January 2025

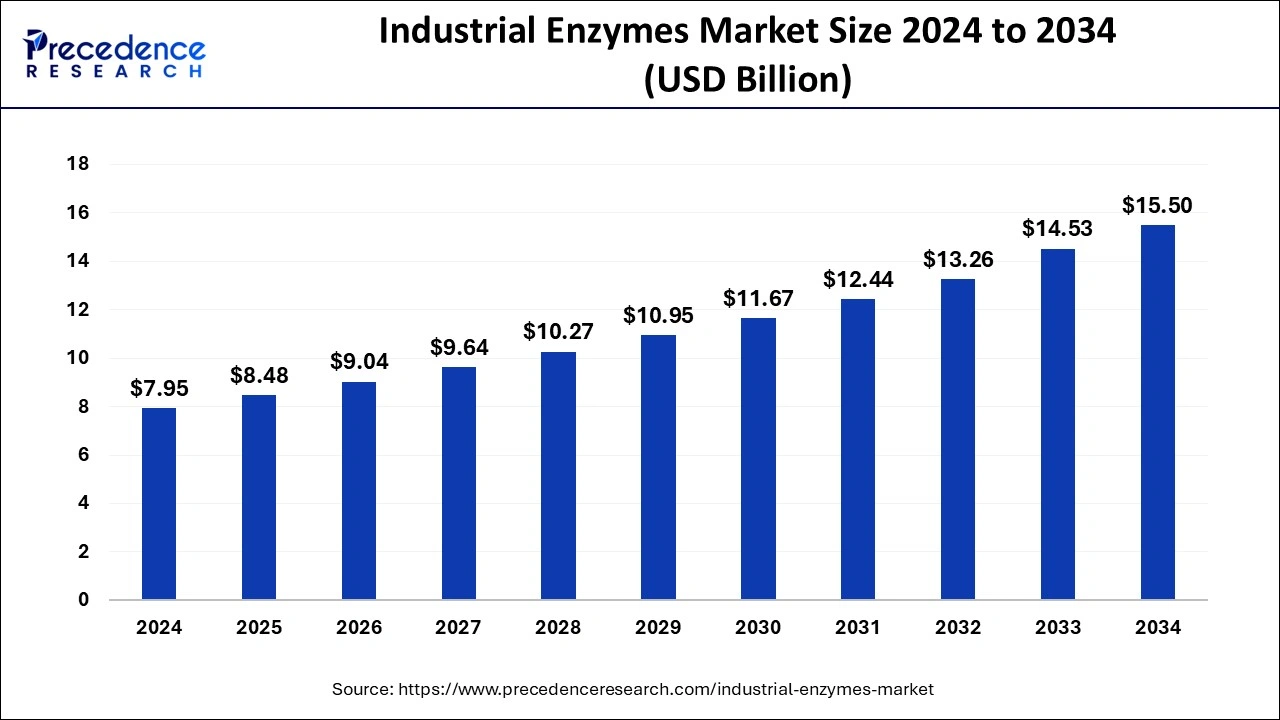

The global industrial enzymes market size estimated at USD 8.48 billion in 2025 and is anticipated to reach around USD 15.50 billion by 2034, expanding at a CAGR of 6.90% from 2025 to 2034. The North America industrial enzymes market size was estimated at USD 2.94 billion in 2024 and is expanding at a CAGR of 6.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial enzymes market size accounted for USD 7.95 billion in 2024 and is predicted to reach around USD 15.50 billion by 2034, growing at a CAGR of 6.90% from 2025 to 2034.

