High-Speed Camera Market Size and Forecast 2025 to 2034

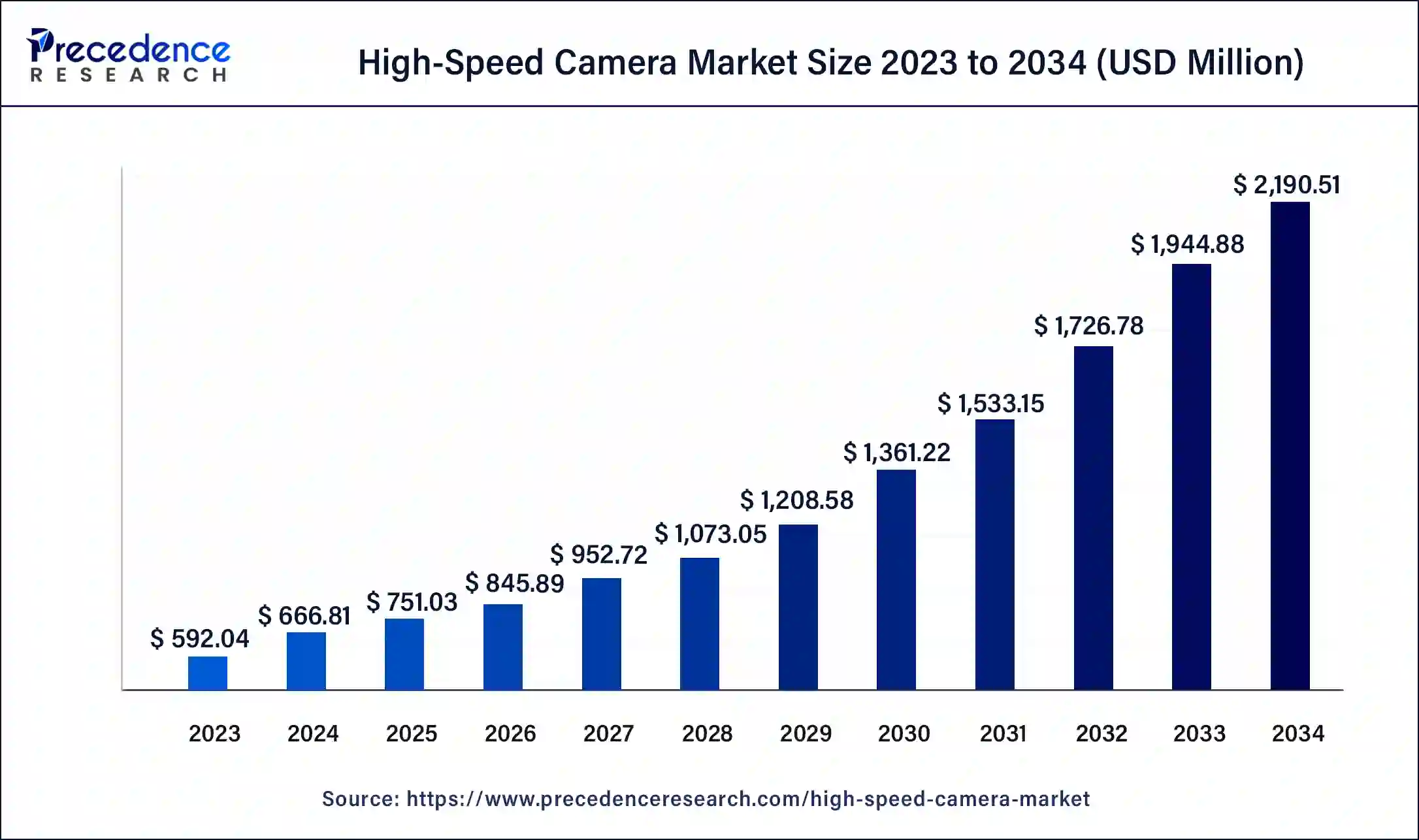

The global high-speed camera market size was estimated at USD 666.81 million in 2024 and is predicted to increase from USD 751.03 million in 2025 to approximately USD 2,190.51 million by 2034, expanding at a CAGR of 12.63% from 2025 to 2034.The market growth is attributed to increasing adoption of advanced imaging technology across diverse industries.

