Industrial Bulk Packaging Market Size and Forecast 2025 to 2034

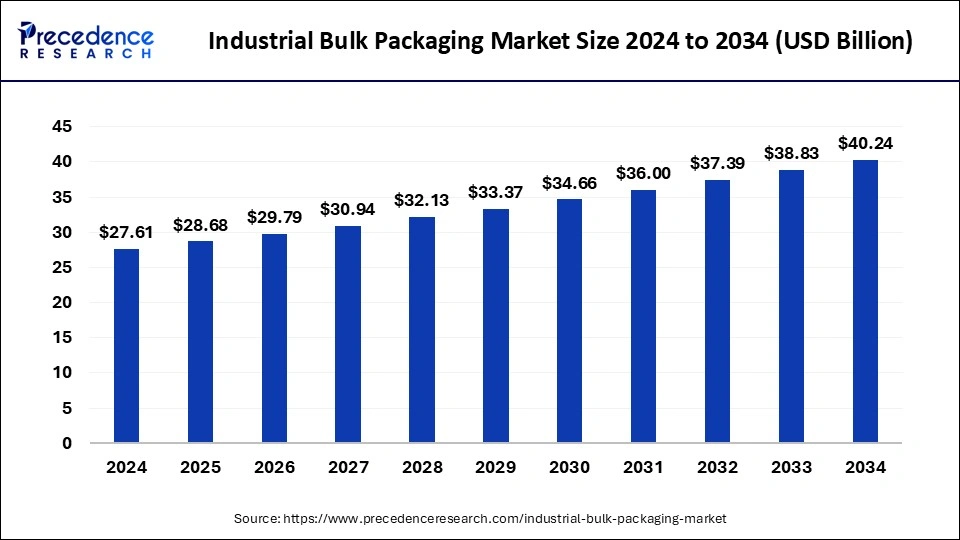

The global industrial bulk packaging market size was estimated at USD 27.61 billion in 2024 and is predicted to increase from USD 28.68 billion in 2025 to approximately USD 40.24 billion by 2034, expanding at a CAGR of 3.84% from 2025 to 2034. Increasing adoption of the inorganic growth strategies like acquisition by the key market players for designing bulk packaging is estimated to drive the growth of the industrial bulk packaging market over the forecast.

