January 2025

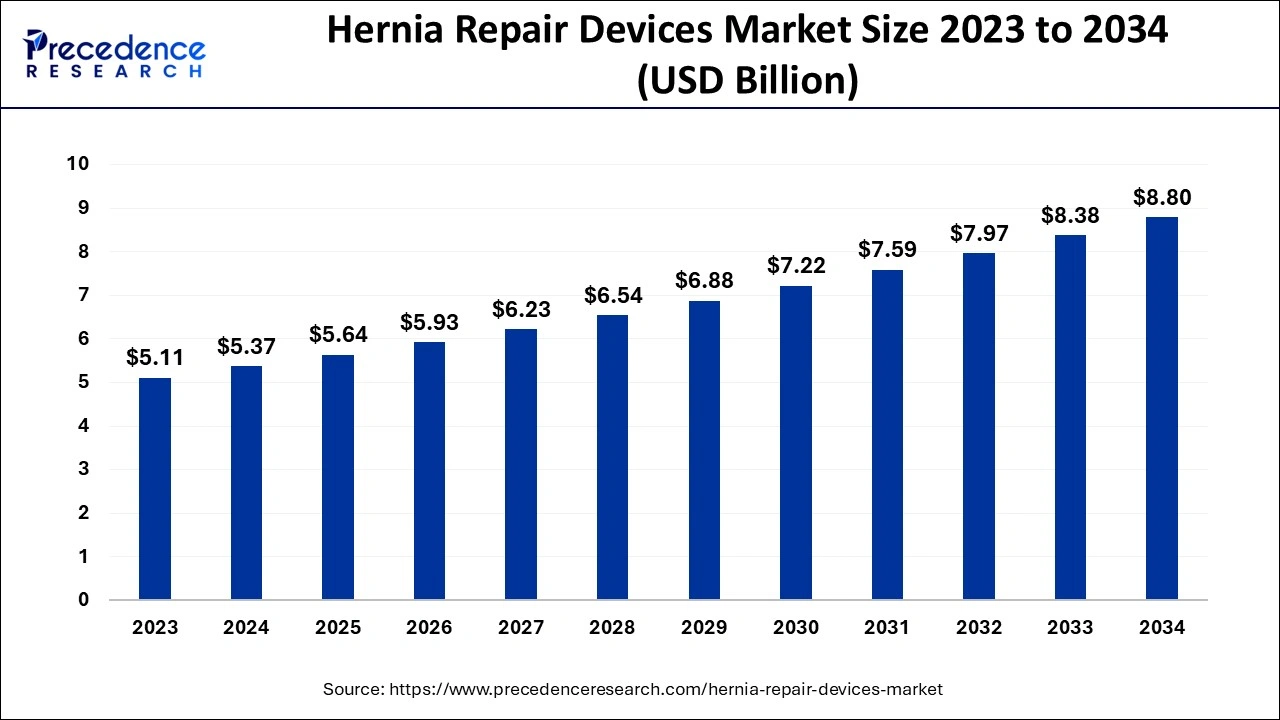

The global hernia repair devices market size is estimated at USD 5.37 billion in 2024, grew to USD 5.64 billion in 2025 and is predicted to hit around USD 8.80 billion by 2034, expanding at a CAGR of 5.07% between 2024 and 2034. The North America hernia repair devices market size accounted for USD 2.74 billion in 2024 and is anticipated to grow at a fastest CAGR of 5.14% during the forecast year.

The global hernia repair devices market size accounted for USD 5.37 billion in 2024 and is anticipated to reach around USD 8.80 billion by 2034, expanding at a CAGR of 5.07% between 2024 and 2034.