High-Speed Camera Market Key Takeaways

- In terms of revenue, the global high-speed camera market was valued at USD 666.81 million in 2024.

- It is projected to reach USD 2,190.51 million by 2034.

- The market is expected to grow at a CAGR of 12.63% from 2025 to 2034.

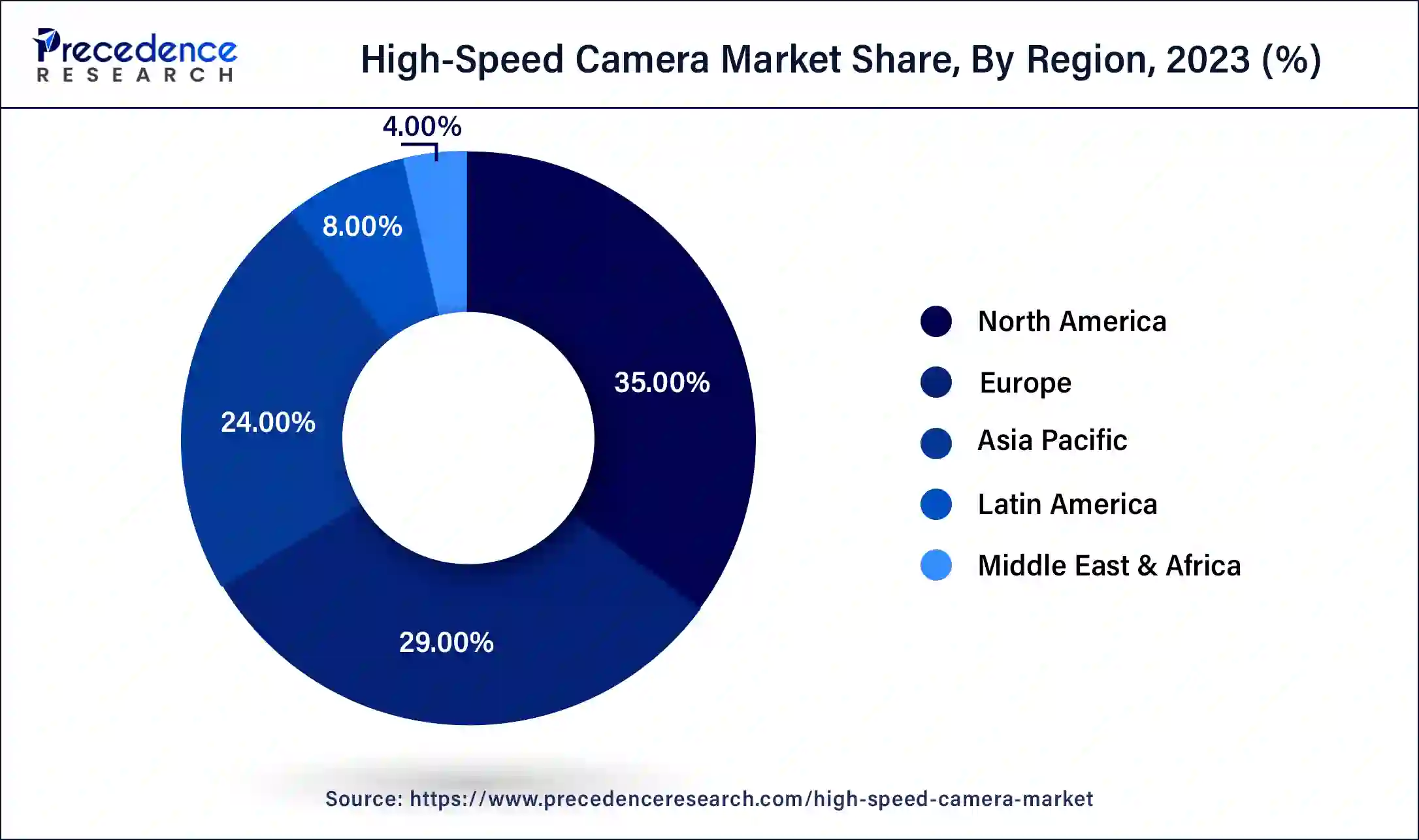

- North America dominated the high-speed camera market with the largest market share of 35% in 2024.

- Asia Pacific is expected to grow with the fastest CAGR in the market during the forecast period.

- By usage, the new high speed camera segment dominated the market in 2024.

