April 2025

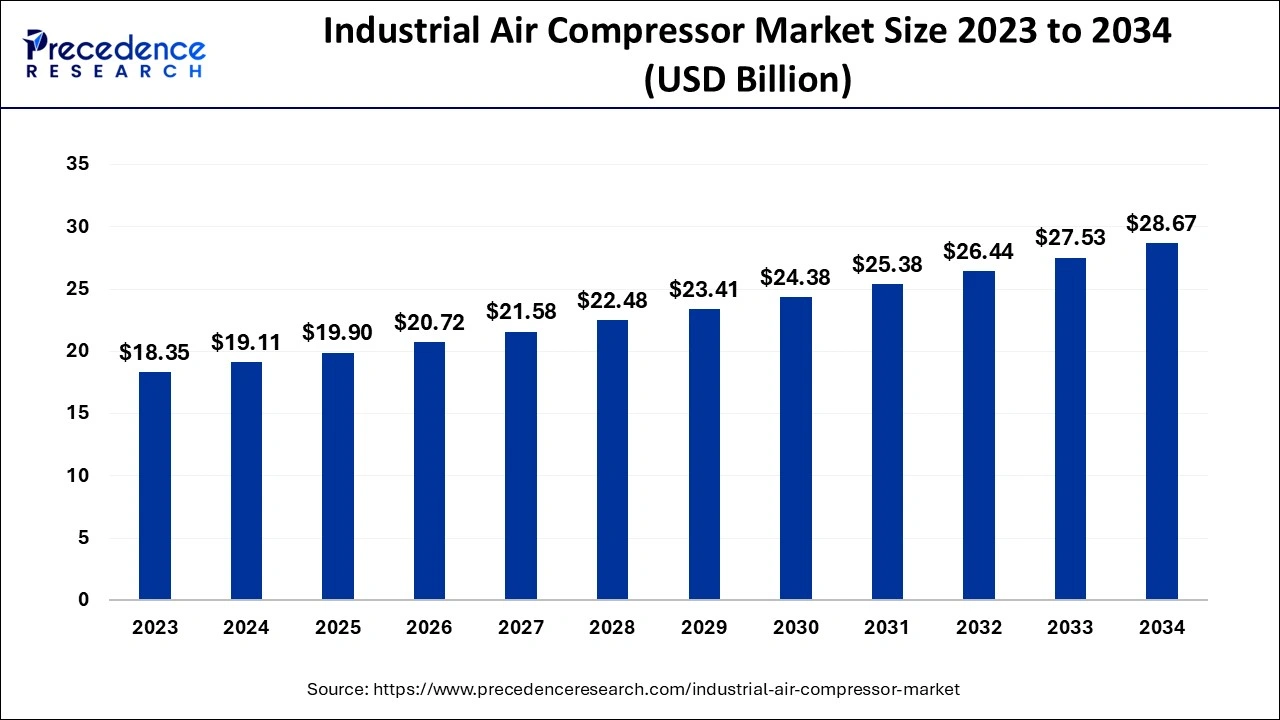

The global industrial air compressor market size accounted for USD 19.11 billion in 2024, grew to USD 19.90 billion in 2025 and is predicted to surpass around USD 28.67 billion by 2034, representing a healthy CAGR of 4.14% between 2024 and 2034.

The global industrial air compressor market size is accounted for USD 19.11 billion in 2024 and is anticipated to reach around USD 28.67 billion by 2034, growing at a CAGR of 4.14% from 2024 to 2034.

