October 2023

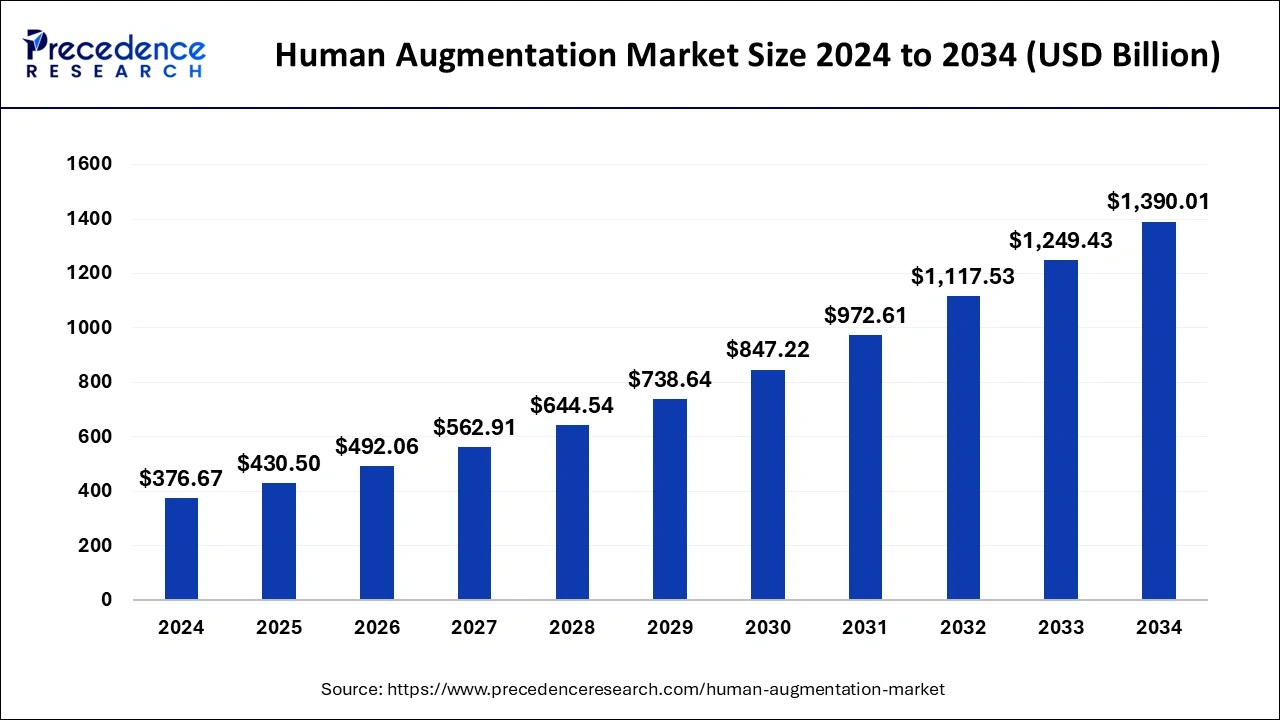

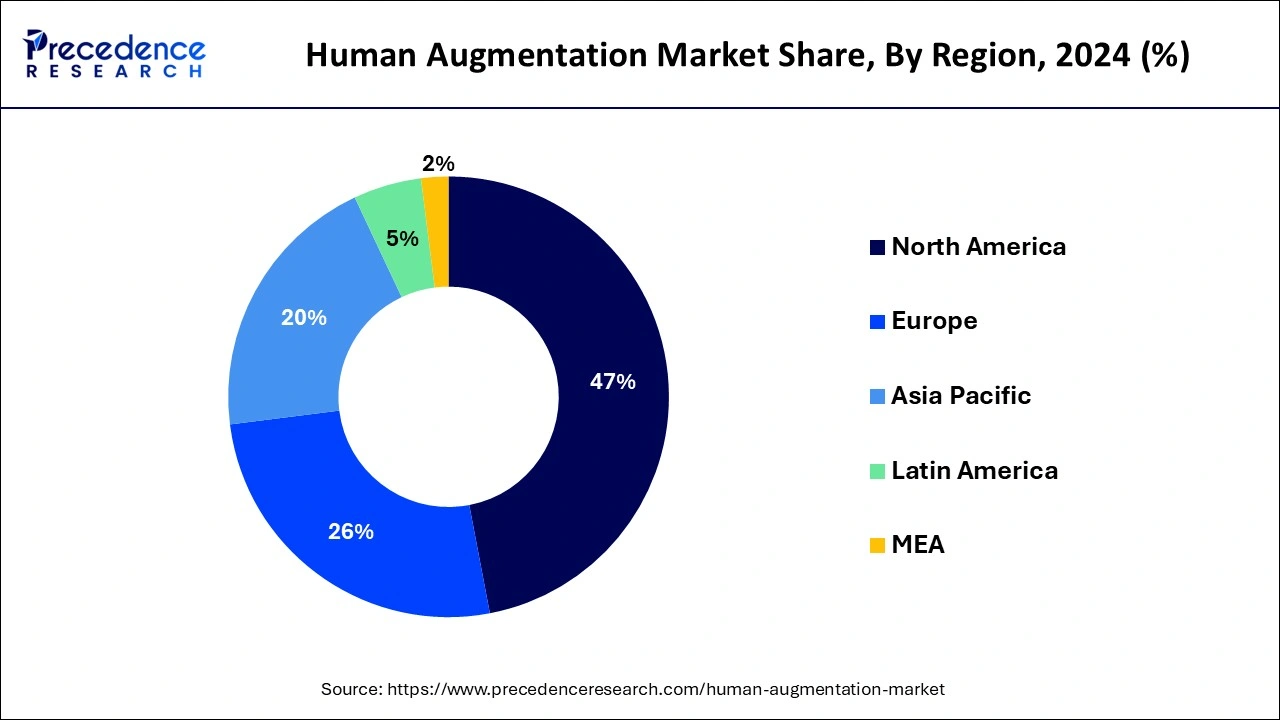

The global human augmentation market size is calculated at USD 430.50 billion in 2025 and is forecasted to reach around USD 1,390.01 billion by 2034, accelerating at a CAGR of 13.95% from 2025 to 2034. The North America market size surpassed USD 177.03 billion in 2024 and is expanding at a CAGR of 14.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global human augmentation market size was calculated at USD 376.67 billion in 2024 and is predicted to reach around USD 1,390.01 billion by 2034, expanding at a CAGR of 13.95% from 2025 to 2034. The market growth is attributed to the increasing integration of advanced technologies such as AI, AR, and VR in applications ranging from healthcare to defense and entertainment.

Artificial intelligence is revolutionizing human augmentation in the form of innovative and technological wearable computing, augmented reality systems, and the brain-computer interface. Machine learning tools add to the augmentation solutions, making them more functional by collecting data and making decisions on use and operation, making the user experiences and operations more efficient. Wearables in health are seeing growing popularity, and AI algorithms are often used to analyze the wearer’s vital signs and suggest possible health problems to solve. Furthermore, with the advancing technologies and AI central to driving adaptive, customized, and optimized augmentation solutions, the future of human capabilities is being written.