- By usage, the used high-speed camera segment is projected to grow rapidly in the market in the coming years.

- By frame rate, the 20,000–100,000 fps segment dominated the market in 2024.

- By frame rate, the >100,000 segment is expected to show the fastest growth in the market over the forecast period.

- By resolution, the 0 -2 MP segment held the largest share of the market in 2024.

- By resolution, the >5 MP segment is projected to grow rapidly in the market in the upcoming years.

- By throughput, the 0 – 2000 MPPS segment dominated the market in 2024.

- By throughput, the >10,000 MPPS segment is expected to show the fastest growth in the market over the forecast period.

- By component, the image sensors segment dominated the market in 2024.

- By component, the image processors segment is expected to show the fastest growth in the market over the forecast period.

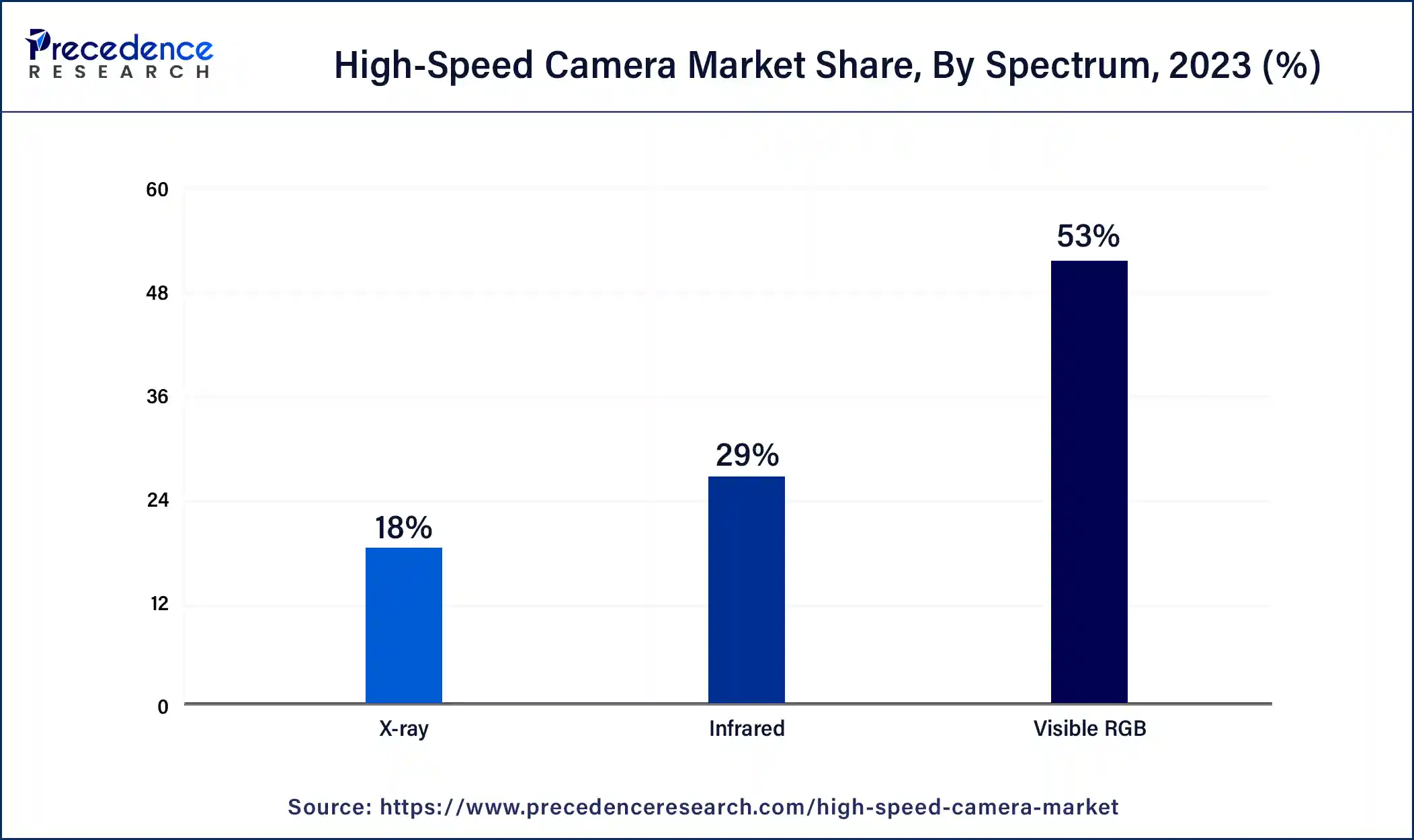

- By spectrum, the visible RGB segment held the largest share of the market in 2024.