Industrial Bulk Packaging Market Key Takeaways

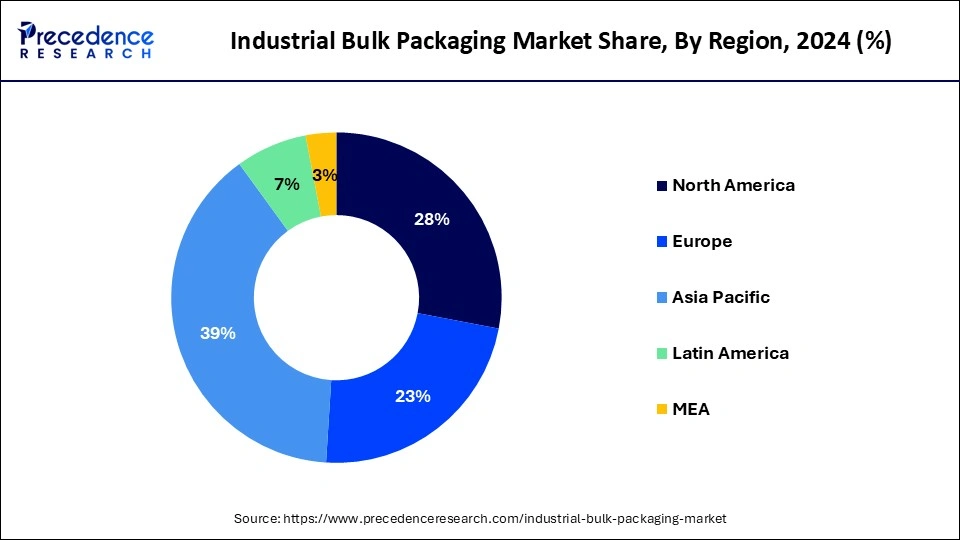

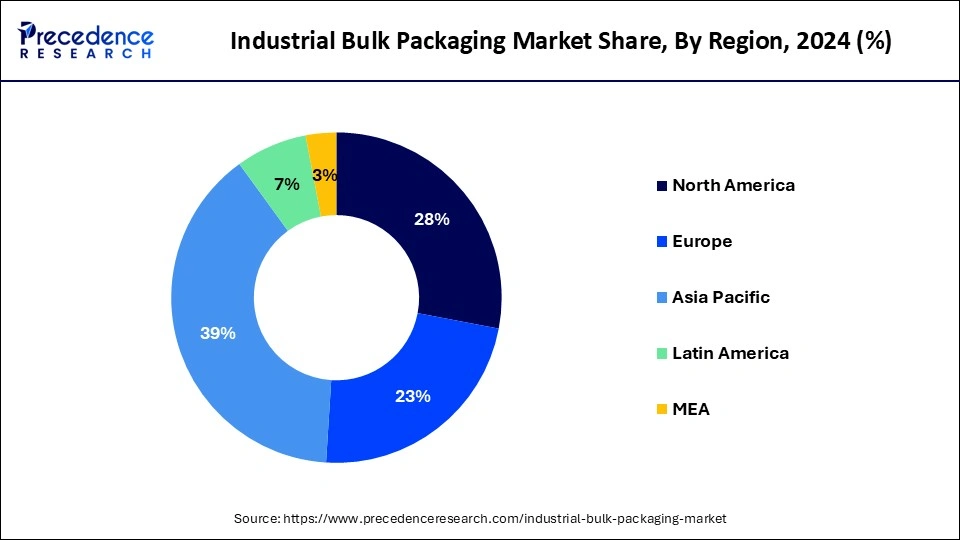

- Asia Pacific dominated the market with the largest revenue share of 39% in 2024.

- By product, the drums segment has held a major revenue share of 48% in 2024.

- By application, the chemicals & petrochemicals segment dominated the market in 2024.

