February 2025

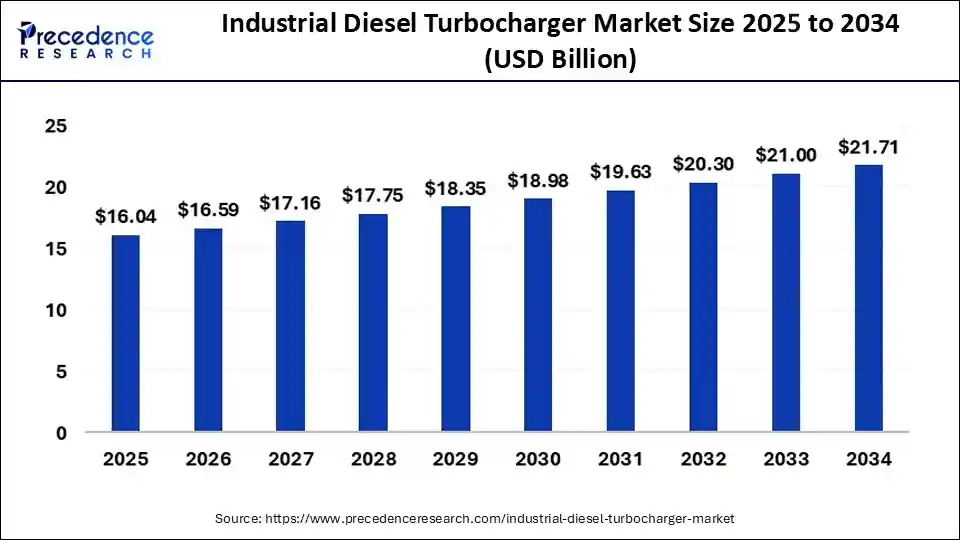

The global industrial diesel turbocharger market size is calculated at USD 16.04 billion in 2025 and is forecasted to reach around USD 21.71 billion by 2034, accelerating at a CAGR of 3.42% from 2025 to 2034. The North America market size surpassed USD 4.65 billion in 2024 and is expanding at a CAGR of 3.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial diesel turbocharger market size accounted for USD 15.51 billion in 2024 and is predicted to increase from USD 16.04 billion in 2025 to approximately USD 21.71 billion by 2034, expanding at a CAGR of 3.42% from 2025 to 2034. The key factor driving market growth is the increasing focus on sustainable operations. Also, the increasing need for fuel efficiency coupled with the stringent emission regulations across many sectors can fuel market growth further.

The impact of artificial intelligence in the industrial diesel turbocharger market goes beyond efficiency, boosting innovation and creating new business avenues. AI-powered algorithms can facilitate resource allocation, individualize user experiences, and improve cybersecurity measures. Furthermore, AI integration in the industry is changing customer interactions through individualized suggestions, automated support systems, and intelligent chatbots.

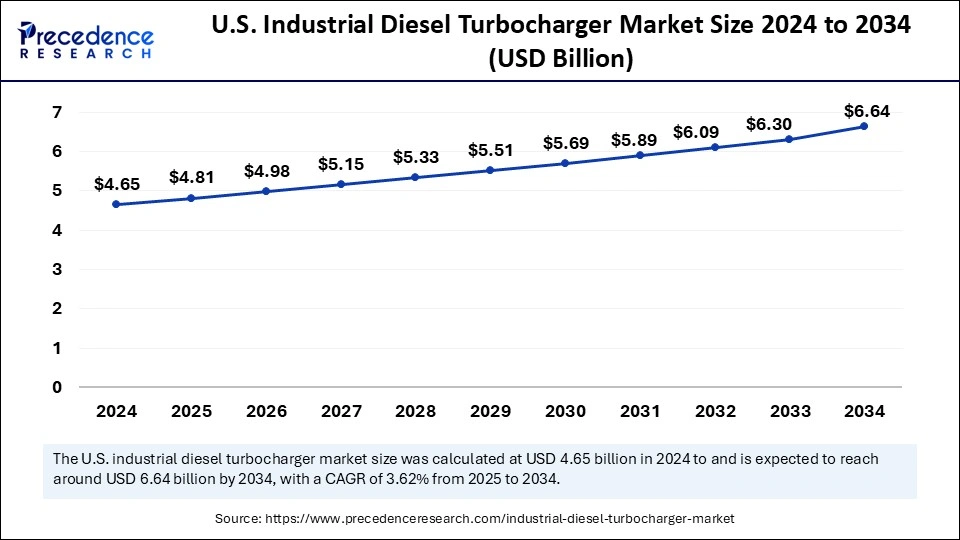

The U.S. industrial diesel turbocharger market size was exhibited at USD 4.65 billion in 2024 and is projected to be worth around USD 6.64 billion by 2034, growing at a CAGR of 3.62% from 2025 to 2034.

