List of Contents

What is the Hemostats Market Size?

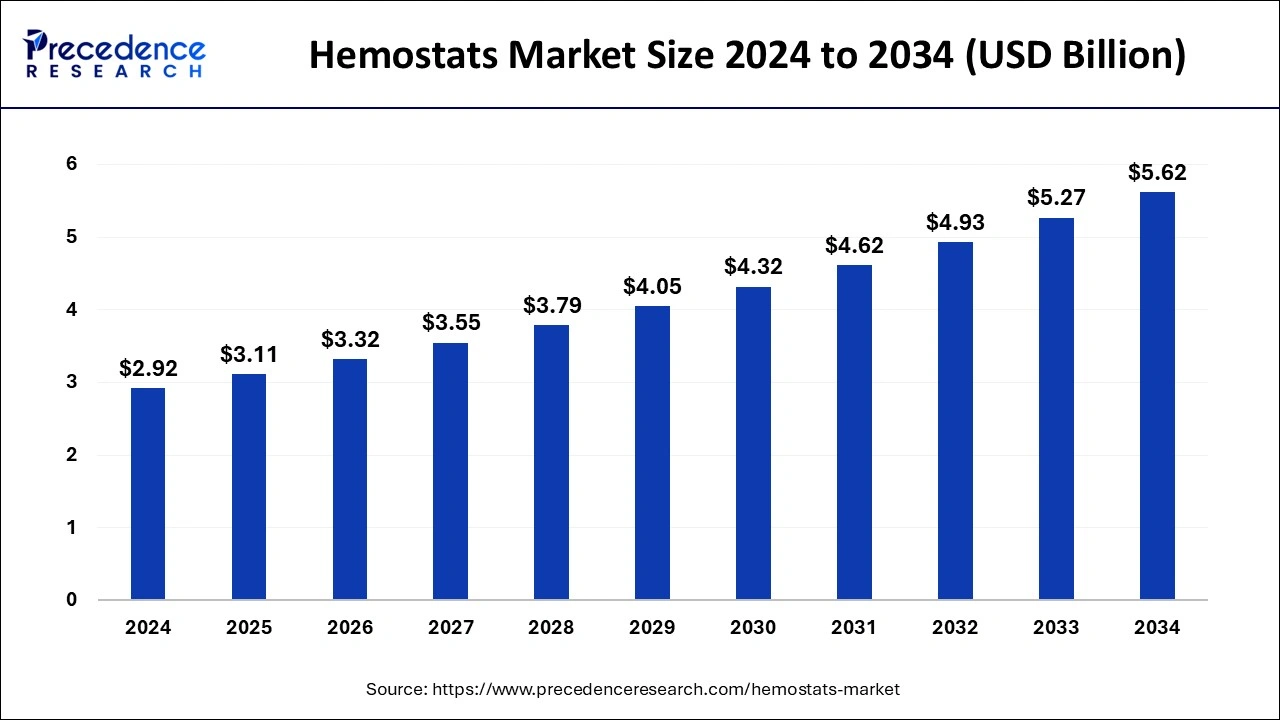

The global hemostats market size is calculated at USD 3.11 billion in 2025 and is predicted to increase from USD 3.32 billion in 2026 to approximately USD 5.62 billion by 2034, growing at a CAGR of 6.79% from 2025 to 2034. to 2034. The global utilization of hemostats in clamping blood vessels, exposing wounds, and grasping tissues that result in reduced risks of infections, reduced hospital stays, improved patient outcomes, and enhanced survival rates surge the growth of the hemostats market.