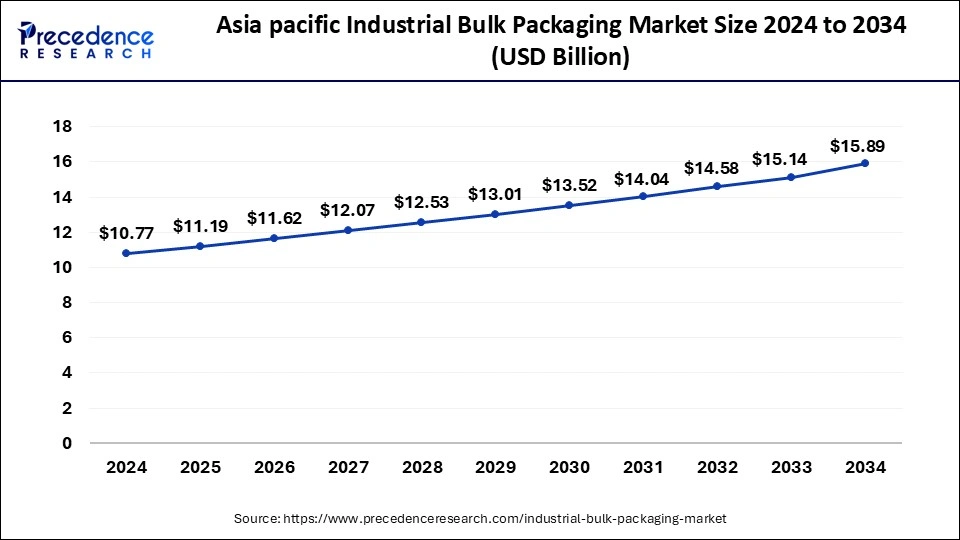

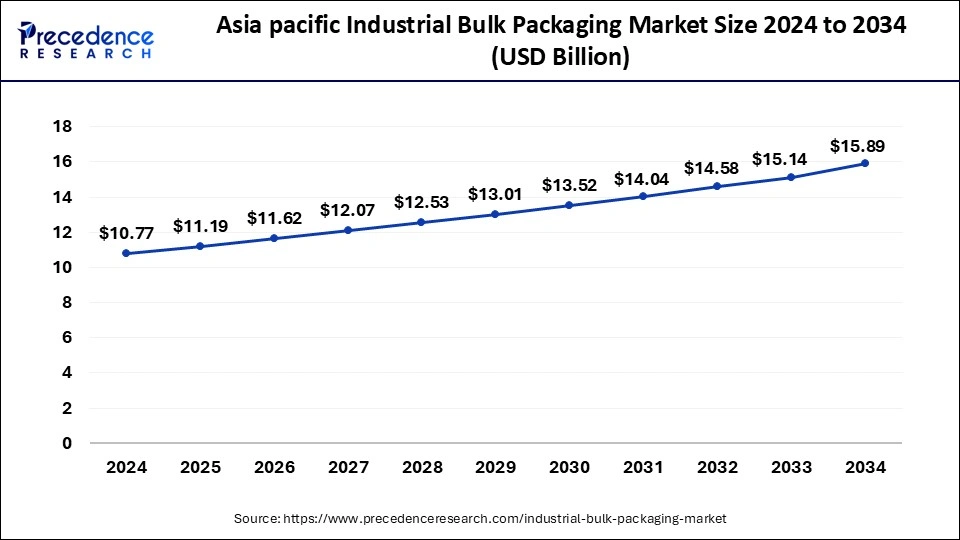

Asia Pacific Industrial Bulk Packaging Market Size and Growth 2025 to 2034

The Asia Pacific industrial bulk packaging market size was exhibited at USD 10.77 billion in 2024 and is projected to be worth around USD 15.89 billion by 2034, poised to grow at a CAGR of 3.97% from 2025 to 2034.

Asia Pacific dominated the industrial bulk packaging market in 2024 owing to increasing diesel and petroleum smuggling activities in Asia Pacific region has raised the demand for the drums and bulk containers. For instance, in June 2024, Domestic Trade and Cost of Living Ministry, abbreviated KPDN, is a ministry of the Government of Malaysia, announced that they will work with the authorities, including the Royal Malaysian Customs Department (Customs), the technical services division and the Road Transport Department (JPJ), government department and the police officers to stamp out petroleum and diesel smuggling activities at the country’s borders. Hence, the rise in petroleum smuggling activities has increased the demand for the industrial bulk packaging in the Asia Pacific region.

North America is expected to grow significantly during the forecast period. Increasing strategic initiative by the key market players of North America to launch the advanced technology bulk packaging solutions is estimated to drive the industrial bulk packaging market over the forecast period.

- For instance, in March 2024, Gravis, North America’s largest provider of engineered bulk transportation packaging solutions announced the introduction of its new name and brand identity and become the biggest supplier of engineered bulk transportation packaging solutions in North America with merger of six top industries. Gravis company creates customized solutions and a world-class experience for its customers in the pharmaceutical, agricultural, food and beverage, chemical and materials industries by utilizing decades of product and supply chain expertise from its legacy businesses, Bagwell Supply, Bulk Lift International, BulkSak, JumboBag, Powertex and Norwood Paper.

The leading supplier of designed bulk transportation packaging solutions in North America is Gravis. In order to create and deliver the best bulk packaging solutions for the pharmaceutical, agricultural, food and beverage, chemical and materials industries, Gravis collaborates with clients. Flexible Intermediate Bulk Containers (FIBCs), non-wood pallets, stretch films, bulk container liners, industrial bags, bulk liners, and pallet liners are just a few of the dry bulk transportation packaging goods that Gravis provides.

Market Overview

Industrial bulk packaging market refers to the industry that offers large scale packaging which is utilized to transport raw ingredients or store or finished goods in the manufacturing process. When products are packaged in bulk rather than individually sized packing, they are frequently done so in large containers intended for bulk usage. Products that are frequently offered in bulk packaging include chemicals, raw materials, and food items like oils or nuts. Bulk packaging is the recommended option over individual-sized packaging when products are intended for commercial or industrial use.