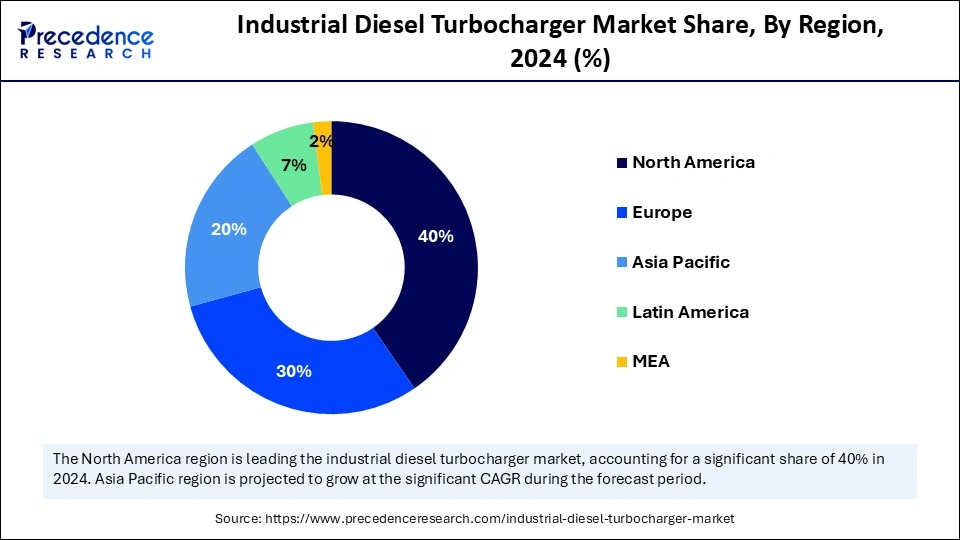

Asia Pacific dominated the industrial diesel turbocharger market in 2024. The growth of the region can be credited to the ongoing urbanization, industrialization, and infrastructure development in emerging economies such as China and India. Furthermore, the growing need for emission-compliant and fuel-efficient engines in the mining, construction, and shipping sectors offers added impetus for market growth.

In Asia Pacific, China dominated the market due to the increasing adoption of innovative turbocharging because of the export of heavy-duty and regulations on the manufacture. The government in China is also implementing new policies to streamline the manufacturing process in the industrial landscapes.

North America is expected to grow at a significant rate over the forecast period. The dominance of the region can be attributed to the increasing demand for efficient turbocharger systems coupled with the region's substantial industrial base. Moreover, growing investments in marine industries and shipbuilding facilities will likely contribute to the market expansion in the region further.

In North America, the U.S. led the market. The dominance of the country is owing to the presence of major organizations such as BorgWarner and Garrett Motion who are expanding their product range with innovative turbocharging technologies, particularly for heavy-duty applications.

Industrial turbochargers play a crucial role in improving engine performance and efficiency. They are essential in fulfilling stringent environmental standards and meeting the increasing demand for fuel-convenient diesel engines across different industries. Market players are emphasizing creating smart solutions that enable better control and management of turbocharger performance, which improves efficiency and also helps in predictive maintenance.

| Report Coverage | Details |

| Market Size by 2034 | USD 21.71 Billion |

| Market Size in 2025 | USD 16.04 Billion |

| Market Size in 2024 | USD 15.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.42% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Engine Type, Component Type, application, Sales Channel and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for fuel efficiency

The major factor driving the growth of the market is the increasing need for fuel economy across many industrial applications. Turbochargers serve a substantial purpose with respect to enhancing the efficiency of these engines. In addition, these features become important to the likes of the agricultural sector and construction industry, which depend on heavy machinery.

Complexity of turbocharger systems

The high cost and technological challenges of turbocharger systems create a substantial hurdle to the market. Innovative turbocharger technologies like twin-scroll systems and variable geometry turbochargers (VGT) necessitate high-grade materials and accurate engineering to ensure performance and durability under harsh conditions.

Increasing demand for electric turbocharger

The automotive industry is rapidly embracing electric vehicle technology, and more advanced models are anticipated to emerge in the market. Government regulations to safeguard the environment are a key factor in revolutionizing the automobile sector. Furthermore, automotive manufacturers are substantially investing in hybrid vehicle technology, creating opportunities in the industrial diesel turbocharger market.

The diesel engines segment led the global industrial diesel turbocharger market in 2024. The dominance of the segment can be linked to the high-power output and enhanced efficiency of diesel engines, which makes them suitable for heavy-duty applications. Also, these engines offer better towing, acceleration, and hauling potential than gasoline engines, impacting the segment's growth positively further.

The internal combustion engine segment is estimated to grow fastest over the forecast period. The growth of the segment is owing to the extensive utilization of these engines in various industrial sectors. However, internal combustion engines offer outstanding durability and drivability. They can also use renewable or alternative fuels such as propane and biodiesel etc.

In 2024, the compressors segment dominated the industrial diesel turbocharger market. The dominance of the segment is due to the essential role of compressors to improve air intake, directly affecting engine power output. Compressors also reduce the risk of electrical shocks better than electrically powered tools also are safe to work in areas with high temperatures and combustive gases.

The turbine segment is expected to grow rapidly over the projected period. The growth of the segment can be credited to the energy recovery ability of turbines, which makes them crucial in enhancing overall fuel efficiency. Furthermore, turbines give electricity without polluting the air or burning any fuel.

The power generation segment dominated the industrial diesel turbocharger market in 2024. The dominance of the segment can be attributed to the increasing need for efficient energy generation solutions due to raised emphasis on sustainable power generation practices and renewable energy transitions. Additionally, sustainable power sources are also gaining traction because of their requirements on a global scale.

The marine application segment is expected to grow at a significant rate over the forecast period. The growth of the segment can be credited to the surge in global trade and the growth of shipping fleets globally, along with the need for efficient power propulsion systems. Moreover, turbocharges are important in marine engines as they have high fuel efficiency and high power output.

The OEM sales segment held the largest industrial diesel turbocharger market share in 2024. The dominance of the segment is owing to the increasing need for original equipment from manufacturers who require turbochargers for their diesel engines.OEMs play an essential role in combining turbochargers into diesel engines during manufacturing, ensuring compliance and performance optimization.

The direct sales segment is expected to grow at the fastest rate over the forecast period. The growth of the segment is owning to its provision of direct access to consumers via manufacturers, ensuring strong relationships and better communication. Direct sales also build strong relationships with customers, which leads to a better understanding of their preferences and needs.

By Engine Type

By Component Type

By Application

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

January 2025

June 2024