January 2025

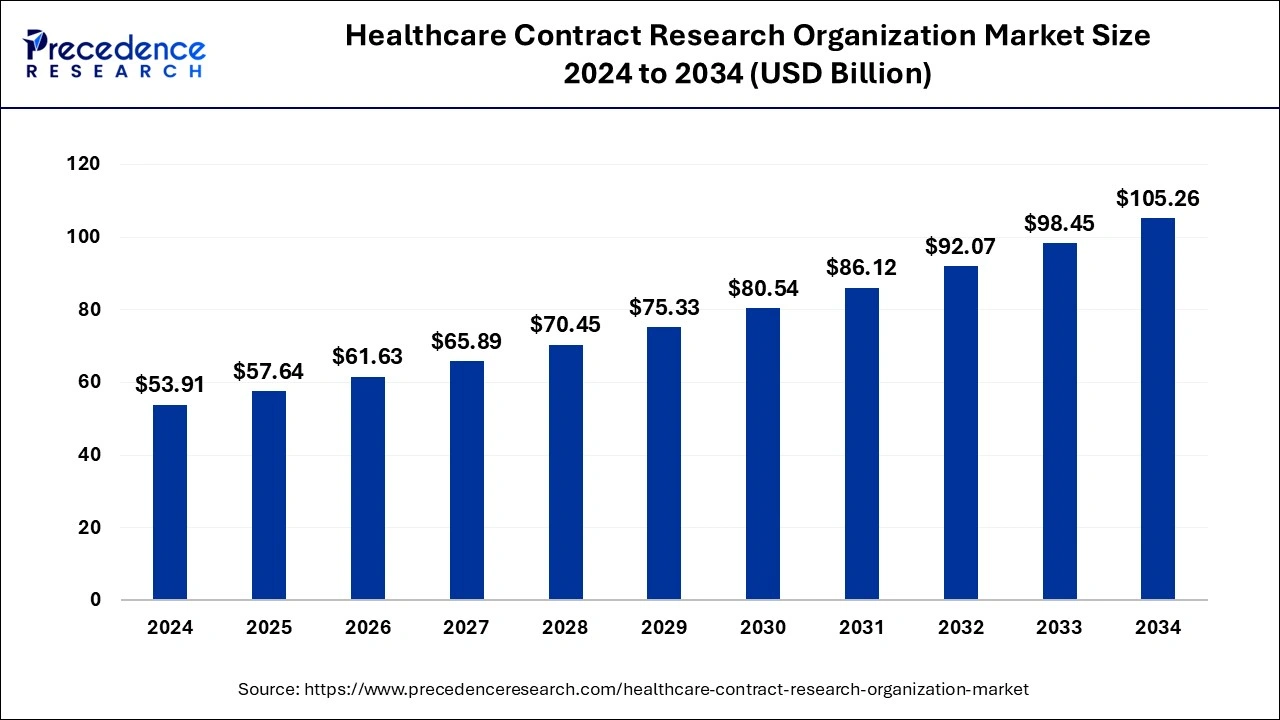

The global healthcare contract research organization market size was accounted for USD 53.91 billion in 2024, grew to USD 57.64 billion in 2025 and is predicted to surpass around USD 105.26 billion by 2034, representing a healthy CAGR of 6.92% between 2025 and 2034.

The global healthcare contract research organization market size is estimated at USD 53.91 billion in 2024 and is anticipated to reach around USD 105.26 billion by 2034, expanding at a CAGR of 6.92% from 2025 to 2034.

The advancements in AI technology is playing a crucial role in shaping the healthcare contract research organization industry. The integration of AI in CRO solutions helps in improving clinical trial design and identifying optimal clinical trial sites. Also, AI can monitor trial data in real-time and automate data cleaning for enhancing clinical trials. Moreover, AI has the capability for generating and managing automated data for the trial lifecycle consisting of patient’s medical history.

