January 2025

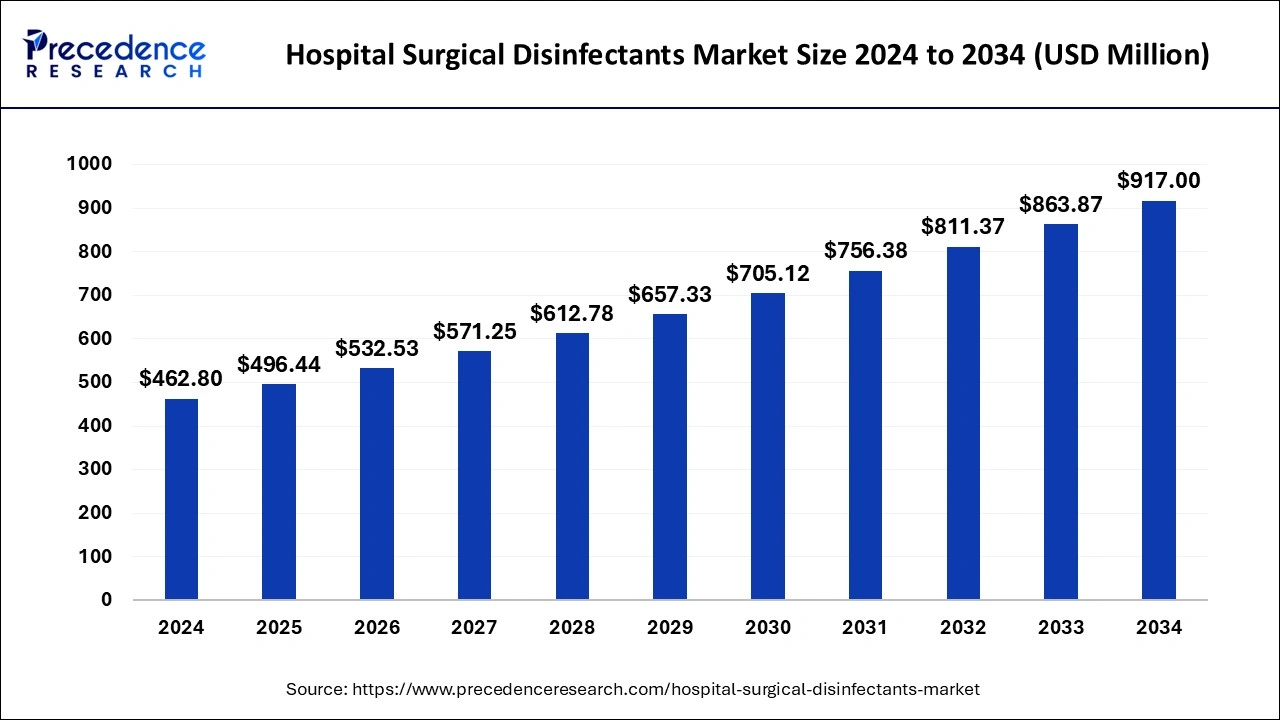

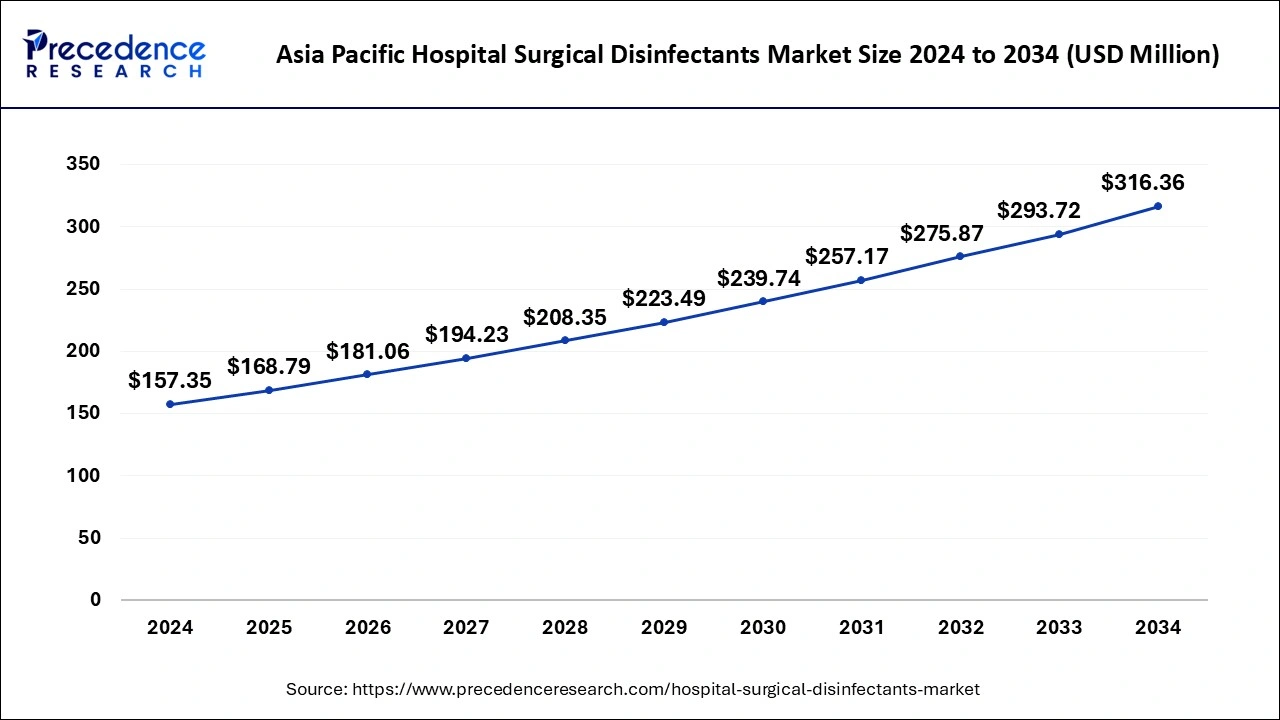

The global hospital surgical disinfectants market size is estimated at USD 496.44 million in 2025 and is predicted to reach around USD 917.00 million by 2034, accelerating at a CAGR of 7.07% from 2025 to 2034. The Asia Pacific hospital surgical disinfectants market size surpassed USD 168.79 million in 2025 and is expanding at a CAGR of 7.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hospital surgical disinfectants market size was estimated for USD 462.80 million in 2024 and is anticipated to reach around USD 917.00 million by 2034, growing at a CAGR of 7.07% from 2025 to 2034. The increasing number of infectious diseases caused by healthcare mismanagement and spread of infections in the hospital premises are driving the growth of the market.

The integration of AI and robotics in the disinfectant operations in the healthcare settings that revolutionalize the identification and combating the infections process. With the use of AI algorithms and advance technologies, it can be detects the potential outbreak of infections in real-time. While robotics can be deployed in hospital settings which can automate the disinfection process in different areas of hospitals. The advancements in the disinfection technology such as UV rays are helps in reducing the harmful pathogens or any disease causing infections.

The Asia Pacific hospital surgical disinfectants market size was estimated at USD 157.35 million in 2024 and is anticipated to be surpass around USD 316.36 million by 2034, rising at a CAGR of 7.23% from 2025 to 2034.

