January 2025

The global hip replacement implants market size is evaluated at USD 5.07 billion in 2025 and is forecasted to hit around USD 6.13 billion by 2034, growing at a CAGR of 2.14% from 2025 to 2034. The North America market size was accounted at USD 2.33 billion in 2024 and is expanding at a CAGR of 2.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hip replacement implants market size accounted for USD 4.96 billion in 2024 and is predicted to increase from USD 5.07 billion in 2025 to approximately USD 6.13 billion by 2034, expanding at a CAGR of 2.14% from 2025 to 2034. The increasing need for hip replacement surgeries due to traumatic injuries and the growing geriatric population is boosting the growth of the hip replacement implant market.

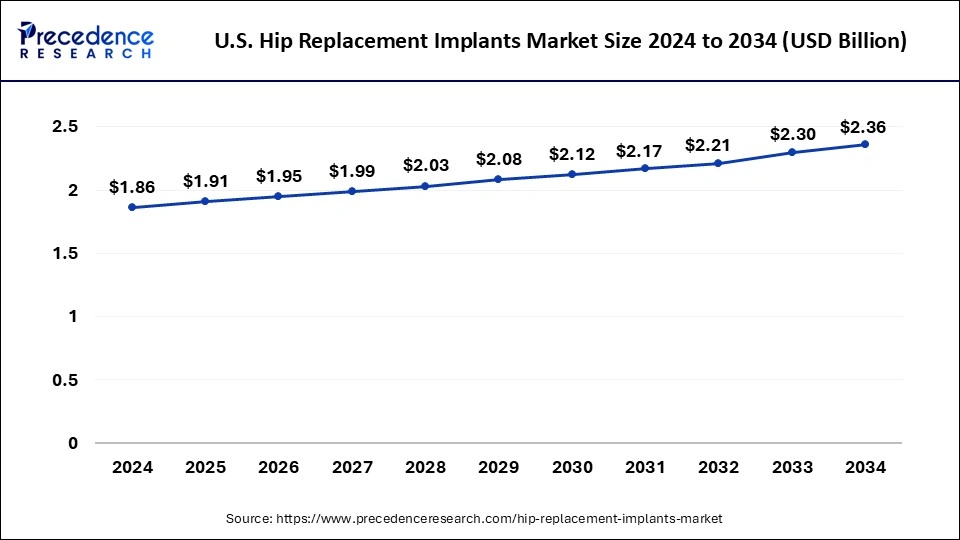

The U.S. hip replacement implants market size was exhibited at USD 1.86 billion in 2024 and is projected to be worth around USD 2.36 billion by 2034, growing at a CAGR of 2.41% from 2025 to 2034.

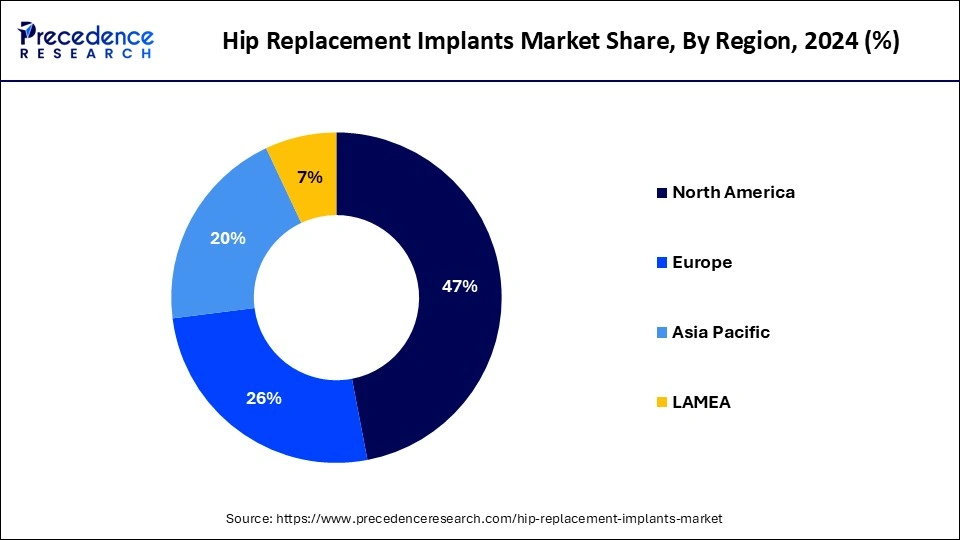

North America dominated the hip replacement implants market in 2024. North America is home to cutting-edge medical facilities and technology, as well as a sophisticated healthcare infrastructure. This infrastructure helps maintain market dominance by facilitating superior surgical treatments, such as hip replacements. North America is home to the corporate offices of several top players in the hip replacement implant industry, including Zimmer Biomet, Stryker, and Johnson & Johnson.

