January 2025

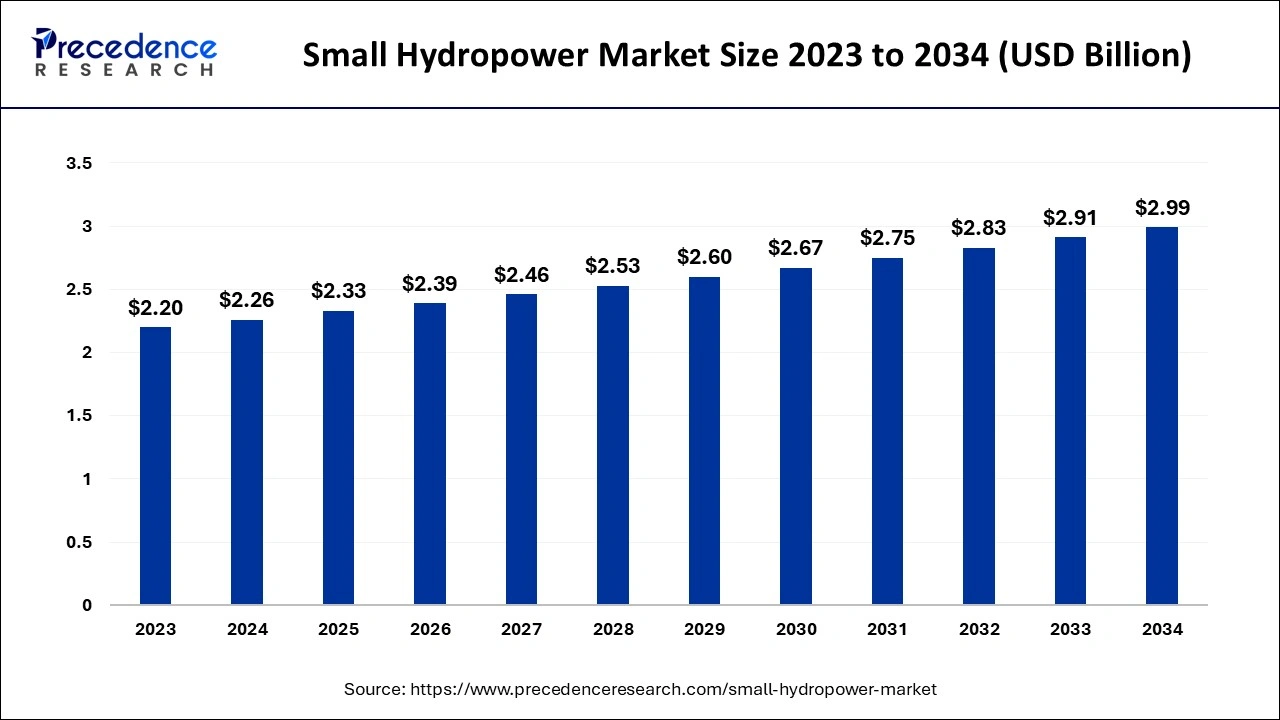

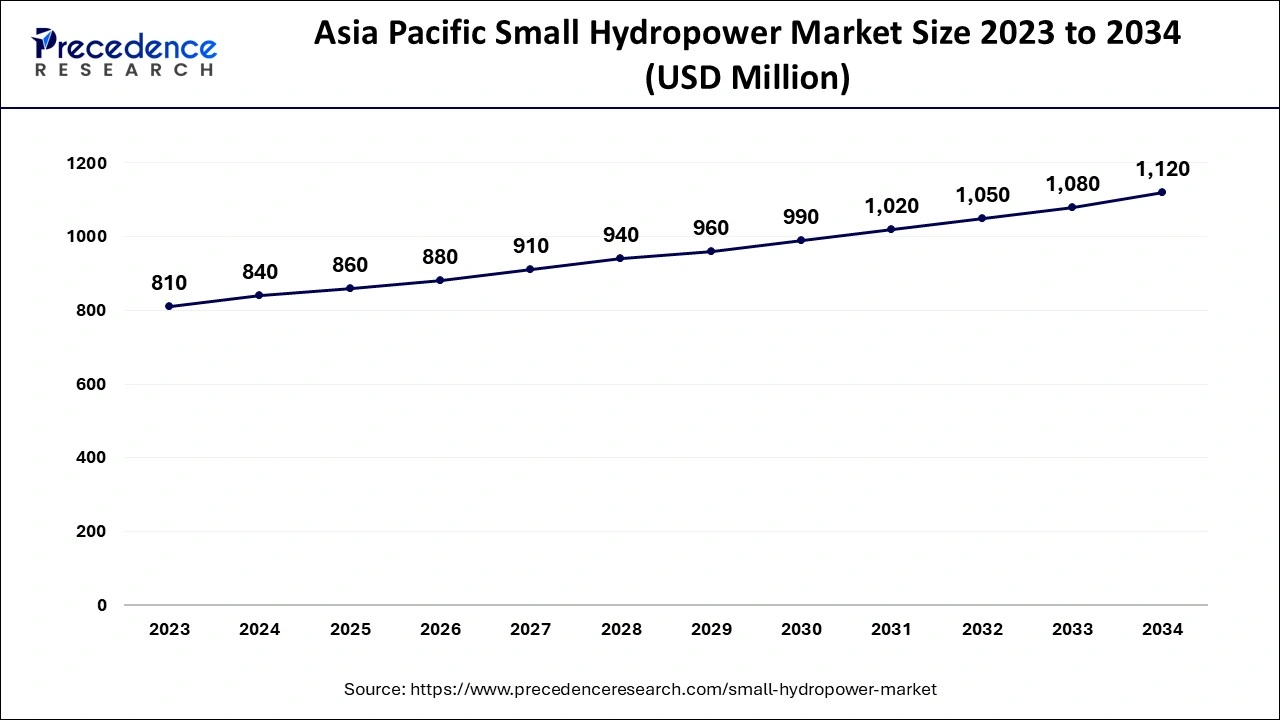

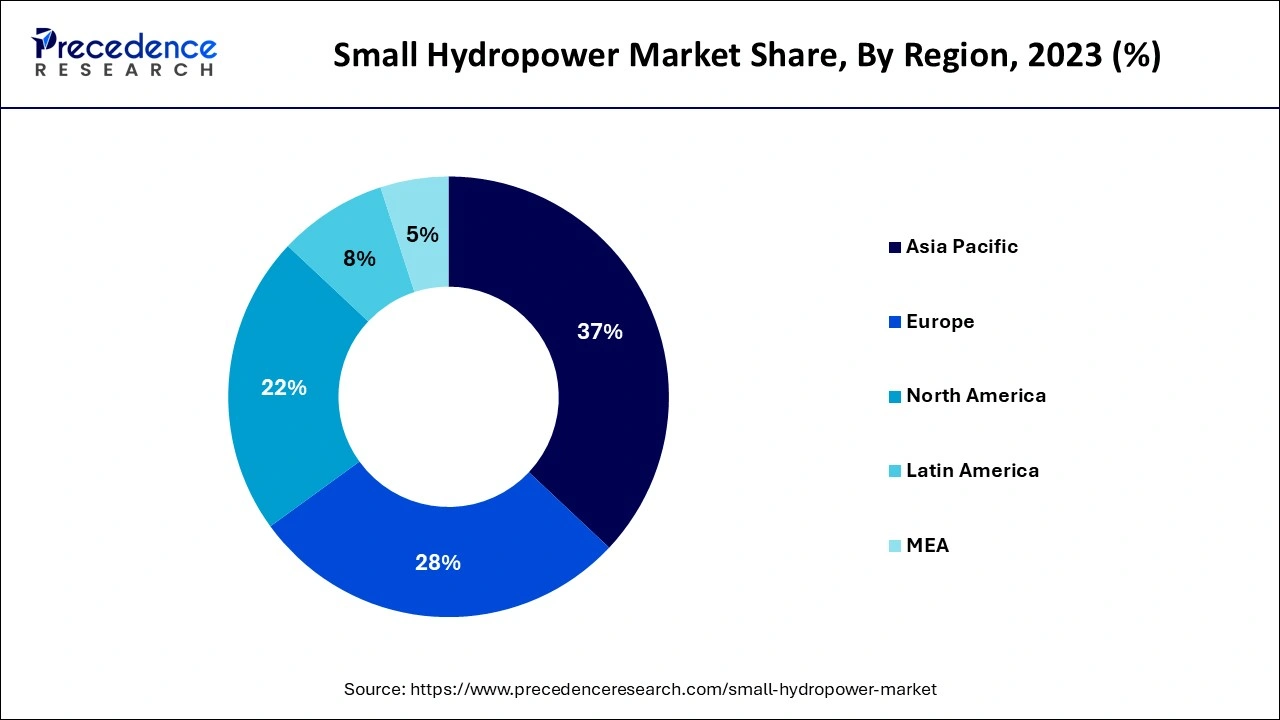

The global small hydropower market size is calculated at USD 2.26 billion in 2024, grew to USD 2.33 billion in 2025 and is predicted to reach around USD 2.99 billion by 2034, expanding at a CAGR of 2.82% between 2024 and 2034. The Asia Pacific small hydropower market size is worth around USD 840 million in 2024 and is growing at a CAGR of 2.98% during the forecast year.

The global small hydropower market size accounted for USD 2.26 billion in 2024 and is estimated to surpass around USD 2.99 billion by 2034, growing at a CAGR of 2.82% from 2024 to 2034. The small hydropower market is growing due to increasing demand for clean energy, policies, and technologies, growing focus towards sustainable and renewable power.

The Asia Pacific small hydropower market size accounted for USD 840 million in 2024 and is expected to be worth around USD 1,120 million by 2034, with a CAGR of 2.98% from 2024 to 2034.

Asia Pacific held the largest share of the small hydropower market in 2023. This is due to the availability of water, rising power consumption, and government policies for renewable power in the area. Governments of the nations, including China, India, Japan, and South Korea, have policies that support small hydropower projects and hence facilitate the development of such facilities. Furthermore, the market has received support from infrastructure investment as well as innovations in technology.

