March 2025

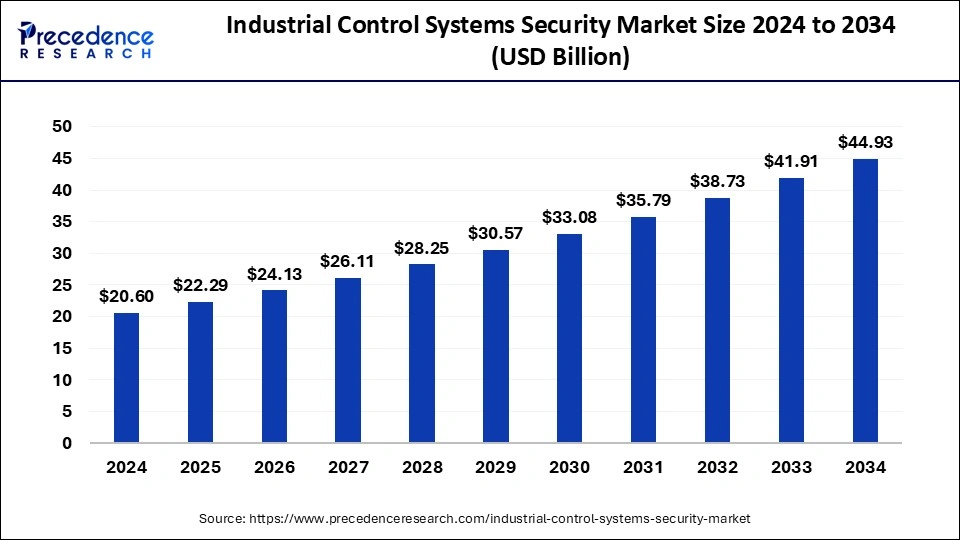

The global industrial control systems security market size is calculated at USD 22.29 billion in 2025 and is forecasted to reach around USD 44.93 billion by 2034, accelerating at a CAGR of 8.11% from 2025 to 2034. The North America industrial control systems security market size surpassed USD 7.00 billion in 2024 and is expanding at a CAGR of 8.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial control systems security market size was estimated at USD 20.60 billion in 2024 and is predicted to increase from USD 22.29 billion in 2025 to approximately USD 44.93 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034. The rising number of cyberattacks on critical infrastructure is the key factor driving the growth of the industrial control systems security market.

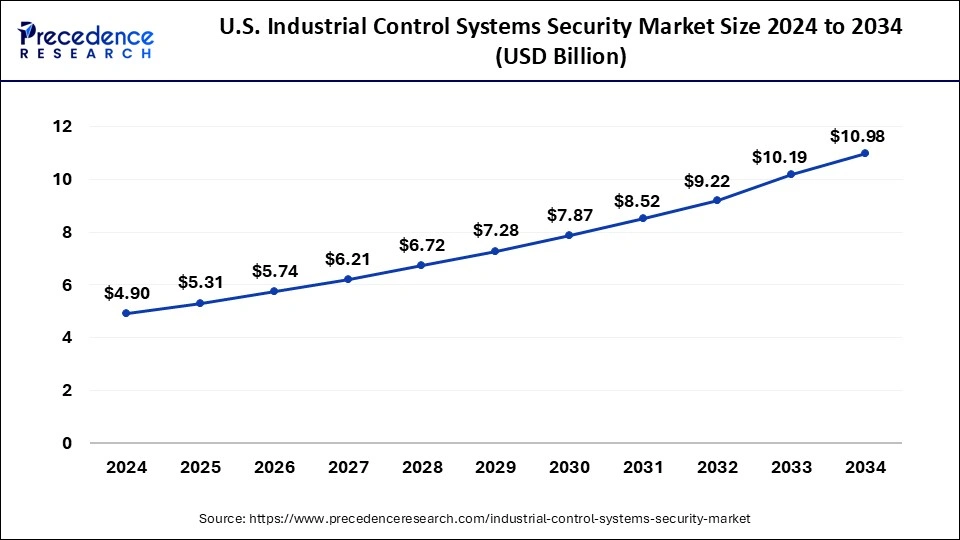

The U.S. industrial control systems security market size was exhibited at USD 4.90 billion in 2024 and is projected to be worth around USD 10.98 billion by 2034, poised to grow at a CAGR of 8.40% from 2025 to 2034.

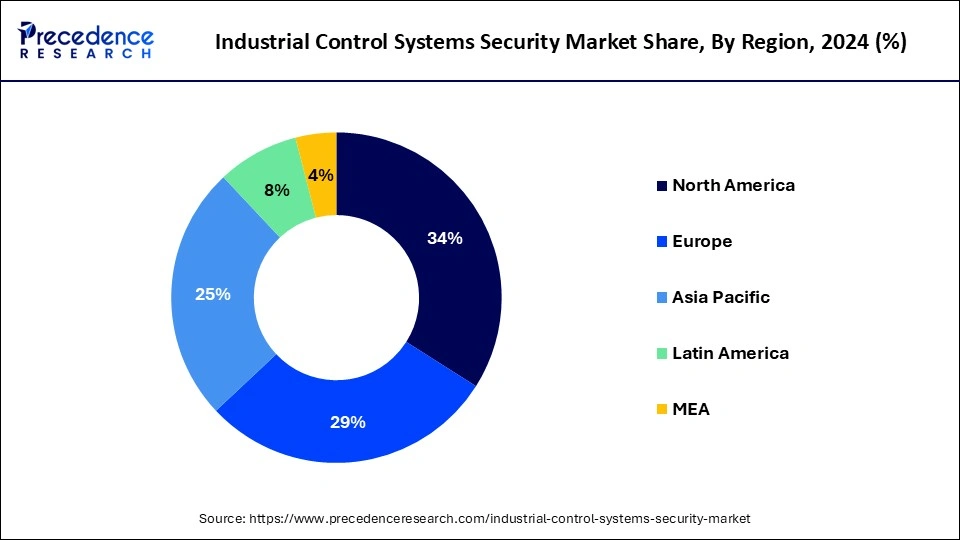

North America dominated the industrial control systems security market in 2024. North America has one of the largest automobile markets, which drives the demand for industrial control systems. Furthermore, the U.S., amidst its fourth Industrial Revolution, features increased data usage in production and integration with various manufacturing systems across the supply chain. During the forecast period, the growth of the global industrial control systems security market is also expected to benefit from Canada's economic recovery.

Asia Pacific is expected to show the fastest growth in the industrial control systems security market during the forecast period. Rapid Industrialization will create numerous opportunities for market expansion in the region. With government support, China is expected to lead in deploying industrial networking technology. Governments drive investments by establishing and enforcing cybersecurity regulations and standards, which set minimum security requirements for critical infrastructure. For example, Japan, South Korea, and Singapore have developed comprehensive cybersecurity frameworks that mandate specific security measures for industrial control systems.

Industrial control systems (ICS) security involves the implementation of measures and practices to safeguard these systems from cyber threats and unauthorized access. ICS is essential for managing and operating critical infrastructure like power plants, water treatment facilities, manufacturing plants, and transportation networks. Unlike traditional IT systems, ICSs are designed to monitor and control physical processes and can pose unique cybersecurity challenges. Additionally, the main objective of ICS Security is to maintain the availability, integrity, and confidentiality of these systems and the information in the process. Availability ensures that these systems operate continuously and reliably without interruptions.

| Report Coverage | Details |

| Market Size by 2034 | USD 44.93 Billion |

| Market Size in 2025 | USD 22.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.11% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Solutions, Services, Type, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Adoption of advanced technologies

The adoption of advanced technologies like the Internet of Things (IoT) in industries has driven the demand for the industrial control systems security market. The increasing use of IoT and other network devices has expanded the threat landscape for criminals and requires robust security measures. The complex industrial network infrastructure, with its numerous connected sensors and controllers, further complicates security. Hence, the need for ICS security in IoT applications has become critical and propelled market growth.

Difficulties in legacy systems

Many industrial control systems in critical infrastructure sectors such as energy, manufacturing, and transportation depend on legacy systems that lack robust cybersecurity features. These systems often operate with outdated software and are not easily compatible with modern security solutions, which makes them difficult to secure. However, the vulnerabilities present in these legacy systems are challenging to address. The complexity involved in securing these outdated systems can significantly impede the industrial control systems security market.

The evolving trend of using digital technology in ICS security

The growing demand for the industrial control systems security market to manage operations in the power, manufacturing, and industrial sectors is driven by the increasing reliance on these systems. Every day, ICS face a wide range of security risks that are becoming more sophisticated in the digital economy. As the industrial sector depends more on these control systems, understanding the importance of industrial cybersecurity and monitoring emerging security trends and threats are more crucial than ever.

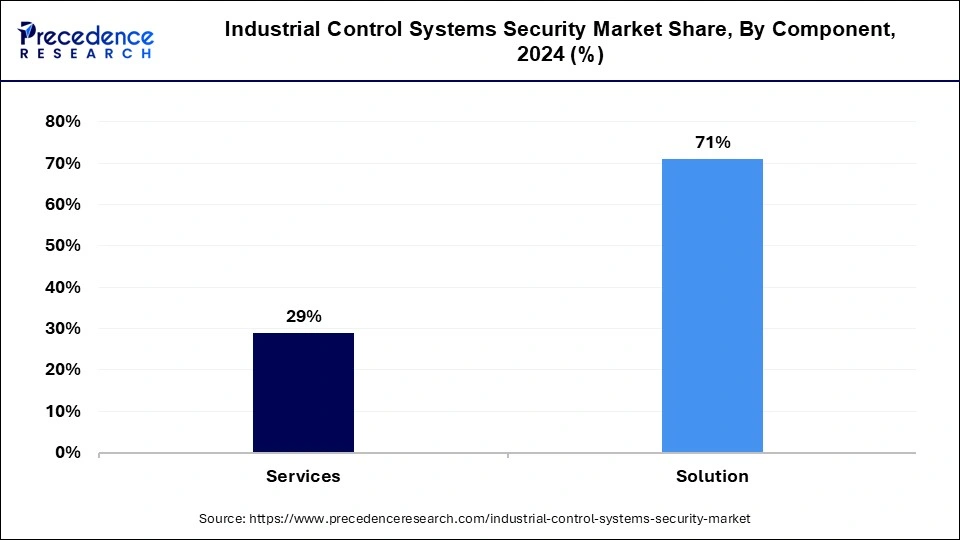

The solution segment dominated the industrial control systems security market in 2024. ICS security solutions adopt a proactive approach, which helps block threats before they affect critical assets and businesses to minimize risk and enhance industrial operations seamlessly. These solutions also offer integrated AI security, threat prevention, and secure 5G connectivity by protecting ICS in sectors such as manufacturing, energy, utilities, and transportation.

The services segment is expected to witness significant growth in the industrial control systems security market during the forecast period. The growth of the ICS security service segment is driven by consumer demand for regulatory compliance requirements, reliable services, and technological advancements fueling digital transformation in the power and utilities sectors. Organizations are prioritizing cybersecurity investments to protect critical infrastructure and operational continuity.

The identity & access management (IAM) segment led the industrial control systems security market in 2024. Factors such as rising security breaches and identity-related fraud are driving the growth of the IAM market. Additionally, the market's expansion necessitates more qualified cybersecurity specialists within businesses. The increased adoption of IAM by SMEs, the introduction of AI/ML-powered services, and scalability benefits further contribute to the market's growth.

The encryption segment is expected to grow at the fastest rate in the industrial control systems security market over the forecast period. In the ICS environment, cryptography is essential for managing and simplifying the encryption of ICS traffic. Encryption involves transforming plaintext into ciphertext using cryptographic algorithms. To decode the data back to plaintext, a decryption key is required, which is a string of numbers or a password generated by an algorithm.

The professional services segment dominated the market in 2024. In software companies, professional services usually refer to a team of technology and solution experts who provide technical advisory and implementation services for customers. OT and IoT security specialists support ICS security professional services by providing technical expertise and a thorough understanding of compliance frameworks.

The managed services segment is projected to grow at the fastest rate in the industrial control systems security market during the forecast period. Managed IT services provider (MSP) is a third-party provider that proactively monitors and manages a customer's server and network infrastructure. Managed cybersecurity services encompass security patch management, firewall management, threat detection, vulnerability assessments, intrusion detection and prevention, and incident response. MSPs also utilize advanced security technologies and best practices to safeguard their clients' data and systems from cyber threats. These factors are expected to drive the demand for industrial control systems security managed services.

The energy & utilities segment held the largest share of the industrial control systems security market in 2024. This can be attributed to the consumer demand for uninterrupted energy and reliable utility services, which drives organizations in these sectors to prioritize cybersecurity. Securing industrial control systems (ICS) is important to maintaining continuous operations and protecting against disruptions that could affect millions of consumers.

The automotive segment is expected to grow at the fastest rate in the industrial control systems security market over the projected period. Automation in the automotive industry is becoming more widespread due to rising labor costs and the need for manufacturers to meet tight deadlines. Devices like industrial PCs, programmable logic controllers (PLCs), and programmable automation controllers (PACs) automate industrial processes without human involvement.

By Component

By Solutions

By Services

By Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

December 2024

November 2024