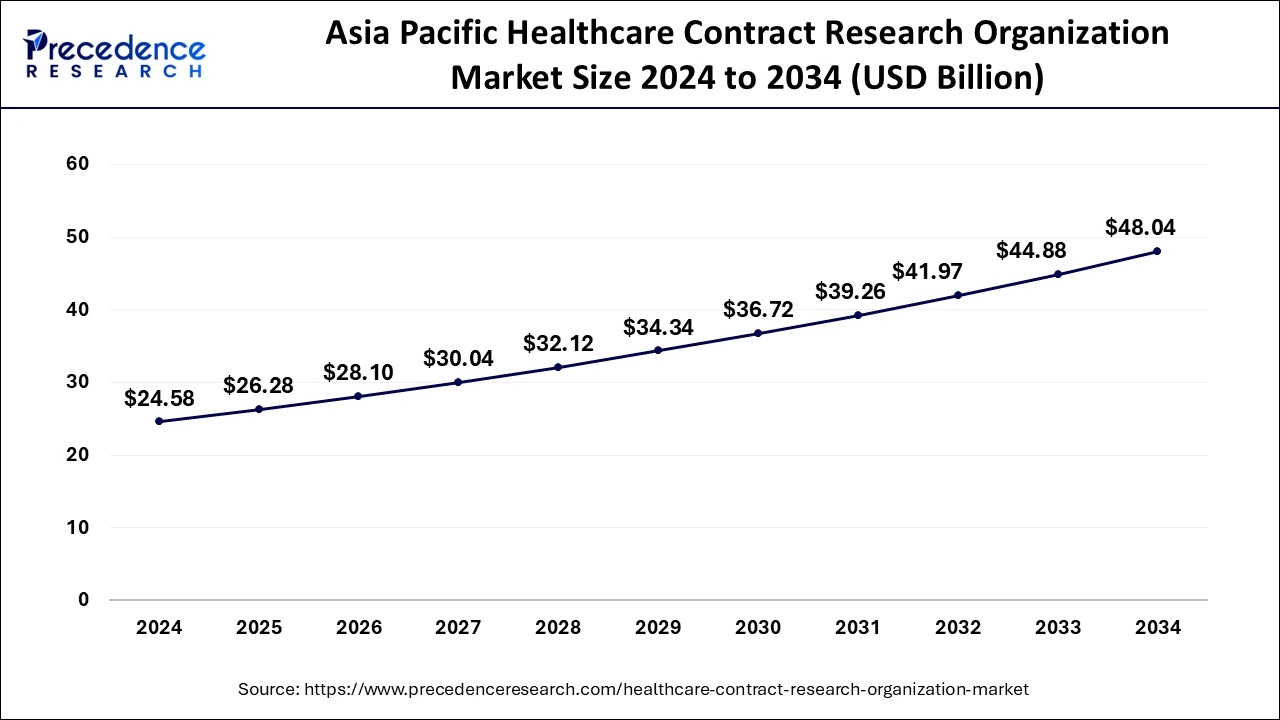

The Asia Pacific healthcare contract research organization market size was evaluated at USD 24.58 billion in 2024 and is predicted to be worth around USD 48.04 billion by 2034, rising at a CAGR of 6.93% from 2025 to 2034.

