January 2025

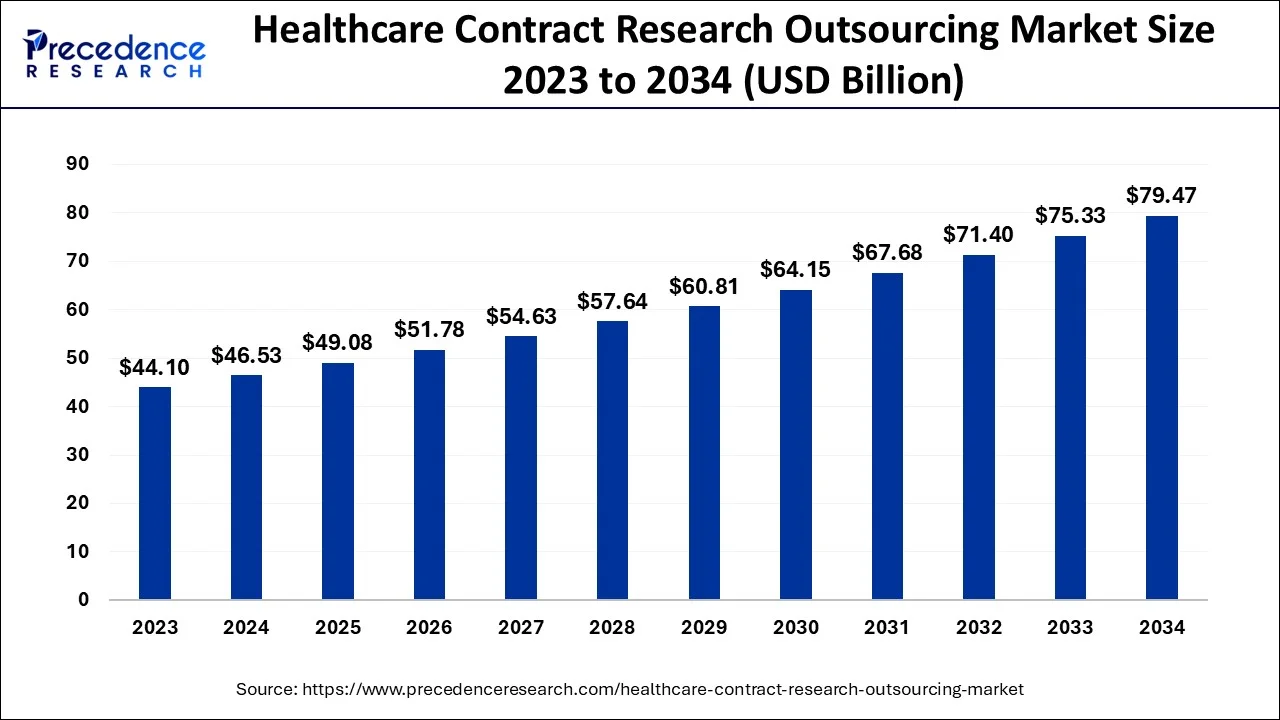

The global healthcare contract research outsourcing market size accounted for USD 46.53 billion in 2024, grew to USD 49.08 billion in 2025 and is predicted to surpass around USD 79.47 billion by 2034, representing a healthy CAGR of 5.50% between 2024 and 2034. The North America healthcare contract research outsourcing market size is calculated at USD 23.73 billion in 2024 and is expected to grow at a fastest CAGR of 5.59% during the forecast year.

The global healthcare contract research outsourcing market size is accounted for USD 46.53 billion in 2024 and is anticipated to reach around USD 79.47 billion by 2034, growing at a CAGR of 5.50% from 2024 to 2034.

