November 2024

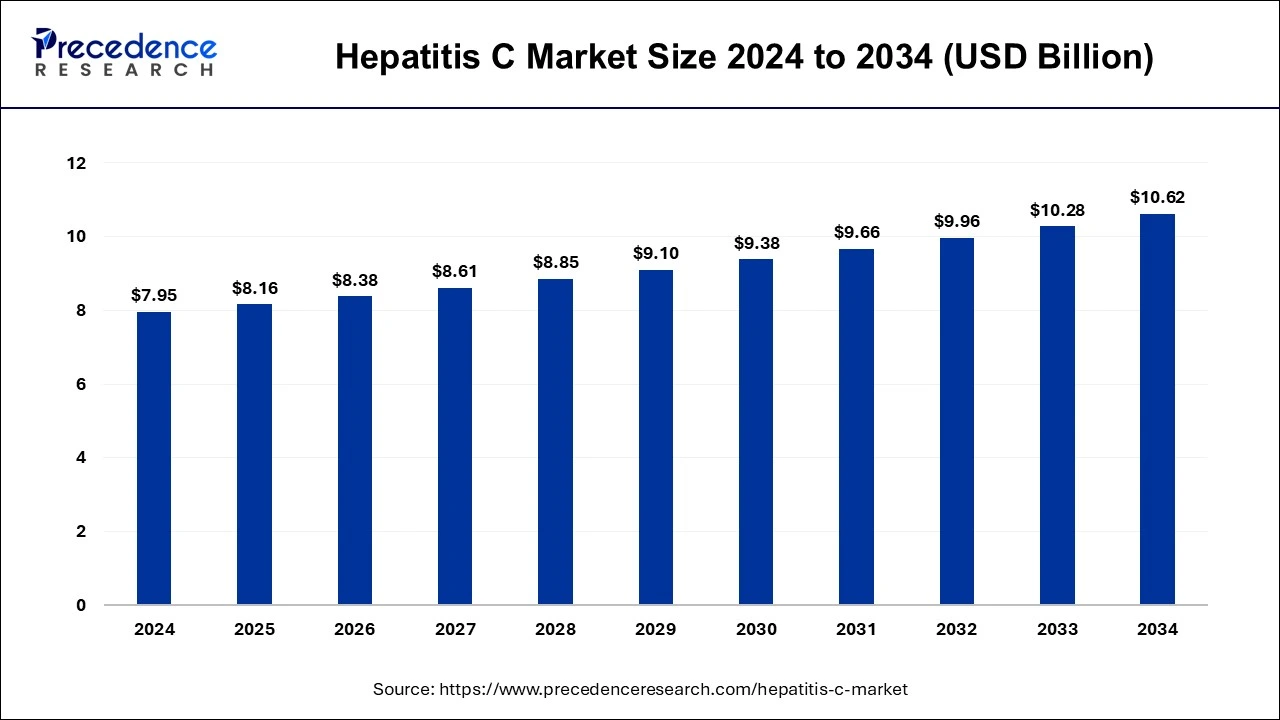

The global hepatitis C market size is calculated at USD 8.16 billion in 2025 and is forecasted to reach around USD 10.62 billion by 2034, accelerating at a CAGR of 3% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hepatitis C market size accounted for USD 7.95 billion in 2024 and is anticipated to reach around USD 10.62 billion by 2034, growing at a CAGR of 3% from 2024 to 2034.

A viral infection called hepatitis C can result in severe liver damage by inflaming the liver. Contaminated blood can transmit the hepatitis C virus (HCV). Hepatitis C treatment up until recently needed weekly injections and oral medications, both of which were difficult for many HCV-infected individuals to take due to other health issues or unfavorable side effects. Furthermore, oral medications taken consistently for two to six months can typically treat chronic HCV.

