November 2024

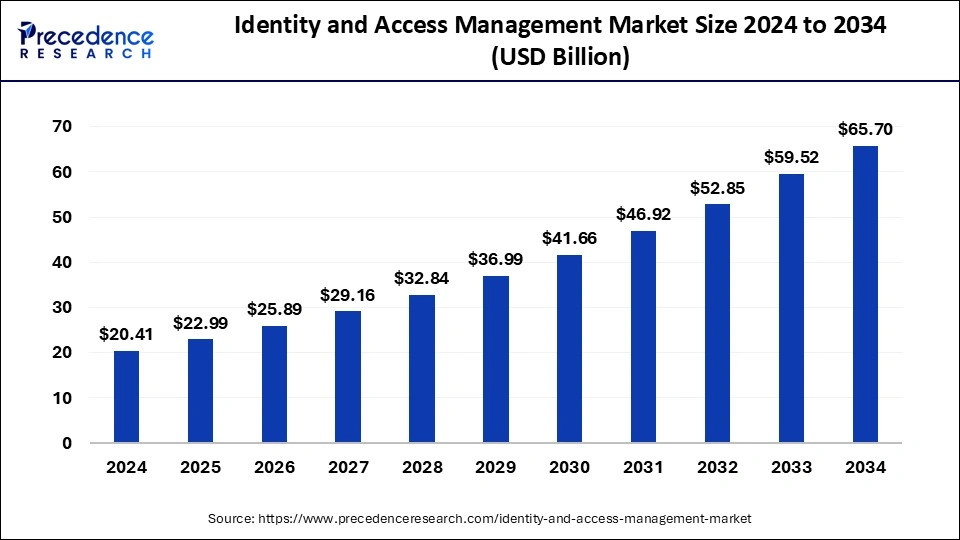

The global identity and access management market size is calculated at USD 22.99 billion in 2025 and is forecasted to reach around USD 65.70 billion by 2034, accelerating at a CAGR of 12.40% from 2025 to 2034. The North America market size surpassed USD 7.55 billion in 2024 and is expanding at a CAGR of 12.43% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global identity and access management market size accounted for USD 20.41 billion in 2024 and is predicted to increase from USD 22.99 billion in 2025 to approximately USD 65.70 billion by 2034, expanding at a CAGR of 12.40% from 2025 to 2034.

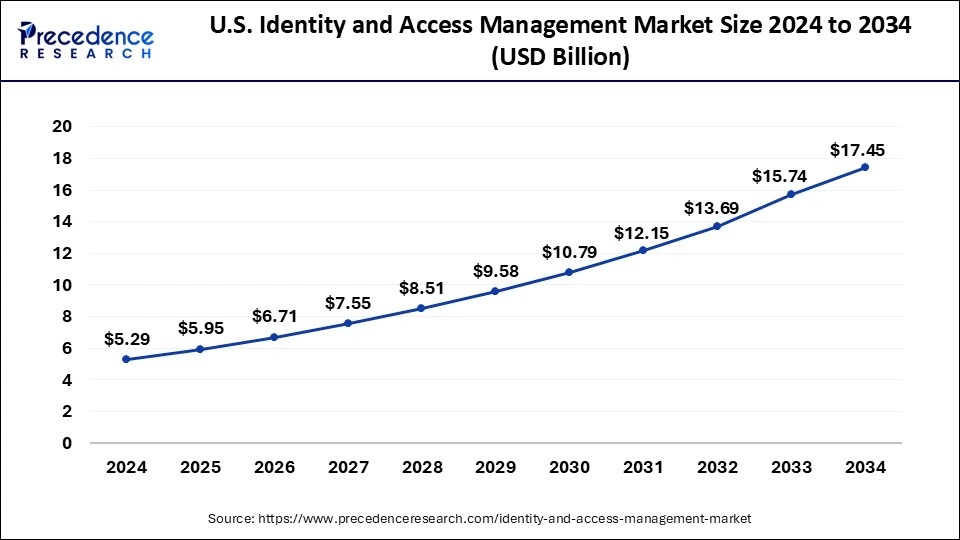

The U.S. identity and access management market size was exhibited at USD 5.29 billion in 2024 and is projected to be worth around USD 17.45 billion by 2034, growing at a CAGR of 12.68% from 2025 to 2034.

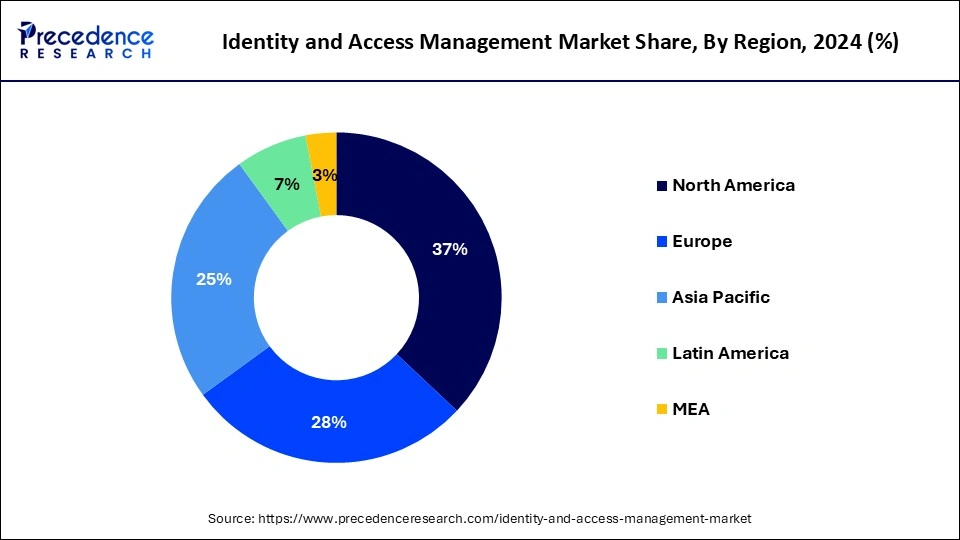

North America dominated the global identity and access management market in 2024. The region is home to numerous enterprises with sophisticated IT infrastructures. The rapid evolution of complex IT infrastructures, including work-from-home or hybrid in-office structures demanding remote access, has significantly increased the significance of robust IAM solutions. The region’s growth is driven by the rising cases of cyber-attacks, growing awareness of security concerns, rising adoption of cloud-based services, and stringent regulatory compliance requirements.

North America is also a hub for several small and medium-sized businesses and large corporations, which increases the need for the protection of consumer data of the employees in the organization. Furthermore, the key market players in the region are focusing on several strategic initiatives such as partnerships or collaborations, mergers & acquisitions, and new products or technology development. Thus, this is expected to propel the growth of the identity and access management market’s growth in the region during the forecast period.

Asia Pacific is expected to witness the fastest growth in the identity and access management market during the forecast period. The region’s growth is attributed to the increasing number of security threats and data breaches in emerging nations, including India, Japan, and China. Several MNCs, as well as small and medium-sized businesses, are in these countries, which increases the need for cybersecurity management and data protection and, in turn, spurs the demand for identity and access management (IAM).

IAM solutions help ensure that the right individuals are provided with appropriate access privileges to systems, applications, and data, and maintain security and compliance standards. Other factors such as the surge in digitization of operations, hybrid or work-from-home model, rapid development of digital infrastructure, rising internet penetration, and supportive government framework are fuelling the identity and access management market growth.

With the surge in digital workspaces and marketplaces, identity and access management play an integral part in every business. Identity and access management (IAM) encompasses the processes and technologies utilized to monitor and control access to a company's digital resources, such as applications, networks, and organizational and user data. IAM deals with the user's access to digital resources and what the user can do with those resources. IAM systems assist in keeping the hackers out while ensuring that each user is offered the exact permissions, they need to do their assigned task and not more than that. Identity and access management solutions assist in assuring that cloud, on-premises, and hybrid systems provide the right roles and individuals the right access at the right time.

| Report Coverage | Details |

| Market Size by 2034 | USD 65.70 Billion |

| Market Size in 2025 | USD 22.99 Billion |

| Market Size in 2024 | USD 20.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid adoption of cloud-based services

The increasing adoption of cloud-based solutions is projected to boost the expansion of the identity and access management market in the coming years. The massive shift towards cloud-delivered IAM and PAM solutions is increasingly becoming popular. Cloud-based solutions have positively impacted digital transformation in several organizations, including BFSI, manufacturing, healthcare, retail, healthcare, IT & Telecom, and others. These solutions provide flexibility, scalability, and cost-effectiveness, which makes them gain popularity among businesses to improve their security posture within a cloud-centric environment. Thus, it is expected to fuel the market’s growth during the forecast period.

High costs

The high cost associated with the identity and access management market is anticipated to hamper the market's growth. High capital investment is required for the installation of the IAM system. Identity and access management solutions require expensive IT infrastructure investment to operate effectively. Several small and medium-sized companies are often discouraged from adopting these technologies due to budget constraints. In addition, the need for IT infrastructure and awareness regarding advanced security solutions in lower and middle-income countries is likely to limit the expansion of the global market.

Surge in cybersecurity cases

The rise in cybersecurity cases is expected to boost the growth of the identity and access management market during the forecast period. The market has witnessed a substantial surge in cyberattacks, which has compelled companies to invest in sophisticated IAM systems for data security and controlled access. Cyberattack escalation is attributed to modern technologies, including machine learning, which often enable attackers or hackers to generate multiple variants of malicious code daily. Safeguarding businesses against cyber threats has become a necessity, which has prompted businesses to use IAM solutions.

In today’s IT environment, IAM plays an integral role in efficiently authorizing geographically dispersed workforces as they are connected to various internal resources, cloud resources, and especially software-as-a-service (SaaS) applications. IAM assists businesses in managing digital identities and controlling access to resources within their networks. This has greatly accelerated the usage of IAM systems in different sectors, bolstering the identity and access management market growth.

The provisioning segment held the largest share of the identity and access management market in 2024. Identity management as a service offers an additional layer of security by verifying and offering access to individuals to a secured company's systems and applications. Companies are aggressively seeking to adopt cloud-based solutions that manage security and risk management and manage remote working.

The multifactor authentication segment is expected to grow rapidly in the identity and access management market over the forecast period. The growth of the segment is driven by the rising adoption of multifactor authentication in several businesses to enhance overall security. The sub-segment adds an additional layer of security, and users are required to provide multiple credentials and a user ID to access a wide range of the company’s applications. Therefore, considering these factors, the deployment of the market contributes to the growth of the market.

The cloud segment accounted for the dominating share of the identity and access management market in 2024 and is projected to continue its dominance over the forecast period owing to the efficient functionality of the system without requiring an external network connection and access through WAN. In the era of the evolving digital landscape, the cases of data breaches and cyber threats are increasing. Businesses prioritize securing access to the company’s resources and protecting sensitive information. Identity and access management (IAM) on-premise is the implementation of solutions within an organization's infrastructure. It involves the deployment of software, hardware, and servers on-site to manage the unique identities of users, authentication, and access privileges for establishing effective security measures.

The on-premise segment is expected to witness considerable growth in the global identity and access management market over the forecast period. IAM solutions in the cloud involve leveraging cloud-based services to manage user identities, access controls, and authentication. Cloud deployment is when resources such as software, servers, and data are accessed as services delivered over the internet. Cloud-based IAM solutions assist in eliminating the requirement for upfront infrastructure investments and reduce hardware and maintenance costs. Businesses pay for the resources and services they use. Therefore, the increasing adoption of cloud-based solutions accelerates the segment growth.

Cloud-based technology allows firms to back up critical company data for a longer period. IT workers are now mostly working in a multi-cloud environment, with nearly 1 out of every ten firms employing five or more clouds.

The public sector & utilities segment held the largest share of the identity and access management market in 2024. The public sector & utilities sector deal with large amounts of public data that are to be stored securely. Moreover, the increasing investment in public sector applications is one of the major factors that are boosting the segment’s growth.

The BFSI segment is expected to witness considerable growth in the identity and access management market over the forecast period. The rapid digitalization and increasing popularity of online payments, e-wallets, and others are anticipated to enhance the adoption of IAM solutions across the BFSI sector to ensure access to the right individuals and comply with stringent security regulations. The BFSI sector deals include critical information such as account numbers, details of credit/debit cards, passwords, and other important customer details. Such critical data emphasizes the significance of data security, and several measures have been taken to safeguard data against cyberattacks.

By Component

By Deployment

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

April 2025

April 2025

December 2024