April 2025

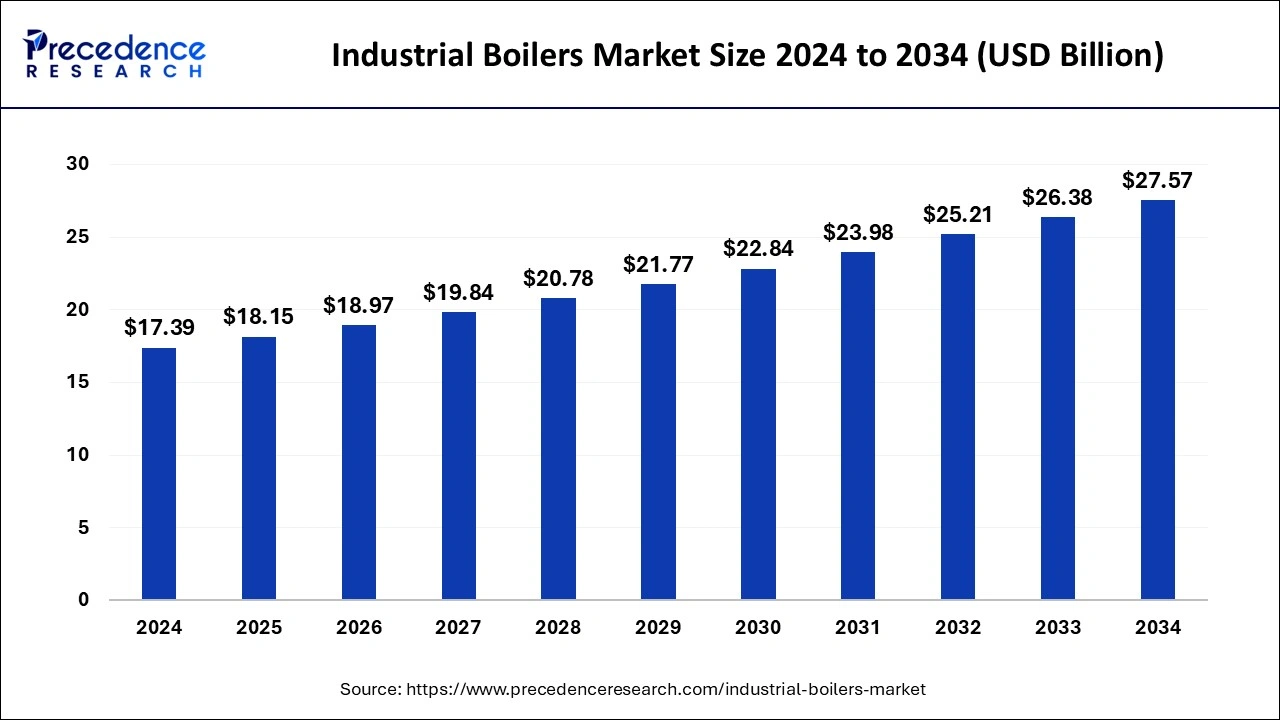

The global industrial boilers market size is calculated at USD 18.15 billion in 2025 and is forecasted to reach around USD 27.57 billion by 2034, accelerating at a CAGR of 4.72% from 2025 to 2034. The Asia Pacific industrial boilers market size surpassed USD 7.65 billion in 2025 and is expanding at a CAGR of 4.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial boilers market was valued at USD 17.39 billion in 2024 and is anticipated to reach around USD 27.57 billion by 2034, expanding at a CAGR of 4.73% from 2025 to 2034. The exciting applications of industrial boilers in generating the heat, steam, mechanical power, and electricity fuel the expansion of the industrial boilers market.

Artificial intelligence and machine learning helps in the optimization of boilers for efficient and clean energy production. AI also helps in reducing the harmful gas emissions in the environment by requiring the least amount of construction and operating expenditures. AI-based approaches are helpful in modelling, predicting performances, and achieving control over emissions of combustion processes. AI-ML algorithms are used to process the data obtained from internet of things (IoT) devices. They can also create models and train them to allow machines to learn and take their own practical decisions for operational and engineering practices of boilers.