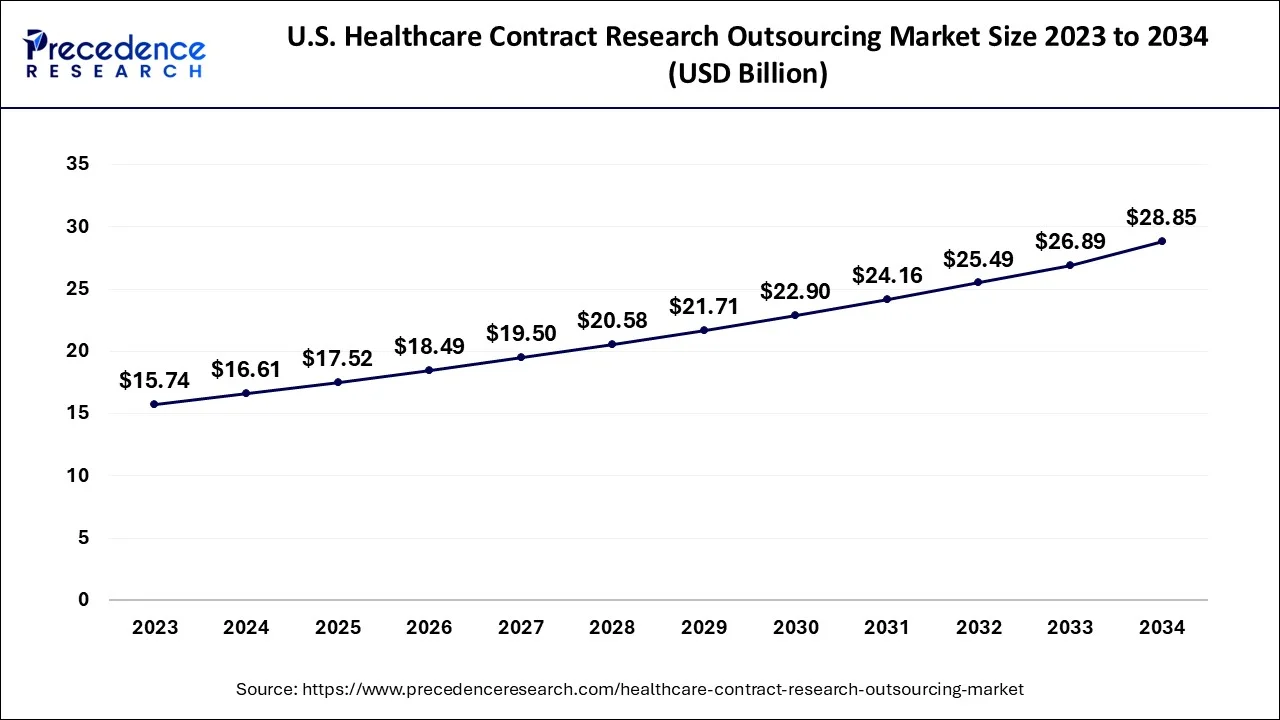

The U.S. healthcare contract research outsourcing market size is evaluated at USD 16.61 billion in 2024 and is predicted to be worth around USD 28.85 billion by 2034, rising at a CAGR of 5.66% from 2024 to 2034.