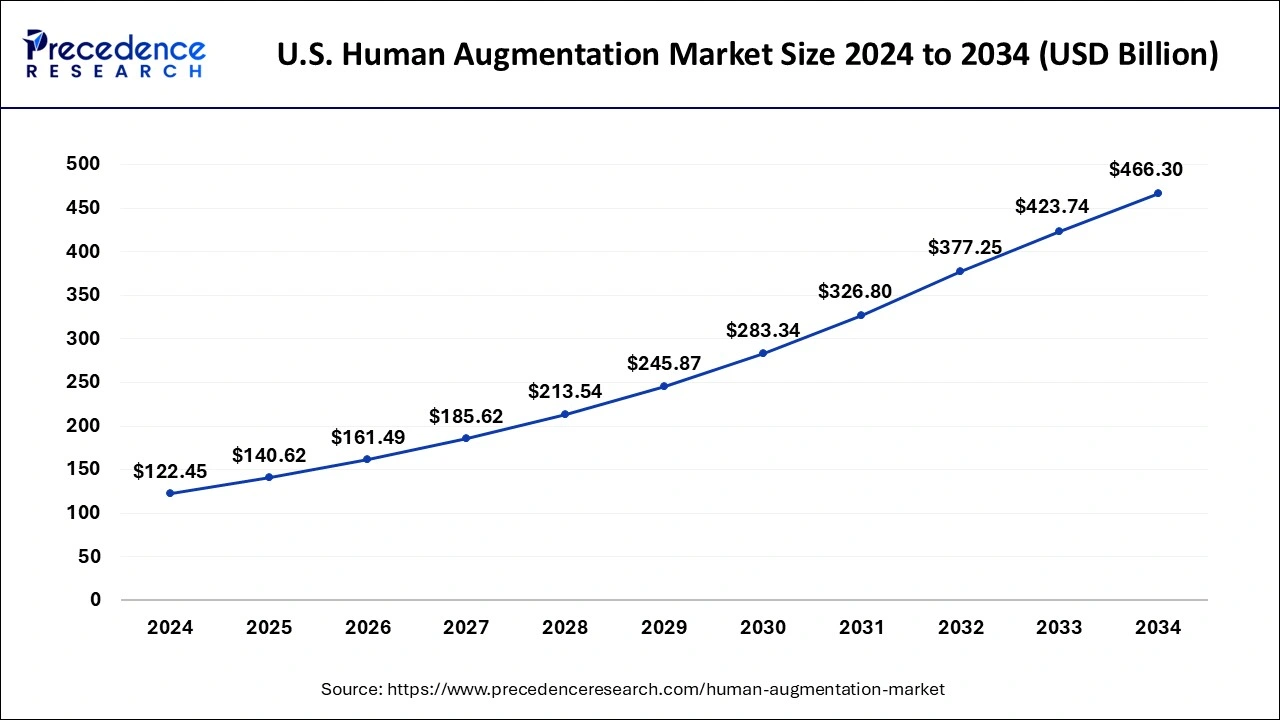

The U.S. human augmentation market size was exhibited at USD 122.45 billion in 2024 and is projected to be worth around USD 466.30 billion by 2034, growing at a CAGR of 14.31% from 2025 to 2034.

North America has held the largest revenue share 46.14% in 2024. In North America, the human augmentation market is witnessing robust growth driven by increased investments in technological advancements. The region's focus on innovation in healthcare applications, including prosthetics and neuroprosthetic devices, contributes to market expansion. Moreover, collaborations between technology companies and healthcare providers are accelerating the adoption of human augmentation, creating a dynamic landscape that responds to the rising demand for enhanced capabilities in various industries.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific human augmentation market is undergoing substantial growth, driven by swift industrialization and widespread technological uptake. Significant investments in research and development, notably in Japan and South Korea, are propelling innovations in robotics, exoskeletons, and wearable technologies. The region's proactive stance in integrating human augmentation across healthcare and military domains further fuels market expansion. This positions Asia-Pacific as a pivotal player in advancing the realm of human augmentation technologies, showcasing its commitment to pushing the boundaries of innovation in this transformative and dynamic field.

In Europe, the human augmentation market is marked by a burgeoning interest in ethical and regulatory considerations. The region embraces advancements in technologies like augmented reality and neuroprosthetics, with a focus on maintaining a balance between innovation and ethical standards. Collaborations between tech firms and healthcare institutions drive progress, positioning Europe as a hub for responsible innovation in human augmentation, and addressing societal and ethical concerns.

The human augmentation market involves the integration of advanced technologies to enhance human capabilities, both physically and cognitively. This includes using devices, implants, or wearable technologies to augment sensory perceptions, improve physical abilities, or enhance cognitive functions. Key technologies include augmented reality (AR), virtual reality (VR), robotics, and bioelectronic implants. Applications span healthcare, manufacturing, and military industries, aiming to improve efficiency, safety, and overall human performance. The market reflects the ongoing intersection of technology and humanity, seeking to push the boundaries of what individuals can achieve through symbiotic collaboration with advanced technological systems.

The pursuit of improved productivity, safety, and quality of life drives the human augmentation market. It encompasses technologies like exoskeletons for physical strength augmentation, brain-computer interfaces for cognitive enhancement, and implantable devices for medical applications. As ethical and regulatory considerations evolve, the market continues to expand, presenting opportunities for innovation and transformative advancements.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.95% |

| Market Size in 2025 | USD 430.50 Billion |

| Market Size by 2034 | USD 1,390.01 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Technology, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancements, military and defense investments

Technological advancements and military and defense investments synergistically propel the demand for the human augmentation market. Breakthroughs in augmented reality (AR), virtual reality (VR), artificial intelligence (AI), and robotics are transforming human augmentation, offering cutting-edge solutions that enhance physical and cognitive capabilities. These advancements drive the market's growth by continually expanding the scope and effectiveness of augmentation technologies.

In the military and defense sector, substantial investments in human augmentation technologies are steering innovation. Governments and defense organizations worldwide are integrating exoskeletons, cognitive enhancement tools, and other advanced technologies to enhance soldiers' performance and survivability. The need for enhanced situational awareness, improved communication, and heightened physical capabilities on the battlefield amplifies the demand for human augmentation solutions, fostering collaboration between technology developers and defense entities and further accelerating market growth.

Regulatory challenges and high development costs

Regulatory challenges pose a significant restraint on the human augmentation market. As technological advancements rapidly outpace regulatory frameworks, there is uncertainty and ambiguity surrounding the ethical and legal aspects of human augmentation. Governments and international bodies are grappling with defining clear guidelines for ethical use, safety standards, and potential societal impacts of these technologies. This regulatory lag can deter investment and adoption, as businesses and consumers hesitate due to concerns about compliance, liability, and ethical considerations. Striking a balance between encouraging innovation and ensuring responsible use is essential for overcoming these regulatory hurdles and fostering market growth.

