March 2025

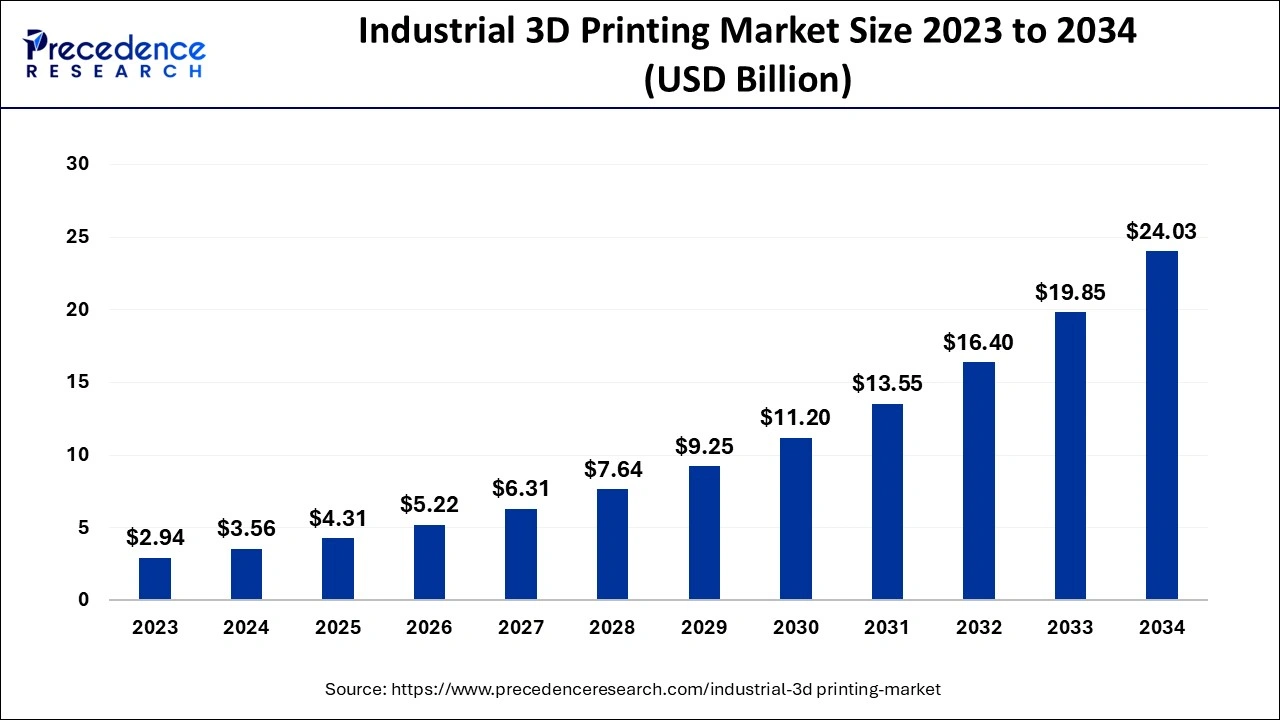

The global industrial 3D printing market size is calculated at USD 3.56 billion in 2024, grew to USD 4.31 billion in 2025 and is projected to surpass around USD 24.03 billion by 2034, expanding at a healthy CAGR of 21.04% between 2024 and 2034.

The global industrial 3D printing market size accounted for USD 3.56 billion in 2024 and is expected to exceed around USD 24.03 billion by 2034, growing at a double-digit CAGR of 21.04% from 2024 to 2034. The industrial 3D printing market is driven by the growing demand for rapid prototyping and customization.

Compared to traditional manufacturing, industrial 3D printing allows for smaller batch production and faster prototyping. Because lead times are shortened, businesses may launch products more quickly and react to changes with less delay. Complex geometries that are frequently unattainable or unaffordable using conventional production methods can be produced with 3D printing. This creates new design opportunities in areas including complex architectural elements, aircraft components, and medical implants.

How is Artificial Intelligence Helping the Industrial 3D Printing Market Growth?

Developers can produce optimized parts using AI-powered generative design technologies that may not be possible with conventional design techniques in the industrial 3D printing market. By examining loads, materials, and performance restrictions, AI algorithms suggest extremely effective architectures that minimize weight and material waste without sacrificing strength. It makes predicted demand forecasting, inventory control, and intelligent scheduling possible, all of which are very advantageous for industrial 3D printing. AI facilitates manufacturers' seamless transition from prototyping to full-scale manufacturing by predicting demand, simplifying production, and optimizing supply networks.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.03 Billion |

| Market Size in 2024 | USD 3.56 Billion |

| Market Size in 2025 | USD 4.31 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 21.04% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Technology, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

High levels of customization

High-performance components that adhere to precise requirements are essential to sectors like the industrial 3D printing market. With 3D printing, components with intricate geometries that would be impossible or difficult to do with conventional manufacturing techniques can be made that are both sturdy and lightweight. Customized fuel nozzles or engine parts, for instance, can be 3D printed in the aerospace industry to enhance performance and fuel efficiency by reducing weight without sacrificing strength.

Skilled workforce shortage

Expertise from a variety of disciplines, such as mechanical engineering, material science, software programming, and post-processing techniques, is integrated into the industrial 3D printing market. For instance, creating parts that are durable and functional requires an understanding of how different materials, such as metals, ceramics, composites, and plastics, behave under varied printing circumstances. Expertise in these fields is required of skilled individuals, and their scarcity hinders the use and expansion of 3D printing technology in sectors including healthcare, automotive, and aerospace.

Continuous development of new materials for 3D printing

Reliance on lengthy, carbon-intensive supply chains is lessened by the ability to print complicated parts on demand using locally accessible materials. Distributed manufacturing models that save emissions and shipping costs can be made possible by the industrial 3D printing market. New materials may now be printed more quickly and precisely due to advancements in 3D printing processes like direct energy deposition (DED) and continuous liquid interface production (CLIP). This facilitates the expansion of industrial 3D printing applications and speeds up the adoption of novel materials.

The hardware segment dominated the industrial 3D printing market in 2023. In the medical industry, 3D printing hardware is used to create customized implants, prosthetics, and surgical equipment. Because of their accuracy and customization possibilities, which sometimes lead to significant cost and lead time reductions, industrial-grade 3D printers have gained popularity for producing patient-specific solutions. Hardware for 3D printing provides an alternative to mass production for enterprises needing small to medium production runs, enabling on-demand manufacture with little setup. Industries like electronics, healthcare devices, and bespoke consumer items particularly benefit from this versatility.

The software segment is observed to grow at the fastest rate in the industrial 3D printing market during the forecast period. 3D printing software uses machine learning and artificial intelligence features to automate specific design and production procedures. Improving print speed and quality means determining the ideal printing parameters, foreseeing any errors, and adjusting in real-time.

The stereolithography (SLA) segment dominated the global industrial 3D printing market in 2023. The capacity of SLA 3D printing to create detailed, highly accurate items with smooth surface finishes is well known. In sectors like jewelry, automobile, aerospace, and healthcare that have high requirements, accuracy and smoothness are crucial. SLA is very appealing for applications where look and detail are important because of its ability to manufacture prototypes and final products with little post-processing.

The fused deposition modeling (FDM) segment will show significant growth in the industrial 3D printing market during the forecast period. Since FDM is one of the most affordable 3D printing techniques, it is very appealing to a wide range of sectors. Because FDM printers and materials are relatively inexpensive when compared to other additive manufacturing techniques, small and medium-sized businesses (SMEs) can employ the technology for tooling, prototyping, and even some end-use applications. The variety of FDM printers has increased due to advancements in FDM technology, like the capacity to print on a variety of materials and colors. These developments make it possible to create increasingly complex and precise components, which makes it easier to integrate technology into high-precision industries like electronics and aircraft.

The manufacturing segment dominated the global industrial 3D printing market in 2023. Specialized tools, jigs, and fittings are frequently needed for manufacturing operations, which can be expensive and time-consuming. These tools can be produced on demand with more flexibility and at a cheaper cost, thanks to 3D printing. In sectors like aerospace and automotive, where parts must be manufactured with precise dimensions to satisfy strict performance and safety criteria, this customization is essential.

The aerospace & defense segment will witness notable growth in the industrial 3D printing market during the forecast period. In aircraft applications, weight reduction is essential since lighter components use less fuel. By employing 3D printing, manufacturers may develop structurally optimized parts to be lighter without sacrificing strength, resulting in significant cost savings over an aircraft’s lifetime. Engineers can swiftly develop and test new designs due to fast prototyping made possible by 3D printing. This expedites the design validation process, assisting A&D firms in bringing innovations to market more quickly while improving designs for cost and performance.

North America dominated the industrial 3D printing market in 2023. North America boasts a well-established industrial base in vital industries like consumer goods, automotive, healthcare, and aerospace. Because of its potential for small-scale production, customization, and rapid prototyping, all of which are very pertinent in these industries, 3D printing has been quickly embraced by these sectors. Robust intellectual property laws in North America foster innovation by giving businesses a secure setting in which to create exclusive goods and technologies. Both startups and big businesses are encouraged to invest in 3D printing by this legislative environment.

Asia Pacific is observed to witness notable growth in the industrial 3D printing market during the forecast period. 3D printing is being utilized more and more for bioprinting, dental implant, and medical devices manufacturing as a result of the growing need for personalized healthcare solutions. Leading the way in this technology's medicinal uses are South Korea and Japan. In sectors like healthcare, where 3D printing is used to create customized implants and prosthetics, customization is especially appreciated. Due to developments in materials science, this trend is spreading quickly throughout Asia Pacific.

By Component

By Technology

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

May 2025

December 2024

November 2024