- By spectrum, the X-ray segment is expected to show the fastest growth in the market over the forecast period.

- By application, the automotive & transportation segment led the market in 2024.

- By application, the research design & testing laboratories segment is projected to grow rapidly in the market in the coming years.

Artificial Intelligence Impact on the High-Speed Camera Market

The data collected by high-speed cameras is efficiently analyzed, granting users a chance to gain more profound knowledge and make faster decisions with AI. Enhancements in image recognition/processing make it highly desirable for high-speed applications, ranging from automobile testing and biomechanics to industrial inspection quality. Incorporation of AI into these cameras promotes the enhancement of newer and better intelligent systems to satisfy the needs of distinct users and opens new horizons as to the capabilities of high-speed imaging. Additionally, it enhances the pace of the growth of high-speed cameras across industries for better growth and opportunities for the technology, along with presenting AI as a key growth factor.

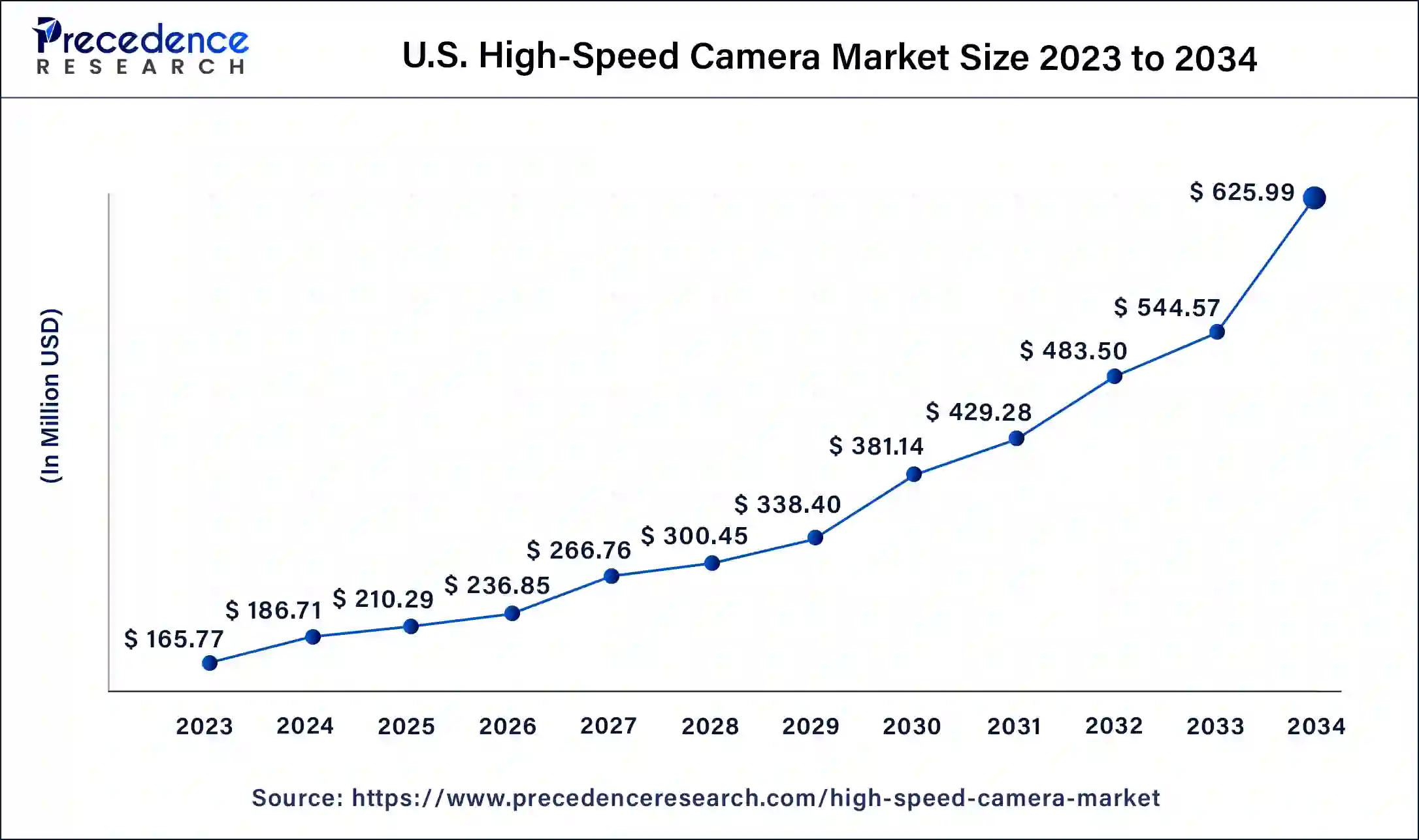

U.S. High-speed Camera Market Size and Growth 2025 to 2034

The U.S. high-speed camera market size was exhibited at USD 186.71 million in 2024 and is projected to be worth around USD 625.99 million by 2034, poised to grow at a CAGR of 12.86% from 2025 to 2034.

North America dominated the high-speed camera market in 2024. High investments in research and development, along with the technologically developed region, contributed to the higher usage of high-speed cameras in different applications. The automotive industry is one of the leading industries that have contributed significantly to this, and manufacturers in the United States have paid much attention to vehicle safety tests and performance assessments. All these factors will further boost the market in the coming years.

- According to a report published by Forbes, a total of 278,870,463 personal and commercial vehicles were registered to drivers in the U.S. in 2022.

Asia Pacific is expected to grow with the fastest CAGR in the high-speed camera market during the forecast period, owing to the rapid industrialization and growing trends towards the usage of the latest technologies in manufacturing industries and automotive industries. Additionally, the increasing concern for quality inspection and the use of automated tools in industries are likely to boost demand for high-speed cameras in the region.

Rapid Industrialization: China's Market on the Rise

China is leading the Asian high-speed camera market, driven by the rapidly expanding manufacturing sector and strong investments in research & development. China is focusing on enhancing its manufacturing excellence, driving demand for high-speed cameras to enable high-quality control and process monitoring. countries technological innovations, expected to boost market expertise in the forecast period.

Market Overview