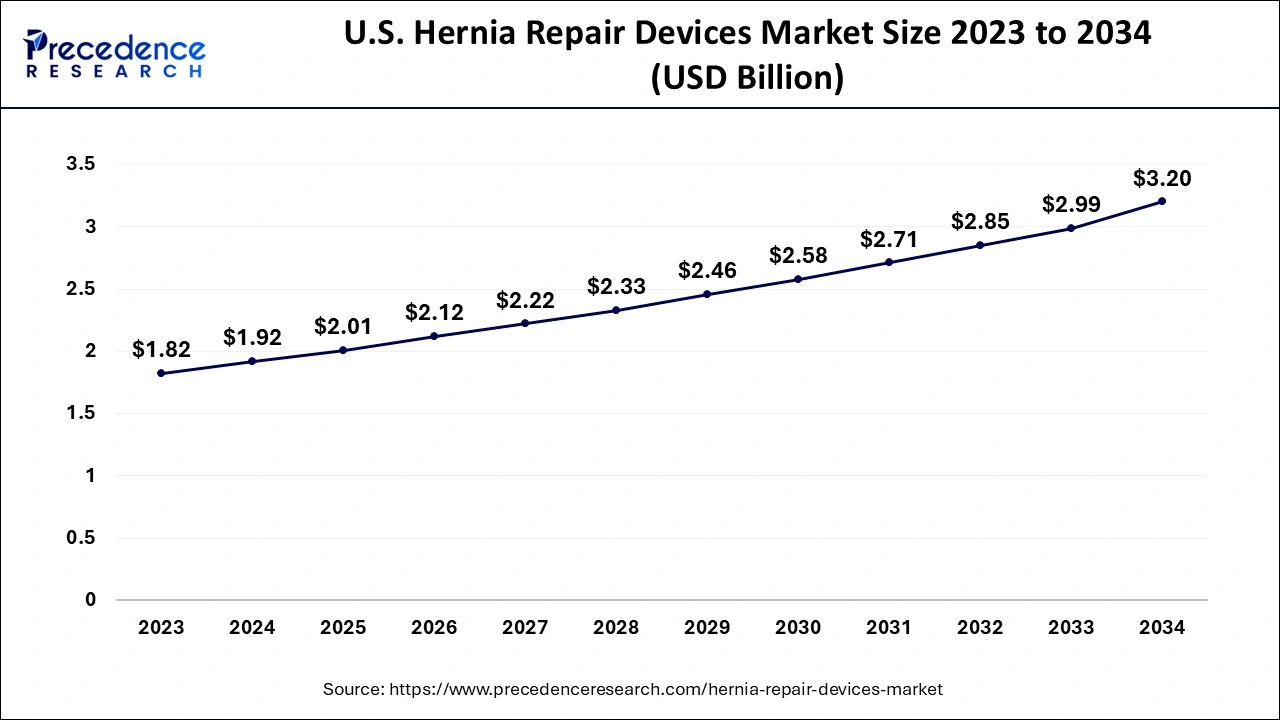

The U.S. hernia repair devices market size is estimated at USD 1.92 billion in 2024 and is expected to be worth USD 3.20 billion by 2034, growing at a CAGR of 5.26% from 2024 to 2034.