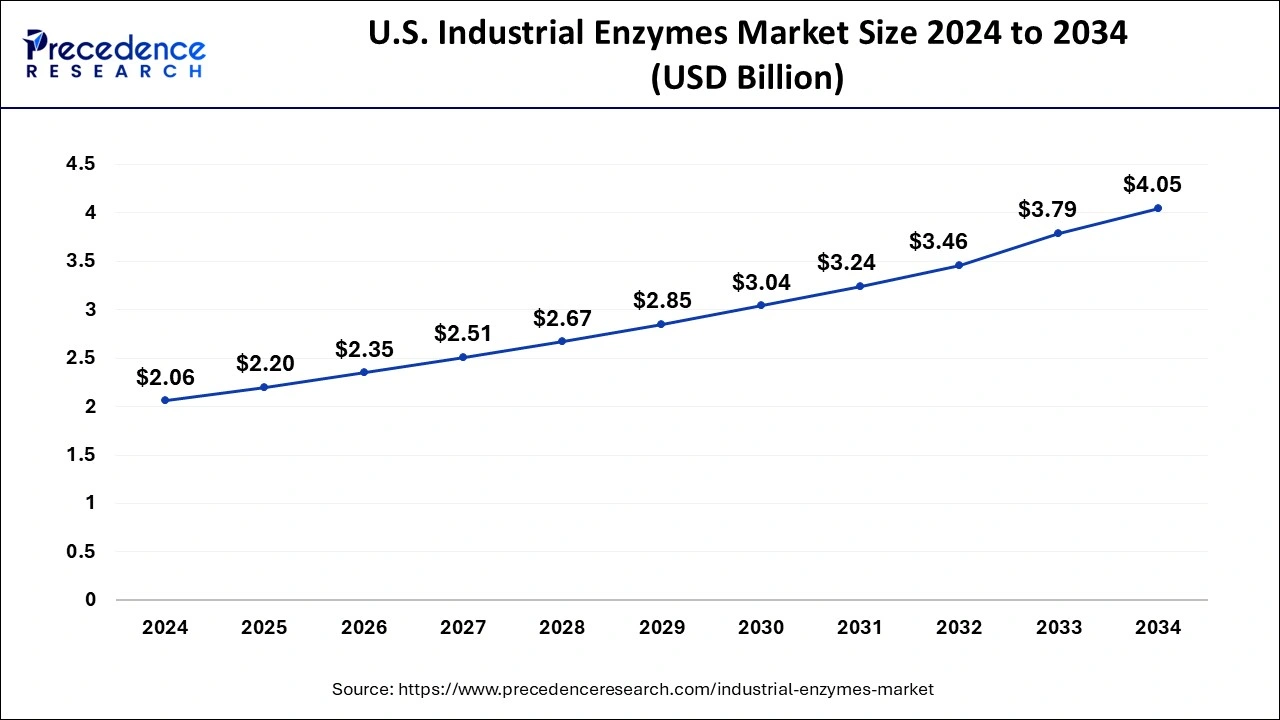

The U.S. industrial enzymes market size reached USD 2.06 billion in 2024 and is projected to grow to USD 4.05 billion by 2034, growing at a CAGR of 7% between 2025 to 2034.

