October 2024

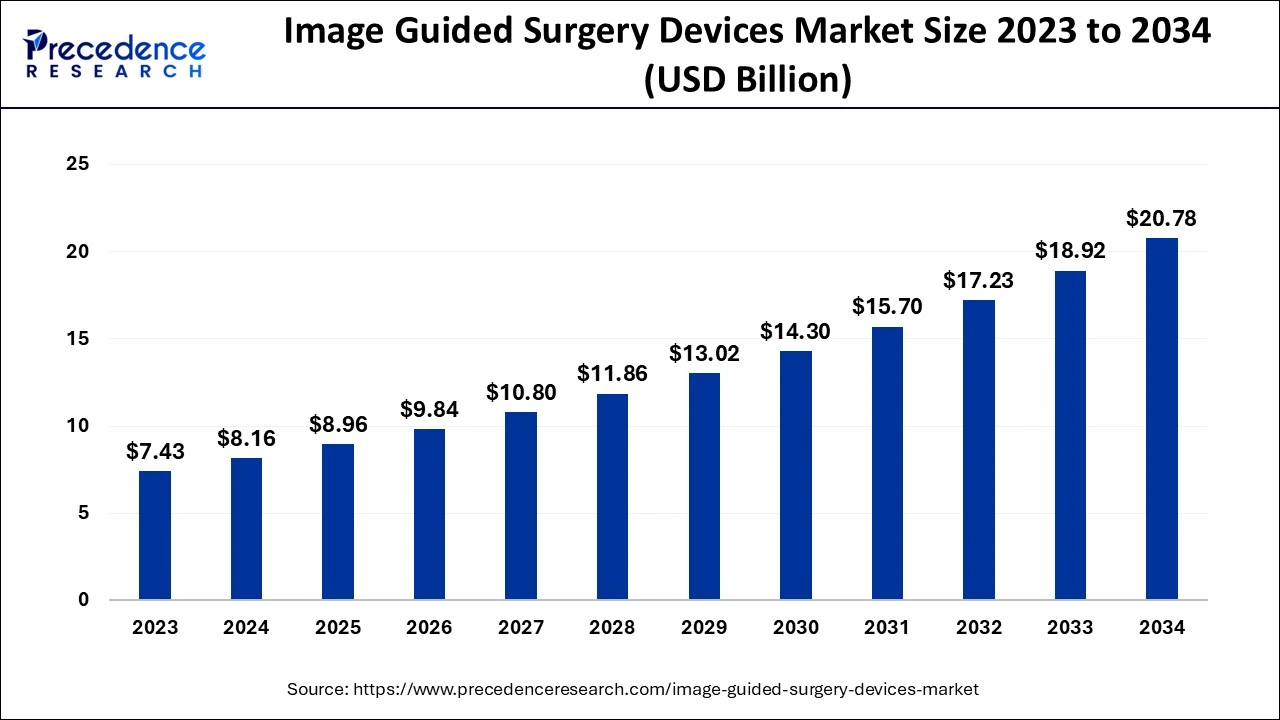

The global image guided surgery devices market size accounted for USD 8.16 billion in 2024, grew to USD 8.96 billion in 2025 and is predicted to surpass around USD 20.78 billion by 2034, representing a healthy CAGR of 9.80% between 2024 and 2034. The North America image guided surgery devices market size is calculated at USD 3.43 billion in 2024 and is expected to grow at a fastest CAGR of 9.92% during the forecast year.

The global image guided surgery devices market size is estimated at USD 8.16 billion in 2024 and is anticipated to reach around USD 20.78 billion by 2034, expanding at a CAGR of 9.80% from 2024 to 2034.

