October 2024

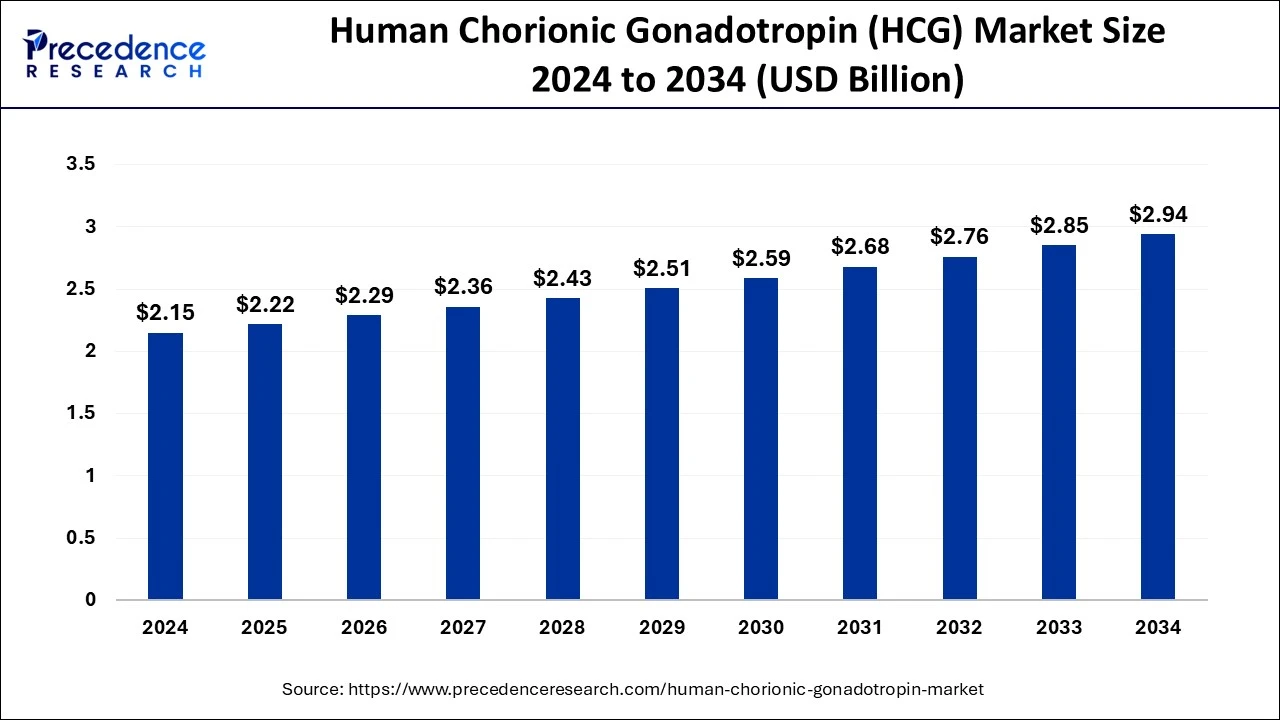

The global human chorionic gonadotropin market size was accounted for USD 2.15 billion in 2024, grew to USD 2.22 billion in 2025 and is projected to surpass around USD 2.94 billion by 2034, representing a CAGR of 3.20% between 2025 and 2034. The North America human chorionic gonadotropin market size is evaluated at USD 880 million in 2024 and is expected to grow at a CAGR of 3.24% during the forecast year.

The global human chorionic gonadotropin market size was calculated at USD 2.15 billion in 2024 and is predicted to reach around USD 2.94 billion by 2034, expanding at a CAGR of 3.20% from 2025 to 2034. The human chorionic gonadotropin market is driven by the rising prevalence of infertility and increased demand for assisted reproductive technologies (ART) such as in-vitro fertilization (IVF).

AI is being used to speed up the development of new medications, including those based on hCG. The time and expense needed for clinical trials can be decreased using machine learning algorithms to evaluate large datasets and forecast which chemicals may have medicinal promise. Patient hCG level monitoring is becoming simpler due to AI-powered diagnostic technologies, like machine learning algorithms built into test equipment or applications. Healthcare professionals can receive real-time feedback from these systems, guaranteeing prompt treatments when needed. Large-scale health data analysis from multiple sources is made possible by AI, which offers important insights into the wider uses of hCG. Researchers can use AI to find novel applications for hCG, such as weight loss or cancer treatment.

