January 2025

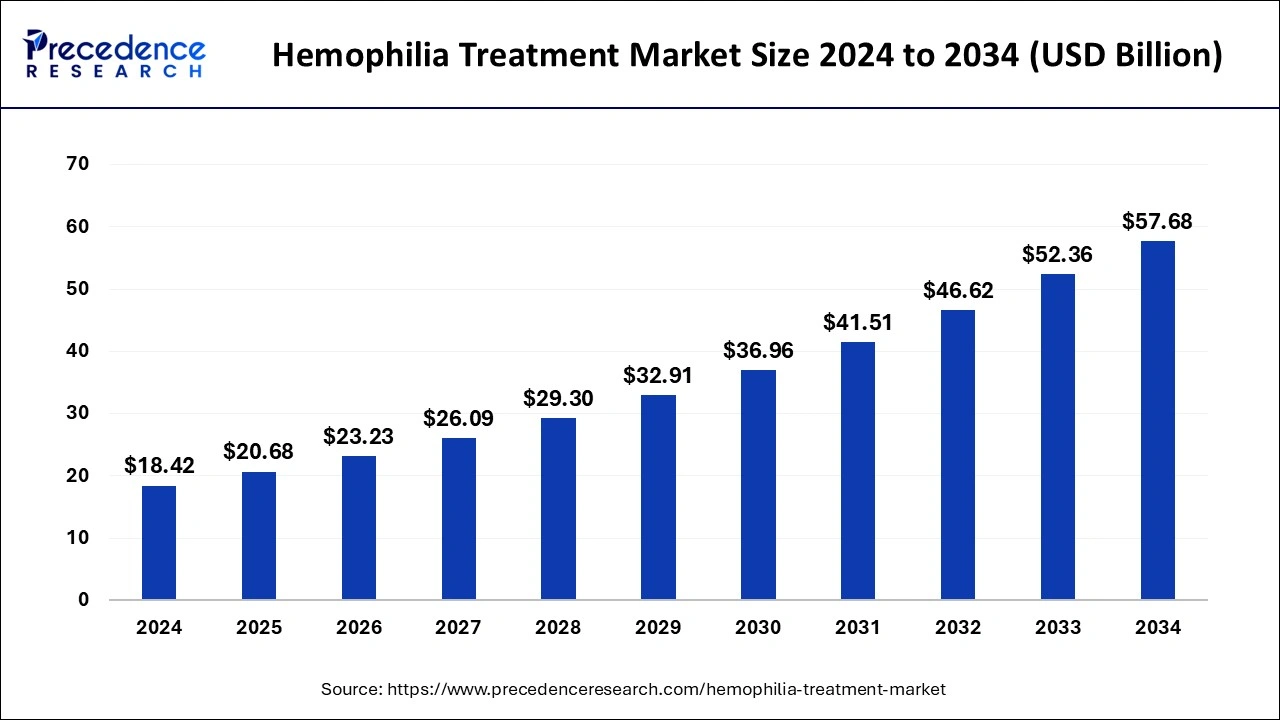

The global hemophilia treatment market size is calculated at USD 20.68 billion in 2025 and is forecasted to reach around USD 57.68 billion by 2034, accelerating at a CAGR of 12.09% from 2025 to 2034. The North America hemophilia treatment market size surpassed USD 8.29 billion in 2024 and is expanding at a CAGR of 12.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hemophilia treatment market size was estimated at USD 18.42 billion in 2024 and is predicted to increase from USD 20.68 billion in 2025 to approximately USD 57.68 billion by 2034, expanding at a CAGR of 12.09% from 2025 to 2034. The growth of the hemophilia treatment market share is driven by an increase in the prevalence of hemophilia.