The hip replacement implants market expansion is aided by their robust presence and wide-ranging distribution networks. Due to the high level of healthcare spending in the area, substantial investments in cutting-edge medical procedures and technology are possible. This hefty cost justifies the increasing use of hip replacement procedures. Hip replacement surgeries are made more accessible to patients by favorable insurance and payment regulations. More people are choosing hip replacements as a result of comprehensive coverage provided by both public and commercial insurers.

Asia Pacific is expected to grow at the highest CAGR in the hip replacement implants market during the forecast period. The population of the region is aging quickly, resulting in a considerable shift in demographics. Hip replacement procedures are becoming more and more popular as people age since hip-related disorders like osteoarthritis are more common in older people.

The spending on healthcare and expenditures in healthcare infrastructure are rising in several Asia Pacific nations. This higher spending encourages the use of cutting-edge medical procedures, such as hip replacement implants. Modern surgical methods and medical technology are being actively embraced by the area. The hip replacement implants market is growing as a result of ongoing advancements in hip replacement implants, such as better materials and less intrusive techniques.

The hip replacement implants market refers to orthopedic surgeons who utilize hip replacement implants as medical devices to replace a worn-out or damaged hip joint with an artificial one. The purpose of these implants is to enhance hip joint function overall, reduce discomfort, and restore mobility. The design, materials, fixation techniques, and customization choices of hip replacement implants vary, enabling orthopedic surgeons to choose the best implant for a patient's health, way of life, and surgical needs.

The hip replacement implants market is fragmented with multiple small-scale and large-scale players, such as Braun Melsungen AG, DJO Global, Inc., Stryker Corp., OMNIlife Science, Inc., Smith & Nephew Plc, Exactech, Inc., MicroPort Scientific Corp., Aesculap Implant Systems, LLC, Zimmer Biomet, Johnson & Johnson, ConMed Corp.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.13 Billion |

| Market Size in 2025 | USD 5.07 Billion |

| Market Size in 2024 | USD 4.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.14% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of hip disorder

The rising prevalence of hip disorders may grow the hip replacement implant market. Hip replacement surgery is becoming more and more necessary for patients as more individuals develop hip diseases. Hip replacement implant demand rises as a direct result of this. Osteoarthritis is one of the more prevalent hip problems in older persons.

The frequency of hip problems is increasing due to global population aging, which is driving up demand for hip replacement procedures and implants. Hip replacement procedures are now more successful and widely available because of advancements in implant technology and surgical methods. The hip replacement implant market will continue to increase as a result of these developments, which can serve a wider variety of patients, including those with severe hip disorders.

Potential risk of nerve injury

The potential risk of nerve injury may slow down the hip replacement implant market. The hip replacement implants market may face major obstacles from the possibility of nerve damage as it may influence patient choices, raise expenses and legal barriers, and draw attention away from hip replacements in favor of other options.

Advancement in hip replacement implants

The advancement in hip replacement implants can be the opportunity to grow the hip replacement implants market. Enhancing the quality and longevity of implants can achieved through technological advancements. For younger patients and those who lead active lifestyles, this lessens the need for revision procedures, increasing the appeal of hip replacement. Technological advances in surgery, such as robotic-assisted surgery and minimally invasive surgery, can lower recovery times, minimize problems, and increase implant placement precision.

The total hip segment dominated the hip replacement implants market in 2023. The typical surgical treatment for treating fractures, degenerative hip problems, and severe hip arthritis is total hip replacement. Total hip replacements are becoming more and more popular because of the prevalence of these problems, particularly in older populations. Complete hip replacement operations are thought to be quite successful in reducing pain and restoring function, and they have a long history of success. Patients and surgeons are more likely to embrace these procedures because of their well-established results.

All hip implants now function better and last longer thanks to developments in implant materials and design. The improved prosthetic materials (such as highly cross-linked polyethylene, ceramic, and titanium), less invasive surgical techniques, and improved fixation techniques are some of the innovations that lead to better patient outcomes and longer implant lifespans.

The hip resurfacing segment is expected to grow at the highest CAGR in the hip replacement implants market during the forecast period. Because hip resurfacing maintains more of the patient's original bone than complete hip replacement, it is frequently chosen by younger, more active patients. For those who want to continue being physically active after surgery, this makes it a good choice. Rather than removing the femoral head completely, the technique consists of capping it with a smooth metal covering.

This bone-conserving strategy preserves more bone for potential future procedures, which is advantageous for individuals who may eventually require a total hip replacement. Compared to total hip replacement, hip resurfacing often carries a decreased risk of dislocation, making it a safer alternative for patients who lead active lives. The greater stability is achieved with hip resurfacing because of the bigger femoral head size.