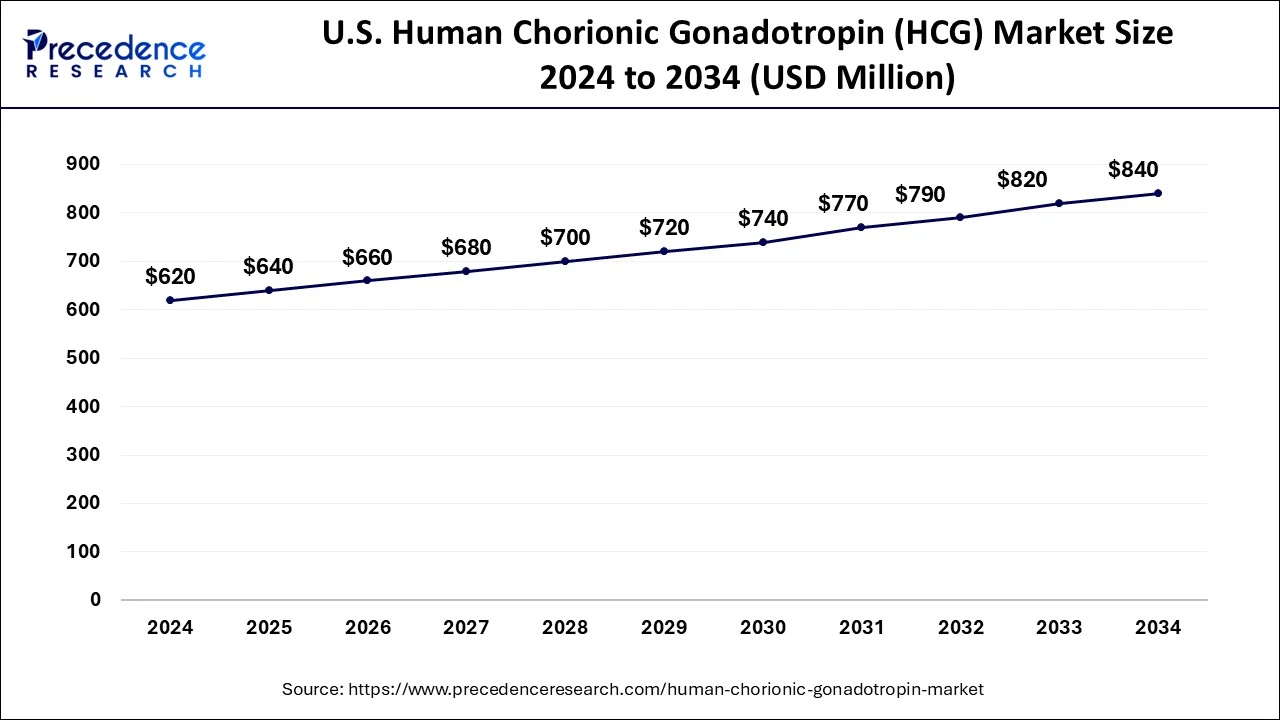

The U.S. human chorionic gonadotropin market size was exhibited at USD 620 million in 2024 and is projected to be worth around USD 840 million by 2034, growing at a CAGR of 3.34% from 2025 to 2034.

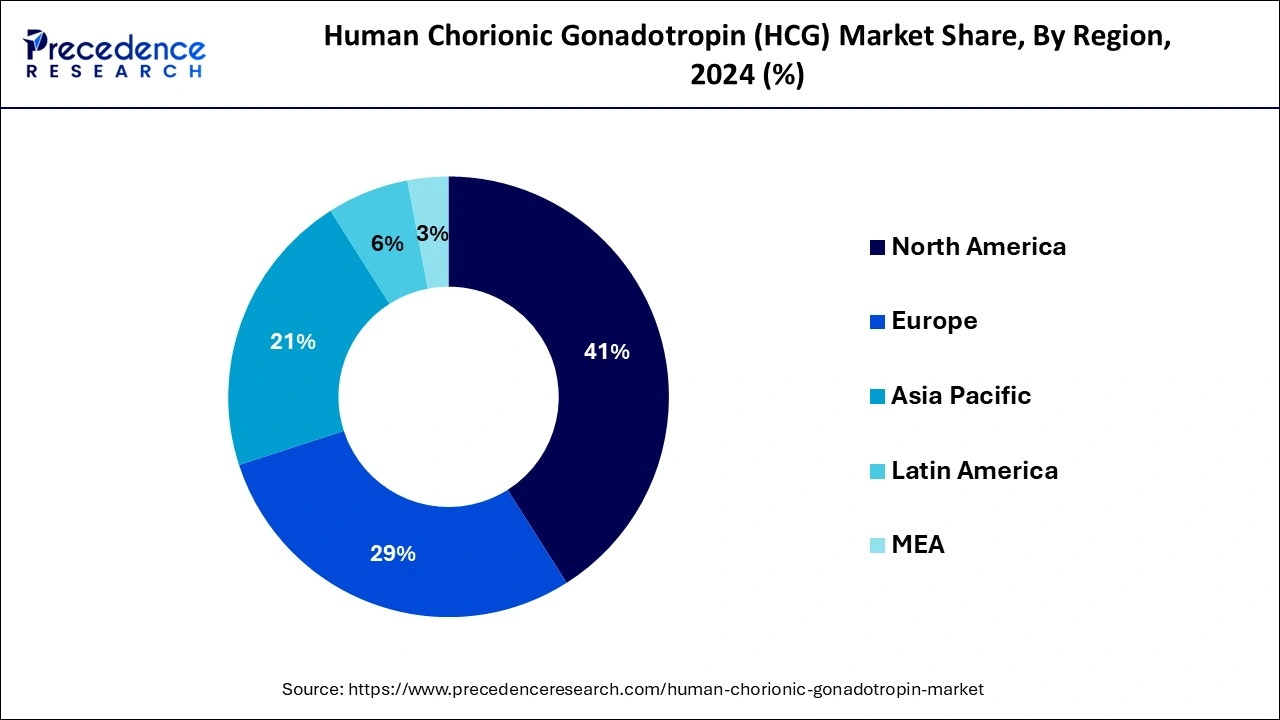

North America dominated the human chorionic gonadotropin market in 2023. In North America, public awareness programs about reproductive health and infertility have been increasingly popular. More individuals and couples are seeking medical assistance as a result of the growing acceptance of reproductive therapies, such as the usage of hCG. Government and commercial sector support has also been crucial, with many organizations providing grants, educational opportunities, and financing for fertility research.

Asia-Pacific is observed to be the fastest growing in the human chorionic gonadotropin market during the forecast period. Advanced reproductive services and fertility clinics are seeing a rise in both governmental and private funding. Greater access to fertility management medicines like hCG is made possible by the growth of medical institutions in underprivileged and rural areas. Many places strongly emphasize family-building customs and children's cultural value, even in the face of economic expansion and urbanization. Treatments utilizing hCG are increasingly being used to help with conception as infertility concerns develop.

Treatments using assisted reproductive technology (ART), including intrauterine insemination (IUI) and in vitro fertilization (IVF), often involve the use of hCG. In women receiving fertility treatments, it aids in ovulation initiation and pregnancy maintenance. The market for hCG has expanded as a result of rising rates of infertility and the number of couples pursuing assisted reproductive techniques. Strict regulatory control applies to the hCG market, especially in the areas of diagnostic testing and fertility treatments.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.94 Billion |

| Market Size in 2025 | USD 2.22 Billion |

| Market Size in 2024 | USD 2.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Therapeutic Area, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of infertility among couples

Delays in marriage and childbearing are becoming more common in developed nations, frequently due to financial, educational, or professional factors. Delaying parenthood might cause infertility issues in later life, increasing the need for assisted reproductive technologies like IVF and hCG-induced ovulation induction. Governments in some areas are aggressively supporting fertility therapies and reproductive health. Tax breaks or subsidies for infertility treatments can lower couples' expenses and increase care access.

Regulatory challenges

The safety profile of any hormone-based treatment, including hCG, is of special interest to regulatory bodies. Side effects from hCG treatment can range from minor ones like mood swings, bloating, and headaches to more serious ones like ovarian hyperstimulation syndrome (OHSS) in women or possible long-term repercussions. These worries increase scrutiny and stiffen the approval procedure. Manufacturers must show that the advantages of hCG products outweigh the hazards of being licensed for new purposes, like weight loss. In certain situations, this can be difficult, particularly if there are concerns about the safety of off-label use.

Innovations in medical technologies and improvements in fertility treatment procedures

Fertility preservation techniques like egg freezing are growing in popularity as societal and cultural changes result in later-age pregnancies. The use of hCG in egg retrieval may become more common due to advancements in cryopreservation and egg thawing methods, which would raise the need for hCG products. A wider range of people can now receive fertility treatments because of the growth of telemedicine and remote consultations.

The native human chorionic gonadotropin segment dominated the human chorionic gonadotropin market in 2023. The term "native hCG" describes the naturally occurring type of human chorionic gonadotropin, which is mostly obtained from pregnant women's urine. It is beneficial for therapeutic applications since it maintains its biological activity and natural structure. Recombinant hCG, created artificially through genetic engineering, is different from native hCG. The need for efficient treatments like native hCG has increased due to rising infertility rates globally, which are caused by factors like delayed pregnancies, lifestyle changes, and hormonal imbalances.

This pattern is especially noticeable in nations where fertility support is actively encouraged or where the population is declining. The recombinant human chorionic gonadotropin segment is observed to be the fastest growing in the human chorionic gonadotropin market during the forecast period.

In vitro fertilization (IVF) and intrauterine insemination (IUI) are two common ART treatments that use recombinant hCG to induce ovulation and improve pregnancy success rates. The market for hCG is being driven by nations, including the US, India, China, and Europe, that are adopting ART services at an increasing rate. Genetic engineering advancements have increased market adoption by enabling cost-effective production without sacrificing product quality.

The female infertility treatment segment dominated the human chorionic gonadotropin market in 2023. hCG therapy is a crucial medication in infertility treatment regimens since it helps women with ovulatory disorders. Recombinant hCG formulations have improved patient outcomes and therapy efficacy. Compared to urine-derived hCG, these formulations are more stable, dependable, and favored due to their lower immunogenicity. Medical solutions employing hCG are now more widely accepted as a result of awareness efforts and education about infertility treatments.

The male hypogonadism segment is observed to be the fastest growing in the human chorionic gonadotropin market during the forecast period. Insufficient synthesis of testosterone, a hormone necessary for male growth and reproductive processes, is a defining feature of male hypogonadism. This insufficiency may result from problems with the hypothalamic-pituitary axis (secondary hypogonadism) or testicular failure (primary hypogonadism). Younger males with secondary hypogonadism are using hCG at increased rates because of growing awareness of fertility preservation.

The hospital pharmacies segment dominated the human chorionic gonadotropin market in 2023. Human chorionic gonadotropin is frequently used to treat male hypogonadism and female infertility. Hospitals are often the primary focus of care for patients with these complex diseases when they get hCG-based treatments and undergo comprehensive assessments. When given via injection, human chorionic gonadotropin necessitates exact quantities. Under expert supervision, hospital pharmacies can guarantee that patients receive the appropriate dosages.

The retail pharmacies segment shows a significant growth in the human chorionic gonadotropin market during the forecast period. Infertility in women, hypogonadism in males, and other hormonal deficiencies are commonly treated using human chorionic gonadotropin. These therapies are conveniently distributed via retail pharmacies, making it simpler to obtain prescription drugs. Retail pharmacies frequently provide longer hours than hospitals or specialty clinics, making it easy for patients to buy prescription drugs. Several retail chains have begun to improve adherence to hCG treatment regimens by providing digital prescriptions, appointment scheduling, and automated reminders for medicine refills.

By Product Type

By Therapeutic Area

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

November 2024

March 2025