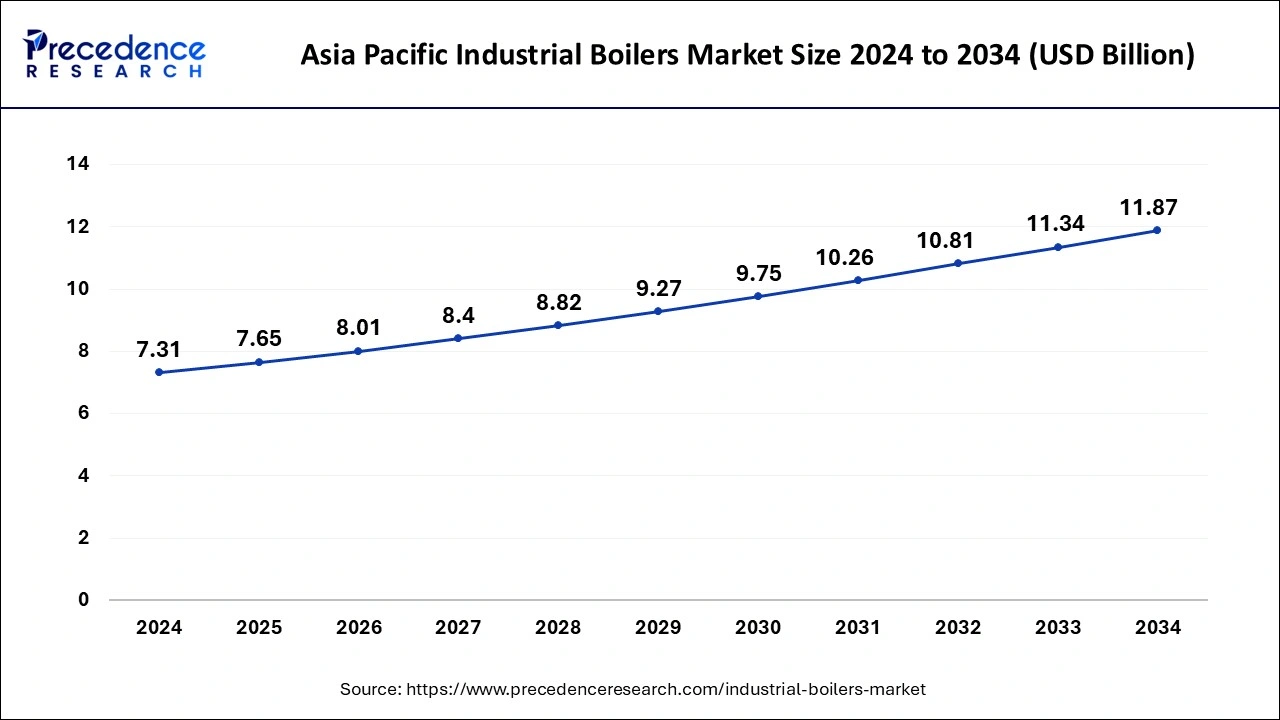

The Asia Pacific industrial boilers market reached USD 7.31 billion in 2024 and is expected to be worth around USD 11.87 billion by 2034, growing at a CAGR of 4.97% between 2025 and 2034.

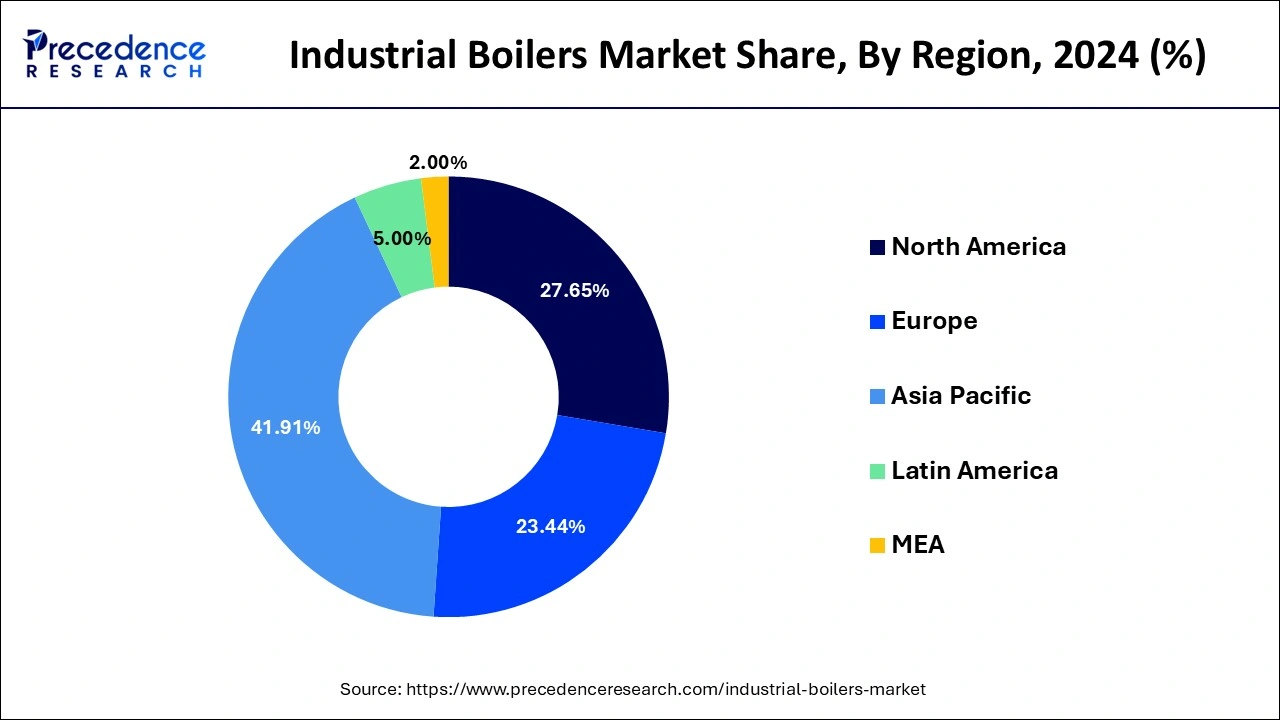

Asia Pacific accounted for around 41.91% of the market share and dominated the global industrial oilers market in 2024. The rapid industrialization owing to the constant government initiatives to attract FDIs is expected to propel the growth of the industrial boilers market. The availability of cheap factors of production and the favorable government policies are attracting the top manufacturers of various industries to expand their manufacturing facilities in the Asia Pacific region. Thus, the demand for industrial boilers is expected to foresee huge growth across the Asia Pacific region especially in the countries like India and China. China and India are becoming the manufacturing hubs of the world. Moreover, the presence of a huge population is presenting lucrative growth opportunities to food & beverages, consumer goods, textiles, and various other industries. This is a crucial factor that can be held responsible for the growth of the industrial boilers market in the Asia Pacific region in the forthcoming future.

Europe region is estimated to be the most opportunistic segment during the forecast period. The presence of a higher number of industries and manufacturing units across Europe has fostered its growth. The increased awareness regarding carbon emissions, increased environmental consciousness, and increased focus of the industries on achieving sustainability have compelled the government to implement strict regulations regarding harmful industrial emissions. This has significantly boosted the growth of the industrial boilers market in Europe. Moreover, with the higher adoption rate of advanced and innovative technologies to attain sustainability and energy efficiency across the manufacturing units in Europe, the demand for industrial boilers has witnessed a surge in demand.

The global industrial boilers market is driven by surging demand from the chemicals & petrochemical and the food & beverages industries. The rapid industrialization and the stringent government regulations pertaining to the harmful emissions are significantly driving the demand for the industrial boilers across the globe. The rising adoption of the industrial boilers across various industries such as chemical, food & beverages, and mining is expected to foster the market growth in the forthcoming years. The growing population and rising disposable income are encouraging the manufacturers to set up new manufacturing facilities in order to cater the demand for the food and beverages, textiles, and consumer goods. The rising investments in the growth of the industries across the globe are boosting the demand for the industrial boilers. The chemical industry has huge contributions in the global GDP, which highlights the importance of increasing demand for the industrial boilers in the chemicals industry. The growing demand in the chemical and petrochemical industry in the developing nations is expected to have a huge impact on the market growth in the foreseeable future.

The rising concerns regarding pollution, carbon emissions, and environment protection have forced the government to take strict actions regarding the industrial emissions. The stringent government norms pertaining to the harmful emissions to the environment are supporting the growth of the global industrial boilers market. Moreover, the rising investments in the thermal power owing to the rising demand for the efficient power supply are major factors that drive the growth of the industrial boilers market across the globe. The technological advancements and the rising focus of the manufacturers to increase the capacity of the boilers is supplementing the market growth. For instance, Bosch Industriekessel Gmbh provides water boilers that range up to 38 MW to the top food & beverage companies like Coca Cola, Nestle, and Daimler.

| Report Coverage | Details |

| Market Size In 2024 | USD 17.39 Billion |

| Market Size by 2034 | USD 27.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.72% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Fuel, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The water tube segment dominated the global industrial boilers market in 2023. This is attributed the increased demand for the water tube boilers in the paper & pulp, chemical & petrochemical, and the food processing industries across the globe. The features like low carbon emissions along with the higher thermal efficiency are the major factor that has fostered the growth of the water tube boilers across industries. The growing investments on the adoption of large capacity boilers along with the replacement of conventional heating systems are further expected to propel the growth of this segment in the forthcoming future.

The chemical and petrochemicals segment garnered a market share in 2024. The huge demand for the high quality steam that has utilization in the production of chemicals such as petrochemicals, alkali, chlorine, fertilizers, and pesticides has fueled the growth of this segment in the past years. The chemical industry has huge contributions in the GDP. The huge demand for huge variety of chemicals across all the industries has boosted its growth. The rising demand for the various chemical products is boosting the demand for the industrial boilers in the chemical industry across the globe. Hence, this segment is expected to sustain its significance throughout the forecast period.

The fossil segment held the largest share of the market in 2024. The growing emphasis on green fuel, especially in industrial areas promotes the segment’s expansion in the market. Multiple industry players are focused on the innovation of products that meet government emission standards and goals. Fossil fuels are readily available on a global scale, making them a convenient choice for industrial boiler operators operating in diverse geographic locations. This global availability ensures consistent fuel supply and reduces logistical challenges associated with sourcing alternative fuels.

The various developmental strategies like product launches, acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players. The market players are constantly engaged in various developmental strategies to gain market share, exploit the prevailing opportunities in the market, and gain competitive edge in the market.

By Type

By Function

By Fuel Type

By Boiler Horsepower

By Technology

By Steam Pressure

By Steam Usage

By Furnace Position

By Shell Axis

By Tubes In Boilers

By Water And Steam Circulation In Boilers

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

December 2024

November 2024