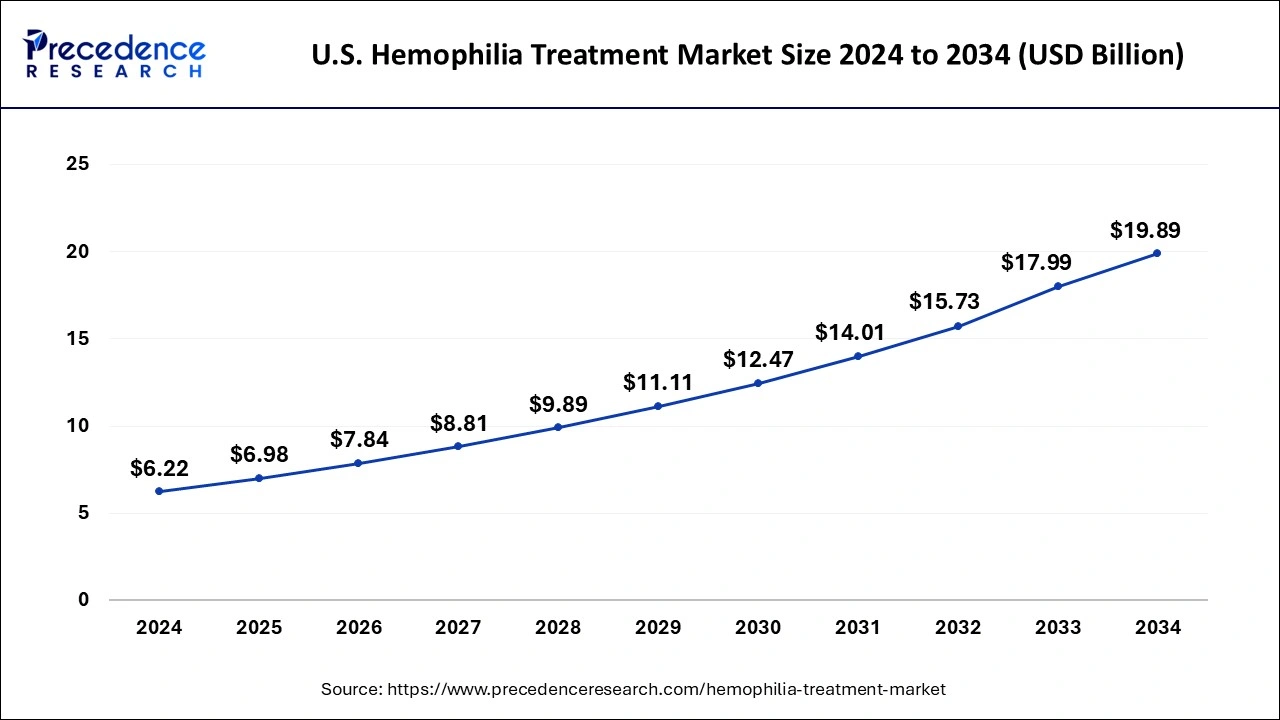

The U.S. hemophilia treatment market size was exhibited at USD 6.22 billion in 2024 and is projected to be worth around USD 19.89 billion by 2034, poised to grow at a CAGR of 12.33% from 2025 to 2034.

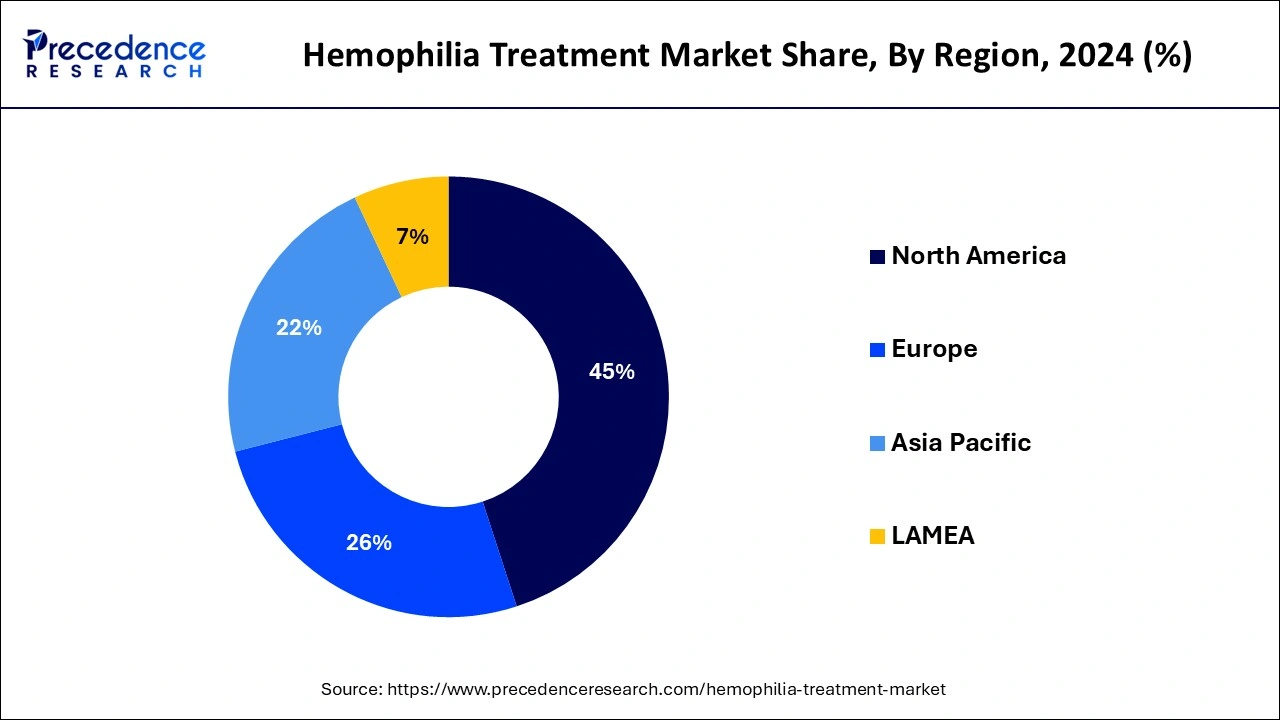

North America registered the largest revenue share of the hemophilia treatment market in 2024. This dominance is fueled by the rising prevalence of blood-related disorders as a result of changing lifestyles and environmental stressors, among many other factors. This has stimulated the governments to conduct awareness campaigns and support plans regarding the treatment of conditions such as hemophilia. The resultant rise in R&D studies for treatment options is further supported by growing investments in the development of widely accepted prophylactic treatments and novel drug delivery systems.

Europe is considered the fastest-growing hemophilia treatment market in the forecasted years. This growth is attributed to the surge in research activities for hemophilia treatment in Europe, driven by recent technological advancements, increased demand for early diagnosis due to rising disease awareness, and established medical facilities. Within Europe, Germany holds the largest share of the market, while the UK is expected to grow at the fastest rate. The government's initiatives in these countries contribute to the hemophilia treatment market expansion further.

Asia Pacific is expected to witness notable growth in the hemophilia treatment market in the forecasted years. The region has seen significant advancements in healthcare infrastructure, improved accessibility to healthcare services, and increased awareness about hemophilia. Additionally, the growing population and improving economic conditions in countries like China and India are driving market expansion in the Asia Pacific. Government initiatives to improve healthcare facilities and increase healthcare expenditure further boost the growth of the hemophilia treatment market in this region.

Increasing gene therapy research and favorable government support driving market growth in China. With a rapidly growing population, rising prevalence of hemophilia, and supportive government initiatives, the hemophilia treatment market in China is set to expand smoothly during the forecast period. Also, advancements in genetic research, new product launches and approvals, increased health awareness, and a surge in diagnostic screenings are expected to boost the demand for hemophilia treatment in China.

Hemophilia is a group of bleeding disorders characterized by prolonged blood clotting. It primarily includes hemophilia A and hemophilia B, caused by the deficiency of clotting factor VIII or IX, respectively. Hemophilia is usually inherited and predominantly affects male children.

The main symptom is bleeding, with mild cases often going undetected until excessive bleeding occurs after surgery or injury. Severe cases may experience spontaneous bleeding, including internal bleeding and joint hemorrhages. Diagnosis typically follows an abnormal bleeding episode or can be confirmed through a blood test if there is a family history. Treatment involves replacing the missing clotting factor via intravenous infusions. Special precautions are necessary during surgery for individuals with this disorder.

| Report Coverage | Details |

| Market Size by 2034 | USD 57.68 Billion |

| Market Size in 2025 | USD 20.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.09% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Drug Therapy, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising case of bleeding disorders

The increasing prevalence of hemophilia is anticipated to drive demand for treatments in the forecast period. The diversity of available therapies and medications also contributes to market expansion. Additionally, emerging economies like India have a growing need for effective therapies to treat Factor VIII deficiency, which can further boost the market growth. Common treatments include antifibrinolytic drugs, gene therapy, inhibitor therapy, home remedies, free factor replacement therapy, and physical therapy. These factors have a substantial positive impact on the hemophilia treatment market's growth.

Challenging approval and regulation processes for hemophilia treatments

The approval and regulation processes in the hemophilia treatment market can be challenging and time-consuming. Companies developing new therapies may encounter difficulties due to stringent rules and requirements for clinical trials, manufacturing, and quality control. This can limit the availability of advanced treatment options. Complications from hemophilia can include joint damage, chronic pain, and bleeding into vital organs. Managing these issues and potential comorbidities, given the chronic nature of the disease, presents additional challenges.

Development of safe and effective gene therapy solutions

Overcoming the challenges in the hemophilia treatment market would quickly establish this new treatment option. Developing gene therapies for hemophilia A and B presents different challenges, with hemophilia A being more difficult to address. Therefore, biotech companies have primarily focused on hemophilia B, while larger pharmaceutical companies have targeted the more extensive hemophilia A market.

Recently, molecular genetic information has been successfully utilized to deliver human hemophilia gene therapy. Several hemophilia gene therapies are set to enter late-stage clinical trials soon. The promising prospects of personalized medicine are expected to greatly contribute to the hemophilia treatment market's growth.

The hemophilia A segment dominated the hemophilia treatment market in 2024 and is expected to grow further over the forecast period. Hemophilia A, also known as classic hemophilia, is the most prevalent form of the disorder, caused by a deficiency of factor VIII, a protein essential for blood clotting. Increased diagnostic rates and growing awareness of hemophilia A treatments are expected to drive segment growth during the forecast period. As the most common type of hemophilia, it accounts for most cases worldwide, resulting in the Hemophilia A segment holding a significant market share due to the larger patient population requiring treatment.

The recombinant coagulation factor segment dominated the hemophilia treatment market in 2024. The growth in recombinant technology products available for treatment has contributed significantly. Recombinant coagulation factors, which are plasma derivatives, are used to treat infections caused by viruses like hepatitis C and HIV. Additionally, recombinant factors have a low risk of transmitting infectious agents.

The non-factor replacement therapy segment is expected to grow at the fastest rate in the hemophilia treatment market over the forecast period. This is due to the increase in the target population and the rise in research and development (R&D) activities for treatment therapies are key drivers. Moreover, in hemophilia, a crucial clotting factor is missing, disrupting the hemostatic balance and leading to excessive bleeding. Non-factor replacement products aim to prevent bleeds by enhancing hemostatic potential (the likelihood of blood clotting if a blood vessel is injured) rather than by increasing factor levels.

By Type

By Drug Therapy

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

February 2025

September 2024