Nevertheless, about half of those who have HCV are unaware of their infection, primarily because they don't exhibit any signs, which can take years to manifest. Because of this, even people without symptoms or known liver disease should be screened for hepatitis C, according to the U.S. Preventive Services Task Force. All people born between 1945 and 1965 are the most at risk because they are five times more likely to contract the disease than people born in other years.

The market will expand as a result of factors including the expansion of the pharmaceutical industry, an aging population, rising healthcare costs, urbanization improving monitoring and screening methods, and a rise in liver cancer and cirrhosis deaths brought on by HBV. Rigid competition, management issues, a lack of diagnostic resources, the high expense of medical care, and legal restrictions, on the other hand, would pose a threat to the market's expansion. Growth in pharmaceutical research and development, cooperation, innovation, and research, high demand for biomarker based tests, HBV treatments under development, government efforts, and increased public awareness are a few noteworthy trends that may be observed.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.16 Billion |

| Market Size by 2034 | USD 10.62 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3% |

| Largest Market | North American |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing awareness creates opportunities - In contrast to other established nations, developing nations like India, China, and Brazil have a sizable patient pool. This raises the demand for medications used to treat hepatitis C. Few nations and state governments have taken steps to reduce the spread of hepatitis C by providing special funding for programs that treat the illness or by subsidizing certain medications. Several private NGOs raise public consciousness of the hepatitis C infection and educate the populace about it. These could also be viewed as market factors for hepatitis C medications. Hepatitis C infection is becoming more common among the world's populace. Sharp needles, unkempt medical supplies, and blood transfers from an infected mother to a newborn baby are the main causes of this.

On the basis of drug class it is classified into HCV Protease Inhibitors, HCV Polymerase Inhibitors, HCV NSSA Inhibitors, Combination Therapy, Interferon and Antiviral, Peginterferon alfa 2a, Peginterferon alfa 2b, Ribavirin and Others. About one-third of patients who have hepatitis C develop cirrhosis of the liver, some of whom will later develop liver failure or liver cancer. Hepatitis C is a significant cause of liver disease in the United States. Currently, a combination therapy such as alpha interferon and ribavirin administered for 6 to 12 months is the suggested treatment for hepatitis C.

Oral antiviral medication is called ribavirin. Both an immune system booster and an antiviral, interferon must be administered intravenously (three times per week) and comes with a long list of unpleasant side effects. The duration of the drug treatment is expected to be between 6 and 12 months.

In 2024, the segment of hospital & retail pharmacies had the largest revenue share. The hospital and retail pharmacies sector is predicted to have the highest income in 2024 and to dominate the market throughout the projection period. The significant market share can be attributed to the numerous patients who seek hepatitis C diagnosis and treatment immediately at the hospital. In addition, the sector is anticipated to have significant growth opportunities due to the rising number of hospital & retail pharmacies providing hepatitis C treatments in emerging economies.

North America, Europe, and Asia Pacific are the three regions that primarily control the global hepatitis C industry. The North American market had the highest revenue in 2024, primarily because of the U.S.'s high demand, the patient population's comparatively higher affordability, and the region's awareness of advanced therapeutics. Some of the key elements influencing the high share include the availability of a well-developed healthcare system, reimbursement, and access to the most cutting-edge medications. Over the course of the projection period, the Asia Pacific market is anticipated to expand at the fastest rate.

The region's growth prospects are anticipated to be favorably reinforced by the high disease burden, expanding access to medicines, improvements in healthcare and sanitation, and increasing awareness of the hepatitis vaccination. To make it easier for more people to access high-quality healthcare, nations like India, China, Indonesia, and other South Asian economies are constantly raising their healthcare spending and reimbursement coverage.

Additionally, it is expected that the Asia Pacific region will benefit from the rising demand for generic medications. Gilead has granted permission to seven Indian manufacturers to export some of the hepatitis medicines to various nations. More than half of the people who have HCV infection live in the nations that are included in this agreement.

By Drug Class

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

November 2024

July 2024