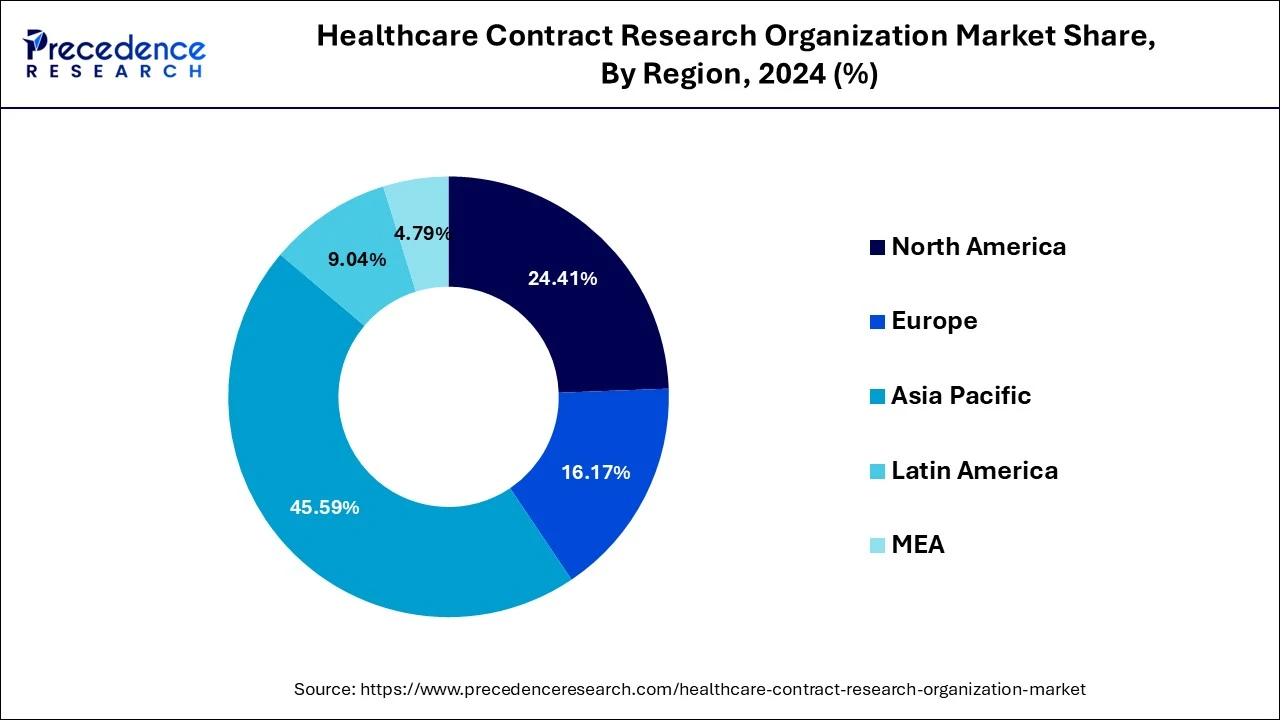

Asia Pacific dominated the healthcare contract research organization market with the largest market share of 45.59% in 2024. This is attributable to the rising prevalence of chronic diseases, easy recruitment and retention of patients, and strict adherence to the regulatory standards. Moreover, the presence of several top contract research organizations such as ACM Global Laboratories, George Clinical, Syngene International Limited, TFS HealthScience (TFS) and some others in the region that offers high quality services at a low cost has fueled the growth of the Asia Pacific healthcare contract research organization market. The availability of cheap labor and experienced research professionals at affordable costs is further fueling the market growth.

North America is expected to grow with the highest CAGR of 5.22% during the forecast period. The presence of several top biopharmaceutical and biosimilar companies along with the presence of several CROs has collectively contributed towards the market growth. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), US conducts more than half of the research & development activities in the pharmaceutical field and also holds intellectual rights of a significant amounts of new medicines. Thus, the rapidly growing investments in the research and development by the top pharmaceutical companies coupled with launch of new medicines in the region are expected to significantly drive the growth of the North America contract research organization market in the forthcoming years.

The healthcare contract research organization market is an important segment of the life sciences industry. This industry deals in providing services for managing clinical trials in pharmaceutical, biotechnology, and medical device companies. There are several types of services provided by this industry comprising of data management, clinical supply management/project management, medical writing, clinical monitoring, patient & site recruitment, bio-statistics, regulatory & medical affairs, investigator payments, technology, laboratory, quality management and some others. The rise in number of research activities in the biotechnology industry has boosted the market expansion. This industry is expected to rise significantly with the growth of the biopharma sector across the world.

| Report Coverage | Details |

| Market Size in 2034 | USD 105.26 Billion |

| Market Size in 2025 | USD 57.64 Billion |

| Market Size in 2024 | USD 53.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.92% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Type, Region |