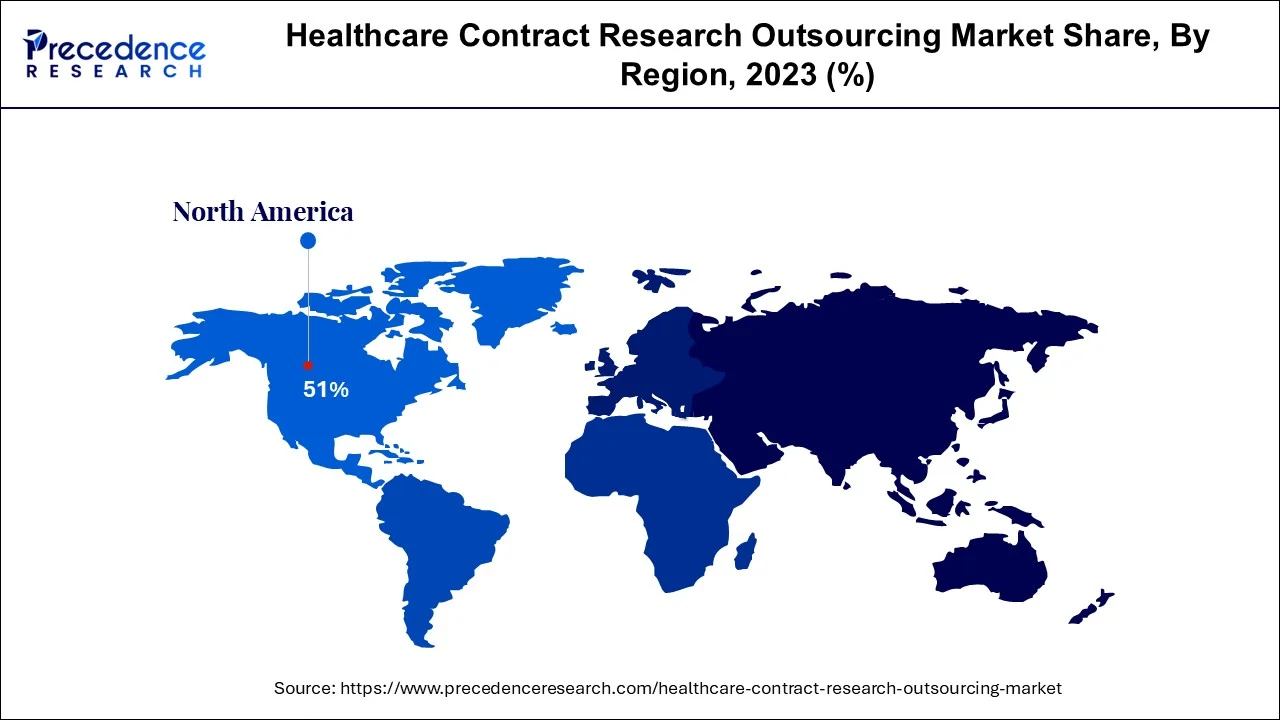

Due to the significant volume of trials conducted and outsourcing within the region, North America represented highest share of over 51% in 2023. This regional industry has also been fueled by the increased government assistance for Research and development activities through subsidies and funding to research organizations and businesses. For instance, the United States government made investments in medical and health R&D in 2018. Similar to this, the Pharmaceutical Technological Development and Research Organization engaged in the creation of COVID-19 vaccinations as a result of the epidemic.

The Asia Pacific region is growing at a remarkable CAGR from 2024 to 2034. Additionally, it is projected that the region would expand quickly over the projected timeline. This may be due to the significant prevalence of long-term illnesses, the accessibility of varied populations, the ease of enlisting and keeping patients, and the implementation of rules by generally accepted norms. In addition, effective government attempts to speed up the permitting process for drugs are boosting the industry. For instance, the Directorate of Pharmaceuticals (India) established new regulations in October 2021 to speed up R&D efforts in the nation by reducing the time needed for approvals by a minimum of 50% during the following two years. These approaches should help to accelerate growth in the region even more

The key drivers anticipated to propel the market over the coming decades are the rising expenditure in R&D programs, the inclination for outsourced tasks due to cost and time limitations, and patent expiry in the healthcare industry. Government agencies prefer to send initiatives to contractual researcher outsourced partnerships because they provide cutting benefits, which helps the industry flourish. The market for contractual research companies in the medical industry is anticipated to increase as a result of additional pressure on pharmaceutical researchers to handle medical evidence, regulatory regimes, and strict safety regulations.

Organizations in the medical and pharmaceutical industries are exporting not simply the manufacturing of medications and also clinical studies. Exporting to underdeveloped nations has increased along with the privatization of clinical trials. To better serve their clients, several medical contract manufacturing businesses are currently expanding their international research infrastructure. For instance, ICON introduced a range of Accellacare in Sept 2020. This worldwide research connectivity allows consumers to obtain cutting-edge therapies more quickly and easily, allowing clients the opportunity to conduct decentralized studies.

Due to the growing demand for product manufacturers linked to clinical research administration, government affairs outsourced, and strict safety requirements, there is projected to be an increase in the need for contract manufacturing insourcing within the healthcare industry. Pharmaceutical and healthcare companies outsource not only drug trade but also clinical studies. As clinical studies are becoming more privatized preclinical outsourced to wealthy nations is growing.