Some hydropower plants in India

| Name | State and river | Year of establishment | Highlights |

| Rangit Dam | State- Sikkim

River- Ranjit |

2000 | It is the highest dam in Sikkim. |

| Teesta Dam |

State- Sikkim River- Teesta |

2003 | This dam comprises 3 turbines for hydropower generation. |

| Indra Sagar Dam |

State- MP River- Narmada river |

2005 | It is the largest reservoir in India. |

| Karcham Wangtoo |

State- Himachal Pradesh River- Satluj |

2005 | - |

| Bansagar |

State- Madhya Pradesh River- Sone |

2006 | - |

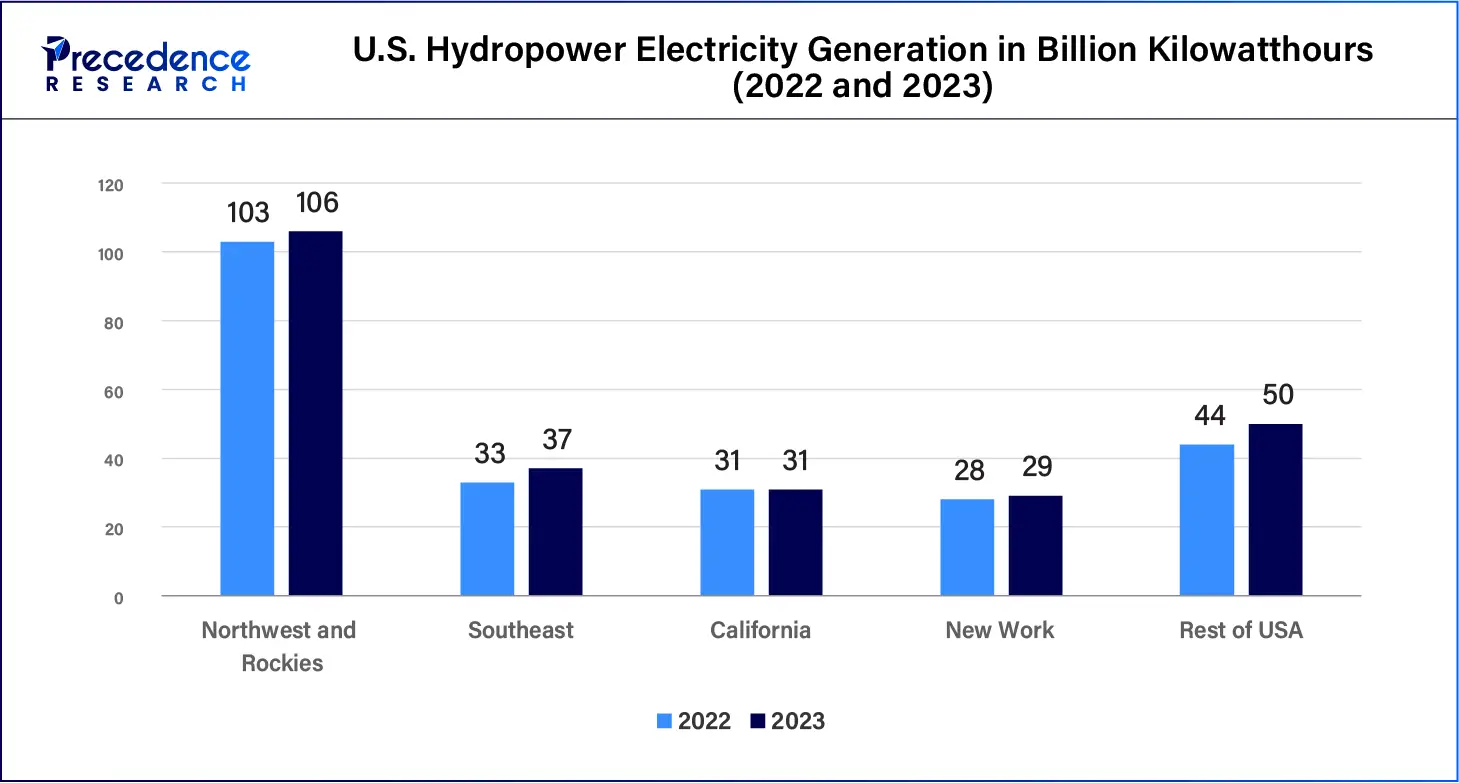

North America is expected to showcase notable growth in the small hydropower market in the upcoming period. This is attributed to increasing off-grid power generation and rural electrification, as well as rising investments in response to climate change, particularly in renewable and small hydropower projects. The market has been established due to government initiatives, infrastructure advancement, and revolutions in technology. Improving the perception of renewable energy and escalating power usage throughout this region.

The small hydropower market uses the flow of water on a turbine that is linked to the generator for the generation of power. Small hydropower is the use of hydroelectric power on the scale of local use by small community or industry power needs or to add to the electricity distribution of a region. They can reduce the generation of electricity using dirty diesel generators to clean electricity generation. In areas such as mountainous regions, small hydropower provides a cost-effective means of power generation for such communities. Small hydropower plants are modern and efficient technologies to provide sustainable energy.

AI Impact on the Small Hydropower Market

In the small hydropower market, Artificial Intelligence (AI) and ML algorithms are used to analyze hydropower plant data, identify patterns and trends, predict future conditions, and recommend optimal operating strategies. AI-powered hydropower optimization employs artificial intelligence and machine learning to enhance the performance and operation of hydropower plants. This process is based on the efficient use of data and knowledge, a proactive approach at different stages, and using advanced algorithms to optimize the yield, reduce expenses, and reduce the negative impact of energy production on the environment.