Bulk packaging may cut expenses, minimize environmental effect by reducing packaging waste, increase operational efficiency, and make it more convenient for businesses to simplify their supply chains. These advantages make bulk packaging popular in sectors like production, distribution, logistics, and wholesale. These can be bulk cardboard boxes, shrink-wrapped loads for moving cases of packaged goods, flexible intermediate bulk containers (FIBCs) for carrying granular commodities, or intermediate bulk containers (IBCs) for holding liquids. Environmental health and safety are the key distinctions between bulk and non-bulk packaging. In a post-industrial world where companies need to move enormous quantities of chemicals to compete, bulk packaging is an essential, but it also comes with a lot of hazards.

Industrial Bulk Packaging Market Growth Factors

- Expansion of home healthcare services can foster the growth of the industrial bulk packaging market in the near future.

- Increasing launch of the new policy by the government to support bulk transportation is estimated to fuel the growth of the market.

- Rise in the demand for bulk packaging at the airport for international transportation of the heavy goods is estimated to drive the growth of the market in the near future.

- Increasing migration of the industry from one location to other has risen the demand for the bulk packaging which is expected to drive the market over the forecast period.

- Increasing research and development has risen the demand for the active ingredients in bulk quantity which has anticipated to drive the growth of the industrial bulk packaging market over the forecast period.

Market Scope

| Report Coverage |

Details |

| Market Size by 2034 |

USD 40.24 Billion |

| Market Size in 2025 |

USD 28.68 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 3.84% |

| Largest Market |

Asia Pacific |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Application, and Regions |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing innovation and designing of the new product for the industrial bulk packaging

The rise in the innovation and development of the new product for the industrial bulk packaging by the key market players is expected to drive the growth of the market over the forecast period. The creation and application of recyclable, reusable, and quickly renewable packaging is known as sustainable packaging. This procedure lessens the ecological footprint and negative effects of consumer goods waste on the ecosystem. The market players are focused more on innovating the sustainable bulk packaging.

- For instance, in April 2024, Imoto Lines. Ltd., a company that develops a wide array of domestic feeder services and Marindows.Inc., software company announced that they will together design zero-emission container ships by 2027 under the guidance of the Ministry of the Environment’s ‘Carbon Neutral Technology Research and Development Program, funding program. The Imoto Lines. Ltd., and Marindows.Inc., companies declared their paln to construct a domestic containership with zero emissions that can operate in hybrid mode by utilizing onboard batteries, generators, and the first exchangeable container batteries in Japan.

Restraint

Strict laws and regulations for usage of certain packaging material

All developing nations now acknowledge the importance of the packaging business. This is hardly surprising, as every produced or processed good is packaged in some way to protect society's and the consumer's interests. These products are subject to extremely important laws and restrictions. Regarding both quantity and quality, these laws serve as a safeguard and a source of consumer satisfaction. The imposition of some stringent laws and regulations for usage of certain packaging material is expected hinder the growth of the industrial bulk packaging market.

Opportunity

Increasing launch of the advanced technology for manufacturing bulk packaging containers

The increasing launch of the advanced technology solution for manufacturing the bulk packaging material and containers is expected create lucrative opportunity for the growth of the industrial bulk packaging market over the forecast period.

- In May 2024, Emmeci S.p.A., a company that is focused on production and development of machines to manufacture rigid cardboard boxes, announced the launch of the automated, mold-less luxury packaging machine, the OD500 R at DRUPA 2024, the largest equipment exhibition and showcasing event in the world. OD500 R technology facilitates on-demand production while improving luxury box customizability and sustainability. The benefits of using OD500 R have been mentioned here as follows: sustainability: Encourages the manufacturing of high-quality reusable products and minimizes waste, flexibility: It is a great option for production batches of any size due to its mold-less production process, and efficiency: reduces expenses, downtime, and environmental effect by doing away with the need for molds. With two MC79S DIGITAL robots and one MC2020 DIGITAL robot, the OD500 R will be introduced as part of a cutting-edge, completely automated process. From creating the box bottom to sealing it once the contents are inside, the system shows total automation.

Product Insights

The drums segment held the dominating share of the industrial bulk packaging market in 2024 on account of increasing adoption of the inorganic growth strategies such as acquisition for the development of the drums and expansion of the industrial bulk packaging market.