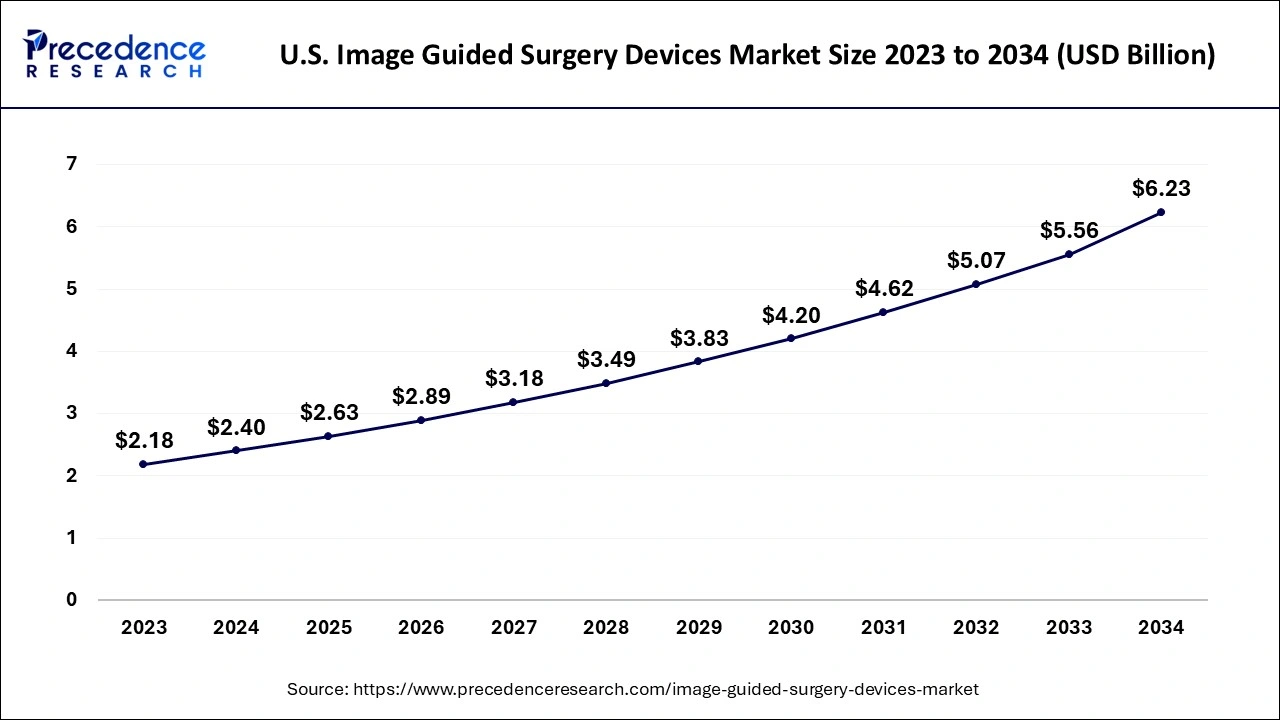

The U.S. image guided surgery devices market size is evaluated at USD 2.40 billion in 2024 and is predicted to be worth around USD 6.23 billion by 2034, rising at a CAGR of 10.02% from 2024 to 2034.

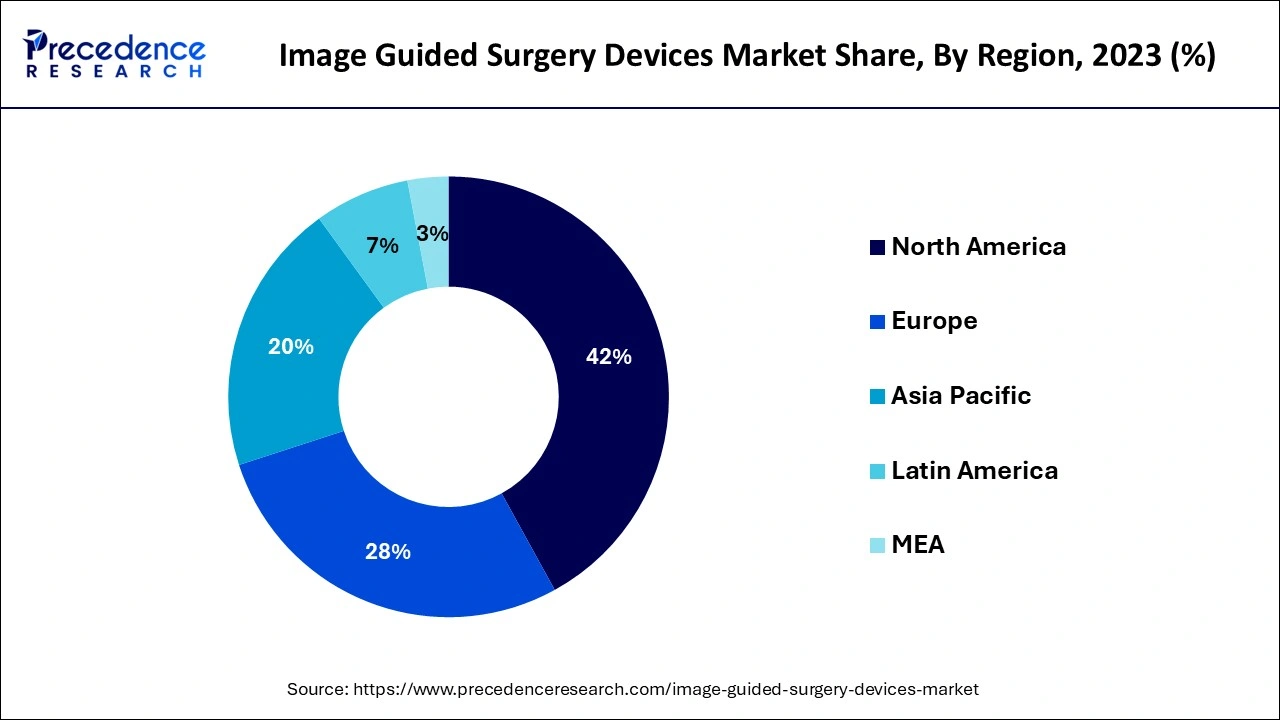

The global market is segmented into North America, Europe, Asia Pacific, and the Rest of the World based on regional analysis. Due to the adoption of new technology and the availability of highly skilled professionals to carry out elaborate and sophisticated procedures, North America and Europe now have the largest market share. Additionally, the rising prevalence of neurological disorders, rising demand for minimally invasive surgery, rising healthcare awareness, growing elderly population, and rising healthcare spending are all contributing to the market's expansion in these areas.

The sector is primarily driven by the increase in the elderly population, the demand for less invasive procedures, and technical developments in imaging systems. The market is growing as a result of the rising prevalence of chronic diseases like cancer as well as the increase in efforts for cancer treatment.

For instance, a global organisation for cancer research estimates that there will be around 19,292,789 new cases of cancer in 2020. In response to the COVID dilemma, the industry participants are concentrating on creating remote solutions, such as cloud-based training on virtual computers, to offer remote counselling and assistance to the patients. In order to give healthcare professionals access to online training for the Philips Ultrasound Affiniti system, Royal Philips and LeQuest teamed in November 2020.

A surgical technique known as image guided surgery involves the use of stained surgical instruments and preoperative or intraoperative photographs by the surgeon to either directly or indirectly influence the process. Image-guided surgery techniques employ cameras, ultrasonic, electromagnetic, or a combination of fields to record and transmit the patient's physical characteristics and the surgeon's precise progress with respect to the patient to computer monitors in the operating room or AR headsets.

Equipment for image-guided surgery supports the diagnosis and treatment of a variety of disorders. Using image-guided surgical technology allows for more accurate and effective surgery. Endoscopic sinus surgery (ESS), though originally developed for neurosurgery, quickly rose to the top of its uses. One of the most significant developments in endoscopic sinus surgery since the beginning of the endoscopic method is image-guided surgery. With the use of this technology, the surgeon may watch the anatomical dissection of the sinuses in real time on a computer display in the operating room.

Approximately 16% of the world's population, or one in six individuals, will be over 65 by 2050, up from 9% in 2019, predicts the United Nations' World Population Prospects. According to the WHO, chronic illnesses such excessive cholesterol, hypertension, cancer, and cognitive heart disorders are replacing infections as the leading cause of mortality worldwide. Thus, it is anticipated that there will be an increase in demand for image-guided treatment systems in the upcoming years to treat these illnesses.

The demand for minimally intrusive treatments is another factor driving business expansion. The adoption of minimally invasive techniques for some common operations can lower postoperative problems and can also decrease healthcare expenditures, according to a nationwide survey research by Johns Hopkins Medicine. As a result, the market is anticipated to grow as a result of the rising demand for less invasive image-guided treatments.

In the UK, radiation is used to treat more than 120,000 patients each year, according to the Institute of Cancer Research. Systems for image-guided treatment have substantially advanced, enabling procedures that are safer and more accurate. For instance, GE Healthcare introduced the Allia IGS 7 angiography system in December 2020. The system was expected to promote workflow effectiveness, simplify the adoption of enhanced image guidance in everyday practise, and improve user experience.

The market is expanding as a result of several initiatives to promote cancer radiation and rising private sector investments in the creation of sophisticated image-guided treatment devices. Several organisations engaged in cancer radiation research include Cancer Research U.K., Medical Research Council, and National Institute for Health Research. For instance, the Department of Radiation Oncology at Stanford Medicine is conducting research to create platforms for minimally invasive cancer diagnosis, imaging, and therapy.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.16 Billion |

| Market Size by 2034 | USD 20.78 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End User, Application, and Geography |

The growing popularity of computer assisted surgery

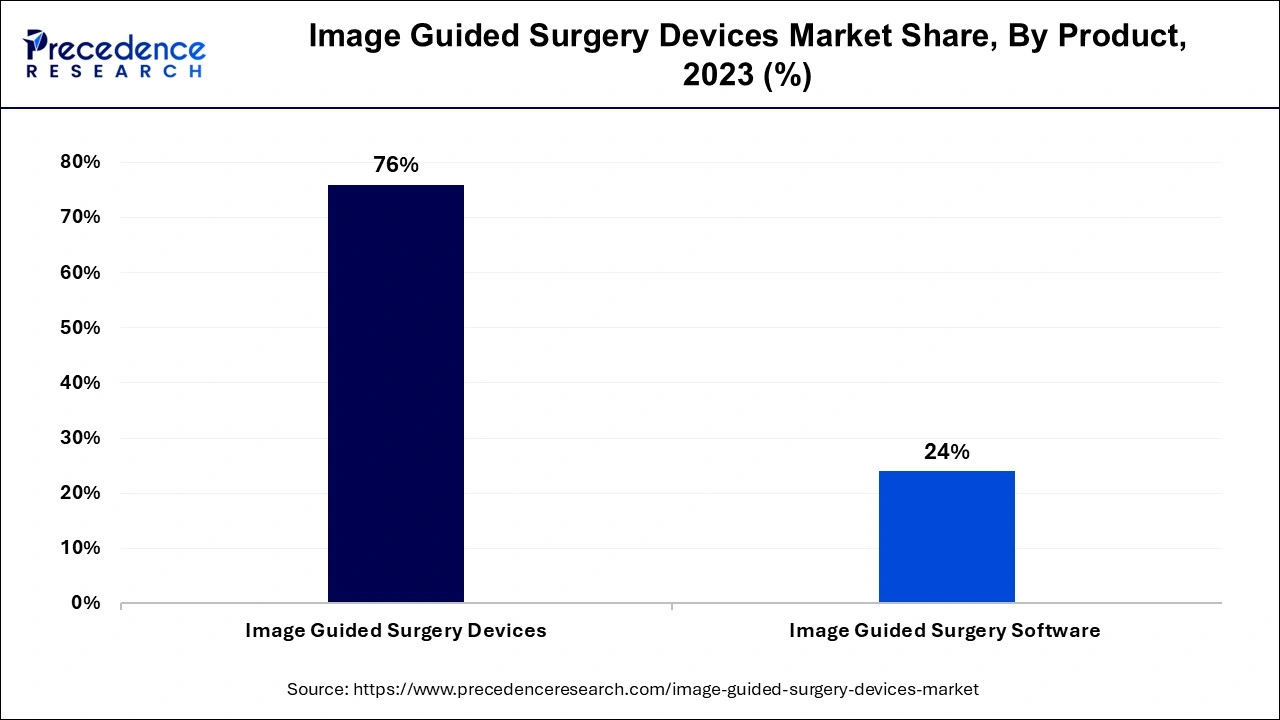

In 2023, the endoscopes category had the highest revenue share more than 32%. The segment is being driven by the rising prevalence of gastrointestinal and cancer illnesses as well as the need for interventional endoscopic systems.

In addition, the endoscopes market is anticipated to grow at the highest CAGR over the forecast period due to endoscopic technology developments and subsequent product releases. For soft tissue approximation and endoscopic application of sutures, the OverStitchSx endoscopic suturing device from Apollo Endosurgery got FDA clearance in November 2017.

In 2023, Magnetic Resonance Imaging (MRI) surpassed the first-largest product group. In the upcoming years, the category is anticipated to see attractive growth potential. The main drivers of the category growth are technological developments and the broad range of applications for these therapies in treatment planning, location and delivery, and treatment response evaluation. Major applications for these systems may be found in the treatment of trauma, neurology, and radiation oncology. Thus, it is anticipated that the growing burden of these diseases would further increase product demand.

In 2023, the hospitals sector's revenue share was above 37%, which was the highest. The two main drivers driving the segment are the rise in different procedures and the widespread use of image-guided treatment systems in hospitals. Due to the growing demand for clinical workflows to be optimized cost-effectively, hospitals are implementing these technologies.

Over the projected period, the market for ambulatory surgical centres (ASCs) is predicted to grow at the quickest rate. This rise is linked to the benefits that these healthcare venues provide, including shorter wait times and considerable financial savings. The rising popularity of same-day surgery in developed countries is a result of substantial cost savings and superior service delivery, which also supports the segment's expansion.

Other end-use categories include research and academic institutions, specialty clinics, and hospitals. The research and academic institutions market is being driven by rising partnerships between manufacturers and research organizations as well as supportive activities for cancer treatment.

The category with the highest revenue share in 2023 more than 34% was cardiac surgery. In the entire world, cardiovascular diseases (CVDs) are the main cause of mortality. The primary driver of the segment's growth is the rise in the number of older people combined with the weight of these diseases. Numerous research projects carried out to produce real-time cardiac interventions are also contributing to the segment's expansion.

Over the forecast period, the neurosurgery market is anticipated to grow at a profitable CAGR of 6.2%. The main drivers of this market are the rising number of accidents and trauma cases as well as the increasing frequency of neurological illnesses. The segment's expansion is also being fueled by an increase in cooperation with important firms on the development of new image-guided therapeutic systems.

In terms of revenue share in 2022, the urology area came in second. The main purposes of image-guided therapy systems for urological applications are diagnosis, treatment planning, and treatment evaluation. The section is anticipated to be driven by rising research for the creation of novel systems employing 3D and 4D imaging, robot-assisted image-guided treatments, and molecular imaging.

By Product

By End User

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

March 2025

January 2025

December 2024