The global market for contract manufacturing outsourced in the pharmaceutical industry is projected to be driven by the complexity of regulatory processes and the growing participation of healthcare professionals in developing drugs and financing. The proficiency of CROs in medicinal fields and local registration procedures both contribute to the industry's expansion. At different stages of drug development, several contractual research organizations offer support with quarterly reports.

| Report Coverage | Details |

| Market Size in 2024 | USD 46.53 Billion |

| Market Size by 2034 | USD 79.47 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.50% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Service, Application, End Use, and Geography |

Regulatory Guidelines Varying & Shortage of Skilled Individuals Limiting Market Growth

Presentation of Well-Known Companies Increasing Market Revenue

The increase in activities aimed at cutting costs and speeding up drug development

The market of medical contractual academic researchers was controlled by the medical services category in 2023, which also had the biggest revenue shares. This increase is due to several factors, including the growing use of biological drugs, current epidemics that have increased the requirement for new therapies, the desire for orphan medications and customized medicine, as well as the necessity for cutting-edge technology. Development is also anticipated to be fueled by elements including technological advancement, the globalization of clinical studies, and the need for contractual research organizations to conduct clinical studies. Even though that Phase 3 trial studies are among the costliest phases of clinical trials roughly 90.0% of the costs associated with clinical drug development outsourcing of these studies to medical contractual research firms produced the largest income in 2022.

Preclinical studies are anticipated to rise quickly during the projection period by 8.1%. Preclinical clinical CRO need is predicted to rise in response to a surge in preclinical studies worldwide and a rising need to control R&D costs, which is expected to fuel market expansion. A majority of the pharmaceutical industry is concentrating on the research of innovative therapies for the treatment of COVID-19 disease after 2021, which has significantly increased the supply for preliminary investigations as a result of the COVID-19 pandemic spread. For mRNA instance, Translate Bio, and Sanofi a firm developing clinical-stage mRNA treatments, announced on March 2021 the beginning of a preclinical investigation for MRT5500, a potential for such an mRNA vaccination against COVID-19-causing SARS-CoV-2. As a result, the mentioned factors will strongly aid in segment expansion.

Medical contract manufacturing companies' largest income share in 2023 came from the associated healthcare category, which controlled the industry. This may be explained by the rise in clinical studies and the requirement to keep track of the investigations that are driving up the need for such solutions. Over the past ten years, medical research has been outsourced to CROs for a variety of reasons, including cost efficiency and technical knowledge. It is anticipated that the adoption of real-time data collecting tools and smart analytics will enhance associated healthcare information in the healthcare industry.

The medical contract manufacturing organizations market is projected to develop at the quickest rate in the government affairs sector. Due to the rise in R&D activities, product registration, clinical study submissions, and therapeutic pipelines, the outsourced of government relations is growing quickly. The company's expansion is anticipated to be supported by the rising need to win approval for brand-new goods, enforce consistency, and accomplish more in less time.

A large oncology pipeline with more than 600 compounds is in the final development stages. Therefore, it is predicted that by the end of the projection period, the oncology or hematology category will hold the biggest market share. The Food and Drug Agency approved 50 new medications in 2021 for 22 purposes, yet there are still a great number of curable cancers kinds that are curable. As a result, there is a greater need for the creation of new pharmaceutical drugs, which stimulate medication innovation. Additionally, since no one medicine is enough for the chemotherapy of cancer, there is intense competition within the oncology market. This necessitates the ongoing creation of improved treatment alternatives, that supports the oncology market.

Pharmaceutical businesses are focusing on developing safer and more effective technologies. During the projection period, rising R&D spending is anticipated to aid biopharmaceutical businesses in boosting their revenues. R&D is being quickly outsourced by pharmaceutical companies to CROs so order to reduce the expenses associated with the internal testing platforms. Small pharmaceutical enterprises are searching for advancements in product design using CRO technologies as a result of a rise in the market for advanced designs and copyright obsolescence. Pharm companies hold a sizable portion of the worldwide healthcare agreement investigation companies outsource the industry due to the increasing sophistication of developing drugs, the need for shortened drug discovery timeframes, cost efficiency, and the advantage of obtaining medicinal expert knowledge affiliated with outsourcing to CROs.

By Type

By Service

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024