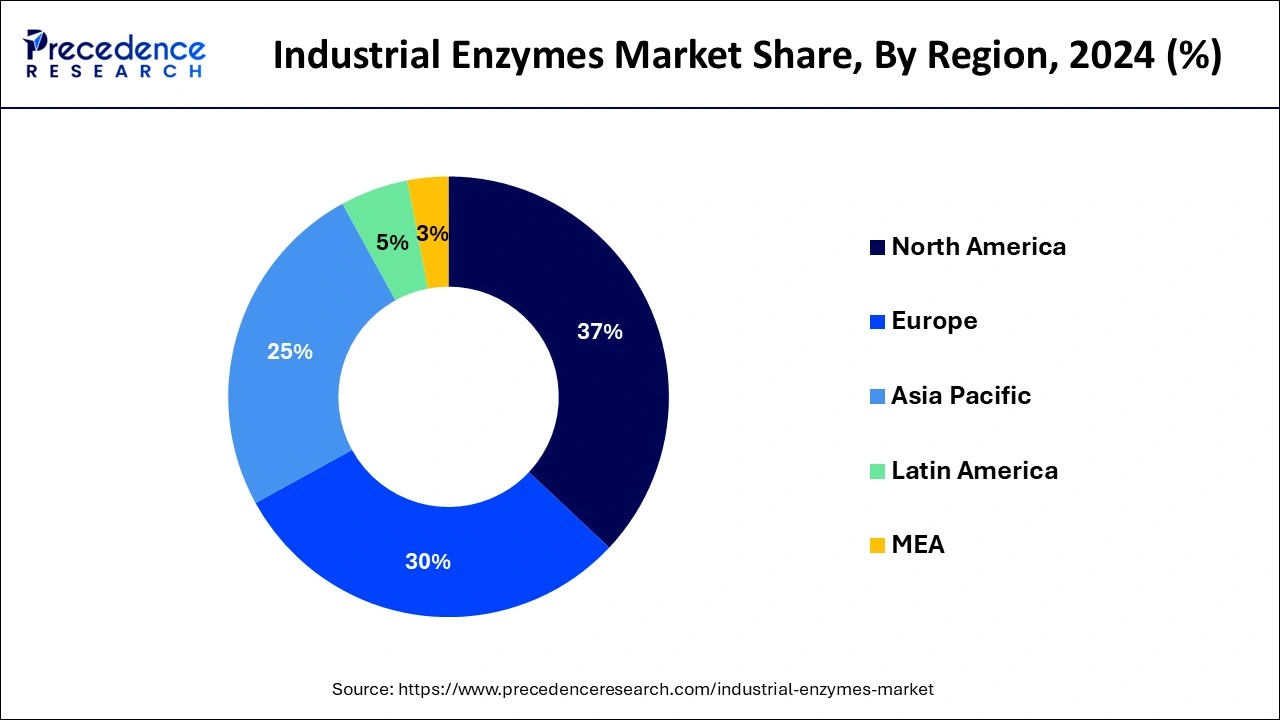

North America leads the market accounting for more than 37% revenue share in 2024 and is anticipated to grow remarkable during the forecast period. Because of the strong presence of several end-use industries, such as food and beverage, pharmaceuticals, laundry detergent, and personal care and cosmetics, as well as the high scope for research and development activities in the region's major countries, North America is a prominent regional market for enzymes.

As one of the primary producers of medicinal, pharmaceutical, and cosmetics products, Europe emerged as the second-largest consumer. The presence of major pharmaceutical and cosmetic businesses such as Novartis AG, Sanofi, Hoffmann-La Roche Ltd., GlaxoSmithKline plc., AstraZeneca, Bayer AG, Novo Nordisk A/S, Merck KgaA, Unilever, New Avon Company, and Henkel AG & Co. in the region is projected to drive enzyme demand.

The region's rapidly growing population and textile industry are likely to fuel the demand for enzymes in textile processing. In addition, Europe is a major producer of automobiles, train coaches, aeronautical equipment, and aircraft. As a result, the region's industrial sector is predicted to increase significantly in the future, boosting product demand for wastewater treatment over the projection period.

Industrial Enzymes market growth is driven by rising product demand from end-use industries such as biofuel, domestic cleaning, animal feed, and food & beverage. The market is expected to be fueled by growing demand for carbohydrase and proteases in food and beverage applications, particularly in Asia Pacific's expanding economies like China, India, and Japan. Furthermore, increased industrialization and improvements in the nutraceutical sector might be ascribed to growth in developed economies. Such factors have boosted product demand significantly.

The need for Industrial Enzymes is predicted to develop in the animal feed and nutraceutical industries, propelling the industry ahead. Furthermore, as consumer awareness of health improves, so does demand for functional foods, which will drive up product demand in the coming years. High sensitivity of enzymes to temperature and pH, as well as item handling security issues, are among the industry's challenges. These variables are expected to have an immediate impact on market growth. The increased usage of their products in a variety of end-use industries, such as food and beverages, animal feed, biofuels, and diagnostics, is expected to benefit key players key players.

Consumers are increasingly demanding higher-quality goods with more natural flavor and taste. As a result of this trend, the necessity for flavored and pleasant processed foods based on industrial enzyme applications arose. These enzymes function as catalysts in metabolic reactions by breaking down vitamins and minerals and converting complex compounds to simpler molecules. These attributes is estimated to fuel the market growth.

| Report Highlights | Details |

| Market Size by 2034 | USD 15.50 Billion |

| Market Size in 2025 | USD 8.48 Billion |

| Market Size in 2024 | USD 7.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.60% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Source, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The carbohydrases product segment leads the industrial enzymes market accounting for more than 48% revenue share in 2024, and is expected to grow significantly during the forecast period. Carbohydrase enzymes are used in a variety of applications, such as pharmaceuticals, animal feed, and food and drinks. Carbohydrases are primarily used as a catalyst for the conversion of carbohydrates, such as fructose and glucose, into sugar syrup, which is then used in the pharmaceutical food, and beverage sectors.

