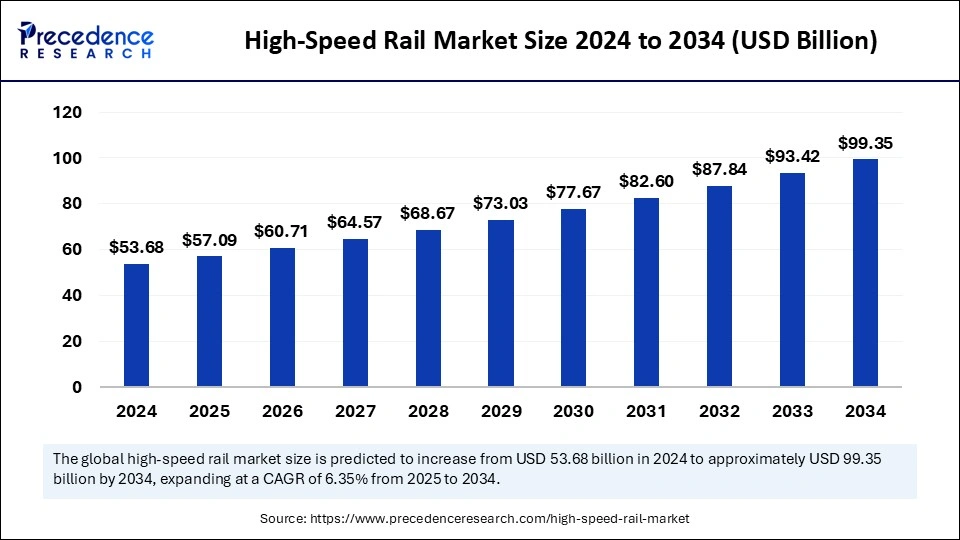

The global high speed rail market size is calculated at USD 57.09 billion in 2025 and is forecasted to reach around USD 99.35 billion by 2034, accelerating at a CAGR of 6.35% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global high speed rail market size was estimated at USD 53.68 billion in 2024 and is predicted to increase from USD 57.09 billion in 2025 to approximately USD 99.35 billion by 2034, expanding at a CAGR of 6.35% from 2025 to 2034. The market is driven by rising urbanization, government investments, and increasing travel demand.

The implementation of smart technology in the high-speed rail market includes the Internet of Things (IoT) and artificial intelligence combined with predictive maintenance systems. Smart technology implementations in rail service operations create diverse operational and safety benefits that lead to increased customer satisfaction. High-speed rail systems benefit from using AI algorithms to process extensive rail data, which results in better optimization of operations and predictive maintenance, enhances safety protocols, and provides superior passenger experiences while optimizing resource utilization.

The high-speed rail market denotes the industry involved in developing and operating high-speed rail services that utilize bullet trains. High-speed railway trains of optimized design enable people to reach cities faster than regular rails, thus reducing total travel duration. Operation of a high-speed rail delivers greater speed and swiftness than trains yet maintains higher velocity outputs. Overall market expansion for high-speed rail results from increased railway development funding and passenger demand for secure and efficient transportation services and increased public transport usage to reduce traffic congestion.

The rising need for efficient, sustainable transportation drives this market following urbanization, environmental concerns, and escalating congestion in road and air traffic. High-speed train applications move passengers between large distances, rapidly serve densely populated areas, and act as essential connectors between cities. The integration of technology, government funding of infrastructure development, and expanding focus on environmentally friendly transport systems leads to technological growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 99.35 Billion |

| Market Size in 2025 | USD 57.09 Billion |

| Market Size in 2024 | USD 53.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.35% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Speed, Propulsion, Component, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing urbanization and rising population

The worldwide expansion of cities and increasing population number creates greater requirements for quick and effective linkages between major urban centers. The high-speed rail market benefits from demographic patterns because passengers choose high-speed rail as a quick, sustainable mode that opposes traditional aircraft and roadway travel. The built infrastructure directly relates to urban expansion because it creates enhanced municipal connectivity that leads to regional development and economic growth. Using trains effectively cuts congestion and improves metropolitan area accessibility, thus becoming vital elements in the process of urban development and planning.

High infrastructure and initial investment costs

The construction of high-speed rail networks requires major financial investment, which acts as an obstacle. Massive cost presents itself as a significant problem during high-speed rail line development. The train network, railway stations, bridges, and tunnels require substantial financial funding for their implementation. The high financial needs tend to prevent numerous countries from investing in the high-speed rail market. New high-speed rail developments face restrictions in their feasibility and expansion because of financial requirements that act as a major growth slowdown factor for this market.

