September 2024

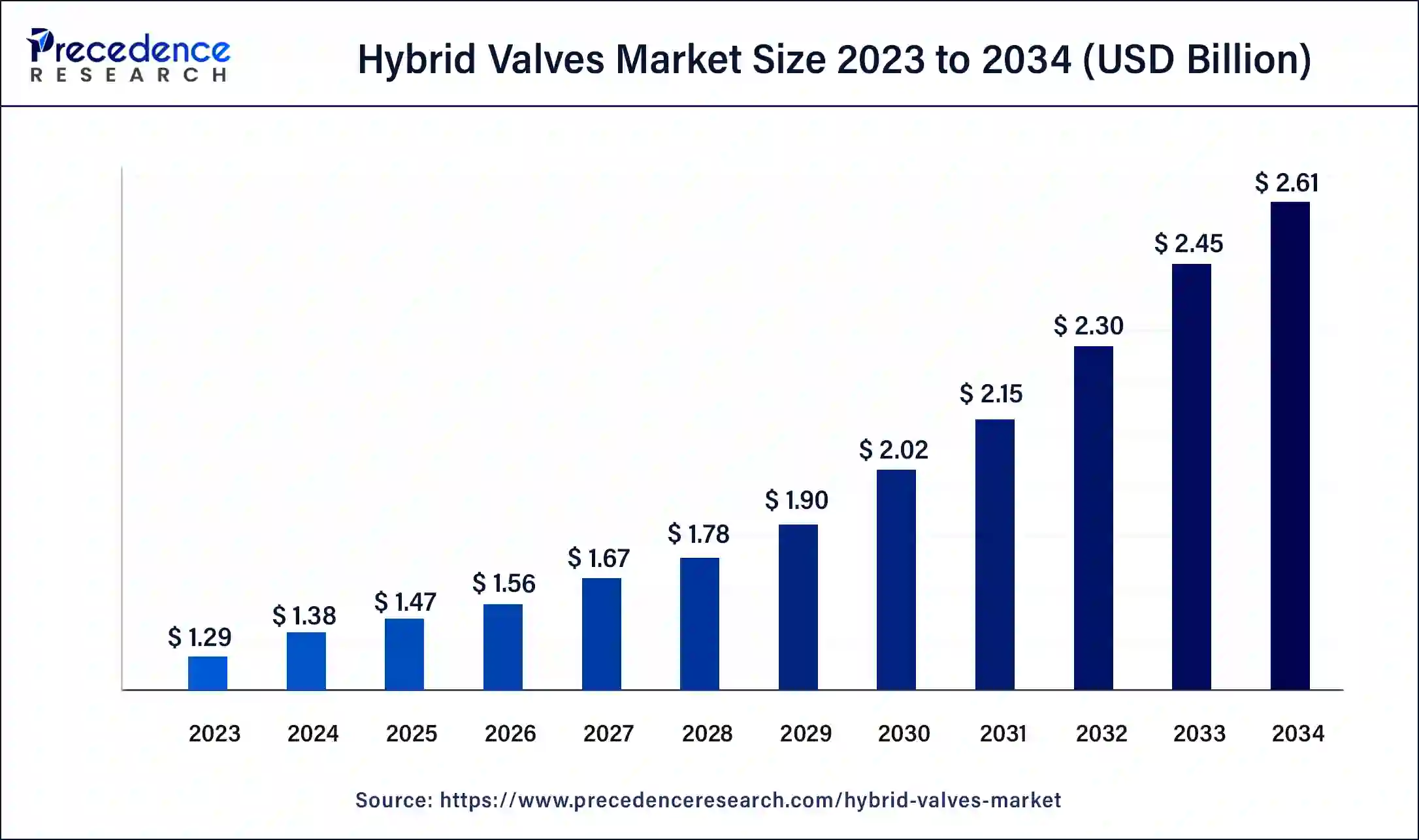

The global hybrid valves market size was USD 1.29 billion in 2023, calculated at USD 1.38 billion in 2024 and is expected to be worth around USD 2.61 billion by 2034. The market is slated to expand at 6.62% CAGR from 2024 to 2034.

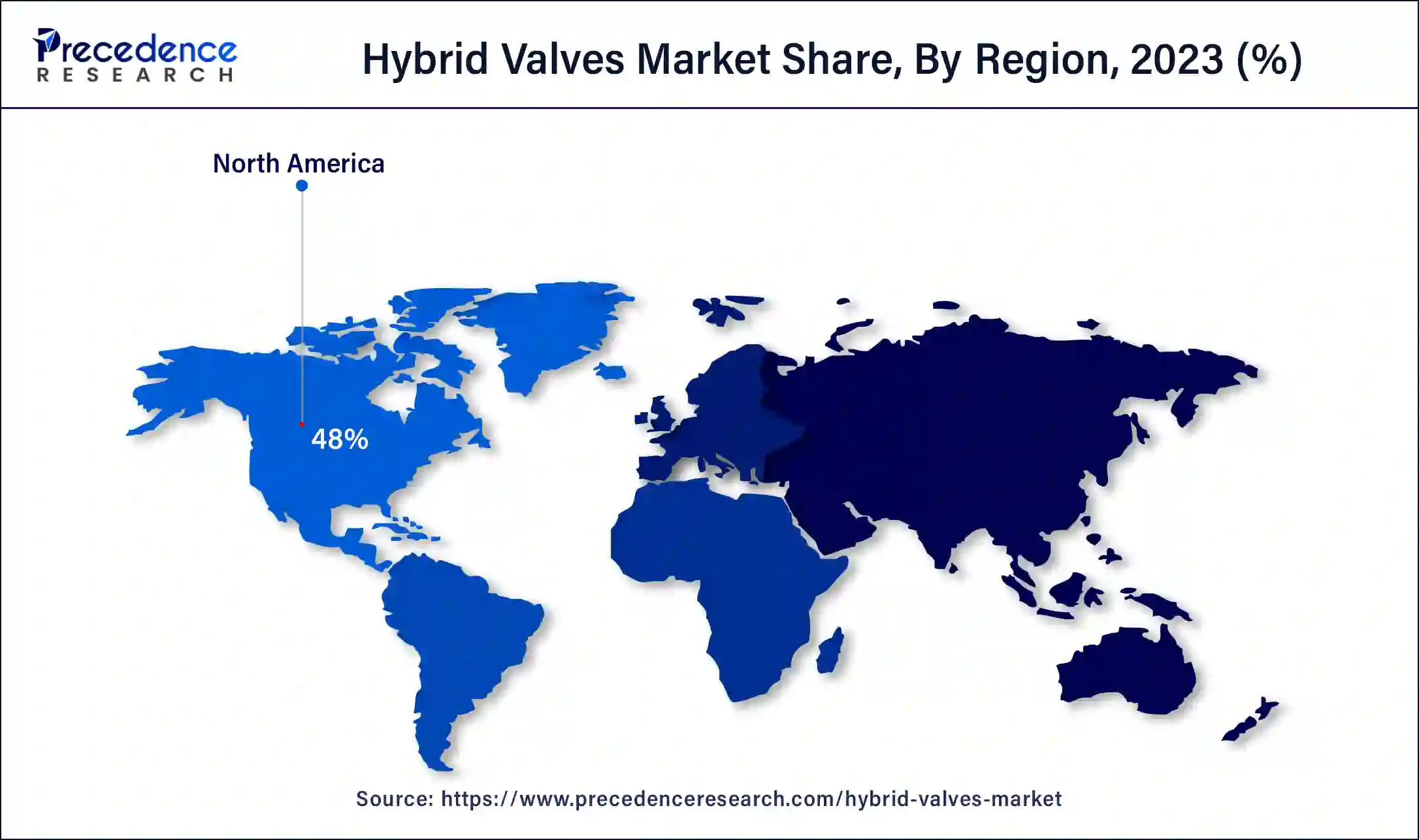

The global hybrid valves market size is worth around USD 1.38 billion in 2024 and is anticipated to reach around USD 2.61 billion by 2034, growing at a CAGR of 6.62% over the forecast period 2024 to 2034. The North America hybrid valves market size reached USD 620 million in 2023. The rise in the use of products in different industries is the key factor driving the hybrid valves market growth.

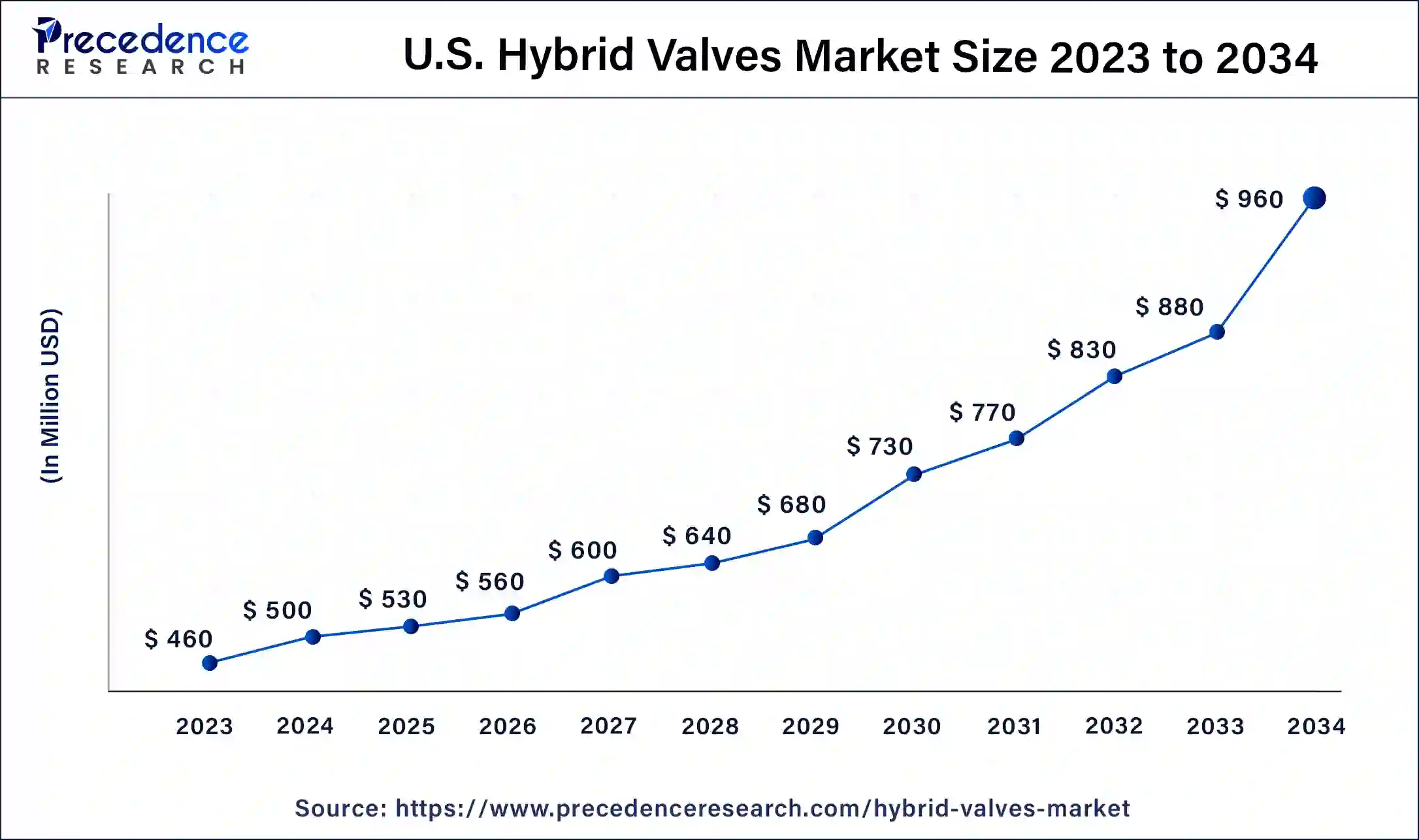

The U.S. hybrid valves market size was exhibited at USD 460 million in 2023 and is projected to be worth around USD 960 million by 2034, poised to grow at a CAGR of 6.91% from 2024 to 2034.

North America dominated the global hybrid valves market in 2023. The growth of the region is driven by rising industrial automation and the need for efficient fluid control systems. Moreover, factors such as the increasing adoption of innovative manufacturing techniques along with strict environmental regulations are further boosting market growth. Market players are also emphasizing the design of innovative hybrid valve solutions to fulfill diverse industry requirements from end-users across various sectors.

Nuclear Share of Electricity Generation in 2023

| Country | Total net capacity [MW] | Nuclear Share (%) |

| ARGENTINA | 1641 | 6.3 |

| ARMENIA | 416 | 31.1 |

| BELARUS | 2220 | 28.6 |

| BELGIUM | 4916 | 41.2 |

| BRAZIL | 1884 | 2.2 |

| BULGARIA | 2006 | 40.4 |

| CANADA | 13699 | 13.7 |

| CHINA | 53152 | 4.9 |

| CZECH REPUBLIC | 3934 | 40.0 |

| FINLAND | 4394 | 42.0 |

Asia Pacific is expected to witness the fastest growth in the hybrid valves market over the forecast period. The region can be attributed to the ongoing economic growth in developing countries like China and India. The requirement for hybrid valves has risen substantially as a result of the need to decrease greenhouse gas emissions in the various industrial sectors. Furthermore, the region is a base of many manufacturing firms such as pharmaceutical, chemical, and automotive sectors. Whose work relies on high-performance valves. Also, there is a growth in infrastructure development investments coupled with government initiatives in water harvesting.

Hybrid valves are utilized in a variety of industries, such as chemical, oil and gas, water treatment, and power generation. Because they provide reliability, better performance, and control than traditional valves, hybrid valves can also optimize pressure and fluid flow, which can lower costs and improve energy efficiency. There is a growing need for safety and dependability in crucial applications like oil and gas pipelines, nuclear power plants, and chemical facilities, as well as industries like water treatment and power production.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.61 Billion |

| Market Size in 2024 | USD 1.38 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Industry, Valve Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing usage of hybrid valves in manufacturing facilities

The hybrid valves market is growing because of the rise in the application of hybrid valves in industries like chemicals, metals and mining, oil and gas, and pharmaceuticals to reduce pressure, vibration, and noise. Additionally, hybrid valves are increasingly used by oil and gas industries to stop corrosion and maintain excessive pressure during production.

Limited awareness and adoption

The hybrid valves market faces a significant constraint due to less adoption and awareness among industry players about hybrid valves. This lack of awareness can slow the adoption rates, by hampering the overall market growth. Moreover, addressing this challenge needs specific educational efforts to highlight the benefits of hybrid valves which showcase their ability to improve performance and decrease operational costs across different industries.

Rising focus on automation and wireless monitoring

By using advanced technologies, valves can now be controlled from any remote location, which allows real-time adjustments and smooth management of fluid flow. Furthermore, this automation can improve precision and reduce operational costs and manual labor. The wireless monitoring systems can offer continuous data on valve performance by minimizing downtime and enabling proactive maintenance. These advancements signify a substantial leap forward in strengthening industrial processes by ensuring swift operations in the hybrid valves market .

The steel segment dominated the hybrid valves market in 2023. The dominance of the segment can be linked to the increasing demand for steel material in applications including high temperature and steam because of the need for greater flow control and handling of a corrosive media application in water & wastewater treatment and chemicals industries during the projected period.

The alloy segment is expected to show significant growth in the hybrid valves market over the forecast period. Alloy hybrid valves are a special type of valve that combines the qualities of different alloys to enhance their performance in specific applications. Moreover, alloys can offer improved performance strength and durability by improving resistance to corrosive and abrasive environments.

The chemical segment led the hybrid valves market in 2023. The growth of the segment can be credited to the increasing use of hybrid valves in chemical plants for controlling complex & distinctive noises coupled with acoustical difficulties. Additionally, the growth of consent decrees on noise, air, and water contamination implemented in refineries are key factors driving the demand for hybrid valves in the chemical sector.

The oil & gas segment will show the fastest growth in the hybrid valves market over the studied period. The growth of the segment can be attributed to the increasing use of hybrid valves in the oil and gas industry to maintain the flow of oil and gas in pipelines, storage tanks, and other upstream and downstream processes. Furthermore, Hybrid valves help to control the flow of liquids, gases, and steam during treatment procedures.

The 6" to 25", segment held a significant share of the global hybrid valves market in 2023. This is due to the fact that 6-inch to 25-inch hybrid valves provide efficient control over the flow of fluids, gases, and steam. These valves are also utilized to maintain the flow of oil and gas in pipelines. Hybrid valves of this size are also employed to control the flow of steam and other fluids.

Segments Covered in the Report

By Material

By Valve Size

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

January 2025

January 2025