2018 Apple health launched a healthcare active pharmaceutical ingredients from which developers can access the EHR data of patients from more than 500 hospitals in the U.S.

Development has been driven by an increase in financing and rising initiatives by key industry players to create a fully standardized API. For instance, in April 2019, Redox raised around USD 33 million in funding to develop a cloud-based API. The requirement for integrated healthcare API is growing as a result of the post-COVID-19 increase in demand for telemedicine and digital health solutions, which is expected to drive the market in the coming years.

| Report Coverage | Details |

| Market Size in 2025 | USD 243.56 Million |

| Market Size by 2034 | USD 337.06 Million |

| Growth Rate from 2025 to 2034 | CAGR of 3.68% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Segments Covered | By Services, By Deployment Model, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The market is expected to be driven by technical developments with regular updates, a growing need for healthcare integration, growing activity from electronic health record vendors (EHR), and healthcare IT start-ups. Additionally, the industry is increasing due to the growing use of application programming interfaces (APIs) in connection with electronic health records, which has allowed access to streamlined health data.

The API market in the healthcare sector benefits from cost savings. Additionally, it avoids management mistakes in the medication supply chain and offers open access to test data for medical procedures. The healthcare industry gathers a lot of data about people's health, and the API helps with the effective administration of this data. In conclusion, the efficiency of the healthcare sector has significantly increased, which is expected to contribute to the market evolution throughout the analysis period.

However, the shortage of qualified specialists and concerns about data security involving sensitive patient health data is expected to limit the market expansion. Inadequate IT infrastructure, a lack of useful API tools, and bad network connectivity are other obstacles that are predicted to inhibit the market growth. Market players are broadening their reach into more and morevarious markets. Substantial adoption of healthcare IT solutions is considered a long-term potential for developing countries while public IT infrastructure in emerging economies has not developed as much as it should which limits market development.

Based on service, the EHR access dominates the market and generated a revenue share of over 32% in 2024. The EHR may be readily integrated with other systems using API, facilitating easy data integration with third parties. Additionally, EHR companies are constantly developing APIs for their platforms to offer value-based patient care, which is increasing adoption significantly. For instance, Microsoft Azure introduced a cloud-based API for the FHIR standard to improve data sharing and interoperabilityin February 2019. Also, in June 2020, Cerner together with American Hospital Dubai opened the first artificial intelligence (AI) research center. The center would leverage electronic health records (EHR) to create centers of excellence for oncology, infectious diseases, and bariatric medicine. The AI research center will use big data analytics and machine learning capabilities to support data-based clinical research activities and data-driven operational improvement projects.Moreover, the service segment is further classified into remote patient monitoring, payment, EHR access, appointments, and wearable medical devices.

Additionally, over the analysis period, the market for remote patient monitoring is expected to grow at the highest rate. During the COVID-19 pandemic, connected health and remote patient monitoring receive a lot of interest for doctors and caretakers that they must treat patients remotely to lower the danger of infection. In order to give patients with improved treatment options and recommendations based on their prior medical information, the providers are providing a variety of patient interaction platforms with integrated API.

The medical equipment that customers can wear, such as activity trackers and smartwatches, are examples of wearables in healthcare. They’re made to track and collect information on of a user’s health and fitness. The growing investments, funding, and grants, as well as a growing preference for wireless connectivity among healthcare providers, are driving the growth of the wearable medical devices market. Wearable devices will gain popularity in the near future due to their numerous features, technological advancements, and wide range of uses in remote healthcare settings and at home. Furthermore, the rising frequency of chronic diseases is expected to drive wearable medical devices market growth over the forecast period.

Rising demand for remote patient monitoring devices along with home healthcare solutions is anticipated to positively influence the market growth for wearable medical devices. In addition, rising consumer focus towards fitness as well as effort for leading a healthy lifestyle is expected to be the other main factor that fuels the product demand. For example, in May 2020, Royal Philips, a global leader in health technology,received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its wearable biosensor (Philips Biosensor BX100) to help manage confirmed and suspected COVID-19 patients in the hospital. The next-generation wireless wearable biosensor enhances clinical surveillance in the Philips patient deterioration detection solution to help clinicians detect risk so they can intervene earlier and help improve care for patients in lower acuity care areas.