Key Takeaways

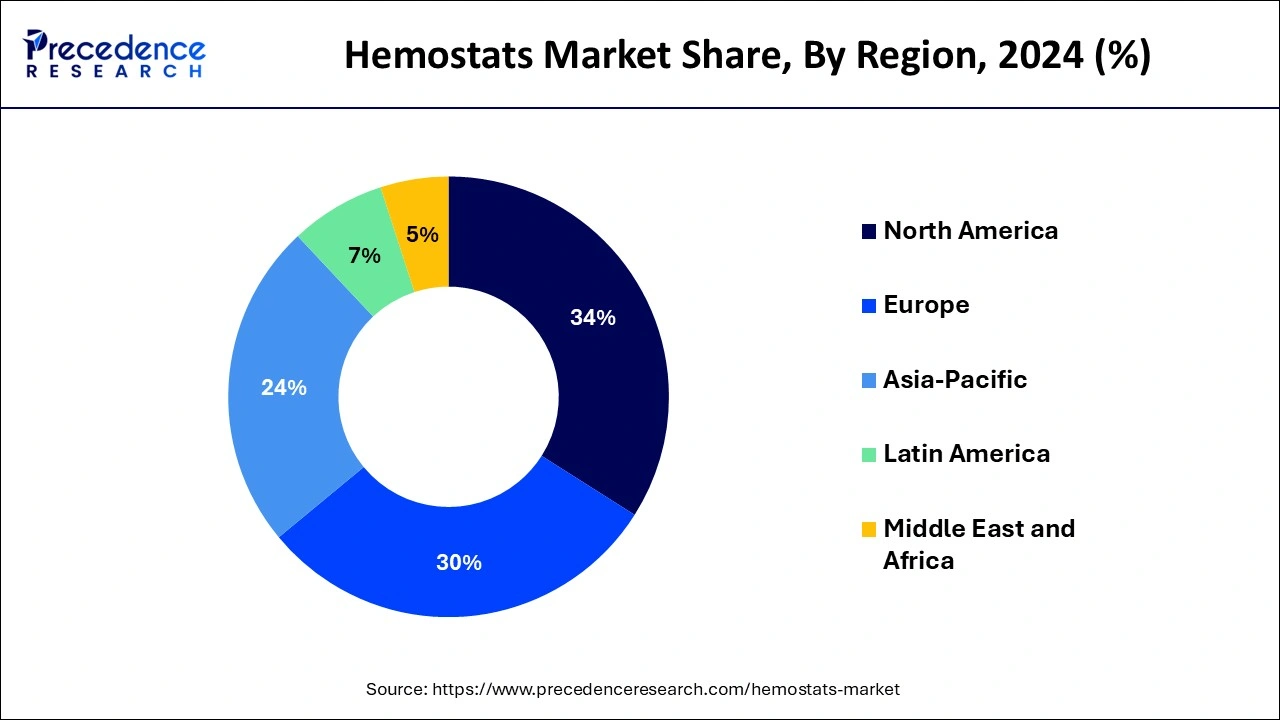

- North America dominated the global market with the largest market share of 34% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By application, the general surgery segment has held the largest market share in 2024.

- By application, the cardiovascular surgery segment is anticipated to grow at a remarkable CAGR during the forecast period.

- By product, the active hemostats segment has held the largest market share in 2024.

- By product, the combination hemostats segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the hospitals and ASCs segment generated the highest market share in 2024.

- By end-user, the other segment is expected to expand at the fastest CAGR over the projected period.

The Future Surgical Tools: AI-Powered Hemostats

The integration of artificial intelligence and machine learning models in hemostasis and thrombosis allows for the identification of complex relationships with multidimensional systems. AI-driven approaches enable the design of innovative topical hemostatic agents that can rapidly and efficiently diagnose complex medical conditions. AI systems facilitate clinical care for professionals by improving the diagnosis and treatment of hemophilia. AI-based computer systems allow computer-aided detection which assists endoscopists in detecting abnormal lesions and helps them in computer-aided diagnosis.

Hemostats Market Overview: The Precision Tools

Hemostats, also known as hemostatic forceps or arterial forceps, are surgical instruments used to control bleeding during surgical procedures or to grasp and hold tissues or blood vessels. They are designed to provide a secure and temporary method of clamping blood vessels or tissues to prevent excessive bleeding. Hemostats have a locking mechanism that allows the surgeon to maintain a constant level of pressure on the tissue or vessel, which is especially important when working in delicate or sensitive areas of the body.

The hemostats market encompasses a variety of hemostatic agents and tools designed to control bleeding in medical and surgical settings. The hemostats market is driven by various factors, including the increasing number of surgical procedures, the aging population, and ongoing advancements in medical technology. Hemostatic products are crucial in reducing blood loss during surgeries, which helps enhance patient outcomes and minimize the risk of complications. They find application in a broad range of medical disciplines, such as general surgery, orthopedics, cardiovascular surgery, and trauma care.

