January 2025

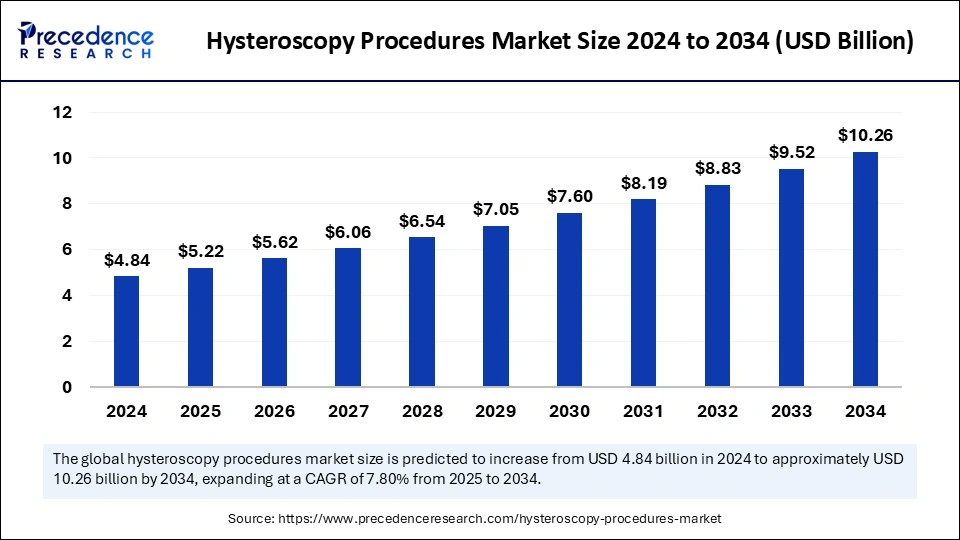

The global hysteroscopy procedures market size is calculated at USD 5.22 billion in 2025 and is forecasted to reach around USD 10.26 billion by 2034, accelerating at a CAGR of 7.80% from 2025 to 2034. The North America market size surpassed USD 1.89 billion in 2024 and is expanding at a CAGR of 7.91% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hysteroscopy procedures market size accounted for USD 4.84 billion in 2024 and is predicted to increase from USD 5.22 billion in 2025 to approximately USD 10.26 billion by 2034, expanding at a CAGR of 7.80% from 2025 to 2034. The hysteroscopy procedures market is driven by increasing gynecological disorders, advancements in hysteroscopy equipment, and government healthcare investments.

The application of artificial intelligence systems in hysteroscopy procedures enhances diagnosis and treatment methods for gynecological conditions in the hysteroscopy procedures market. The advanced AI techniques enable accurate detection of medical conditions, including uterine cancer, thus allowing doctors to make early diagnoses for better patient results. AI models incorporate hysteroscopic data collection and personal medical information through hormone tests and pregnancy records, which helps produce exact results about fertility outcomes.

The adoption of hysteroscopy in clinical settings increases because AI enhances the safety, accuracy, and efficiency of complex processes, including image interpretation and risk assessment. AI will play an expanding role in developing minimally invasive gynecological care with evolving technology that improves the accuracy of medical diagnosis and treatment methods.