High-speed cameras are a breakthrough beyond ordinary digital cameras designed for capturing high-quality images and high-speed moving objects in the same perspective. The official equipment of these unique cameras includes incredibly high frame rates. This allows the filming and analyzing of swift movements and occurrences beyond the efficiency of human vision. High-speed cameras have processors to handle a lot of data, sensors for image capture, memory units for data storage, and lens units for image focusing.

High-speed cameras are utilized in various industries including automotive tests, industrial manufacturing, and science which created their high demand. Furthermore, the existing technology is improving these cameras in terms of their performance and cost-effectiveness, and due to this the usage of these cameras is expanding and people going for these cameras than for the traditional imaging systems. Increasing awareness in terms of innovation and accuracy across multiple segments also contributes to the high-speed camera market's growth.

High-Speed Camera Market Growth Factors

- The demand for high-speed cameras is increasing in various sectors, including automotive testing, industrial manufacturing, scientific research, and healthcare. Their ability to provide precise and detailed images supports applications such as crash testing, quality control, and medical diagnostics.

- The automotive and transportation industry has dominated the market in recent years due to its need for high-speed imaging in safety testing and performance evaluations.

- Innovations in camera technology, such as improved sensors, enhanced image processing, and advanced cooling systems, are expected to drive market growth. These advancements improve performance and broaden the applications of high-speed cameras.

- The increasing focus on automation, precision, and innovation across various sectors is anticipated to further drive the adoption of high-speed cameras.

- Ongoing advancements are expected to make these cameras more accessible and effective, supporting their expanding role in both traditional and emerging applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2,190.51 Million |

| Market Size in 2025 | USD 751.03 Million |

| Market Size in 2024 | USD 666.81 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.63% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Usage, Frame Rate, Resolution, Throughput, Component, Spectrum, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for precision and accuracy in industrial applications

High adoption of precision and accuracy in various industrial processes is likely to boost the demand for high-speed cameras. Applications, including manufacturing and automotive testing, employ high-speed cameras to capture very detailed information about rapidly moving objects. Their deformation serves such purposes as testing components, analyzing impact resistance, or establishing the efficacy of machines. Besides their application in quality assurance, these cameras are vital for analyzing the best practices for enhancing productivity and flaw detection in real time.