Growth Factors

- As the global population continues to grow and age, there is a rising demand for various surgical procedures. Hemostats are essential tools for controlling bleeding during surgeries, and the increasing number of surgical interventions contributes to the growth of the market.

- Healthcare professionals and medical institutions are becoming more aware of the benefits of using hemostatic agents and tools to minimize bleeding and reduce the risk of complications in surgical procedures. This awareness can lead to higher adoption rates.

- Traumatic injuries, including accidents and emergencies, often require immediate hemostatic intervention to control bleeding. The rising incidence of trauma cases contributes to the demand for hemostatic products in emergency medicine.

- The development of healthcare infrastructure in emerging markets and the expansion of healthcare facilities in various regions can lead to greater access to surgical procedures and, consequently, an increased demand for hemostatic products.

- Stringent regulatory standards and quality control measures in the healthcare industry contribute to the safety and efficacy of hemostatic products, increasing confidence in their use and fostering market growth.

- The growing trend toward minimally invasive surgical techniques has created a demand for hemostatic products that are suitable for these procedures, such as laparoscopic and robotic surgeries.

Hemostats Market Outlook: Exploring The Future Trends

- Industry Growth Overview: Increasing surgical procedures, growing innovations, and rising trauma cases are driving the industry growth.

- Major Investors: Large multinational medical device, pharmaceutical corporations, institutional investors, and venture capital firms are the major investors.

- Startup Ecosystem: The development of novel biomaterials with the use of nanotechnology is the focus of the startup ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.11 Billion |

| Market Size in 2026 | USD 3.32 Billion |

| Market Size by 2034 | USD 5.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.79% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, By End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hemostats Market Dynamics

Driver

Rising number of surgical interventions

The incidence of surgical procedures continues to climb as global demographics change and populations grow. Several factors such as an aging population that involves more medical attention, a surge in the prevalence of chronic diseases requiring surgical interventions, and the development of surgical techniques and technologies. In precise, the expanding middle-class population in emerging economies has resulted in greater access to healthcare and a surge in elective surgeries. Their ability to effectively control bleeding during surgeries is paramount to ensure safe and successful procedures. Thus, these factors further drive demand across the market.

In addition, surgeons across numerous specialties rely on hemostatic devices and agents to reduce blood loss, increase surgical precision, and decrease the risk of complications. Hemostats are indispensable in a wide range of surgeries, including general surgery, orthopedics, cardiovascular surgery, and trauma care. Furthermore, as medical advancements continue, the hemostats market benefits from ongoing innovation, the development of more user-friendly products, and the integration of advanced materials and technologies. The rising demand for surgical interventions, coupled with the importance of effective bleeding control, positions the hemostats market for sustained growth and a central role in the enhancement of patient care and surgical outcomes in the years to come.

Restraint

Limited access in developing regions

Thermostat agents and devices play a crucial role in modern healthcare, their reach remains limited in many parts of the world, particularly in underserved and developing regions. One primary issue is the lack of adequate healthcare infrastructure, which affects the availability of surgical services and the necessary tools, including hemostatic products. In remote and economically disadvantaged areas, healthcare facilities may be limited in number and resources, making it difficult for patients to access necessary surgical care.

Furthermore, in many developing regions, there is a shortage of trained healthcare professionals who can effectively utilize hemostatic agents and devices. This lack of expertise and awareness about these advanced medical tools can hinder their adoption. Economic factors also need to be considered. In regions with limited healthcare budgets and resources, the cost of acquiring hemostatic products may be prohibitive.

Manufacturers often face challenges in making their products affordable and accessible to healthcare institutions in these areas. The limitations in supply chain and distribution networks can further impede access to hemostatic products. Ensuring the timely and efficient delivery of these critical medical tools to remote and underserved regions can be logistically challenging.

Opportunity

Continued innovations in hemostats agents

The development of more advanced and effective hemostatic products plays a pivotal role in enhancing patient care, improving surgical outcomes, and reducing complications in a wide range of medical procedures. In the realm of hemostatic agents, manufacturers are continually exploring new formulations, materials, and technologies to create products that offer faster and more reliable hemostasis while minimizing the risk of adverse reactions. Innovations in these agents can lead to improved clotting efficacy and enhanced safety, ultimately benefiting patients and healthcare providers.

Moreover, the design and engineering of hemostatic devices are evolving to meet the changing demands of modern medicine. With the growth of minimally invasive surgery and the demand for precision in surgical procedures, the development of specialized devices tailored to these applications is a prominent opportunity. These innovations aim to improve usability, reduce complications, and streamline the hemostatic process. In addition, the integration of smart technologies and real-time monitoring in hemostatic products offers promising prospects.

Such advancements can provide healthcare professionals with valuable data on clotting status, wound healing, and patient vitals, enabling more informed decision-making and personalized care. As healthcare continues to advance, innovations in hemostatic agents and devices will play a vital role in ensuring that surgeries are safer, more efficient, and produce optimal patient outcomes.

Application Insights

According to the application, the general surgery segment has held highest revenue share in 2024. General surgery encompasses a broad range of procedures involving the abdomen, digestive system, and other organs. Hemostats are used to control bleeding in surgeries such as appendectomies, gallbladder removal, and hernia repairs.

The ability to achieve effective hemostasis is vital in these operations, as it contributes to reduced blood loss, shorter operating times, and decreased post-operative complications. The dominance of the general surgery segment reflects the demand for reliable, safe, and efficient solutions that healthcare providers and surgeons depend on to ensure the success and safety of general surgical interventions.

The cardiovascular surgery segment is anticipated to expand fastest over the projected period. Cardiovascular surgery is a specialized field that involves intricate procedures on the heart and blood vessels, often with minimal room for error. In heart and vascular surgeries, precise hemostasis is critical to ensure the repair or replacement of heart valves, coronary artery bypass grafting, or other procedures without complications related to bleeding.

Product Insights

In 2024, the active hemostats segment had the highest market share on the basis of the product. Active hemostats are products that contain biologically active substances or synthetic agents designed to enhance the body's natural clotting processes. These substances may include thrombin, fibrin sealants, or other clot-promoting factors. Active hemostats accelerate the clotting of blood and promote hemostasis. Thus, these factors drive demand for hemostats market across the segment.

The combination hemostats segment is anticipated to expand fastest over the projected period. This is due to these products offering a dual approach, utilizing mechanical methods to control bleeding while also promoting clot formation through the use of biologically active substances. Combination hemostats are products that incorporate both active and passive components to achieve hemostasis.

End-User Insights

In 2022, the hospitals & ASCs segment had the highest market share based on the end-user. Hospitals and ambulatory surgical centers are primary users of hemostatic agents and devices. Hemostats are extensively used in these settings across a wide range of medical specialties, including general surgery, orthopedics, cardiovascular surgery, trauma care, and more. They play a crucial role in controlling bleeding during surgical procedures and ensuring patient safety.

The others segment is anticipated to expand fastest over the projected period. The other segment usually includes other healthcare institutions, clinics, and healthcare providers that use hemostatic agents and devices to ensure that solutions are available and optimized for various clinical contexts, ultimately contributing to improved patient care, surgical outcomes, and emergency medical response. These could encompass specialty clinics, outpatient surgical facilities, dental clinics, and others.

Regional Insights

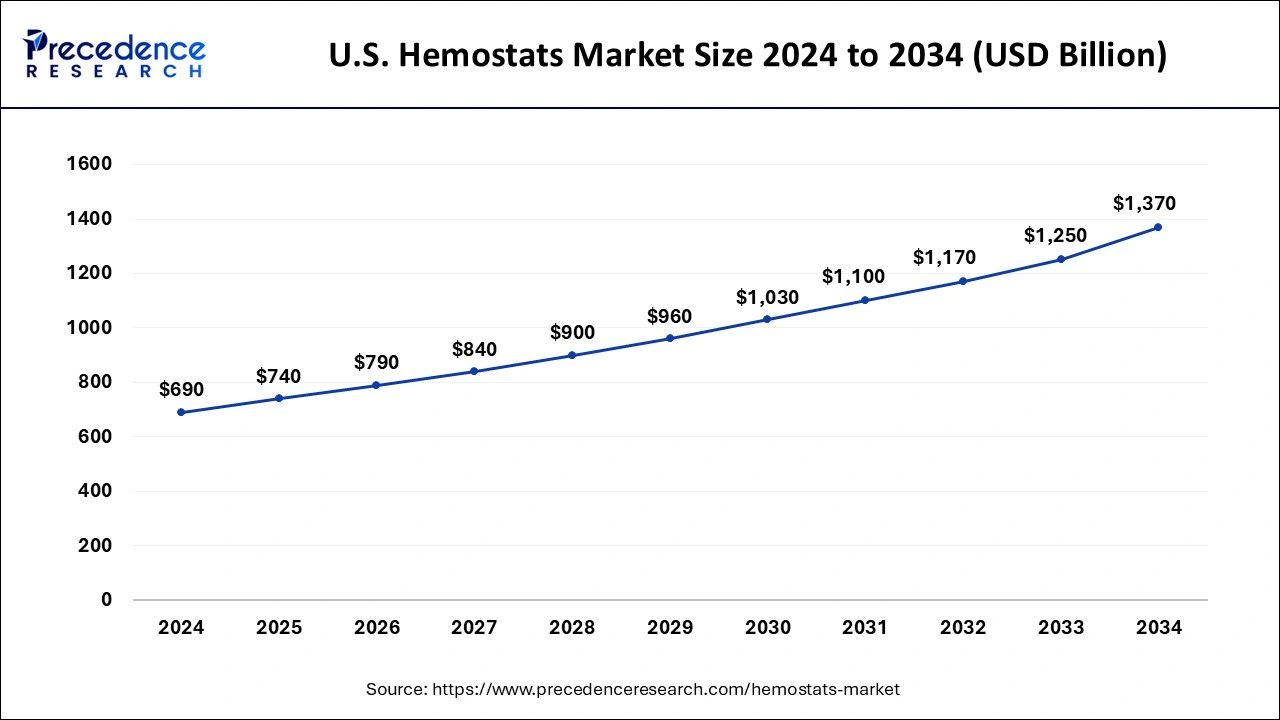

U.S. Hemostats Market Size and Growth 2025 to 2034

The U.S. hemostats market size is exhibited at USD 740 million in 2025 and is projected to be worth around USD 1,370 million by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

North America Driven by Advancing Healthcare

North America has held the largest revenue share of 34% in 2024. This is due to the region's advancing healthcare, ensuring patient safety, and promoting surgical precision. It also signifies the region's role as a hub formedical device innovation, with a strong emphasis on research and development in the healthcare sector. The region is home to many leading medical device manufacturers and research institutions, fostering innovation in hemostatic products and their adoption in clinical practice. For instance, in January 2023, the U.S. Food and Drug Administration (FDA) granted the Breakthrough Device Designation for Medcura, Inc.'s LifeGel Absorbable Surgical Hemostat.

- On March 15, 2025, the U.S. president signed an agreement for continuing resolution (CR) to extend government funding until the end of the 2025 fiscal year (FY) that ends on September 30. The Funding for the National Institutes of Health (NIH) has been extended at FY 2024 levels, and is expected to adjust funding for programs authorized by the 21st Century Cures Act to the level of $127 million for FY 2025 called for in the law.

Expanding Healthcare Drives the Asia Pacific

Asia Pacific is estimated to observe the fastest expansion. The region is growing its role in the global healthcare landscape and commitment to improving patient care, surgical outcomes, and emergency medical response, making it a vital part of the evolving healthcare ecosystem. Efforts to improve access to healthcare and reduce disparities in healthcare delivery are leading to a greater number of patients undergoing surgical procedures and trauma care, further driving the demand for the hemostats market across the region.

Well-Established Healthcare Systems Boost Europe

The hemostats market in Europe is a dynamic and evolving segment of the healthcare industry. Europe is known for its well-established healthcare systems, advanced medical technologies, and a strong focus on patient safety. Thus, the hemostats market in Europe reflects a region committed to providing advanced healthcare services with a strong emphasis on patient care, safety, and surgical precision. It continues to be a key player in the global healthcare landscape.

Indian Hemostats Market & Trends

The Indian hemostats market is rapidly expanding due to various factors, including a growing geriatric population, rising adoption of hemostat products, and an increased number of surgical cases. The Government of India's initiative to perform free surgeries, due to the increased prevalence of chronic disease and increased demand for effective hemostasis products in the healthcare sector. The rising disposable incomes and medical reimbursement policies are further contributing to market growth support

Increasing Surgical Procedures Fuels U.S.