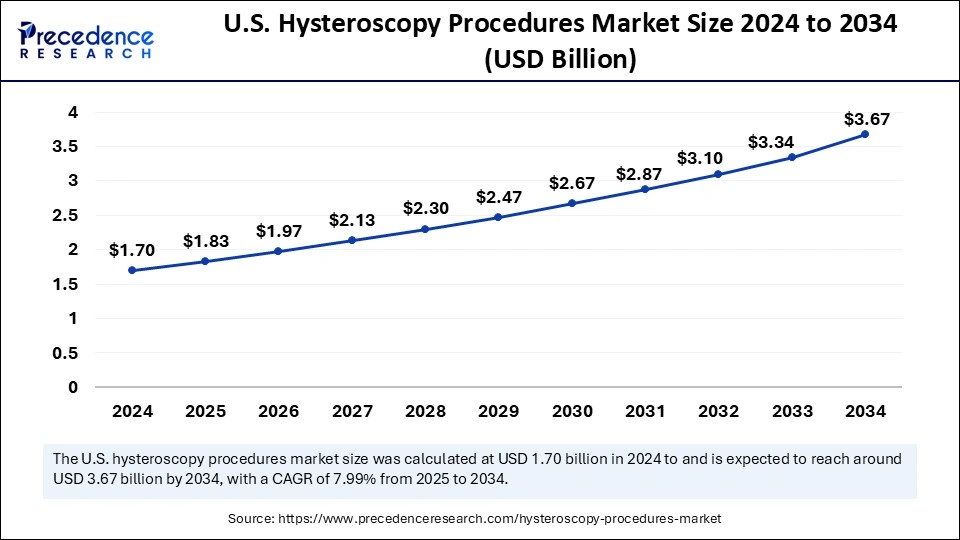

The U.S. hysteroscopy procedures market size was exhibited at USD 1.70 billion in 2024 and is projected to be worth around USD 3.67 billion by 2034, growing at a CAGR of 7.99% from 2025 to 2034.

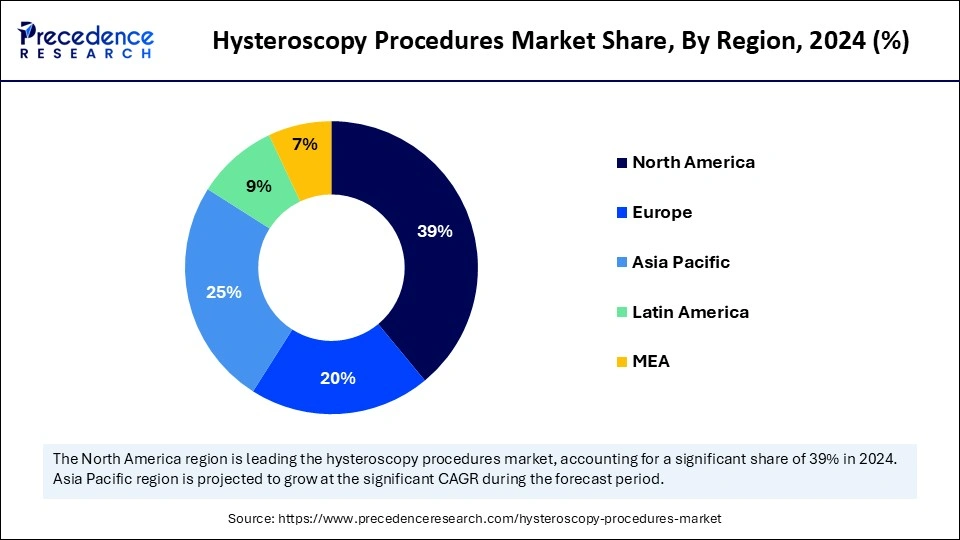

North America held the dominating share of the hysteroscopy procedures market in 2024. The strong healthcare system enables extensive medical technology implementation and minimally invasive surgeries, including hysteroscopy. A growing number of women require gynecological testing and treatment because many individuals face conditions like uterine fibroids, polyps, and abnormal bleeding. Multiple healthcare facilities can efficiently adopt hysteroscopy techniques because of increased accessibility, which speeds up its adoption rate.

Advanced hysteroscopy technologies spread widely throughout the U.S. healthcare system because they combine technological advancement with expensive healthcare financing. Leading market players operating in the U.S. strengthen the market while dedicating their efforts to developing efficient, user-friendly instruments, including high-definition imaging systems and improved hysteroscopes.

Asia Pacific is expected to witness the fastest rate of growth in the hysteroscopy procedures market during the predicted timeframe. The surge in healthcare infrastructure modernization initiatives from governments drives regional growth primarily because it enhances access to advanced medical technologies. The substantial population in this region creates a rising need for gynecological treatments. The improved healthcare investments by countries such as China, India, and Japan will drive market expansion because they provide patients with enhanced access to advanced diagnostic tools and treatment technologies.

The healthcare requirements for gynecological procedures in India are increasing due to higher rates of uterine fibroids, polyps, and abnormal bleeding among its large population. The Indian government dedicates substantial resources to developing healthcare facilities that advance the accessibility of complex medical devices, including hysteroscopy.