The metal-on-polyethylene segment dominated the hip replacement implants market in 2023. The hip implants made of metal on polyethylene (MoP) have been around for many years and have a solid track record of performance. Surgeons and patients alike have faith in their dependability and effectiveness due to their extensive history of clinical usage. In general, MoP implants are less expensive than those made of ceramic or metal-on-metal. These implants are more accessible to a wider spectrum of patients due to their cost, which also lessens the financial strain on healthcare systems. The highly cross-linked polyethylene (HXLPE), a polyethylene technological advancement, has greatly increased the wear resistance and durability of metal-on-polyethylene implants. These improvements lengthen the implant's lifespan by lowering the likelihood of osteolysis and implant wear.

The ceramic-on-polyethylene segment is expected to grow at the highest CAGR in the hip replacement implants market during the forecast period. The ceramic materials are renowned for their outstanding wear resistance and biocompatibility. In comparison to conventional metal-on-polyethylene implants, the resultant implants offer improved resilience and endurance when paired with advanced polyethylene, such as highly cross-linked polyethylene.

Compared to metal-on-polyethylene implants, ceramic-on-polyethylene implants generate fewer wear particles, which lowers the possibility of osteolysis and implant loosening. Because of this feature, they are a good choice for younger, more active patients who need implants that will last. Since ceramic materials don't discharge metal ions, the possibility of metallosis and other unfavorable reactions from metal-on-metal implants is reduced. This increases the safety of ceramic-on-polyethylene implants for those with allergies or metal sensitivity.

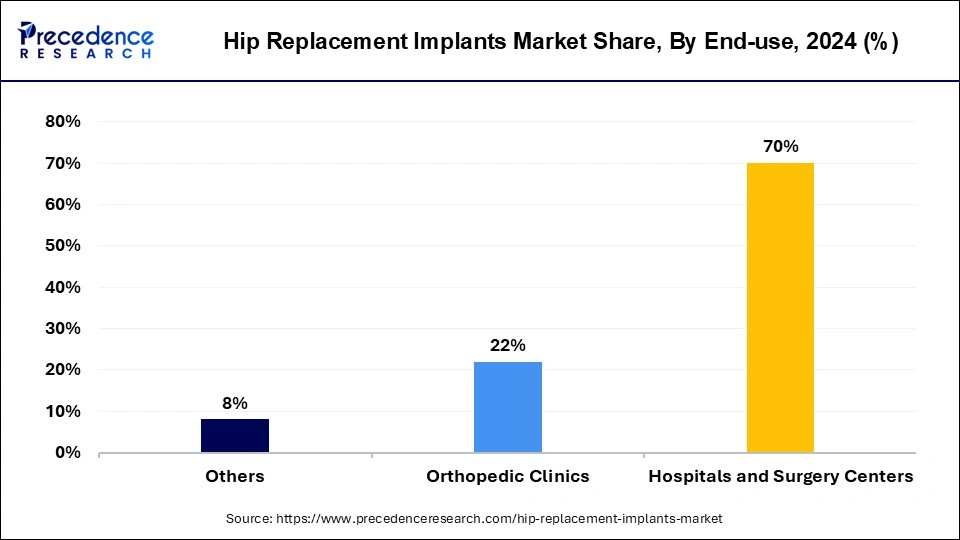

The hospitals & surgery centers segment dominated the hip replacement implants market in 2023. Comprehensive care facilities, such as preoperative assessment, surgery, aftercare, and rehabilitation, are provided by hospitals and surgical centers. They are the go-to option for hip replacement surgeries since they offer a whole range of services.

Hip replacement procedures are performed with optimal quality and efficiency, and they are advanced to the latest medical technology and specialist surgical equipment found in hospitals and surgery centers. The modern technology makes surgery safer and improves surgical results. Hip replacement surgery is a common practice among expert orthopedic doctors working at these institutions. Furthermore, thorough patient care is ensured by the participation of multidisciplinary teams that include nurses, physical therapists, and anesthesiologists.

The orthopedic clinics segment is expected to grow at the highest CAGR in the hip replacement implants market during the forecast period. The hip replacements are among the most common joint replacement procedures that orthopedic clinics specialize in. They are able to provide extremely focused and knowledgeable care because of their specialty, which draws patients looking for specialist care. The orthopedic clinics frequently provide a more individualized and patient-focused method of therapy.

Compared to bigger hospitals, patients may prefer the individualized attention and continuity of treatment that smaller specialty clinics may provide. With lower wait times and simpler appointment scheduling for consultations and treatments, many orthopedic clinics provide increased accessibility and convenience. The patients seeking immediate care will find this accessibility very enticing. Because orthopedic clinics have lesser overhead than hospitals, they can occasionally provide more affordable options. They are a desirable alternative for patients and insurance companies due to their cost advantage.

By Product Type

By Material

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

July 2024