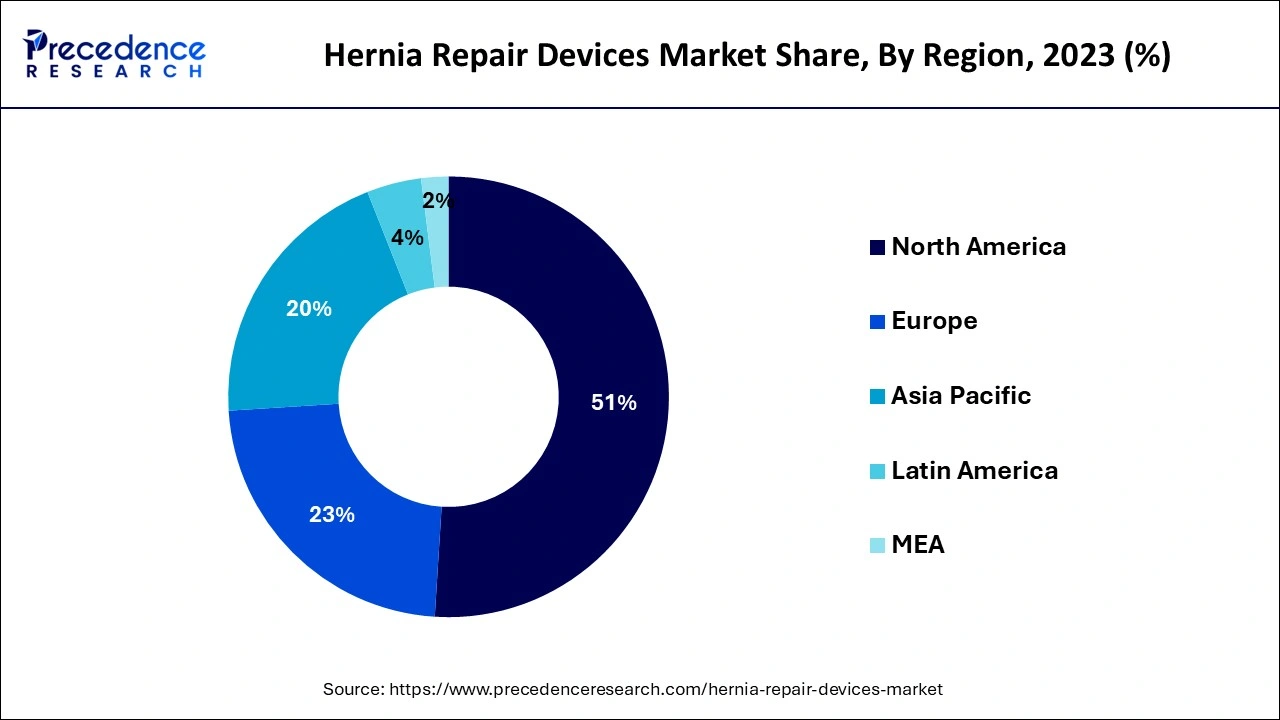

With a revenue share of 51% in 2023, North America dominated the market owing to extensive treatment research and development activities. For instance, the British Medical Research Council and North American Nocturnal Oxygen Therapy conducted studies to establish the efficacy of long-term therapy. The increasing usage of topical wound hernia repair devices (TWO) and hyperbaric hernia repair devices in this region also impacts market demand. Due to urbanization and occupational risks, this region also has a higher risk of developing respiratory ailments, which is anticipated to fuel market growth throughout the projected period.

Due to the higher adoption rates of new technology, these systems also promote research and development in these nations, which attracts international players to the U.S. and Canada. Additionally, the presence of significant vital players in this region is anticipated to fuel market expansion. Thus, the above elements will likely fuel market expansion in this area during the projection year.

An organ or collection of organs that protrude is called a hernia. It happens when an organ or other biological part protrudes past the muscle or tissue wall that encloses it and becomes visible. While engaging in specific activities like jogging or walking, one may experience hernia symptoms such as vomiting, discomfort, and constipation in addition to others.

Abdominal wall hernias include diaphragmatic hernias, inguinal hernias, umbilical hernias, femoral hernias, incisional hernias, Spigelian hernias, obturator hernias, Hiatal hernias, and epigastric hernias. Most hernias are insignificant and can be surgically fixed to prevent further problems.

The rising prevalence of hernias, benevolent reimbursement practices, and technological developments in repair devices are essential drivers for market expansion.

The increased rate of hernias is fueling an increase in demand for practical repair tools, which is anticipated to support market expansion. Over a million operations for hernia repair are performed yearly in the United States alone, according to the U.S. FDA. The rising frequency of hernias is fueling the need for an effective remedy, which is anticipated to drive market expansion.

One of the main factors encouraging the expansion of the sector is the increasing prevalence of hernias worldwide. A hernia is a medical problem that typically develops when an internal organ within the human body pushes through a weak area in the abdominal muscles. According to clinical studies, physical issues like obesity, excessive coughing, straining while urinating, genetics, and physically demanding tasks like heavy lifting may cause hernias.

Over 20 million hernias are operated upon each year, making up 15% to 18% of all surgical procedures, according to a 2020 article in the BMJ Journal. The number of hernia repair surgeries has significantly increased due to the rising hernia incidence. The need for hernia repair devices is developing throughout the healthcare sector due to the increasing need to repair and strengthen sick hernia tissue.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.37 Billion |

| Market Size by 2034 | USD 8.8Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.07% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Surgery Type and By Procedure Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Geriatric population's healthcare burden fuelling innovations in hernia repair devices - High patient morbidity is linked to hernias. As a result, med-tech companies in the market for hernia repair devices are expanding R&D spending on new tools and solutions. Manufacturers have been forced to create effective hernia mesh, biologic materials, and endoscopy equipment, among other things, to enhance medical outcomes due to the growing load of the senior population in the healthcare system.

A hernia is more common in people over the age of 55 years because of the greater risk of health problems and naturally occurring muscle deterioration. The forecast term is expected to witness a positive CAGR for the worldwide hernia repair device market. Hernia prevalence is increasing, which can be due to the aging population growth, quick lifestyle changes, and high obesity rates.