Due to a growth in the surgical procedures, the demand for hemostats in the U.S. is increasing. The presence of the advanced healthcare sector is increasing its adoption rates, where the industries are also developing smart solutions, promoting their use. The healthcare investments are also promoting their innovations.

Robust Healthcare Propels the UK

The robust healthcare system of the UK utilizes various surgical devices, which are increasing the adoption of hemostats. The growing investments and funding are also encouraging their use and development. Moreover, the growing demand for minimally invasive surgeries is also increasing their use.

Expanding Healthcare Stimulates South America

South America is expected to grow significantly in the hemostats market during the forecast period, due to expanding healthcare infrastructure. The growing surgical volumes are also contributing to their increased demand. Additionally, the companies are developing advanced hemostasis solutions, which are backed by investments, enhancing the market growth.

Growing Disease Burden Facilitates Brazil

The growing disease burden is increasing the surgeries, which is driving the demand for hemostats in Brazil. This is also enhancing their innovations to enhance their applications and safety. The expanding hospitals and growing healthcare investments are also promoting their adoption rates.

- R&D

The R&D of hemostats involves the development of novel bioengineered materials that act through multiple mechanisms and enhance delivery systems for minimally invasive surgeries.

Key players: Baxter, Johnson & Johnson Services, Inc. - Clinical Trials and Regulatory Approvals

The clinical trials and regulatory approvals of the hemostats focus on the product's safety, clinical superiority, and efficacy.

Key players: Johnson & Johnson Services, Inc., Integra LifeSciences. - Healthcare Provider Support and Services

The healthcare provider's support and services of hemostats involve technical assistance, education, and training.

Key players: Baxter, Johnson & Johnson Services, Inc.

Key Players' Offering

- Baxter: The company provides FLOSEAL, TISSEEL, COSEAL, ARTISS, and PERCLOT.

- BD (Becton, Dickinson and Company): The company provides Arista AH absorbable hemostat and Avitene microfibrillar collagen hemostat.

- Integra LifeSciences: A wide range of collagen-based products is provided by the company.

- Johnson & Johnson Services, Inc.: Surgicel family, Surgifloe hemostatic matrix, etc, are provided by the company.

- Medtronic: The company provides various advanced hemostats.

Hemostats Market Companies

- Baxter (U.S.)

- Biom'up (U.S.)

- BD (Becton, Dickinson and Company) (U.S.)

- Integra LifeSciences (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- Pfizer Inc. (U.S.)

- Stryker (U.S)

Recent Developments

-

In March 2025, Hemopatch Sealing Hemostat was launched by Baxter. This Hemostat is a ready-to-use absorbable collagen pad for tissue sealing and hemostasis, in both Europe and Asia.

-

In March 2025, Olympus launched the Retentia HemoClip, a new single-use hemostasis clip for GI endoscopists, initially in the US with plans for global expansion. This clip provides 360° rotation and an intuitive one-step deployment, offering control over placement with three different sizes to accommodate a variety of closure applications.

-

In March 2024, Sanofi received FDA approval for fitusiran (Qfitlia), an siRNA therapeutic, for use in hemophilia A and B, with or without factor VIII or IX inhibitors, to prevent or reduce bleeding episodes in adults and children 12 years and older.

-

In September 2024, Medcura, Inc., a leader in innovative hemostasis solutions that deploy patented biopolymer technologies to control surgical bleeding, received a 2024/2025 Best Technology in Spine Award for LifeGel™ Absorbable Hemostatic Gel.

- In April 2024, LifeScience PLUS announced the launch of a new hemostatic wound healing solution for treating donor sites named DonorSeal which is a 100% natural plant-based cellulose matrix and provides rapid hemorrhage control, wound healing, and blood loss reduction.

- In November 2023, Ethicon announced the approval for ETHIZIATM which is an adjunctive hemostat solution that is clinically proven and provides sustained hemostasis in difficult bleeding situations.

Segments Covered in the Report

By Product

- Passive Hemostats

- Combination Hemostats

- Active Hemostats

- Others

By Application

- Plastic Surgery

- Orthopedic Surgery

- Trauma

- Cardiovascular Surgery

- General Surgery

- Neurosurgery

- Others

By End-User

- Tactical Combat Casualty Care Centers

- Hospitals & ASCs

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client