High-speed imaging reveals defects in materials or products that are hardly noticeable at standard speeds. Additionally, as industries move towards automation and robotics, the demand for advanced and innovative high-speed cameras is critical in monitoring automated fast industrial processes. All these factors will contribute to boosting the market in the coming years.

- In July 2023, Adimec Advanced Image Systems, a leading supplier of high-end cameras for machine vision, announced the launch of its new machine vision camera at Vision China 2023. Adimec introduced the high-speed Quartz Q-25A150 camera, specifically designed for semiconductor inspection and metrology systems. Additionally, the company showcased other advanced cameras, including the high-resolution Sapphire S-49A70, the high-speed Quartz Q-21A230, and the Diamond D-103A12-T01, aimed at enhancing display inspection processes.

Restraint

High costs

The high cost of utilizing this advanced high-speed camera is expected to hamper the market in the coming years. Such cameras, with the sophistication derived from their imaging sensors, frame rates, and or sophisticated software, are expensive to acquire, which restricts their wider adoption. Additionally, the maintenance and calibration costs of these complex instruments will make them expensive, which will contribute to boosting the market in the coming years.

Opportunity

High adoption in autonomous vehicle development

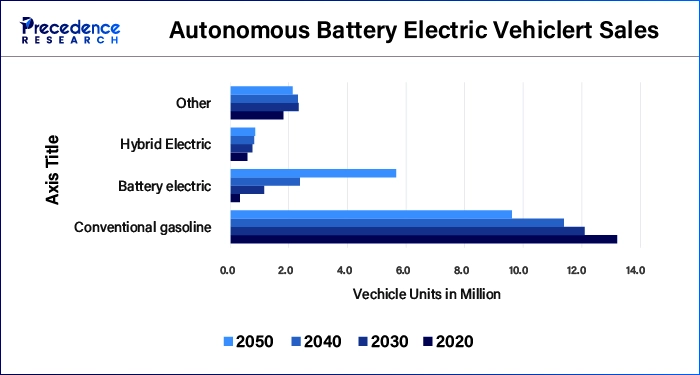

The rising adoption rate in the development of autonomous vehicles is anticipated to create immense opportunities for the players competing in the market. Self-driving cars require accurate and real-time data collection to learn about and interact with road traffic conditions. Advanced video technologies across high-speed cameras have fast-forwarded the tool accuracy of sensors and reinforced the test of algorithms for real-time decisions. These cameras facilitate the verification and optimization of self-driving car technologies, thus facilitating the market for further developments in self-driving car investigation and implementation.

The employment of high-speed cameras within vehicle simulacra and testing situations benefits the evaluation of AVs' performance under unfavorable contexts like diverse weather conditions and dynamic traffic patterns. Furthermore, the growing demand for automation vehicles, including Level 4 and Level 5, boosts the need for high-speed imaging technology, thus fuelling the market.

Usages Insights

The new high speed camera segment dominated the high-speed camera market in 2024. Specific industries, including automotive, aerospace, and the defense segment, have invested a lot in acquiring new high-speed cameras to upgrade their testing, analyzing, and quality-controlling processes. The fact that the technologies in high-speed imaging are progressing at a high pace, including the technologies used in the cameras, has also contributed to the preference for new cameras. Moreover, high-speed cameras are preferred in industries that value speed in operations while maintaining precision, which further boosts the market.

The used high speed camera segment is projected to grow rapidly in the high-speed camera market in the coming years, as it is relatively cheaper than new cameras. The circulation of quality used equipment in the market due to upgrading to new models is the case with most businesses. Furthermore, the larger number of consumers shifting towards using high-speed cameras further boosts the market.

Frame Rate Insights

The 20,000–100,000 fps segment dominated the high-speed camera market in 2024, as it is widely used in situations as a universal and versatile type of media. This range is good for medium image resolution and quick shooting, and it is ideal for high-speed occurrences in car manufacturing, production lines, or laboratory tests. Cameras in this frame rate segment are used in industries to examine processes, such as material deformation, crash tests, and even the flow of fluids. The durability and efficiency of such cameras make them necessary in industries that need speedy streaming. Additionally, higher image quality and clarity at these frame rates further boost their demand.

The >100,000 segment is expected to show the fastest growth in the high-speed camera market over the forecast period. Consumers require extremely high frame-rate imaging for specific applications. These are being utilized in fields related to the aerospace and defense industry and in some highly sophisticated scientific research where it is necessary to record very rapid processes. Cameras with frame rates over 100,000 fps are necessary for such processes as explosion, ballistics, and high-frequency vibrations when, at lower frequencies, it is impossible to focus on the necessary detail. Furthermore, the ongoing improvements in the technology front that make small and affordable cameras in that range are expected to widen their reach, thus boosting the segment.

Resolution Insights

The 0 -2 MP segment held the largest share of the high-speed camera market in 2024. High-speed cameras of such resolutions are used mostly in manufacturing and testing facilities, automotive safety testing, and research, where rapid event capture is more important than ultimate detail. Since these cameras have lower resolution, they give a higher frame rate and are suitable for applications that demand real-time analysis of dynamics. They also help to save money and provide a possibility to generate reasonable amounts of data that are still informative and contain the most necessary visual details. Furthermore, these cameras are very efficient in situations where lighting or available space is low, which further fuels their demand.

The >5 MP segment is projected to grow rapidly in the high-speed camera market in the upcoming years owing to their increasing use in high-definition imaging applications. They are used in aerospace, defense, and scientific research applications where it is becoming necessary to capture high-detail pictures of rapidly moving targets. Cameras in this category offer higher resolution, which is critical in regard to the imaging of particles and flows, biophysical processes, and other phenomena. Additionally, the improved results of sensors and better handling of data increase the use of high-quality cameras across industries, which further boosts the segment in the coming years.

Throughput Insights

The 0– 2000 MPPS segment dominated the high-speed camera market in 2024 due to its ability to perform in a number of applications while offering sufficient performance. Cameras of this throughput category are relatively well-balanced between picture achievement and data processing and are well-suited for car crash testing, industrial surveys, and preliminary analysis in science.

The cost of these cameras is also considerably lower compared to the higher throughput ones, which has made it possible to incorporate them in different industrial applications where very high throughput is not a precondition. Additionally, they process moderate amounts of data in parallel with other analytical tasks with no overload in data storage and processing. All these factors further propel the market in the coming years.

The >10,000 MPPS segment is expected to show the fastest growth in the high-speed camera market over the forecast period due to the growing number of fields that require ultra-high-speed imaging and data capture. This type of camera is expected to grow in highly technical sectors, such as space business, security, and elevated academic studies. It is essential to collect and analyze very large amounts of data in short periods.

Cameras with throughputs over 10,000 MPPS deliver the capacity to capture and handle large amounts of data and are crucial for describing very fast processes, such as particle collision or high-performance ballistic tests. Furthermore, the increasing development of new applications where high-definition and high-speed image and data capturing are essential is anticipated to boost the segment in the coming years.

Component Insights

The image sensors segment dominated the high-speed camera market in 2024 due to the fact that it is solely responsible for acquiring high-quality and real-time images. Optical image sensors, including the CMOS and CCD, are significant because they are responsible for converting light into electrical signals that dictate the quality reception of the captured shots. Furthermore, the constant development of new and more efficient sensors will strengthen the image sensor segment growth in the market in the coming years.

The image processors segment is expected to show the fastest growth in the high-speed camera market over the forecast period owing to their increasing demand. Timing processors are very relevant if one has arrays of high-speed cameras, where data has to be analyzed and, compressed and enhanced within the shortest time possible. Administratively, high-definition video recording and motion details are some of the applications that require complex image processing. Moreover, the upsurge in processing speeds and enhanced algorithms fuels the advancements of high-speed cameras and their uses.

Spectrum Insights

The visible RGB segment held the largest share of the high-speed camera market in 2024 due to its broad uses in a number of industries. Vizable RGB cameras are required for high-speed event detection and subsequent real-time analysis where visible light is paramount. They have the ability to capture in motion and at high speeds, thus being used in quality assurance checking, materials testing, and research.

The X-ray segment is expected to show the fastest growth in the high-speed camera market over the forecast period owing to the increasing emphasis on their uses in the fields of medicine and industry. X-ray cameras allow one to observe the company and structure of a material, which makes them ideal for usage in sectors such as medical devices. Growing projections of global healthcare investment and the progress observed in the X-ray imagery systems further fuel segment growth.