Increasing prevalence of hernia - Hernias require medical and surgical interventions as treatment options. A hernia results when an internal body part pushes through a weakness in the surrounding muscle or tissue wall. Due to the rise in the prevalence of hernia types such as inguinal and femoral, there is a strong need for hernia repair equipment, which is anticipated to propel market expansion. One of the crucial surgical treatments that the World Health Organization prioritizes is inguinal hernia repair (WHO).

It also ranks among the most widespread surgical disorders, impacting 220 million globally. Inguinal hernia problems result in over 40,000 fatalities each year and a loss of 3,500,000 DALYs (disability-adjusted life years). Additionally, 20 million hernia repairs are conducted worldwide, representing less than a tenth of hernia prevalence.

A rise in the number of obese people - With the prevalence of hernias and the number of obese patients rising, managing these individuals has taken center stage in hernia treatment. Being overweight or obese puts extra strain and pressure on the abdominal muscles, which weakens them and raises the risk of hernias.

Additionally, individuals who do not follow the advised lifestyle changes and who continue to move heavy objects after having surgery to correct hernias run a greater risk of getting recurrent hernias. Particularly umbilical hernias, and hernia recurrence, is more likely to occur in obese patients, both in male and female populations.

Strict legal approval procedure - Additionally, the high cost of hernia repair device R&D is anticipated to restrain market expansion. Before releasing a hernia repair device, a producer must meet several clinical and regulatory conditions. Medical equipment manufacturers are compelled to maintain the initial high cost of hernia repair devices due to the lengthy development and approvals phases. High product costs prevent people from having proper access to numerous technical breakthroughs, which hinders their uptake.

Key Market Opportunities

Increase in the use of minimally invasive surgery - Because it has fewer risks, less discomfort, and a shorter hospital stay, it is more popular. Due to the increased patient demand for minimally invasive procedures and their advantages over open surgeries, which carry risks of wound infection, among other things, hernia minimally invasive surgeries are becoming more common.

The use of surgical devices has expanded due to new technical developments and the demand for minimally invasive surgical procedures, which has boosted market growth and is anticipated to present opportunities for the industry.

The hernia mesh category led the market in 2023 with a revenue share of 77%. The main factors contributing to this market segment's growth are the capacity to give tensile strength in the long term to stop a recurrence and increase infection resistance. Synthetic and Biologic mesh is further divided into the hernia mesh category. Due to its high availability, ease of access to raw materials, and affordability, the synthetic mesh segment dominated the market in 2023.

During the projected period, the hernia fixation devices market is anticipated to experience the quickest revenue CAGR growth. The portion is divided into applicators of sutures, tacks, and glue. In 2022, tack applicators ruled the market due to the expensive nature of the equipment and the ease with which merchandise was accessible.

Due to their widespread use in numerous surgical procedures, sutures held a sizeable market share in 2022. Due to benefits including fewer post-operative issues, the glue applicators market is anticipated to increase throughout the forecast period.

Due to advantages including cheap cost and reduced complications after the surgery, open surgery had a revenue share of 77% in 2023 and is predicted to maintain its dominance over the market for the forecast period. To do open hernia surgery, the abdomen must be extensively incised, and a surgical mesh is used to cover the healed hernia to strengthen the tissues.

The prevention of hernia recurrence, affordable operation, and reduced risk of complications are all advantages of open surgery. However, the segment's growth is expected to be hampered by available surgical side effects, including excessive blood loss, blood clots forming, and other organs that could be damaged.

Due to its widespread acceptance as a hernia treatment option, laparoscopic surgery is anticipated to experience the quickest revenue generation growth throughout the projection period. Due to benefits including short hospital stays, speedier healing, lesser cuts, and lower infection rates, these minimally invasive surgeries are advised.

The inguinal hernia has accounted revenue share of over 67% in 2023. Due to factors including patient acceptability because of tension-free techniques and widespread use of these surgical procedures, inguinal hernias dominated the market. The FDA estimates that more than 800,000 inguinal repair procedures are carried out annually in the United States. As a result, there is a significant need for hernia repair equipment due to the frequency of these operative procedures.

In the form of revenue growth throughout the forecast period, the incisional hernia segment is anticipated to experience the fastest CAGR growth. The incision on the abdominal wall or surgical wounds that have not fully healed can result in an incisional hernia. After inguinal surgery, this procedure is the second most often performed procedure.

Segments Covered in the Report

By Product Type

By Surgery Type

By Procedure Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2023

February 2025

February 2025