Based on deployment, the cloud-based API held the largest market share of about 81.50% in 2024. Due to the increasing accessibility of free storage space for storing and organizing patient and hospital healthcare data during emergencies by medical professionals and providers. Due to its related benefits including data privacy and security, the on-premise healthcare application programming interface also had a significant revenue share in 2023. Also, complete control over healthcare software limits data breaches. Additionally, the program is easy to install, and the recorded data may be used for reprocessing in the hereafter.

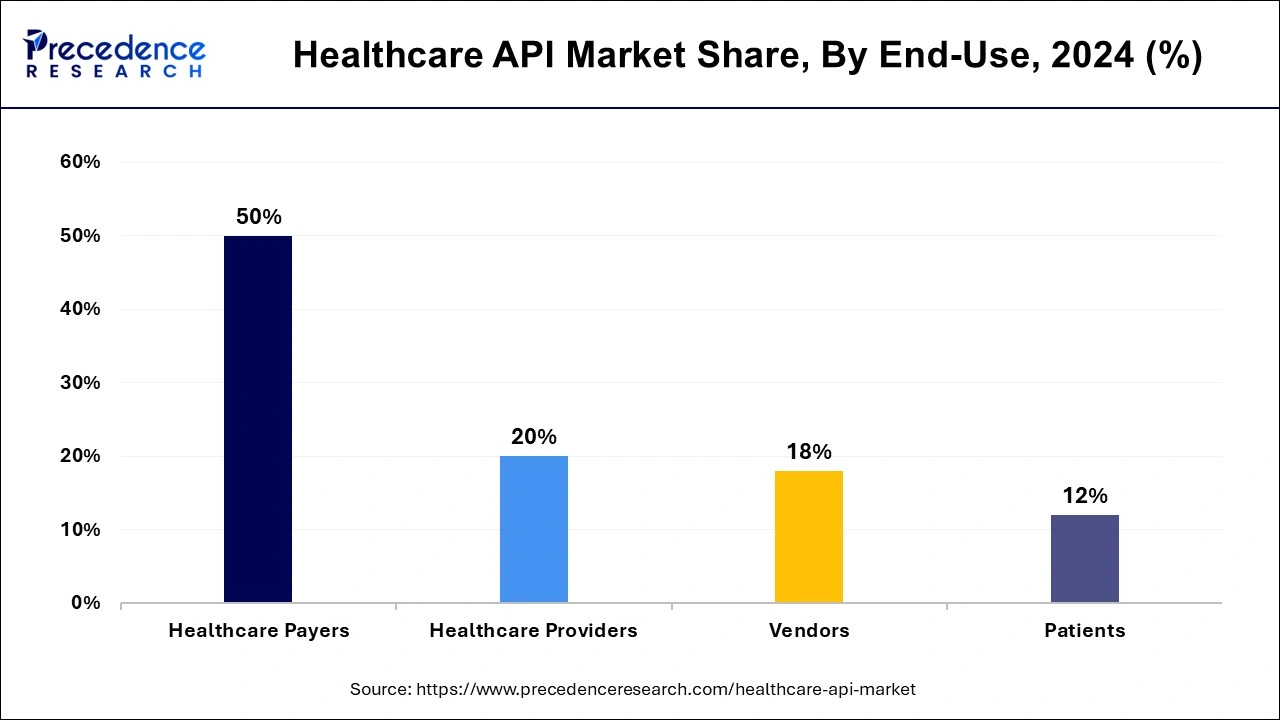

Based on end-use, the healthcare payers segment has the highest revenue share of 50% in 2024. Also, the healthcare providers segment is further classified into clinics, hospitals, and other distributing firms. The medical record storage, information of patients, data related to healthcare, and the history of patients which is available in emergency cases these all information stored by API.

The healthcare providers segment shows a significant growth in the analysis period. The integrated API provides quick clearance and inspection of the needed data by healthcare payers and caregivers through the development of a customized process. API also makes it simple to manage to follow - up appointments and invoice patients. Payers may securely access patient health details and bills without having to deal with intrusive phone calls or receptionists.

By Service

By Deployment Model

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024