Hydro Turbine Market Size and Forecast 2025 to 2034

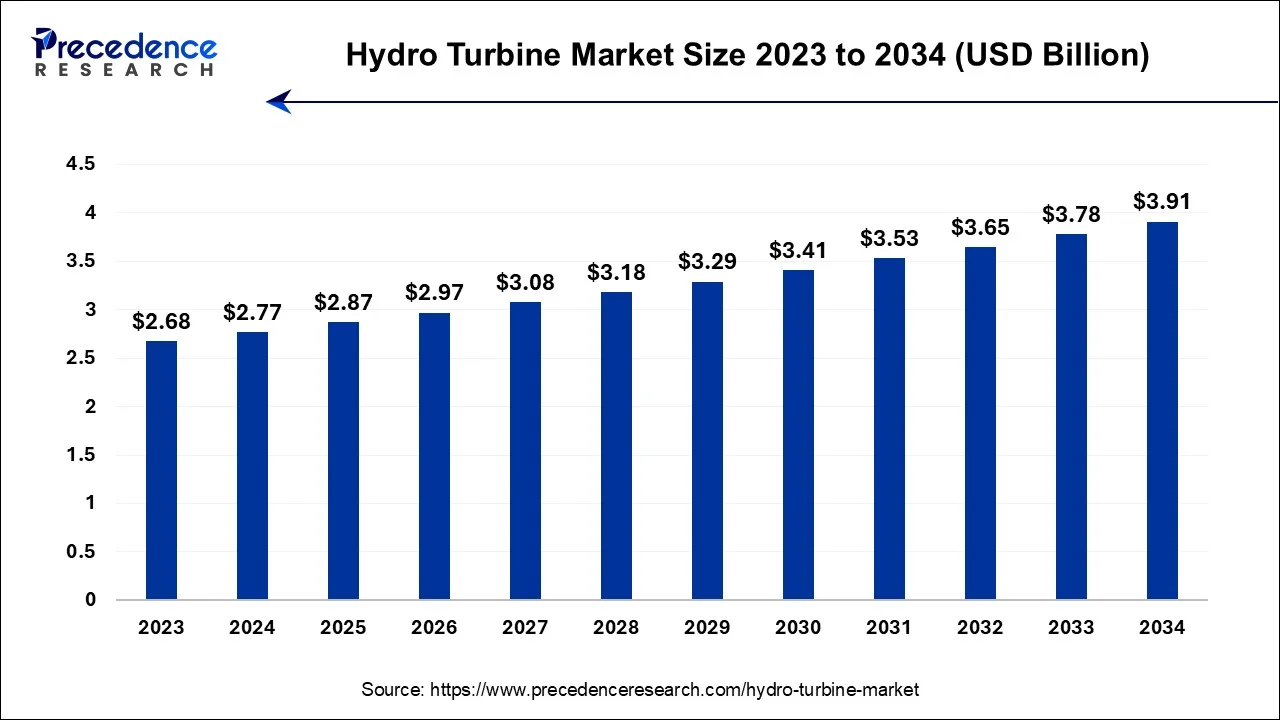

The global hydro turbine market size was calculated at USD 2.77 billion in 2024 and is projected to surpass around USD 3.91 billion by 2034, expanding at a CAGR of 3.51% from 2025 to 2034.

Hydro Turbine Market Key Takeaways

- In terms of revenue, the hydro turbine market is valued at $2.87 billion in 2025.

- It is projected to reach $3.91 billion by 2034.

- The hydro turbine market is expected to grow at a CAGR of 3.51% from 2025 to 2034.