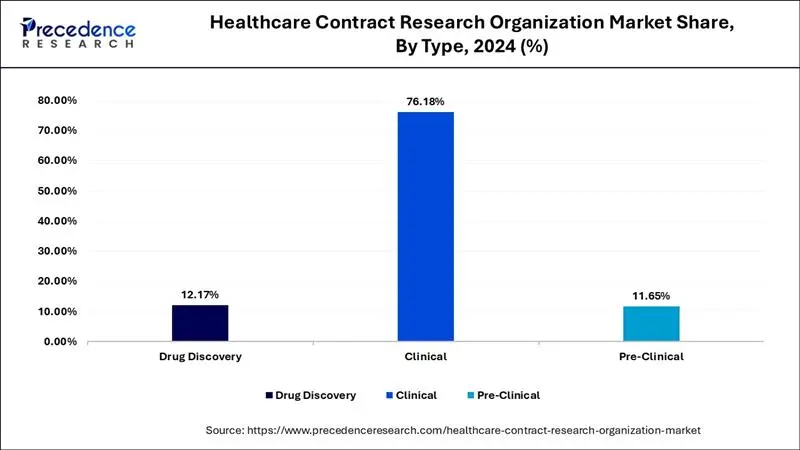

The rising demand for the drug discovery services is significantly boosting the growth of the global healthcare contract research organization market. The rising burden of chronic diseases is fostering the investments by the pharmaceutical manufacturers in the drug discovery to develop new and effective drugs. The rising investments in the development of small molecule drugs have significantly driven the demand for the drug discovery services of healthcare CROs across the globe. The small molecule drugs are the most effective drugs that can effectively treat various diseases by directly affecting the infected cells. Moreover, the growing penetration of CROs across the globe owing to the lucrative growth opportunities being offered by the market due to the growing geriatric population and growing burden of non-communicable diseases is significantly propelling the market growth.

Regulatory Complexities along with Data Privacy Concerns Hinders the Industrial Expansion

The healthcare contract research organization market faces several problems in their daily operations. Firstly, there are numerous regulations by several governments that forbids the adoption of healthcare CRO services which in turn acts a restrain in the industry. Secondly, the data breaching issues in the CRO platforms can result in duplication of data which may create a havoc among the end-users, thereby hindering the market expansion.

Advancements in Biologics and cell and gene therapies to Shape the Future

The developments in gene therapies and biologics has increased the demand for healthcare CRO services. CRO solutions can help in clinical trial management by ensuring that trials are conducted according to protocol and compliances. Moreover, these services find applications in logistics management by facilitating multi-country transport of genetic products. Thus, rising advancements in Biologics and cell and gene therapies is expected to create ample growth opportunities for the companies in the upcoming days.

The clinical monitoring segment dominated the global healthcare contract research organization market with the highest market share of 21% in 2024. This can be attributed to the technical expertise and specialized services offered by the CROs that helps to save time and cost of the client and also provides efficient results. The adoption of real time data acquisition equipment and smart analytics amongst the healthcare CROs has enhanced the clinical monitoring services, which is further expected to drive the market growth. These technologies help to detect any errors early and avoid the delay or termination of the projects.

The regulatory/medical affairs segment is expected to expand at a notable CAGR of 11.12% during the forecast period. There are strict regulations and rules imposed by the government that needs to be followed strictly. The regulatory affairs associated with various tasks such as clinical trials, product registration, research & development, and approvals are hectic and hence most of the companies outsource these tasks to the specialist CROs.

Clinical segment dominated the global healthcare contract research organization market, accounting for around 76.18% of the market share in 2024. The rising demand for the personalized medicines and growing number of biologic drugs coupled with the rising demand for the advanced technologies in the healthcare CROs. The Phase III of the clinical trials are the most expensive phase that generates the maximum revenue. The rise in number of clinical trials associated with discovery of novel medications for cancer treatment has driven the market growth.

The pre-clinical segment is projected to grow at a notable CAGR of 8.51% during the forecast period. The failure of 50% of the toxicology tests in the pre-clinical trials is expected to foster the number of pre-clinical trials. In preclinical trials, CRO services are used for several applications such as generating data, modifying drug formulations, scaling operations, ensuring regulatory compliance and some others. The growing demand for CROs to perform in vivo tests has boosted the industrial expansion.

By Service

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024