The combination of using AI to optimize the small hydropower market resources and materials improves the effectiveness of climate initiatives through increased energy generation and decreased effects on the environment. As reservoir management, turbines, and grid couplings are maximized, this innovation improves the efficient production of renewable energies and the elimination of fossil fuels and carbon emissions to create a sustainable energy future.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.99 Billion |

| Market Size in 2024 | USD 2.26 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.82% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Capacity, Component, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for renewable energy

The demand for renewable energy is fostering technological development within the small hydropower market. Small hydropower (SHP) is also called a low-cost energy source and can be used as an optimal solution for regions. Small hydropower presents a reliable and sustainable solution in the assessment of the increasing focus on reducing greenhouse gas emissions and transitioning to cleaner sources of electric power. SHP can also assist in controlling the emission of negative air quality and protect against fuel shortages and high costs. Hydroelectric power is a safe, efficient, and economical solution for clean power generation and, more importantly, water management.

Environmental impact

The small hydropower market is able to produce clean electricity, but it has significant environmental effects that significantly affect the aquatic system. The construction can change the aquatic structure and environment. The fixed investment cost of developing a hydropower plant is very high. Hydropower production will depend on the amount of rainfall in the area, as in dry seasons, there is power rationing, or sometimes it’s very low.

Increasing integration of IoT with hydropower

The application of Internet of Things (IoT) technology in the small hydropower market is a great opportunity to improve its productivity. IoT helps manage the collection of real-time data from the hydropower system to help predict maintenance time and improve the use of the systems and resources.

Through the use of smart sensors as well as analyses of data in the small hydropower market, operators can be in a position to maximize the efficiency of energy generation, minimize times when the system is not generating energy, and improve the system’s reliability. Moreover, IoT solutions provide an opportunity for remote control and, thus, enhance the availability and profitability of small hydropower.

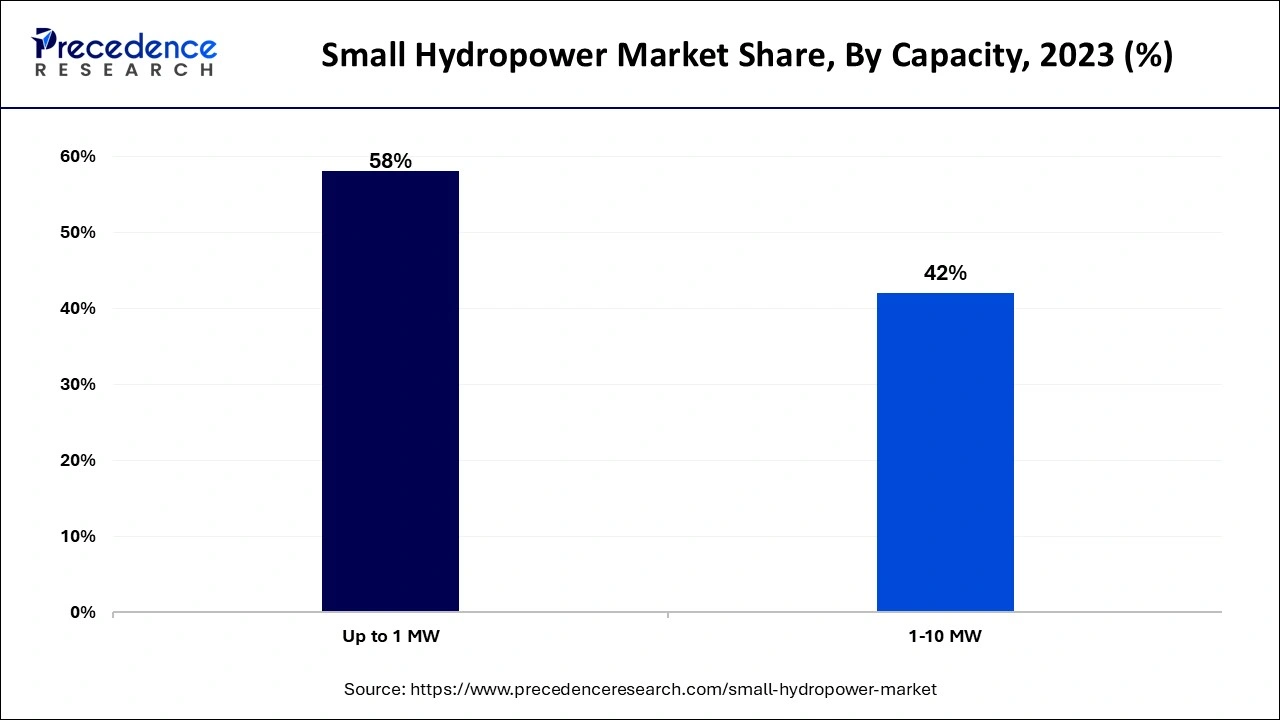

The up to 1 MW segment accounted for the largest share of the small hydropower market in 2023. Globally, small hydropower plants with installed capacity of up to 1 MW are one of the most significant segments of hydropower. This type of system is installed in regions with water flow, including mountains and foothills, and can be integrated into individual facilities or the grid.

The 1 MW to 10 MW capacity segment will register the fastest growth in the small hydropower market during the foreseeable period. 1 – 10 MW small hydropower having higher head and installed capacity than below 1 MW small hydropower. An analysis based on the investment costs per kW of 1 – 10 MW small hydropower plant projects is substantially lower than below 1 MW small hydropower.

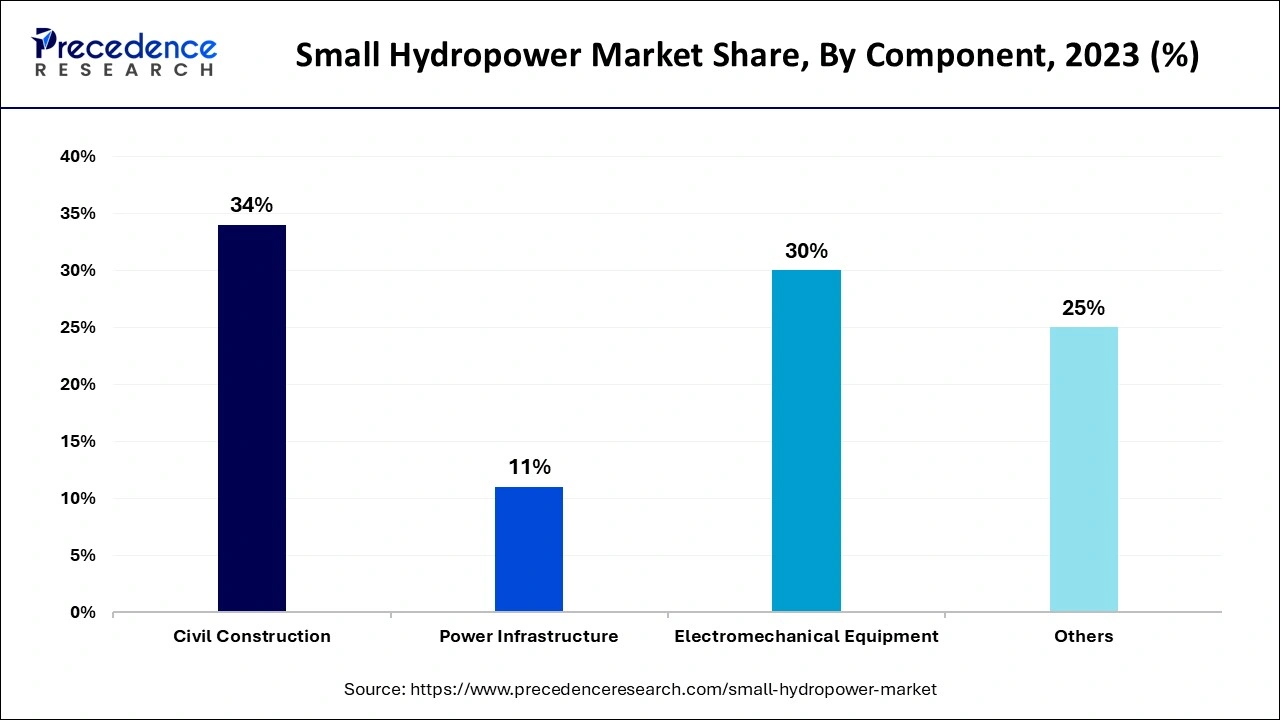

The civil construction segment dominated the global small hydropower market in 2023. Hydroplants are electrical generators that produce electricity based on the flow of water, which makes them very accurate. The most efficient renewable energy process in hydropower engineering. Hydroelectric generators transform the mechanical energy possessed by the water in motion into electricity. Hydropower plants include the use of electrical and mechanical appliances and systems. The mechanical elements are gates, turbine, gear Box, tanks, piping, the hydraulic power unit, and the electrical components include the generator, automatic voltage regulator, transformer, and transmission line.

The electromechanical equipment segment is expected to grow significantly in the small hydropower market during the forecast period. Hydropower plants are built to generate electricity from the energy of moving water. Advancements in construction technologies and techniques have facilitated the development of small hydropower projects, making them more efficient and cost-effective.

The micro hydropower segment held the largest share of the small hydropower market in 2023. Hydropower plant of micro type produces up to 100 kilowatts of electric power. A micro hydro power plant is designed to generate power for a house, farm, ranch, or village. Microhydro power is the simplest and most reliable source of renewable energy for the property. Micro hydropower systems generate a continuous and predictable supply of electrical energy in contrast to other attractive, scalable renewable technologies.

The mini segment is expected to grow significantly in the small hydropower market during the forecast period. These are power plants of less than 10MW, which capitalize on mini water currents and are suitable for offering electricity services to rural or remote regions. A project of these characteristics can continuously generate a massive amount of energy at an incredibly low cost. Existing and new buildings and structures and any other facilities that require a flow of water can install mini-hydroelectric power plants to supply energy to rural areas or any region not connected to the electrical grid. The construction of a mini-hydropower plant not only provides a benefit to society at large by helping to reduce greenhouse gas emissions.

Segments Covered in the Report

By Capacity

By Component

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

July 2024