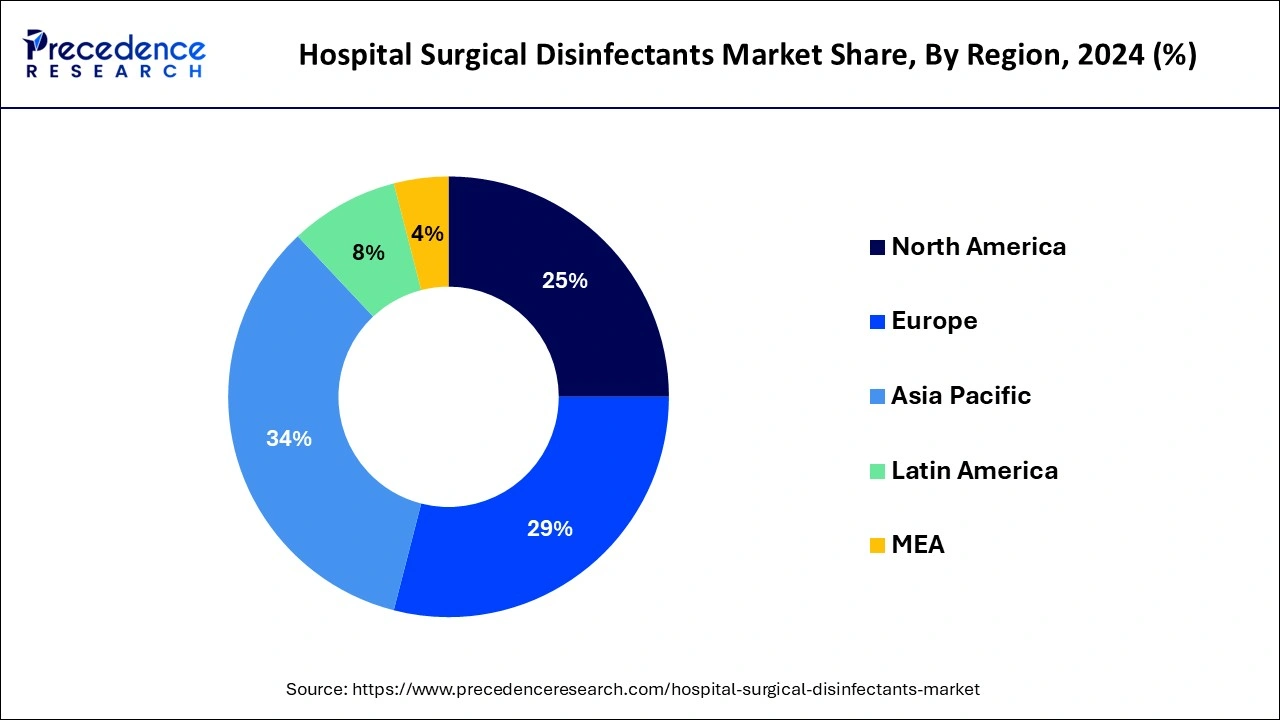

Asia Pacific dominated the hospital surgical disinfectants market with the largest market share of 34% in 2024. This is related to factors like the high prevalence of hospital-acquired infections and improvements in healthcare infrastructure that promote the use of hospital surgical disinfectants. Additionally, it is anticipated that market expansion will be fueled by regulatory requirements to provide safe and high-quality healthcare services during the forecast period. For instance, the Chinese regulatory body, the National Medical Products Administration (NMPA), declared that it would expedite the registration of medical disinfectants that adhere to the EU, Japanese, and US requirements. Therefore, these factors are anticipated throughout the projected period to fuel market expansion.

The region's rising incidence of illnesses and procedures could further fuel market expansion. The highest rate of operations and surgeries in the area is another factor driving the industry. Asian nations, including India, China, and Thailand, are seeing increased medical tourism. For instance, the AIIMS New Delhi in India broke the record for the most surgeries performed in a calendar year with 1.97 lakh procedures. These nations' expanding healthcare systems have led to an increase in the consumption of hospital surgical disinfectants.

One of the key market drivers is the rise in healthcare spending in both the public and private sectors. A situation like this will likely spur the entry of several national and local businesses, boosting regional market expansion. Major market participants are also working to access untapped areas like Korea, China, and India, broadening the market's potential. Additionally, the region's fast-expanding hospital and laboratory population and the thriving medical tourism sector are fuelling the Asia Pacific region's market expansion. Such elements help the local economy even more.