Protease is another well-known product that is used in the food, pharmaceutical, detergent, animal feed, chemical, and photography industries for protein breakdown, catalytic hydrolysis of protein peptides to amino acids, and a variety of other uses. Serine, threonine, cysteine, aspartate, papain, glutamic acid, and metalloproteases are the most common forms of proteases.

Consumer awareness of deteriorating nutrition levels has boosted worldwide protein consumption, which is likely to boost demand for proteases in the food industry during the forecast period. Furthermore, the pharmaceutical, detergent, and chemical end-use sectors are predicted to increase in emerging nations such as China, India, and Brazil, boosting segment growth over the projection period.

Based on the Source, the Industrial Enzymes Market is divided into Plants, Animals, and Microorganisms. The microorganisms source segment has accounted for more than 82% of revenue share in 2024 and is expected to grow significantly during the forecast period. Bacterial, fungal, and yeast enzymes are the three types of microorganism-based enzymes. Phenol oxidases, esterases, and hydrolases are among the industrial enzymes derived from mushrooms. Bacillus is the most common source of bacterial enzymes. Detergents, pharmaceuticals, and the food and beverage industries use the bulk of industrial enzymes. Due to its increasing use in a variety of end-use industries, fungi-based products are a popular choice. Fungal enzymes have a wide range of applications since they are used in the manufacturing and preparation of a wide range of foods, including beer, soy sauce, dairy products, processed fruits, and baked goods.

In addition to fruits and vegetables, industrial enzymes can be found in a variety of foods. Plant-based foods are high in enzymes and can be ingested without the need to be processed or cooked. Bromelain is in high demand since it is utilized as an anti-inflammatory agent, aids in protein digestion, and aids in wound debridement. Plant-based foods are in high demand because they alleviate stress on the small intestine by speeding up digestion.

The pancreas and stomach of cattle and swine are the most common sources of animal-based. These only work within a narrow pH range, rendering them useless in the gastrointestinal tract. In an acidic (low pH level) environment, these enzymes become unsteady, resulting in their death before the required function is completed. As a result, animal-based enzymes are supplied to the body within a protective enteric coating that can withstand stomach acidity.

Based on the Application, the food & beverages application segment leads the industrial enzymes market accounting for more than 23% of revenue share in 2024 and is estimated to grow significantly in the upcoming years. Industrial enzymes are essential in the production of nutrient-dense foods and beverages. Cheese processing, fruit and vegetable processing, fats and oils processing, grain processing, protein processing, and other food processing sectors such as baking, dairy, cereal extraction, and brewing require customized solutions and unique enzyme products. Food and beverage manufacturers can use specialized enzyme solutions to improve the quality of their end goods, increase yield, optimize resources, minimize prices, reduce pollution, and reduce waste.

Amylases, lipases, and proteases are commonly utilized in detergent formulations, making detergents the second-largest application segment. Protease enzymes are most commonly found in laundry detergents. They assist in the removal of protein stains such as grass, blood, eggs, and human perspiration. Amylases are frequently used to remove deposits from starchy foods including spaghetti, mashed potatoes, custards, gravies, oatmeal porridge, and chocolate. Laundry detergents and chlorine-free dishwashing detergents both include these enzymes. Lipases are also commonly used to remove greasy stains such as salad oil, frying fats, butter, lipstick, difficult stains on collars and cuffs, and sauces.

Enzymes are also important in the conversion of cellulosic biomass to cellulosic ethanol. The rising rate of fossil fuel depletion, as well as the growing need for green alternatives is expected to boost demand for biofuels, which will drive product demand over the projection period. Lipases, phospholipases, and cellulases are the most common enzymes employed in the biofuel industry.

Segments Covered in the Report

By Product

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024