July 2024

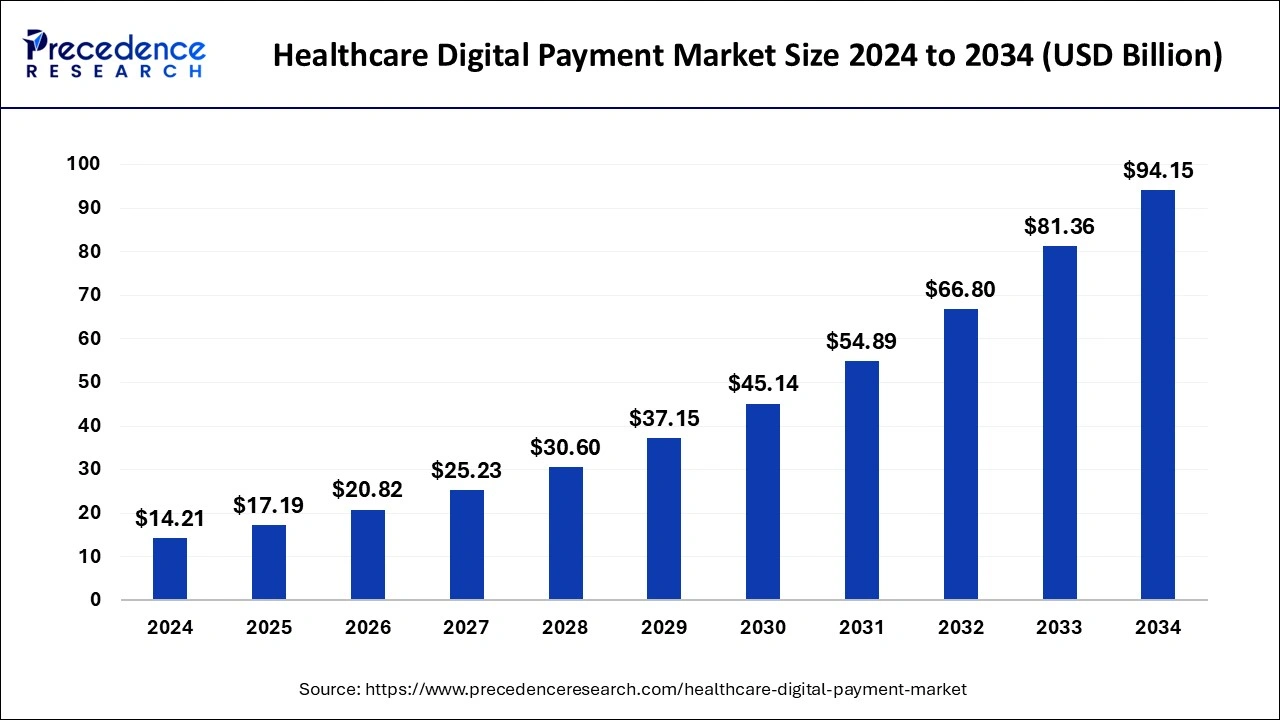

The global healthcare digital payment market size is accounted at USD 17.19 billion in 2025 and is forecasted to hit around USD 94.15 billion by 2034, representing a CAGR of 20.82% from 2025 to 2034. The North America market size was estimated at USD 5.68 billion in 2024 and is expanding at a CAGR of 20.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare digital payment market size was estimated at USD 14.21 billion in 2024 and is predicted to increase from USD 17.19 billion in 2025 to approximately USD 94.15 billion by 2034, expanding at a CAGR of 20.82% from 2025 to 2034.