Environmental concerns and sustainability initiatives

The high-speed rail market experiences expanding sustainability trends and decreasing carbon emission initiatives because of accelerating global worries about environmental deterioration and climate change. The worldwide initiative against climate change has pushed people to concentrate on developing eco-friendly transport systems. Energy-efficient bullet trains act as important components that help advance market transformation. They reduce carbon emission levels drastically beyond planes and automobiles, thus fulfilling international objectives to decrease greenhouse gas production.

The electric power source of high-speed trains allows operators to choose renewable energy options, leading to lower carbon emissions. High-speed rail helps organizations fulfill environmental regulations while attracting eco-sensitive consumers, which stimulates both investment in high-speed rail and its development. Countries are dedicating their resources to the sustainable transportation industry. For instance, to reach carbon neutrality by 2050, the European Union designs the Green Deal and Sustainable and Smart Mobility Strategy to focus on high-speed rail trains as essential components.

The 200-299 km/h segment contributed the largest share of the high-speed rail market in 2024. High-speed rail operates at speeds between 200–299 km/h, which makes such trains drastically faster than typical passenger trains. The operational speed range belongs to the lower sector of high-speed rail systems while delivering dependable transportation. The specially designed tracks provide these trains with the capability to guarantee both speed and efficiency for their city-to-city operations. High-speed rail investments by numerous countries provide benefits such as better transportation links, economic expansion, and highway congestion control.

The 300-399 km/h segment is expected to show considerable growth over the forecast period. High-speed railway lines operate above 300 km/h throughout their tracks. The 300–399 km/h speed range serves as one of the categories used for defining high-speed rail systems. The combination of fast travel options, cost-efficiency, and energy-saving capabilities makes it appealing. The operational speed range enables rail transport to provide swift transit times and reduced travel durations relative to standard rail services. In this speed range, trains deliver quick services with shortened trip times that outperform regular rail but prevent the escalating expenses linked to operational and maintenance costs.

The electric segment accounted for the largest share of the high-speed rail market in 2024. High-speed trains primarily use electric power because of their peak efficiency and reliability features and minimal environmental footprint compared to diesel and dual-power systems. The operation of bullet trains depends on electric high-speed trains, which provide constant speed performance necessary for effective train operation. Electric propulsion emerges as the essential technology for new high-speed rail schemes because global sustainability regulations continue to tighten alongside increased sustainability demands on the market. Electric propulsion provides the best option in terms of operational efficiency, cost-effectiveness, and reduced environmental impact relative to diesel. Electric trains access quicker acceleration along with better service reliability because of existing train electrification systems.

The dual power segment is anticipated to witness significant growth in the studied period. The structure of railway transport, HSR, employs high-speed trains with designated tracks to transport travelers at efficient velocities. HSR implements two power sources, electric power, and diesel fuel, to operate its systems, and trains function through combined units or standalone units. Propulsion systems that combine diesel and electricity gain popularity among high-speed rail infrastructure developments in most scenarios. Dual-power systems enable dual electric and diesel operation for routes combining electrified and non-electrified sections to support due to their multiple power sources.

The wheelset segment contributed the largest high-speed rail market share in 2024. High-speed train wheelsets serve as coupled wheels attached to an axle, which distributes train weight while serving as a guide along railroad tracks. The stable and smooth operation of trains at high speeds depends on wheelsets because they convert electrical energy into mechanical energy that drives train wheels. The wheelset achieves its mobility because of the wheel flange. The wheelset enables high-speed trains to receive tractive force by establishing gripping contact between the wheels.

The transformer segment is expected to show considerable growth in the market over the forecast period. HSR transformers transform electric power to operate the traction system that drives high-speed trains. Bullet train/high-speed train transformers function as either traction power supply units or substation distribution systems. The supply of power to traction systems requires transformers to work at elevated temperature levels. Transformers inside traction systems serve the essential function of moving electrical energy through channels of low-voltage power until it reaches the motor. A traction drive system in high-speed trains uses its traction transformer as major equipment to perform energy conversion tasks.

North America accounted for the largest share of the high-speed rail market in 2024. The North American market demonstrates potential because it combines initiatives to reduce carbon emissions with efforts to enhance communication networks. The North American high-speed rail sector is experiencing increasing popularity because of projects such as the Texas Central Railway and the California High-Speed Rail Project. The combination of growing traffic jams in cities and the requirement for quick and effective intercity traveling has stimulated the market demand.

Asia Pacific is expected to grow at the fastest rate in the high-speed rail market over the projected period, thanks to substantial investments in rail infrastructure and a strong governmental emphasis on modern transportation options. China and Japan are at the forefront of high-speed rail technology, with China boasting the largest network in the world. This dominance stems from a long-standing commitment to expanding rail systems, which cater to population growth and urban development. High-speed trains in the Asia Pacific effectively connect major economic centers, facilitating regional development and promoting integration among diverse areas. The market continues to expand as the region focuses on sustainable public transportation initiatives aimed at reducing urban congestion and air pollution.

By Speed

By Propulsion

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client