- For instance, in April 2023, Greif, Inc., a company focused on providing industrial packaging services and products, revealed the completion of acquisition of the Centurion Container LLC ("Centurion"), a company that manufactures plastic drum, and increased its ownership from 9% to 80% in an all-cash transaction for US$145 million in Centurion Container LLC company. With Greif, Inc. owning a majority stake in Centurion, the seasoned management team has effectively grown a vast reconditioning network since the joint venture's founding in 2020. This will significantly increase Greif's footprint in North America and Centurion's supply of recyclable and environmentally sustainable packaging options.

- Furthermore, in December 2023, Novvia Group, distributor of life sciences packaging acquired JWJ Packaging, a company focused on supplying drums, rigid containers and pails, etc. for expansion of its geographic presence in the Northeastern U.S. region. The acquisition even helped the Novvia Group to expand its product portfolio.

Application Insights

The chemicals & petrochemicals segment held the largest share of the industrial bulk packaging market in 2024. Increasing adoption of the inorganic growth strategies like partnership to deliver sustainable packing solutions for chemicals and petroleum is expected to drive the growth of the segment over the forecast period.

- For instance, in June 2024, AeroFlexx, a company that is focused on producing sustainable packaging industry signed a strategic partnership with Chemipack, a privately held chemical company that supplies liquid concentrates for a variety of applications, such as personal care and household products, wet wipes and industrial fluids. Through this partnership, AeroFlexx and Chemipack companies will be able to provide one of the most cutting-edge and environmentally friendly liquid package formats to the Europe market, meeting industry demand and important packaging efforts. The packaging offered by AeroFlexx is gaining a lot of traction in the Europe market. This scalable solution will assist fulfill the increasing need for environmentally friendly package solutions and expand AeroFlexx's global reach.

Industrial Bulk Packaging Market Companies

- BWAY Corporation

- Cleveland Steel Container

- Composite Containers LLC

- Eagle Manufacturing Company

- Grief

- Hoover Ferguson Group, Inc.

- International Paper

- Myers Container

- Time Technoplast Ltd.

- Peninsula Drums

Recent Developments

- In June 2024, Coveris, an international packaging company signed the partnership with the Interzero, environmental service providing company for developing new strategies for innovative plastic recycling, waste management and providing the closed-loop solutions for packaging industries. This partnership between the Coveris company, manufacturer of packaging and Interzero, the supplier of circular economy services and experts in sorting and recycling plastics represents a critical turning point in the closing of the loop in plastics recycling, assisting both businesses in their committed goal of eradicating waste in all of its forms. With the introduction of ReCover, a cutting-edge waste recycling method that promotes the circular economy for plastics, Coveris has already made significant progress toward realizing its “No Waste” objective. Coveris' ReCover companies will now process the materials that Interzero gathered and sorted, resulting in the production of superior recycled resins by mechanical recycling that surpasses current market standards in quality. Afterwards, Coveris' high-performance packaging goods, like Duralite R collation films, will make use of these resins.

- In June 2024, Parkside, privately held packaging company, revealed the expansion of its product portfolio by the introduction of the sustainable flexible packaging options with the recyclable metallised barrier paper solution. The new recyclable metallised barrier paper solution launched by the Parkside company is suitable for wide range of non-food and food application and is primarily used for products such as healthcare items, coffee and snacks.

- In June 2024, Univation Technologies, LLC, a company that supplies polymerization catalysts announced the launch of the licensed technology “Unigility Tubular High-Pressure Polyethylene (PE) Process Technology platform. The newly launched platform by Univation Technologies, LLC company enables production of the ethylene-vinyl acetate (EVA) copolymer resins and low-density polyethylene (LDPE). In addition, licensees can engage in important ethylene-vinyl acetate (EVA) end-use applications in the food and industrial packaging market segments, such as flexible hosing, greenhouse films, cereal liners, fresh meat, photovoltaics, footwear components, and cereal liners and cheese barrier packaging, due to Univation Technologies, LLC company's UNIGILITYTM Tubular High Pressure Polyethylene (PE) Process Technology.

Segment Covered in the Report

By Product

- Drums

- IBC

- Pails

- Totes/ Cracks

- Others

By Application

- Chemicals & Petrochemicals

- Food & Beverages

- Pharmaceuticals

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa