April 2025

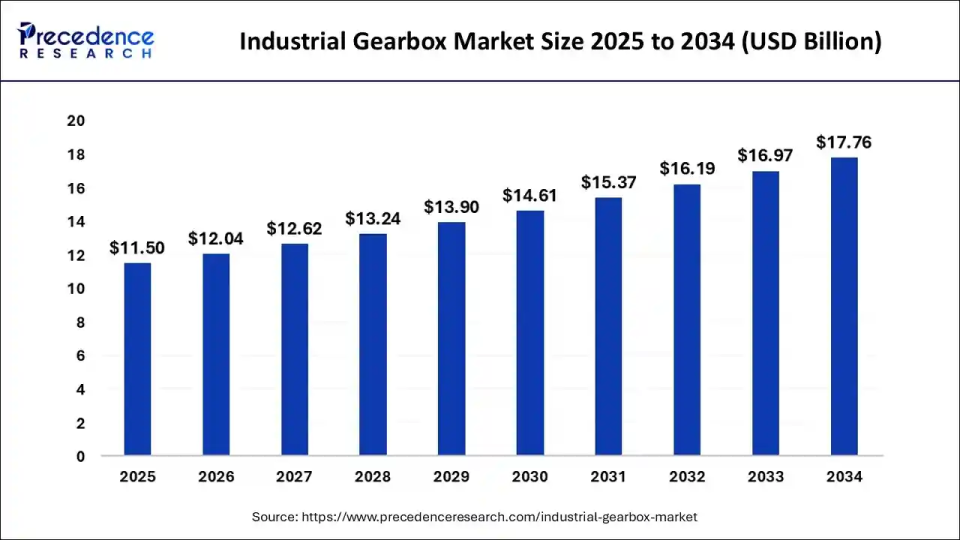

The global industrial gearbox market size is calculated at USD 11.50 billion in 2025 and is forecasted to reach around USD 17.76 billion by 2034, accelerating at a CAGR of 4.87% from 2025 to 2034. The Asia Pacific industrial gearbox market size surpassed USD 4.95 billion in 2025 and is expanding at a CAGR of 5.01% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial gearbox market size was estimated at USD 11.03 billion in 2024 and is anticipated to reach around USD 17.76 billion by 2034, expanding at a CAGR of 4.87% from 2025 to 2034. The rising demand for energy efficient solutions, rapid industrialization and urbanization, development of advanced gearbox technology with increasing investments and the increased focus on non-conventional energy sources such as wind power heavily relying on gearboxes for power transmission are driving the growth of the industrial gearboxes market.

The integration of AI in industrial gearboxes can be applied for predictive maintenance by analysing data from sensors for early fault detection and predicting failures before they occur thereby allowing proactive maintenance interference with minimized downtime. Furthermore, the reduced maintenance costs with improved operation safety, efficiency and dependability by utilizing machine learning algorithms are helping in optimizing industrial gearbox performance for specific applications.

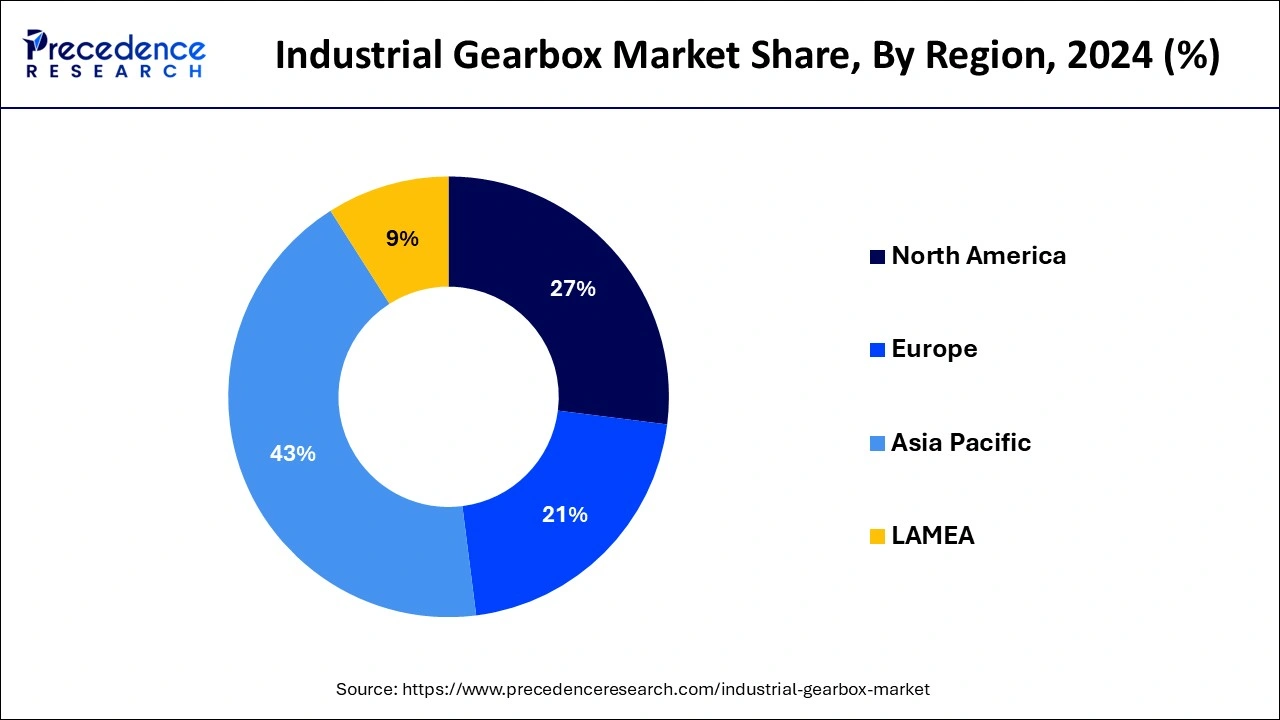

The Asia Pacific industrial gearbox market size was evaluated at USD 4.74 billion in 2024 and is predicted to be worth around USD 7.73 billion by 2034, rising at a CAGR of 5.01% from 2025 to 2034.

Asia-Pacific dominated the global industrial gearbox market with the largest market share of 43% in 2024. China dominated the industrial gearbox market in North America region. The industrial gearbox is widely used in different sectors. In 2020, steel output is expected to increase by 6.5% over the previous year in China. This factor is driving the growth of industrial gearbox market. With 38.6 gigawatts installed wind capacity as of 2020, India is the world’s fourth largest onshore wind market by deployments. The factors such as growing demand for energy, rapid industrialization and urbanization, and rising initiatives for infrastructural development are boosting the growth of industrial gearbox market in Asia-Pacific region.

North America is expected to expand at the fastest CAGR during the forecast period. The U.S. and Canada dominate the industrial gearbox market in North America region. The growing manufacturing sector and the existence of major market players operating in industrial gearbox market are propelling the expansion of industrial gearbox market in the region. In addition, the adoption of innovative technologies for reducing human interference in different industries is also driving the growth of industrial gearbox market in North America region.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.76 Billion |

| Market Size in 2025 | USD 11.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.87% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Design, End User, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The helical industrial gearbox segment dominated the market in 2024. The parallel shafts and winding tooth lines are used in helical industrial gearbox. They have stronger teeth seamlessly blended and are quieter as well as the ability to transmit larger loads, making them ideal for elevated applications.

The planetary industrial gearbox segment is fastest growing segment of the industrial gearbox market in 2020. The planetary industrial gearbox is typically utilized as rotation multipliers. The automatic door openers, motorized wheels, and winches are among the most common applications of planetary industrial gearbox.

The parallel axis segment dominated the industrial gearbox market in 2024. The parallel axis industrial gearbox has simple mechanism for application in various industries. This type of industrial gearbox is highly efficient and runs with small and medium speeds. It is widely used in manufacturing sectors.

The angled axis segment is fastest growing segment of the industrial gearbox market in 2024. The angled axis industrial gearbox is produced at an angle of 90 degrees. The angled axis industrial gearbox is widely used in automotive and mechanical sectors.

The power generation segment dominated the industrial gearbox market in 2024. The surge in demand for energy and power combined with the rising awareness regarding renewable energy are driving the growth of global industrial gearbox market. The industrial gearbox has many benefits such as enhanced radial and axial load and reduced positioning time, which is driving the demand for industrial gearbox for power generation.

The manufacturing industry segment is fastest growing segment of the market in 2024. The developed and underdeveloped countries are progressing at a rapid growth rate in manufacturing industry. The manufacturing or production process of steel and cement requires industrial gearbox. This factor is boosting the global industrial gearbox market expansion.

By Type

By Design

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

December 2024

November 2024