In February 2024, the Bennett, Coleman, and Co. report indicated that India diagnoses about 340,000 women with cervical cancer each year, which will boost the market demand for associated products.

Europe is expected to witness sustainable growth in the hysteroscopy procedures market during the predicted timeframe. An increased focus on gynecological health diagnosis by patients in the UK drives demand for hysteroscopy instruments. Health outreach programs and educational programs motivate women to obtain screening appointments and diagnostic evaluations, thus boosting the adoption of hysteroscopy for prompt gynecological condition identification and therapy.

Hysteroscopy is a minimally invasive procedure used to observe the inside of the uterus, mainly to diagnose and treat several gynecological conditions, including uterine polyps, fibroids, adhesions, and abnormal bleeding. The intervention has diagnostic and therapeutic value since it aids doctors in making medical diagnoses while simultaneously providing treatment by eliminating growths and fixing anatomical problems. The minimally invasive approach of hysteroscopy delivers benefits against traditional surgery because it leads to shorter hospital stays accompanied by decreased infection risk and fewer postoperative problems.

The hysteroscopy procedures market is experiencing growth because the number of gynecological disorders such as fibroids, polyps, and abnormal bleeding of the uterus is increasing, thereby creating demand for diagnostic and treatment options. The market growth of hysteroscopy expands due to growing patient and healthcare professional interest in minimally invasive procedures because these approaches lead to increased recovery time and reduced complications than surgical treatment.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.26 Billion |

| Market Size in 2025 | USD 5.22 Billion |

| Market Size in 2024 | USD 4.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.80% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | CPT Codes, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing incidence of gynecological disorders

The gynecological conditions act as a principal force that drives market expansion within hysteroscopy procedures. Fibroids, polyps, endometriosis, and abnormal uterine bleeding are becoming more prevalent worldwide among female patients. The various gynecological disorders produce pelvic pain and heavy menstrual bleeding with optional infertility, which decreases women's daily functioning. The rising numbers of gynecological conditions stem from changes in lifestyle patterns, late pregnancy choices, and obesity-related factors.

The minimally invasive hysteroscopy gives patients a less invasive surgical option to confirm diagnoses and deliver precise medical treatments. The benefits from hysteroscopy, such as reduced recovery duration, minor pain, and reduced complications, have resulted in growing popularity as a treatment option among women.

Growing preference for minimally invasive procedures

Patients and healthcare providers now prefer medical procedures that require minimal incisions, reduced complications, and shorter timelines for recovery. The diagnostic procedure called hysteroscopy requires specialists to use a thin illuminating tube through the cervix to inspect the uterine space, thus making it less intensive than standard surgical approaches. This approach reduced the risk of pathogen infections and shortened treatment duration in hospitals and rehabilitation periods. The adoption of hysteroscopy has increased because clinical research shows effectiveness and security.

Reimbursement challenges

Reimbursement challenges act as a major obstacle that hinders the expansion of the hysteroscopy procedures market growth. The payment policies for hysteroscopy procedures in various regions fail to match either the insufficiency of existing coverage or the expenditure required to conduct the procedure. The inconsistent reimbursement guidelines that span different regional areas create additional barriers to hysteroscopy adoption by healthcare providers. The development of favorable reimbursement systems that follow standardized guidelines with policymaker collaboration on minimally invasive procedure access represents essential measures to address this restraint.

Increasing healthcare investment

The increasing investments in healthcare infrastructure have resulted in multiple centers that use advanced equipment and qualified specialists to deliver better hysteroscopy service availability. Rising healthcare expenditure supports medical technology development, which enables research of better hysteroscopic equipment that is sophisticated and efficient. Advanced innovations have improved the security, precision, and effectiveness of hysteroscopy medical treatments, thus attracting healthcare providers and patients. The rising healthcare spending creates conditions that will drive significant market growth in hysteroscopy procedures by improving access and equipment quality while generating better patient results.

The 58558 CPT code segment contributed the largest share of the hysteroscopy procedures market in 2024. The American Medical Association (AMA) has created CPT code 58558 to document diagnostic and therapeutic surgery through hysteroscopy that includes biopsy. The single code sustains multiple hysteroscopy usages to diagnose and treat various vaginal conditions, such as polyps and fibroids, as well as instances of abnormal bleeding.

Healthcare providers rely on CPT code 58558 as their main code to obtain reimbursement from insurance firms and government healthcare programs. The increase in gynecological condition occurrences produces growing hysteroscopy procedure volumes, which subsequently elevates CPT code 58558 usage. Healthcare providers obtain proper financial remuneration through precise billing and coding implementation of CPT code 58558, thus preserving hysteroscopy service sustainability.

The 58562 CPT code segment is expected to grow considerably in market. The medical procedure exists to treat fibroid-related symptoms such as abnormal uterine bleeding and pelvic pain through its minimally invasive approach beyond traditional surgical solutions. Medical professionals use CPT code 58562 to treat the increasing cases of uterine fibroids.

Medical professionals expect higher use of this code because patients become more interested in receiving minimally invasive treatments. The market is adopting CPT code 58562 because patients find the procedure benefits attractive for their reduced complications and shorter recovery times with improved patient comfort. The market segment expects to gain more patients interested in fibroid treatment because of the growing demand from patients.

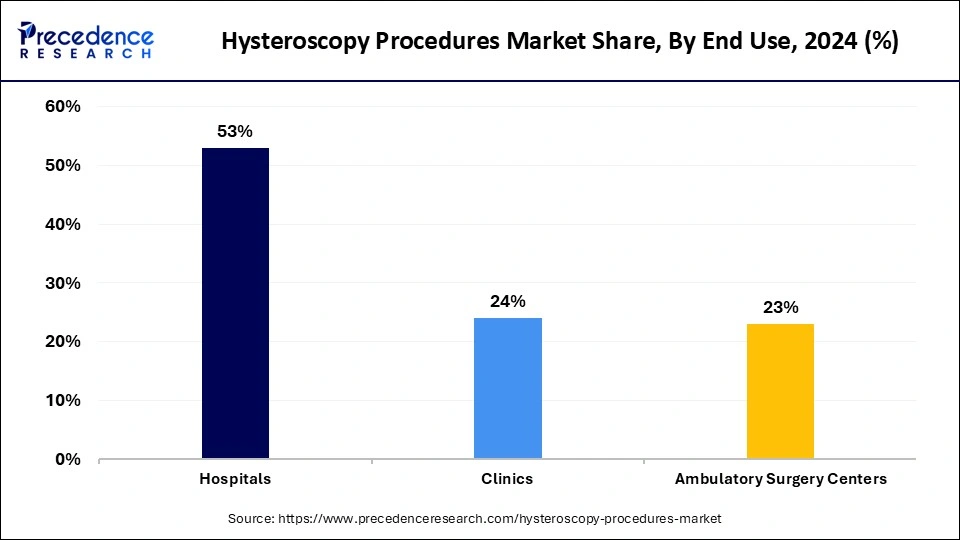

The hospitals segment accounted for the largest share of the hysteroscopy procedures market. As primary healthcare centers, hospitals deliver various medical services that include correct diagnostic procedures and therapeutic gynecological interventions. The procedure of hysteroscopy has become essential in detecting and treating pelvic pain while it also addresses uterine fibroids, polyps, and cervical cancer conditions. Research shows growing gynecological disorders lead to increased hospital-level demands for hysteroscopic procedure availability.

Hospitals consider hysteroscopy beneficial because this technique operates efficiently for detection and treatment purposes in gynecological care. The widespread popularity of hysteroscopy in hospitals depends on its ability to deliver minimally invasive treatments.

The ambulatory surgery centers segment is anticipated to witness significant growth in the market over the studied period. Patients choose them for their efficient and cost-effective approaches to medical treatment. The popularity of hysteroscopy procedures continues to rise in outpatient centers because these facilities provide high-quality care at reduced prices compared to traditional hospitals.

Minimally invasive gynecological treatments performed by patients at ASCs are anticipated to increase the market demand for hysteroscopy instruments. Better hysteroscopic technology with high-definition cameras, small scopes, and optimized procedure efficiency drives adoption because these innovations make the procedures safer and more efficient.

By CPT Codes

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

May 2024

July 2024