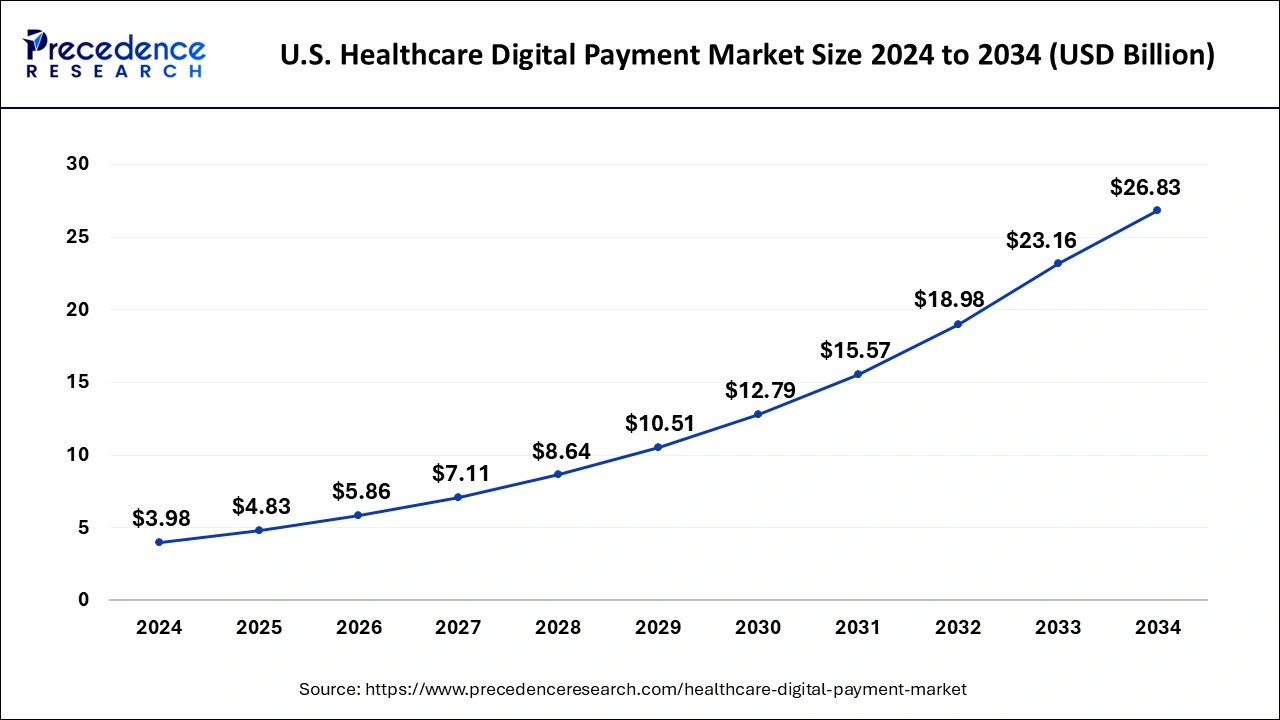

The U.S. healthcare digital payment market size was exhibited at USD 3.98 billion in 2024 and is projected to be worth around USD 26.83 billion by 2034, growing at a CAGR of 21.02% from 2025 to 2034.

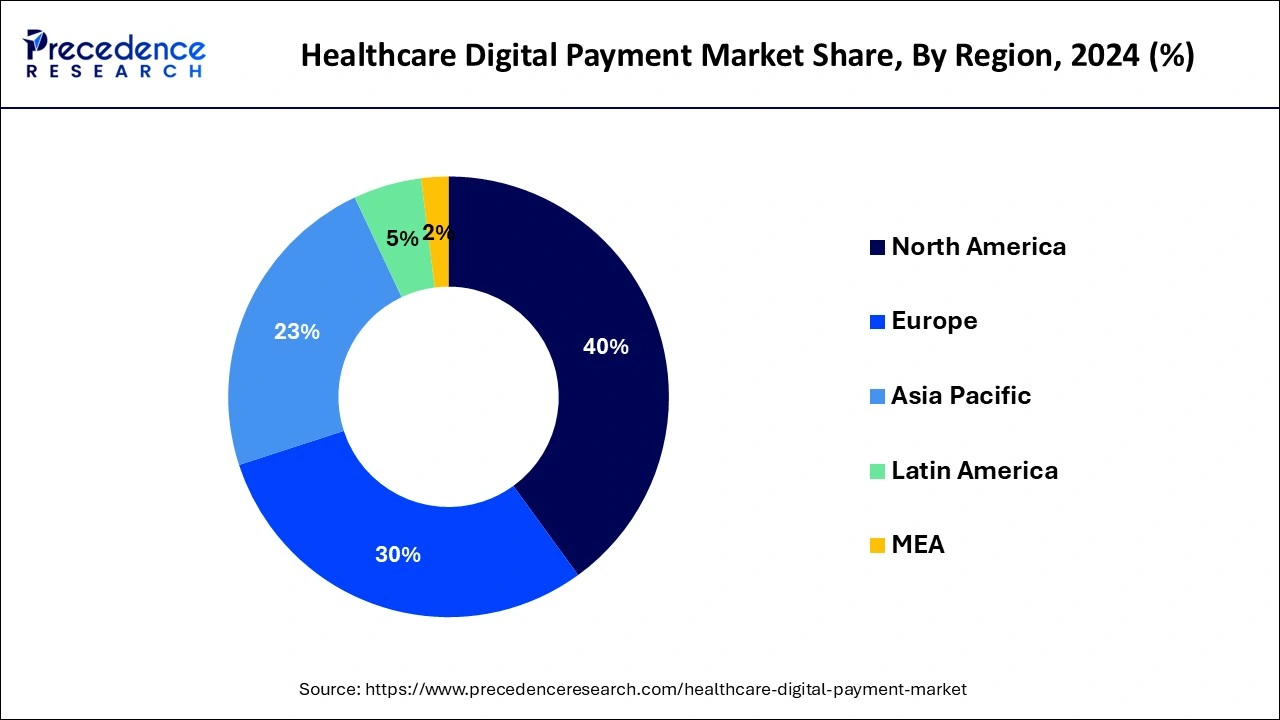

North America held the largest revenue share of 40% in 2024 due to its advanced healthcare infrastructure, widespread technology adoption, and strong emphasis on digital transformation. The region's well-established regulatory framework and high patient awareness contribute to the significant market share. Furthermore, the presence of key players, robust financial systems, and a proactive approach towards healthcare innovation position North America at the forefront of digital payment adoption in the healthcare sector, driving its major share in the market.

Asia-Pacific is poised for rapid growth in the healthcare digital payment market due to expanding digital infrastructure, increasing smartphone penetration, and a rising demand for convenient and contactless transactions. With a large population accessing healthcare services, the adoption of digital payment methods is becoming crucial. Government initiatives, coupled with a growing tech-savvy population, create a favorable environment for the widespread acceptance of healthcare digital payments, driving the market's accelerated growth in the Asia-Pacific region.

Meanwhile, Europe is experiencing notable growth in the healthcare digital payment market due to the increasing adoption of digital technologies, rising demand for streamlined healthcare services, and favorable regulatory initiatives. The region's advanced infrastructure supports the integration of digital payment solutions into healthcare systems, providing patients with convenient and secure ways to manage medical expenses. Additionally, a growing awareness of the benefits, such as efficiency and accessibility, is driving the acceptance of healthcare digital payments, contributing to the market's significant expansion in Europe.

Healthcare digital payment refers to the electronic transfer of funds for medical services, treatments, or products using online platforms or electronic devices. In simple terms, it means paying for healthcare expenses through digital methods like credit cards, mobile apps, or online banking, eliminating the need for traditional paper-based transactions. This modern payment approach enhances convenience for patients by allowing them to settle medical bills securely and swiftly from the comfort of their homes.

It also streamlines administrative processes for healthcare providers, reducing paperwork and the likelihood of errors. Overall, healthcare digital payment aims to make financial transactions in the medical industry more efficient, transparent, and accessible, contributing to a smoother and more patient-friendly healthcare experience.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 20.82% |

| Market Size in 2025 | USD 17.19 Billion |

| Market Size by 2034 | USD 94.15 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Deployment, and Mode of Payment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rise of mobile wallets

The rise of mobile wallets has significantly surged the demand for healthcare digital payment solutions due to increased convenience and accessibility. Mobile wallets, such as Apple Pay, Google Pay, and others, offer a user-friendly and secure platform for individuals to manage and pay for their healthcare expenses. With the widespread adoption of smartphones, users find it easy to store their payment information in these digital wallets, streamlining the payment process for medical services. Patients now prefer the simplicity of using mobile wallets, as they eliminate the need for physical cards or cash transactions.

The seamless integration of mobile wallets with healthcare payment systems allows individuals to settle medical bills effortlessly, fostering a more efficient and patient-friendly experience. This trend aligns with the broader shift towards digital transactions, reflecting the growing reliance on technology for managing financial aspects of healthcare services.

Resistance to change

Resistance to change serves as a significant restraint on the market demand for healthcare digital payment solutions. In traditional healthcare systems, there is a longstanding reliance on manual and paper-based processes for billing and payments. The reluctance of both healthcare providers and patients to depart from these familiar methods hinders the widespread adoption of digital payment technologies. Healthcare professionals may be resistant to altering established routines, which can slow down the integration of digital payment systems.

Similarly, patients accustomed to conventional payment methods may be hesitant to embrace new, digital alternatives. This resistance stems from concerns about the learning curve associated with using unfamiliar technologies and a general aversion to disrupting established practices. Overcoming this resistance necessitates effective education and awareness campaigns to highlight the benefits of healthcare digital payments, emphasizing convenience, efficiency, and improved overall healthcare experiences for both providers and patients.

E-commerce integration

E-commerce integration is generating significant opportunities for the healthcare digital payment market by streamlining and enhancing the overall patient experience. The integration of digital payment solutions into healthcare platforms enables patients to seamlessly manage and pay for medical services online. This convenience aligns with the broader trend of increasing e-commerce activities, making it easier for individuals to handle their healthcare transactions in a secure and user-friendly digital environment.

Moreover, as patients become more accustomed to digital transactions through e-commerce platforms, the healthcare industry can capitalize on this familiarity to drive the adoption of digital payment methods. The incorporation of digital payments into e-commerce ecosystems not only offers a more efficient way for patients to settle bills but also opens avenues for innovative services and features, fostering a positive environment for the growth of healthcare digital payment solutions.

The payment processing segment held the highest market share of 23% in 2024. In the healthcare digital payment market, the payment processing segment encompasses the technology and systems involved in securely managing financial transactions related to healthcare services. This includes handling payments, managing billing information, and ensuring compliance with healthcare financial regulations through digital means. Recent trends in payment processing for healthcare digital payments involve the integration of real-time processing, ensuring swift and accurate financial transactions.

Additionally, there's a growing emphasis on incorporating advanced security measures such as tokenization to safeguard sensitive payment information, enhancing overall trust in digital payment solutions within the healthcare sector.

The payment gateway segment is anticipated to witness rapid growth at a significant CAGR of 23.5% during the projected period. In the healthcare digital payment market, the payment gateway segment refers to the technology that facilitates secure and seamless financial transactions between patients, healthcare providers, and insurance companies. Payment gateways play a crucial role in encrypting sensitive data, ensuring privacy compliance, and authorizing transactions.

A notable trend in this segment involves the integration of advanced security features, such as tokenization and biometric authentication, to enhance data protection. Additionally, the adoption of cloud-based payment gateways is on the rise, providing scalable and flexible solutions for healthcare organizations to manage transactions efficiently.

The cloud segment has held a 53% market share in 2024. In the healthcare digital payment market, the cloud segment refers to the deployment of digital payment solutions on cloud-based platforms. Cloud deployment enables secure storage and access to financial and health data, facilitating seamless transactions. Current trends indicate a growing preference for cloud-based solutions in healthcare, driven by their scalability, cost-effectiveness, and ability to support advanced analytics. This shift allows healthcare organizations to leverage cloud infrastructure for efficient and flexible healthcare digital payment processes, contributing to improved accessibility and data management in the industry.

The on-premise segment is anticipated to witness rapid growth over the projected period. The on-premise segment in the healthcare digital payment market refers to the deployment of payment solutions hosted locally within healthcare institutions. This deployment model involves installing and maintaining payment infrastructure on-site, providing organizations with direct control over security and customization. Trends in the on-premise segment include a continued preference among some healthcare providers for maintaining sensitive financial data within their premises, ensuring compliance with regulatory standards. While cloud-based solutions gain popularity, on-premise deployments persist, particularly for institutions prioritizing data control and security.

The bank cards segment has held 34% market share in 2024. In the healthcare digital payment market, the bank cards segment refers to transactions facilitated through debit and credit cards. This mode of payment offers a secure and convenient way for patients to settle medical bills. Trends indicate a growing preference for bank cards, with an increasing number of consumers opting for the simplicity and speed of card transactions. The widespread use of bank cards underscores the importance of seamless and reliable digital payment options in the healthcare sector, contributing to the overall evolution of payment methods within the industry.

The digital wallet segment is anticipated to witness rapid growth over the projected period. The digital wallet segment in healthcare digital payments refers to transactions conducted through mobile applications or online platforms, allowing users to store and manage payment information securely. This segment is witnessing a rising trend as patients increasingly prefer the convenience of digital wallets for settling healthcare bills. With the growing ubiquity of smartphones, digital wallets streamline payment processes, offering features such as quick transactions, enhanced security, and accessibility. The trend indicates a shift towards a more seamless and user-friendly payment experience within the healthcare industry.

By Solution

By Deployment

By Mode of Payment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

September 2024

March 2025

January 2025