The high costs associated with the development and deployment of human augmentation technologies act as a formidable constraint on market demand. Research, design, and testing of advanced technologies demand substantial financial investment. Additionally, complying with evolving regulatory standards further amplifies development costs. These financial barriers limit the number of companies entering the market and can result in elevated prices for end-users, hindering widespread adoption. Overcoming this challenge requires strategic collaborations, increased research funding, and a more streamlined regulatory environment to encourage innovation while mitigating the financial burden on developers and, ultimately, end-users.

Consumer electronics integration and healthcare innovation

Consumer electronics integration plays a pivotal role in surging demand for the human augmentation market as technology seamlessly intertwines with daily life. The integration of human augmentation features into consumer electronics, such as smart glasses, fitness trackers, and health monitoring devices, enhances user experiences. These technologies not only contribute to lifestyle improvements but also introduce individuals to the benefits of augmented capabilities, fostering a broader acceptance and utilization of human augmentation in various aspects of life.

Simultaneously, healthcare Innovation is a key driver, propelling demand for human augmentation technologies to new heights. The healthcare sector's increasing adoption of these technologies reflects a commitment to improving patient outcomes and quality of life, creating a significant market demand for innovative human augmentation solutions that positively impact both healthcare professionals and patients alike. The intersection of consumer electronics and healthcare innovation expands the market reach, making human augmentation an integral part of improving overall well-being and performance.

According to the type, the wearables segment held a 61.30% revenue share in 2024. Wearable human augmentation involves devices worn externally, like smart glasses and exoskeletons, enhancing physical capabilities. Trends highlight the integration of augmented reality (AR) in wearables for immersive experiences and the development of lightweight exoskeletons for industrial and healthcare applications, driving market growth.

The in-built segment is anticipated to expand at a significant CAGR of 15.1% during the projected period. In-built human augmentation refers to the integration of advanced technologies directly into the human body, including implants and bioelectronic devices. Trends indicate a rising focus on neuroprosthetics, enhancing cognitive functions, and implantable medical devices. The market sees continuous innovation in bio-hacking technologies for improved health monitoring and performance enhancement.

The body worn segment held the largest market share of 58% in 2024. Body worn human augmentation involves devices directly worn or attached to the user's body. This includes exoskeletons, smart clothing, and wearable gadgets. The market trend indicates a surge in demand for lightweight and ergonomic designs, emphasizing user comfort. Advancements include enhanced sensor technologies for precise data capture and improved integration with augmented reality, making body-worn devices more versatile for various applications in healthcare, industrial settings, and everyday life.

The non-body worn segment is projected to grow at the fastest rate over the projected period. Non-body worn human augmentation refers to technologies that do not require direct attachment to the body. Examples include neuroprosthetics, brain-computer interfaces, and implantable devices. The market trends highlight a focus on miniaturization and improved biocompatibility, aiming for seamless integration with the human body. Advancements in non-body worn technologies prioritize user safety, efficiency, and the ability to address specific medical conditions, expanding applications in healthcare and cognitive enhancement.

The wearable segment held the largest market share of 46% in 2024. Wearable technology in the human augmentation market refers to devices seamlessly integrated into daily life, enhancing human capabilities. These include smart glasses, fitness trackers, and health monitoring devices. Trends focus on miniaturization, improved biometric sensing, and extended functionalities, offering users real-time data for health and performance. The market sees a rising demand for wearables that seamlessly merge with lifestyle, promoting accessibility and continuous monitoring for personalized augmentation experiences.

The virtual reality segment is projected to grow at the fastest rate over the projected period. Virtual reality in the human augmentation market immerses users in computer-generated environments, amplifying experiences. VR trends emphasize enhanced realism, improved interaction, and applications in training and rehabilitation. The market explores VR's potential for cognitive augmentation, offering immersive solutions for mental health, education, and skill development. As VR technology advances, its integration into human augmentation continues to reshape industries, fostering innovation and transformative experiences.

The consumer segment held the highest market share of 32% in 2024. The consumer end user segment in the human augmentation market encompasses the integration of augmented capabilities into everyday life. Trends include the incorporation of human augmentation features in wearables and smart devices, enhancing user experiences. This segment is witnessing a surge in demand as consumers increasingly seek technology-driven improvements in lifestyle, entertainment, and personal productivity.

The medical segment is anticipated to expand at the fastest rate over the projected period. The medical end user segment focuses on healthcare applications, with trends emphasizing innovations in prosthetics, exoskeletons, and neuroprosthetic devices. Human augmentation technologies in the medical field aim to enhance patient rehabilitation, mobility, and overall quality of life, reflecting a growing trend toward adopting advanced solutions for improved healthcare outcomes.

By Type

By Product

By Technology

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

August 2024

July 2024

October 2023