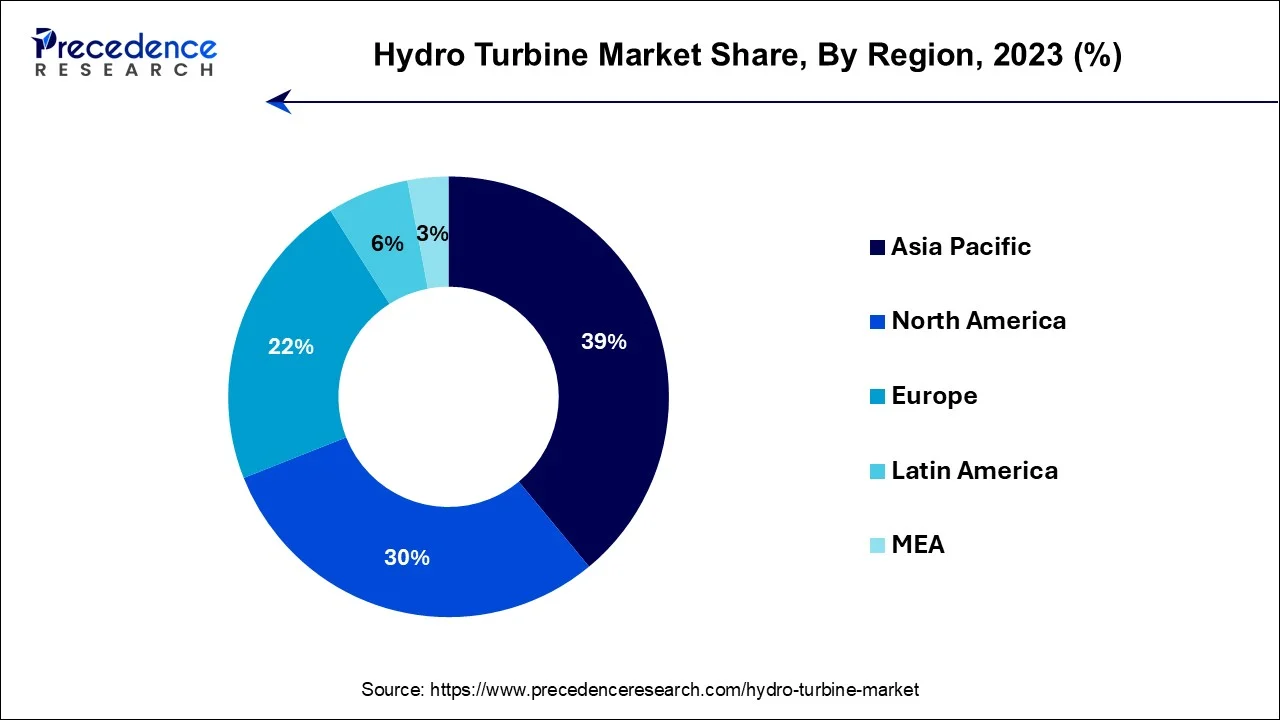

- Asia-Pacific led the market with the biggest market share of 39% in 2024.

- Europe is projected to expand at the fastest CAGR during the forecast period.

- By Turbine Type, the impulse turbine segment has held a major revenue share of 63% in 2024.

- By Turbine Type, the reaction turbine segment is expected to grow at a notable CAGR of 5.8% during the forecast period.

- By Head Type, the low head turbine segment recorded more than 42% of revenue share in 2024.

- By Head Type, the high head turbine segment is estimated to expand at the fastest CAGR over the projected period.

- By Installation Site, the small hydro power plant segment registered the maximum market share of 36.8% in 2024.

- By Installation Site, the large hydropower plant is predicted to grow at a remarkable CAGR over the projected period.

Asia Pacific Hydro Turbine Market Size and Growth 2025 to 2034

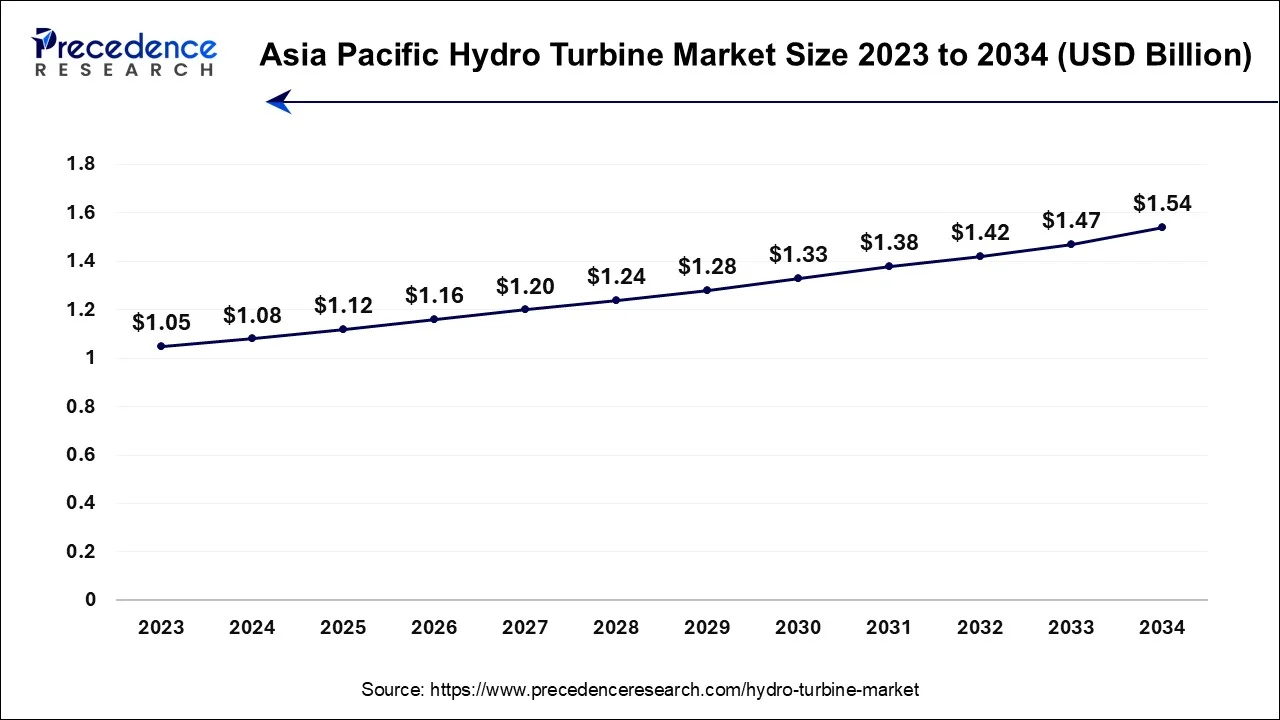

The Asia Pacific hydro turbine market size was evaluated at USD 1.08 billion in 2024 and is expected to grow to USD 1.54 billion by 2034, expanding at a CAGR of 3.61% from 2025 to 2034.

Asia-Pacific held the largest revenue share 39% in 2024. The hydro turbine market in the Asia-Pacific region is witnessing remarkable growth, driven predominantly by China and India. These nations are channeling significant investments into hydropower projects to fulfill their escalating energy demands. A notable trend in this region is the emergence of small and mini hydropower installations, thoughtfully tailored to meet local energy needs while accounting for environmental considerations.

Additionally, digitalization is gaining substantial momentum, with an increased focus on real-time monitoring and control systems. These digital solutions are aimed at boosting operational efficiency and enhancing the reliability of hydropower generation, further fueling the market's expansion in the Asia-Pacific region.

Currently, Asia Pacific is dominating the hydro turbine market. The heavy investment and initiative towards hydropower infrastructure. Within the region, China contributes the largest share to the market. The region is focusing on the extension of renewable energy globally.

India has seen a significant growth in the market, the growth is driven by technological advancements, increasing focus on sustainability, increasing energy demand, with the support of government support for the promotion of hydropower development, with government policies and projects helping the growth of the market. The rising investments and support to se renewable energy sources further boost the growth of the market. Companies like BHEL, Alstom, Voith, and Andritz are among the major players in the Indian hydropower turbines market, which helps and contributes to the growth and expansion of the market in the country.

Europe is estimated to observe the fastest expansion In Europe, the hydro turbine market is experiencing a resurgence, fueled by the continent's commitment to renewable energy. Offshore hydropower projects, particularly in the North Sea, are driving demand for specialized turbines. Moreover, a transition to high-efficiency hydro turbines and the integration of digital technologies are prevalent trends. Europe's emphasis on sustainability and grid integration continues to shape the market, with countries actively investing in modernizing and expanding their hydropower infrastructure.

North America's hydro turbine market is surging as countries prioritize expanding their renewable energy portfolios. This growth is underpinned by the widespread adoption of advanced turbine technology and grid integration solutions, enhancing the efficiency and reliability of hydropower generation. North America's unwavering commitment to clean energy sources remains a driving force, fostering both market growth and innovation within the region's hydro turbine industry.

The UK has a steady and mature market, and the growth of the market is driven by the increasing demand for renewable energy sources amid a rising shift towards sustainability and government initiatives for prioritizing hydropower and increasing the adoption of sustainable energy, which boosts the growth of the market in the country. Major players in the UK hydropower turbine market, including General Electric (GE), Andritz Hydro, and Voith Hydro, play a crucial role in the growth and expansion of the market in the country.

Market Overview

A hydro turbine is a mechanical device used in hydropower plants to convert the kinetic energy of flowing water into mechanical energy, which is then transformed into electrical energy through a generator. It consists of various components, including blades or runners, a rotor, and a shaft. Water flows over the blades, causing them to rotate. The rotation of the blades drives the rotor, which, in turn, spins the generator to produce electricity. hydro turbines come in different types, such as Francis, Kaplan, and Pelton, each designed for specific hydrological conditions. They play a crucial role in harnessing renewable energy from water sources, contributing to clean and sustainable electricity generation.

Market Trends

- The increasing investments by governments for reducing the use of fossil fuels and the use of renewable sources, with a rising shift towards sustainability, drive the growth of the market.

- Technological advancements and innovation in hydro turbine technology for the development of more efficient and small-scale turbines are a growing trend that drives the growth.

- Rising focus of the government as well as the population on sustainability amid rising environmental concerns and focus on the adoption of sustainable energy solutions drives the growth.

- Infrastructural development plans and modernization of the existing plants to improve efficiency and extend their lifespan are a growing trend and drive the growth.

Hydro Turbine Market Growth Factors

The hydro turbinemarket is witnessing substantial growth worldwide as the demand for clean and sustainable energy sources intensifies. Hydropower, harnessed through hydro turbines, stands as a reliable and eco-friendly option, contributing significantly to this transition. Furthermore, government incentives, subsidies, and policies promoting renewable energy projects, including hydropower, are bolstering the hydro turbine market's expansion. These measures not only encourage investment but also provide the necessary impetus for infrastructure development.

Technological advancements in turbine design and efficiency are enhancing their performance and attractiveness for power generation. As the demand for clean energy continues to grow, the hydro turbinemarket is poised to play a pivotal role in meeting global electricity needs.

In the hydro turbinemarket, emerging trends are reshaping the landscape. One notable trend is the proliferation of mini and micro hydropower projects, driven by the demand for more efficient turbines designed to suit smaller installations. These projects offer a more localized and scalable approach to hydropower generation, aligning with the need for sustainable energy solutions in various regions.

Furthermore, the industry is embracing digitalization as a growing trend. Digital technologies are being integrated for real-time monitoring and control, which enhances operational efficiency and reliability. This shift towards digital solutions is poised to revolutionize how hydropower facilities are managed and optimized, providing greater flexibility and control over power generation processes.

Additionally, the industry contends with the complexities of securing project approvals and adequate financing, both of which can be protracted and intricate processes. These challenges demand careful navigation and strategic approaches for developers and investors alike.

Within this evolving landscape, opportunities abound for turbine manufacturers and service providers. Expanding into emerging markets with untapped hydropower potential offers a promising avenue for growth. Moreover, there is a growing market segment for retrofitting existing hydropower facilities with modern, more efficient turbines and providing comprehensive maintenance services to ensure optimal operational performance and longevity. As the global commitment to renewable energy strengthens, the hydro turbinemarket is poised to continue its upward trajectory, offering potential rewards for industry participants who can navigate the challenges and seize these opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.91 Billion |

| Market Size in 2025 | USD 2.87 Billion |

| Market Size in 2024 | USD 2.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.51% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2033 |

| Segments Covered | Turbine Type, Head Type, Installation Site and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Renewable energy transition and hydropower capacity expansion

The hydro turbine market is experiencing a surge in demand driven by two intertwined factors: the global transition to renewable energy and the pressing need for hydropower capacity expansion. Including the worldwide shift towards renewable energy sources is a major catalyst. As countries seek to reduce carbon emissions and combat climate change, renewable energy has gained unprecedented prominence. Hydropower, facilitated through hydro turbines, offers a clean and consistent energy source, aligning perfectly with this transition. Governments and utilities are increasingly turning to hydropower as a dependable and sustainable solution, spurring the demand for hydro turbines.

Moreover, the imperative to expand hydropower capacity is another powerful driver. The allure of hydropower lies in its scalability; it can cater to both small-scale, localized projects and large-scale, utility-level installations. This versatility makes hydro turbines indispensable as they play a pivotal role in harnessing the potential of rivers and water resources. Together, the renewable energy transition and hydropower capacity expansion are propelling the hydro turbine market to new heights, shaping it as a fundamental pillar in the global quest for sustainable energy solutions.

Restraints

Competing land use and technological challenges

Competing land use and technological challenges present significant restraints on the hydro turbine market. Competition for suitable land and water resources for hydropower projects. Urbanization and industrial expansion pose substantial challenges to the hydro turbine market. As regions undergo urban growth, the competition for available land and water resources intensifies. This heightened competition often results in conflicts over land use priorities, environmental concerns, and complex regulatory requirements. These factors collectively obstruct the development of new hydropower projects and significantly curtail the expansion potential of the hydro turbine market.

Technological challenges also play a role. The efficient harnessing of hydropower depends on various factors, including turbine design, materials, and infrastructure. Developing and deploying advanced technologies that improve turbine efficiency and reduce environmental impacts can be a complex and costly endeavor.

Additionally, adapting existing hydropower facilities to meet modern environmental standards and grid integration requirements presents its own set of technological challenges. Overcoming these obstacles requires substantial investments in research and development, which can hinder the growth of the hydro turbine market. Addressing competing land use and technological challenges is essential to ensure the continued development and sustainability of hydropower and the hydro turbine market in the face of growing energy demands and environmental concerns.

Opportunities

Grid integration solutions, mini and micro hydropower

Grid integration solutions and the proliferation of mini and micro hydropower projects are driving the demand for the hydro turbine market. Grid integration solutions play a crucial role in optimizing the utilization of hydropower resources. Amid the growing emphasis on renewable energy, the integration of hydropower into existing grids via grid integration solutions has become pivotal. This seamless integration serves to bolster grid stability by providing a consistent and reliable energy supply. Notably, hydropower's capacity for continuous generation mitigates the challenges associated with intermittent renewables like solar and wind, thereby enhancing grid reliability.

The rise of mini and micro hydropower projects is another significant factor. These smaller-scale installations cater to localized energy needs, particularly in remote or off-grid areas. hydro turbines designed for these projects offer higher efficiency and flexibility. The demand for such projects is driven by the need for sustainable, decentralized energy sources, making hydropower an attractive option. As communities and industries seek reliable and eco-friendly energy solutions, the hydro turbine market benefits from the growth of these smaller installations, further bolstering its demand and market reach.

Technological Advancement

Technological advancements in the hydro turbine market feature smart hydropower, novel technologies, and designs. The smart hydropower integrates a control system and digitalization to improve the performance of the hydropower plants. The low-impact designs promote the popular fish-friendly turbines. The purpose of this turbine is to reduce environmental impact. This supports fish to escape from the passages through hydropower facilities. The novel technologies dwell on innovation. Hydrokinetic turbines and pumps as turbines (PAT) are a popular innovation mainly used for small-scale hydropower applications. The enhancement and variations achieve the technological factors of the market.

The energy storage solutions enhance and ease hydropower processes. The advancements elevate other terms such as speed generation and flexibility. The technology accelerates the operation process and improves the sustainable factors of the hydro turbine market. The demand for renewable energy sources is gaining an innovative approach in the market.

Turbine Type Insights

The Impulse turbine segment has held 63% revenue share in 2024. The Impulse turbines operate by the principle of impulse and are primarily used for high-head applications. They convert the kinetic energy of high-velocity water jets into mechanical energy by directing the water flow onto a set of spoon-shaped buckets or blades. The force of the water jet causes the blades to rotate, driving the turbine and generating power. In the hydro turbine market, a trend observed is the continued use of impulse turbines in high-head hydropower projects, especially in regions with steep terrain, as they are well-suited for harnessing the energy of fast-flowing water.

The reaction turbine is anticipated to expand at a significant CAGR of 5.8% during the projected period reaction turbines, on the other hand, are employed in low to medium-head applications. They operate on the principle of reaction, utilizing the pressure difference between the inlet and outlet of the turbine to generate power. Water flows through a set of fixed guide vanes and onto the turbine blades, causing them to spin. Reaction turbines are commonly used in a wide range of hydropower projects. A trend in the hydro turbine market is the ongoing development of innovative designs and materials for reaction turbines to improve efficiency and adaptability in varying hydropower conditions, contributing to their continued relevance in the industry.

Head Type Insights

The low head turbines computing held the largest market share of 42% in 2024. Low head turbines are hydro turbines designed for use in locations where the hydraulic head (the vertical drop from the water source to the turbine) is relatively low, typically up to 30 meters. These turbines are characterized by their efficient performance in low-head, high-flow conditions. They are commonly used in run-of-river hydropower projects, irrigation systems, and industrial applications. In the hydro turbine market, a trend is the increasing adoption of low head turbines, especially in regions with abundant water resources but limited head height, to harness energy efficiently while minimizing environmental impact.

The high-head turbine is projected to grow at the fastest rate over the projected period. High head turbines are designed for locations with significant hydraulic head, typically exceeding 300 meters. These turbines are optimized for sites with steep terrain and substantial water pressure. They are commonly used in mountainous regions and in pumped storage hydroelectric plants. In the hydro turbine market, a trend is the continued development of high head turbine technology to maximize energy output from high-head hydropower installations. The demand for these turbines remains robust in areas with favorable topography for hydropower generation, contributing to their market growth.

Installation Site Insights

The small hydropower segment had the highest market share of 36.8% in 2023. Small hydropower plants, with a capacity of up to 1 MW, are characterized by their modest size and suitability for decentralized energy generation. These plants often utilize micro or mini hydro turbines designed for efficient power generation at low flow rates. A notable trend in this segment is the increasing deployment of small hydropower projects, especially in remote or off-grid areas. These projects cater to localized energy needs and contribute to rural electrification, aligning with the global push for decentralized and sustainable energy solutions.

The large hydropower plant segment is anticipated to expand at the fastest rate over the projected period. Large hydropower plants, typically with capacities above 10 MW, are major contributors to grid-scale electricity generation. They employ larger hydro turbines, often of the Francis or Kaplan type, designed for higher flow rates and greater power output. In this segment, a notable trend is the ongoing modernization and upgrading of existing large hydropower facilities to enhance efficiency and environmental performance. Additionally, there is a growing emphasis on environmental sustainability, with efforts to mitigate the ecological impact of these projects through advanced technologies and fish-friendly turbine designs.

Hydro Turbine Market Companies

- General Electric Company

- Siemens AG

- Andritz AG

- Voith Group

- Toshiba Corporation

- Bharat Heavy Electricals Limited (BHEL)

- Mitsubishi Heavy Industries, Ltd.

- Harbin Electric Company Limited

- Alstom Hydro

- The Columbia Machine Works, Inc.

- Flovel Energy Private Limited

- Canyon Hydro

- CKD Blansko Engineering, a.s.

- Toshiba Hydro Power (Hangzhou) Co., Ltd.

- WWS Wasserkraft GmbH

Recent Developments

- In February 2025, GE Power India secured an additional contract worth INR 273.5 crore from GREENKO KA01 IREP as a part of the existing agreement for the Saundatti hydro project in Belagavi, Karnataka. (Source: business-standard.com )

- In May 2025, at Kia's EV day in Barcelona, Spain, in March, the brand introduced a new modular electric van called the Platform Beyond Vehicle (PBV). It consists of four variants: crew, passenger, wheelchair, and cargo access vehicle options. (Source: popsci.com )

- In February 2025, Proteus Marine Renewables deployed the AR1100 tidal turbine in Japan, which became the country's first-ever megawatt-scale grid-connected tidal energy system. It's a valuable initiative towards clean energy. (Source: oedigital.com )

- In 2023, The NISA project, jointly owned by Copenhagen Infrastructure Partners and Stat Kraft, has secured a 500 MW contract in Ireland's inaugural offshore wind auction, marking a significant milestone in the country's renewable energy efforts.

- In 2022, GE has acquired a 49% stake in Continuum's onshore wind farm as part of its support for India's energy transition. GE Energy Financial Services invested through structured preferred equity in Continuum's 148.5 MW Morjar wind power project in Gujarat, India.

- In 2022, Voith has successfully acquired all shares in Voith Hydro from former joint venture partner Siemens Energy. This move solidifies Voith's position as a comprehensive hydropower industry supplier, boasting expertise in generators and other key components.

- In 2020, GE Renewable Energy was chosen by EDF RE and Mitsui & Co., Ltd to provide equipment for the 87 MW Taza onshore wind farm in Morocco. The project will feature 27 of GE's 3.2-85 onshore wind turbines, located near Taza in Northern Morocco.

Segments Covered in the Report

By Turbine Type

- Impulse Turbine

- Reaction Turbine

By Head Type

- Low Head Turbine

- Medium Head Turbine

- High Head Turbine

By Installation Site

- Small Hydro Power Plant

- Medium Hydro Power Plant

- Large Hydro Power Plant

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344