Application Insights

The automotive & transportation segment led the market in 2024, as they are used in crash testing, assessing vehicle safety, and evaluating performance. The fast-motion cameras are particularly useful for recording slow-motion clips of high-energy occurrences, including car crashes or airbag tests, to conform to the standards. Furthermore, a growing number of self-driving cards are expected to propel the market in the coming years.

The research design & testing laboratories segment is projected to grow rapidly in the market in the coming years owing to the increased complexity of such activities as scientific experiments and the necessity to analyze rapid processes. A high-speed camera is a tool that is necessary for shooting fast-moving processes in different areas of science and technology, such as physics, material science, and biology. Moreover, the increasing trend in the idea of high accuracy and technological advancement in experimental research is expected to create a high demand for high-speed cameras.

Some Major High-Speed Camera Innovations at the NAB 2025, Las Vegas (April 5-9, 2025)

| Sony Electronics | BRC-AM7 4K PTZ (pan-tilt-zoom) camera with AI-enabled Auto Framing and Tracking |

| Panasonic | Lumix S1RII features a 44.3MP BSI CMOS sensor and supports 8K 30p and 4K 60p (Full) recording, along with a high-performance engine with L2 Technology. |

| Blackmagic Design | The PYXIS 12K, a new digital film camera, features a 12K RGBW sensor, the same as the URSA Cine 12K LF, in the compact PYXIS body. |

| DJI | The Osmo Mobile 7 Series, featuring the Osmo Mobile 7P and Osmo Mobile 7, is designed to improve smartphone photography with 3-axis stabilization and intelligent subject tracking |

| Sony | The VENICE Extension System Mini, a new accessory designed to be used with the VENICE allows the camera's sensor to be separated and extended from the body via a thin, detachable cable. |

High-Speed Camera Markets Top 10 Companies

- AOS Technologies AG

- Del Imaging Systems

- Fastec Imaging Corporation

- Mikrotron GMBH

- NAC Image Technology

- Olympus Corporation

- Optronics GmbH

- Photron Limited

- Vision Research, Inc

- Weisscam GmbH

Recent Development

- In February 2025, Shimadzu Corporation announced the launch of the HyperVision HPV-X3 high-speed video camera, designed to be used in materials science and aerospace development to visualize and understand physical phenomena associated with material deformation, material failure, shock waves, plasma, and electrical discharges.

- In January 2025, researchers at Thethe Korea Advanced Institute of Science and Technology (KAIST) developed a bio-inspired camera that mimics insect eyes, achieving ultra-high-speed imaging with high sensitivity.

- In October 2024, the Minister for Justice, Helen McEntee TD, invested €9 million in funding for up to 100 new speed cameras as part of Budget 2025 to enhance road safety

- In March 2024, Vision Research released its Phantom Miro C321 Air high-speed camera, designed specifically for airborne testing applications. This 2-megapixel camera builds on the rugged and field-proven design of the Phantom Miro C321, originally developed for vehicle crash testing. The Miro C321 Air camera meets the demanding requirements of both manned and unmanned airborne testing, offering high frame rates and advanced imaging capabilities.

Segments Covered in the Report

By Usage

- Used High-speed Camera

- Rental High-speed Camera

- New High-speed Camera

By Frame Rate

- 1000-5,000 FPS

- >5,000-20,000 FPS

- >20,000-100,000 FPS

- >100,000 FPS

By Resolution

- 0-2 MP

- >2-5 MP

- >5 MP

By Throughput

- 0-2,00 MPPS

- >2,000-5,000 MPPS

- >5,000-10,000 MPPS

- >10,000 MPPS

By Component

- Lens

- Image Sensors

- Batteries

- Fans & Cooling Systems

- Image Processors

- Memory Systems

- Others

By Spectrum

- Infrared

- Visible RGB

- X-ray

By Application

- Automotive & Transportation Industry

- Industrial Manufacturing Plants

- Food & Beverages Industry

- Consumer Electronics Industry

- Entertainment & Media Industry

- Sports Industry

- Paper & Printing Industry

- Aerospace & Defense

- Research Design & Testing Laboratories

- Healthcare Industry

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa