January 2025

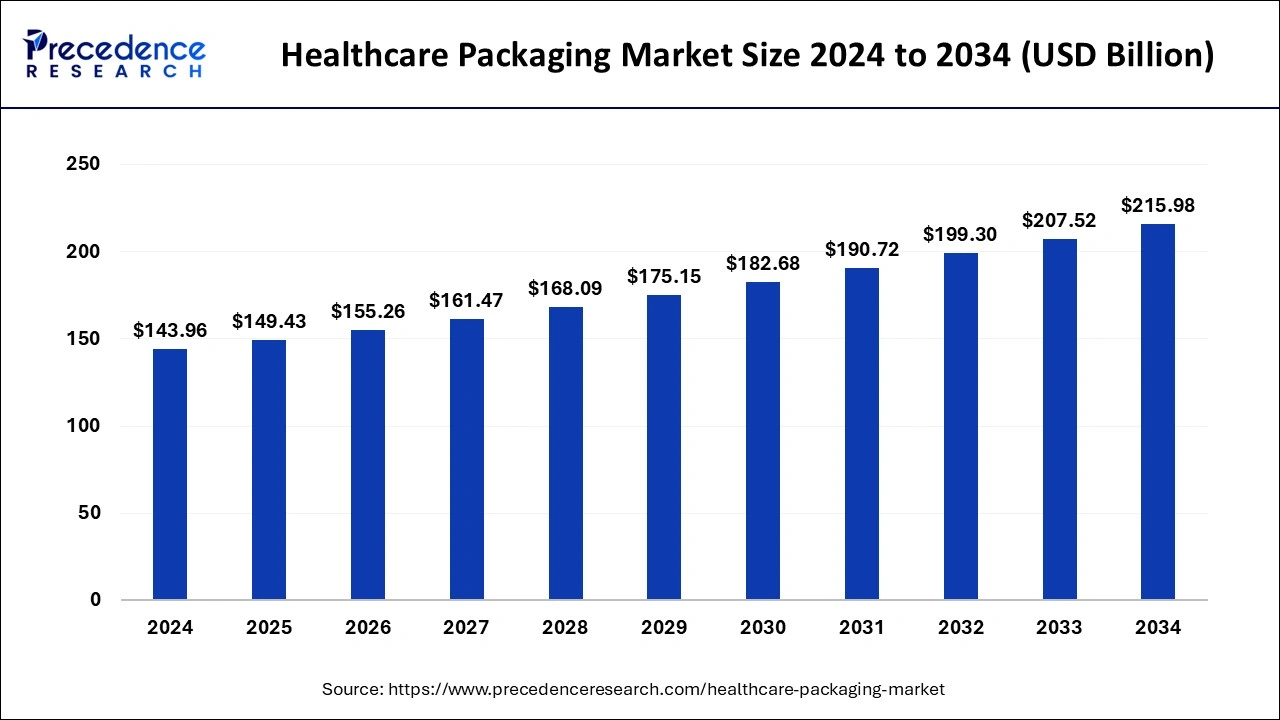

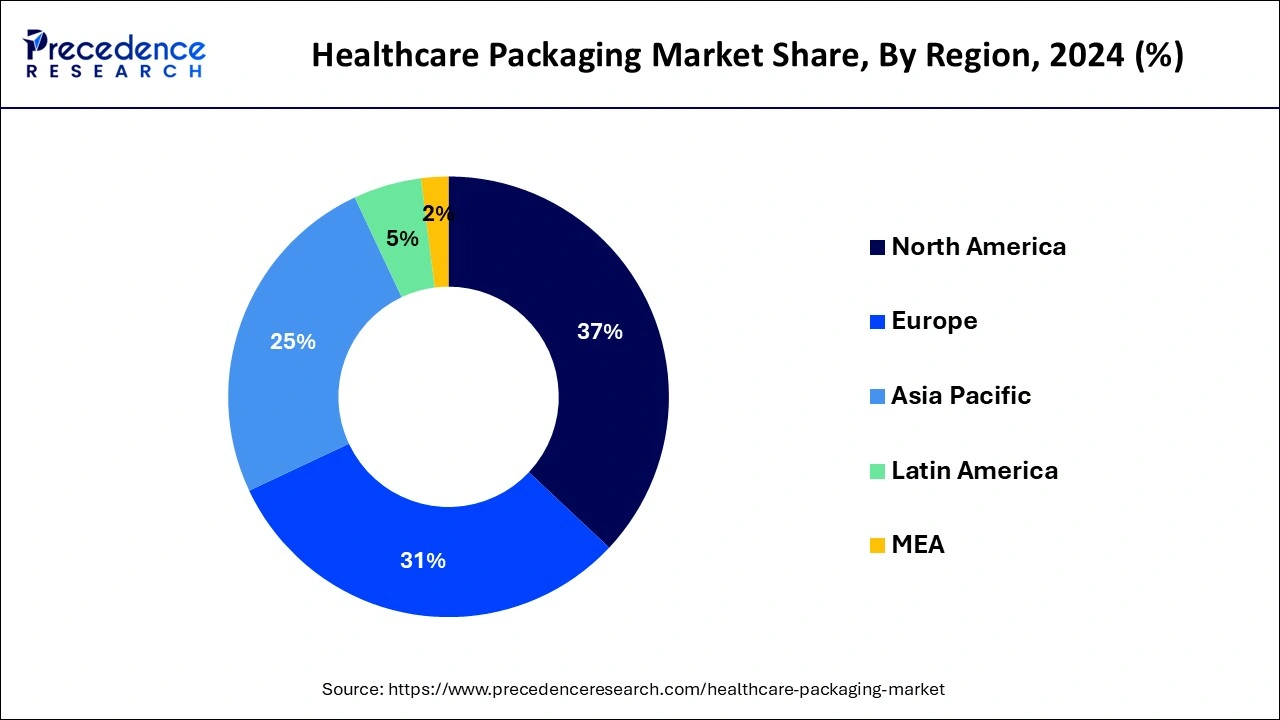

The global healthcare packaging market size is valued at USD 149.43 billion in 2025 and is forecasted to reach around USD 215.98 billion by 2034, accelerating at a CAGR of 4.14% from 2025 to 2034. The North America healthcare packaging market size surpassed USD 53.27 billion in 2024 and is expanding at a CAGR of 4.18% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare packaging market size accounted for USD 143.96 billion in 2024 and is expected to hit around USD 215.98 billion by 2034 and is poised to grow at a CAGR of 4.14% over the forecast period 2025 to 2034.

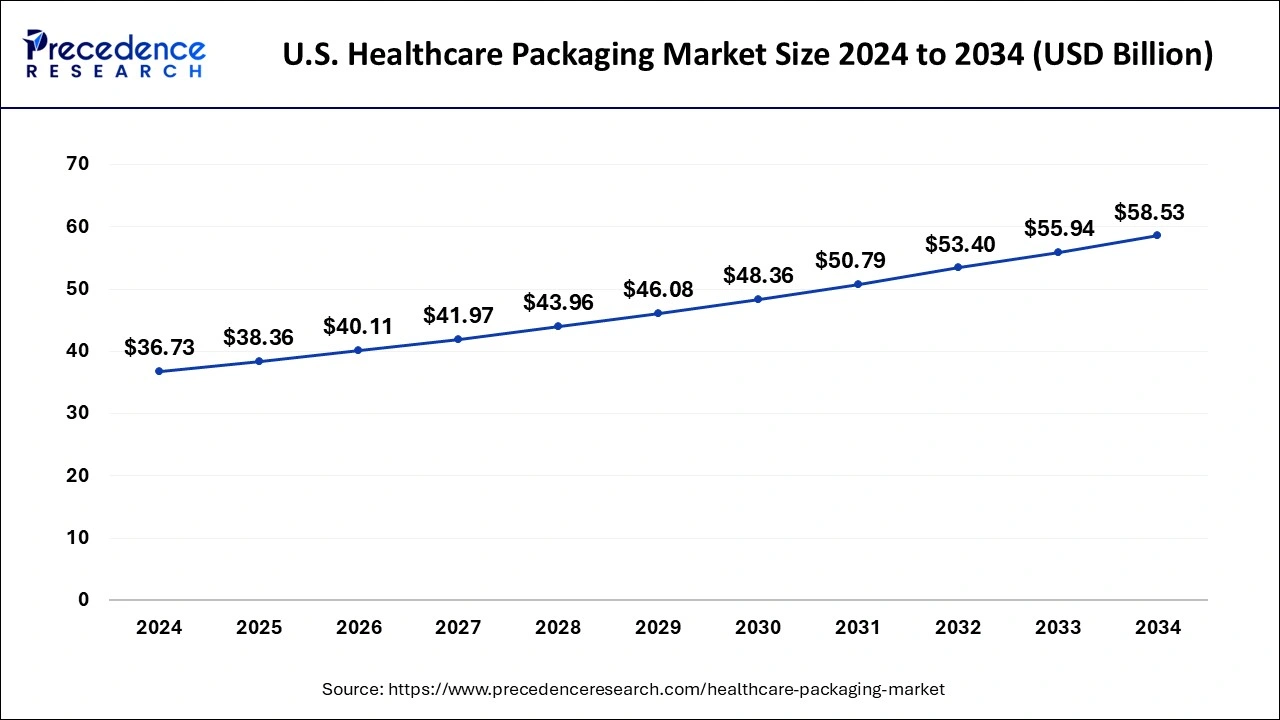

The U.S. healthcare packaging market size reached USD 36.73 billion in 2024 and is anticipated to be worth around USD 58.53 billion by 2034, poised to grow at a CAGR of 4.77% from 2025 to 2034.

North America region accounted for 37% revenue share in 2024. Due to its sophisticated primary medical community, considerable medical & life science research operations, high healthcare expenditure intensities, and sizable pharmaceutical & medical industry, the United States is one of the major geographical markets for healthcare packaging goods.

During the predicted period, the Asia Pacific market is estimated to grow at the greatest CAGR. Asia-Pacific, which is home to the majority of the world's population, is anticipated to have the fastest market growth. As a result of their quick economic growth and expanding developmental activities, nations like China and India are expected to see significant market growth.

Despite the fact that healthcare packaging includes a number of remarkable features, its primary function is to safeguard a packed medical device or pharmaceutical product. Healthcare items may have unique requirements and are typically sterilized before packaging, therefore healthcare product packaging attempts to meet the strictest medical standards and regulations while also protecting the integrity of the product. The product should be stable in the packaging the whole time it is on the shelf. The ability of companies in the healthcare packaging sector to create COVID-19 immunization vials is growing. They are increasing up their efforts to ship vials to vaccine makers in order to make sure that they arrive quickly, safely, and in a manner that is straightforward to use for filling operations. Vials in plastic tubs are delivered to pharmaceutical filling facilities by producers of packaging.

In the manufacturing and packaging processes utilized in the medical device and pharmaceutical industries, safety and sustainability are given top priority. Traceability regulations have been established across the board in the healthcare sector to fight the selling of counterfeit drugs and medical supplies. The proliferation of disposable kits is one of the most ubiquitous changes in the supply of medical and surgical equipment. Strict regulations, globalization, and other economic factors all have an influence on market expansion. New regulatory frameworks for information and anti-counterfeiting may be challenging for manufacturers to design and implement as labels change quickly.

Regarding economic worries, a variety of political and economic factors continuously exert downward pricing pressure on the pharmaceutical packaging businesses. In order to develop novel medical package designs, manufacturers in the healthcare packaging industry are stepping up their R&D efforts. This includes everything from material selection to rigorous testing and sterility assurance. They are developing packaging innovations that are simple to employ in crisis situations. Manufacturers are creating packaging options that aim to boost consumer satisfaction and patient outcomes. To give users the necessary information, packaging methods need to utilize better labeling.

The market for healthcare packaging is expanding as a result of factors such the rise in illness occurrence, the number of pharmaceutical formulations, and the rising need for practical packaging options. Regulations scrutinize the pharmaceutical business quite closely. Therefore, in addition to cost, pharmaceutical businesses' key priorities include assuring safety and combating adulteration. Leaching of additives into liquid medicine formulations is a common concern that businesses must deal with.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.15% |

| Market Size in 2025 | USD 149.43 Billion |

| Market Size by 2034 | USD 215.98 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material Type, By Product, By Application, By Drug Delivery Mode, By Packaging, and By Packaging Format |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Stringent regulatory changes - Although the healthcare packaging industry is expanding, there are still barriers including rigorous legislation, globalization, and other economic factors. New regulatory frameworks for information and anti-counterfeiting may be challenging for manufacturers to design and implement as labels change quickly. Numerous regulatory and economic factors continuously exert lower pricing pressure on the pharmaceutical packaging sector.

Growth of Disposable Kits - The expansion of disposable kits is one of the most ubiquitous changes in the supply of medical and surgical equipment. These goods are becoming more and more specialized for clinical, diagnostic, and surgical treatment as well as for certain health professionals who need a pre-packaged, sterile plastic container holding their own specific selection of equipment, gadgets, and related peripherals. These goods are emblematic of the overall trend in the surgical and medical product business toward disposables. This trend is encouraged by hospital managers and medical purchasing associations. Hospitals may run more effectively and for less money by using pre-made kits, trays, and packs. Inventory levels are kept to a minimal since suppliers are willing and able to ship rapidly to hospital central supply sites and have enough stock in their own warehouses to prevent hospital shortages.

Speed Up in Packaging Innovations Leading Cost and Time Reduction - Pharmaceutical research has always advanced at a pace that has kept pace with improvements in packaging techniques. The packaging ensures the medications' integrity while being stored, transported, and delivered. As a result, changes in the packaging industry are tied to changes in the market for NDA Pharmaceuticals. Software and technology services will enable pharmaceutical package design to be performed considerably more swiftly. The services will be developed to shorten time to market while simultaneously enhancing design and testing precision, which will result in significant cost savings for both the developer and the client. Due to these recent improvements, the packaging industry is using materials more effectively, requiring fewer samples to be evaluated for stability, less time, less labor, and fewer types of equipment overall. The blister cavity is created using 3D design tools to preserve an appropriate thickness distribution for the high-performance packaging material.

The plastic industry dominated the global market in 2024. Plastic is the product that manufacturers find most profitable globally. Plastic is anticipated to give an alternative option as recyclable polymers like polyethylene and polyethylene terephthalate are regularly used to build sustainable healthcare packaging solutions. Healthcare packaging has changed in various ways, one of which being the producers' preference for plastic over glass as a material. With the development of invention and technology, plastic packaging that was not only able to protect the contents but was also significantly less fragile than glass, was brought to the market.

Additionally, plastic packaging options are lightweight and provide great barrier qualities against moisture, gas, solvent, and the majority of environmental elements. These qualities—lightweightness, relative affordability, and simplicity of access to raw materials—have significantly improved manufacturers' profitability. The availability of plastic packaging options in the pharmaceutical packaging industry has greatly risen as a result of these considerations.

In 2024, primary packaging led the packing type sector, and it is anticipated that the segment would continue to dominate over the projection period. Over the projected period, the category is anticipated to grow as consumer need to extend product shelf lives and growing consumer demand to protect healthcare items both increase. The material used for primary packaging is in direct touch with the items.

The primary packing in medical packaging is the most crucial since it should maintain the safety and original state of the medication. Knowing the potential interactions between the container and the contents is essential for primary packaging. Typically, stability and compatibility of a product or component are verified during the initial research and development phase. Packaging must be designed to prevent medication interactions and ensure that drugs are properly contained. such as Strip packaging, blister packets, etc. Glass, plastic, or metal containers, bottles, vials, ampules, stoppers, seals, desiccants, fillers, and other items may be used as main packaging.

On the basis of application, the medical devices sector led the healthcare packaging market. During the forecast period, the segment is anticipated to rise as a result of the rising demand for medical devices in hospitals and clinics, rising consumer spending power, rising consumer health awareness, and expanding research and development in medical instruments and equipment. In the healthcare sector, a variety of medical device kinds are employed. These tools include of instruments and supplies for surgery, stents, pacemakers, hip implants, dental implants, and other things. Before any of these gadgets may be used by patients in hospitals or other medical facilities, they must all be packed appropriately. Sterilization and cleaning are only two of the procedures used in the packing of medical devices to assist prevent contamination during storage or transportation.

By Material Type

By Product

By Application

By Drug Delivery Mode

By Packaging

By Packaging Format

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025