The disinfectants are the type of chemical compound that is used to sanitize the overall premises and destroy microorganisms from the surface. Hospital disinfectants are used in a wide range of applications such as building and fitting surfaces to the surgical devices. Disinfectants help in preventing the disease caused by infections. Chlorine & Chlorine Compounds, Hydrogen Peroxide, Peracetic Acid, Hydrogen Peroxide & Peracetic Acid, Ortho-Phthalaldehyde, Phenolics, Iodophors, and Quaternary Ammonium Compounds are some of the widely used disinfectants that is used by the healthcare settings.

| Report Coverage | Details |

| Market Size in 2025 | USD 496.44 Million |

| Market Size by 2034 | USD 917 Million |

| Growth Rate from 2025 to 2034 | CAGR of 7.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Increasing surgical procedures

The increasing number of surgical procedures performed in hospitals and the rising awareness of infections and disorders. One of the fundamental criteria in healthcare units for surgeries is the use of solutions that are surgical disinfection. Because they stop or slow down the growth of germs on the skin, these products are more routinely used in hospitals and other medical settings to reduce the risk of infection during surgery and other treatments. As a result, these events will likely drive the market throughout the projection period.

Environmental impacts

The hospital surgical disinfectants have the harmful chemicals that created the harmful impacts on the environment surfaces and the availability of other solutions are restraining the growth of the hospital surgical disinfectants market.

Increasing prevalence of the HAIs

HAIs are a significant concern for patients and healthcare personnel worldwide. The need for surgical equipment disinfection is expanding to reduce the risk of microbial contamination as hospitalizations and HAIs rise globally. According to WHO estimates, HCAIs affect hundreds of millions of individuals worldwide each year. Seven patients in affluent nations and ten in underdeveloped countries out of every 100 hospitalized patients have at least one HAI. The rising incidence of these disorders is anticipated to increase hospital surgical disinfectant demand in various healthcare facilities to prevent the spread of infection. Hospitals typically use disinfectant solutions to avoid contamination and reduce the incidence of HAIs, which is further expected to propel market growth.

Due to the rising use of a formulation for pre-operative and pre-injection skin preparation, the chlorhexidine segment led the market in 2024. The category is expanding as a result of the rising demand for chlorhexidine-based solutions that can be combined with other formulations, such as alcohol and iodine. The need for hand rubs such as sanitizers, which are efficient against various bacteria, has also increased, contributing to the rise in chlorhexidine demand.

Chlorhexidine is also anticipated to rise at the most significant CAGR from 2023 to 2032 due to the rising usage of surgical disinfectants in pre-injection and pre-operation skin preparation during surgical operations as raising awareness of their benefits. It is an effective and long-lasting antiseptic since it protects against SSIs, central line-associated bloodstream infections, or other comparable disorders. A wide range of antibacterial action, extremely infrequent side effects, and durable antimicrobial activity are all characteristics of CHG. Varying concentrations, such as 0.11%, 2.40%, and 4.60%, are used. The other significant reasons anticipated to propel the segment during the forecast period are an increase in awareness of the benefits of chlorhexidine for hygiene and an increase in surgical operations.

The hospital segment has held the maximum market share of 47% in 2024. Some of the main drivers propelling the hospital segment include an increase in surgical operations and the occurrence of infections. For instance, the CDC reports that approximately 1 in every 31 hospital patients had an infection. Using appropriate surgical disinfectants is crucial since it aids in stopping the spread of diseases. A report indicates that most hospitals and healthcare facilities are in Asia Pacific, fuelling industry expansion.

Over the projection period, the ambulatory surgical centers segment is anticipated to increase profitably. Growing public awareness of one-day procedures is a crucial driver of the segment's expansion. People in many nations choose ASCs since they are less expensive than hospitals for treatment due to the rising expense of medical operations. Due to the increased use of cutting-edge surgical equipment at ASCs, more people are being drawn to receive medical treatment there. Additionally, it is anticipated that the segment would be driven by an increase in the variety of operations that may be reimbursed. These elements should encourage the use of surgical disinfectants in ASCs, which will accelerate the segment's expansion over the forecast period.

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2024

September 2024

January 2025