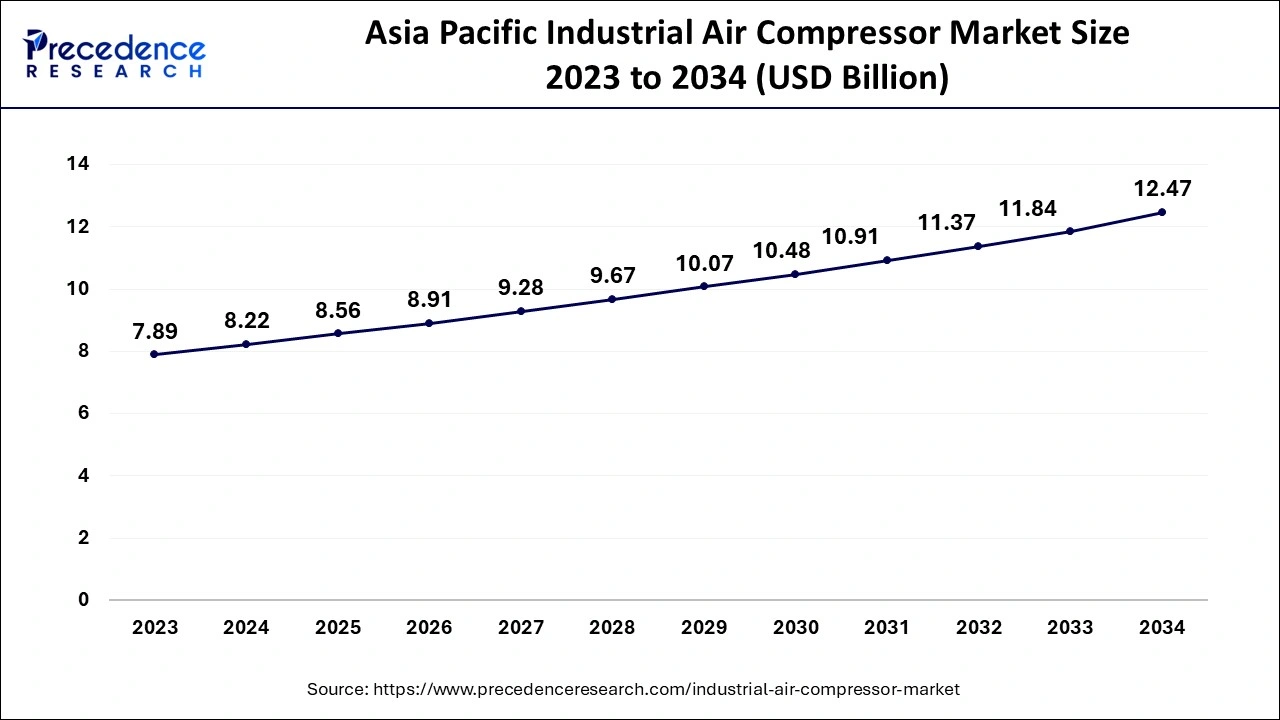

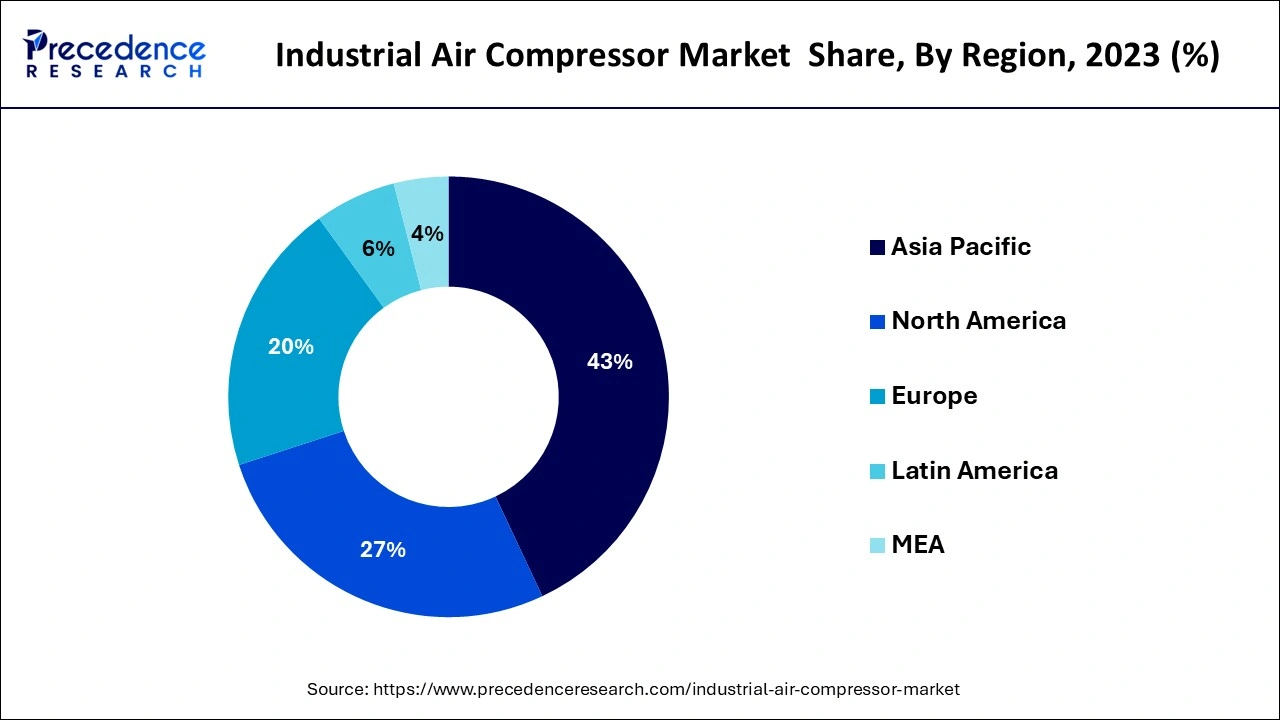

The Asia Pacific industrial air compressor market size is evaluated at USD 8.22 billion in 2024 and is predicted to be worth around USD 12.47 billion by 2034, rising at a CAGR of 4.25% from 2024 to 2034.

Asia-Pacific is proving to be a booming market for the growth of the industrial air compressor market, due to increased industrialization and rising investments in LNG, chemicals, and mining, as well as the expansion of the domestic manufacturing sector, which includes automotive, and food and beverage manufacturing. Furthermore, Asia-Pacific is seeing substantial economic growth, and to satisfy its energy demand while adhering to decarburization rules, it is seeing a boom in investments in the hydrogen and green energy sectors.

North America region is also proving to be a driving market for this sector pertaining to the rapid urbanization of this region. Demand for air compressors will be influenced by rising demand for residential appliances such as refrigerators and air conditioners, as well as rising living standards. Furthermore, rising vehicle demand, increased mining and oil exploration operations, and advancements in the energy and power generating sectors are all expected to contribute to regional market growth. Product demand will be boosted even more by the extremely promising energy and healthcare industries in the U.S.

Industrial air compressors are mechanical devices used to pressurize liquids or gases. The most common is air. A variety of compressors are used in the industry to provide the following features: instrument or shop air; powering air tools, abrasive blast equipment, and paint sprayers, and more. Industrial air compressors are universal devices that provide compressed air for a variety of production processes. When selecting an air compressor for an application, it is important to make sure that the selected unit can produce the desired output while maintaining low maintenance and operating costs. The best air compressor for a particular application depends on many factors, including the purpose, tools or processes it supports, and the project budget.

One of the most important advantages of using air compressors is that they are safe. They can withstand high temperatures and offer the simplicity and security of using only air instead of additional energy sources. When compared to equipment that uses electricity, there is no risk of electric shock to personnel who handle the equipment, and in the workplace, the safety of your team is always vital.

As the world becomes more urbanized, industries are springing up at a quicker rate in many places. Demand for a variety of industries, such as food and beverages, manufacturing, semiconductors, electronics, and so on, has expanded, particularly in emerging countries. Centrifugal air compressors are widely utilized in these industries because they provide large amounts of air at a low cost. It also has a longer working life, reducing the amount of capital investments even further. Several rising economies, including Asia-Pacific and Africa, have accelerated their industrial and economic growth. Furthermore, government measures to promote industrial automation, as well as a focus on industrial automation for optimal resource usage, are boosting demand for industrial air compressors.

The growing need for automobiles around the world, particularly in the Asia-Pacific region, is expected to boost demand for industrial air compressors, since the product is widely utilized in the automotive industry for manufacturing. The expansion of the vehicle industry in Europe and North America will also help the market thrive. Despite the fact that their populations are growing at a slower rate than those in emerging countries, U.S. and Europe remain the most important markets for the automobile industry, owning to technical advancements. Moreover, the air compressor market outperformed the rest of the industry and is expected to grow. The rapid industrial improvements in the Asia-Pacific area, spurred by the widespread use of compressed air in practically all manufacturing activities, will push up their use. Stationary air compressors are utilized in a variety of applications, including refrigeration and air conditioning, cars, and industrial uses. Smaller ones are used in autos, freezers, and air conditioners, whereas medium and bigger ones are used by industrial end-users. Hence, the escalating demand throughout the globe due to the improved lifestyle, growing spending power, and increasing population of the region will drive the demand for air compressors.

| Report Coverage | Details |

| Market Size by 2024 | USD 19.11 Billion |

| Market Size by 2034 | USD 28.67 Billion |

| Growth Rate from 2024 to 2034 |

CAGR of 4.14% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Design, Technology, Output Power, Seal, Coolant Type, Compression Stage, Driver Type, End User, Gography |

Depending upon the product type, the positive displacement category is predicted to grow. Positive displacement air compressors are used in construction, automotive and transportation, packaging, food and beverage, metals and mining, and other end-user sectors. Increased investment is expected in these areas, which will enhance demand for positive displacement air compressors. The dynamic compressors operate at a constant pressure and are classified according to their axial or radial design. External circumstances, like as variations in inlet temperatures, have an impact on the operation of dynamic compressors.

On the basis of by design type, the stationary segment is expected to be the largest segment during forecast period. The industrial air compressors can be fixed at a specified position attributable to their stationary design. These air compressors have a greater cfm rating than portable air compressors because they can create a large amount of compressed air at once. These are used in facilities and industries where the compressor does not need to be mobile. When compared to portable compressors, stationary compressors may deliver higher air pressures.

The portable air compressor market has been steadily growing in recent years, thanks to increased use in building sites, road construction, and packaging machinery across a wide range of industries. Over the forecast period, burgeoning infrastructure initiatives in Asia-Pacific, Middle East, and Africa will provide manufacturers with attractive business prospects.

On the basis of pressure type, the 0-20 bar segment is expected to be the largest market to show a tremendous growth during the forecast period. Due to increased investments, the up to 20 bar segment is predicted to grow at the fastest rate. Food and beverage companies, as well as pharmaceutical companies, are substantially investing in industrial air compressors. Growth in these industries is expected to raise demand for compressors that can handle pressures in this range over the forecast period. The 20-100 bar segment is steadily moving in the market as it is high pressure air compressor.

On the basis of output power, the 51–250 kW segment is expected to dominate the industrial air compressor market. The rated pressure for compressors in this range is expected to be 0.3–20 bar. Power plants, water and wastewater treatment plants, the chemical and petrochemical industries, the food and beverage industry, mining, the automotive and transportation sectors, packaging, construction, the metals sector, and manufacturing are all places where they're used. Several large-scale chemical projects, particularly in emerging economies, have boosted demand for industrial air compressors with output powers ranging from 51 to 250 kW, and demand is expected to continue to climb during the projected period.251-500 kW is one of the leading segments in this category after 51-250 kW segment. The demand for high pressure air compressor is used in heavy loaded industries.

On the basis of seal type, the oil-flooded segment accounted largest market share in 2022. They are becoming increasingly popular since they are less expensive than oil-free compressors and can usually complete the compression process in a single stage. The compressor is widely used in areas where cleaner compressed air is not required, such as oil and gas, textiles, rubber and plastics, and metals and mining.

To keep the mechanism functioning smoothly, most oil-free compressors use alternative materials such as water or a Teflon coating. Because bearings and gears are lubricated outside the compression chamber, effective sealing prevents oil from polluting the compressed air. As outcome, there is no oil in the air supply. Some oil-free designs even eliminate metal-to-metal contact within the compression chamber, obviating the requirement for oil-based or synthetic lubrication entirely.

On the basis of coolant type, the air-cooled segment of the industrial air compressor market is likely to be the largest contributor. Modern compressors are usually air-cooled, with forced ventilation utilizing blowers, heat exchangers, and other components to keep the fluid cool. These compressors made up a larger portion of the industrial air compressor market, and their demand is expected to rise throughout the projected period.

Although water-cooled compressors require less power than air-cooled compressors, the electrical expenses of the cooling system, as well as water and water treatment costs, must be considered when choosing water-cooled. When those costs are taken into account, air-cooled compressors are usually more cost-effective. Hence, the air-cooled type is mostly used.

On the basis of end user, the chemicals & petrochemicals segment accounted largest revenue share in 2023 as developing economies' increased demand for chemical and petrochemical products.

Food and beverages industry is also one of the dominating segments that drive the need of industrial air compressor as they demand for high powered and high efficiency air compressors. Increased investment and demand for oil-free compressors in the food and beverage industry, as well as increased demand from the HVAC business drives the market.

Metals and mining segment is also influencing the air compressor market as rapid urbanization demands the need of such product in the market.

By Product

By Design

By Technology

By Output Power

By Pressure

By Seal Type

By Coolant Type

By Compression Stage

By Driver Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

November 2024