March 2025

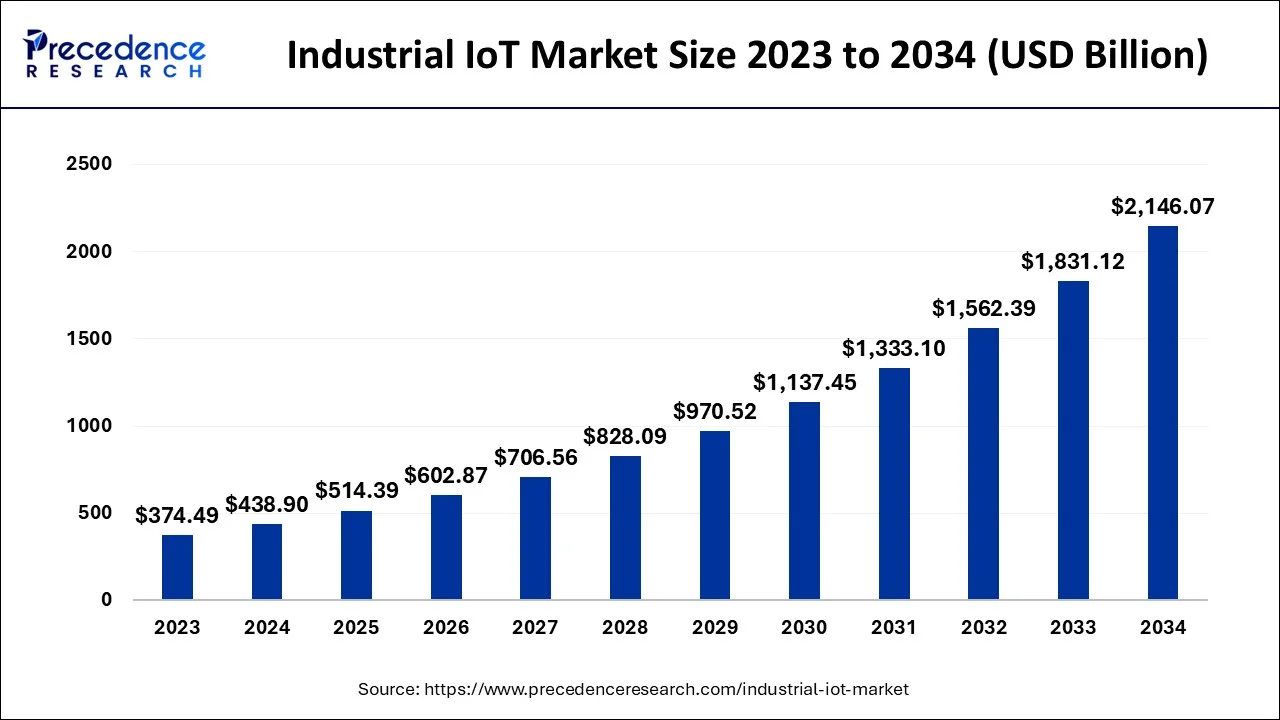

The global industrial IoT market size accounted for USD 438.90 billion in 2024, grew to USD 514.39 billion in 2025 and is predicted to surpass around USD 2146.07 billion by 2034, representing a healthy CAGR of 17.20% between 2024 and 2034. The North America industrial IoT market size is calculated at USD 149.23 billion in 2024 and is expected to grow at a fastest CAGR of 17.36% during the forecast year.

The global industrial IoT market size is estimated at USD 438.90 billion in 2024 and is anticipated to reach around USD 2146.07 billion by 2034, expanding at a CAGR of 17.20% from 2024 to 2034.

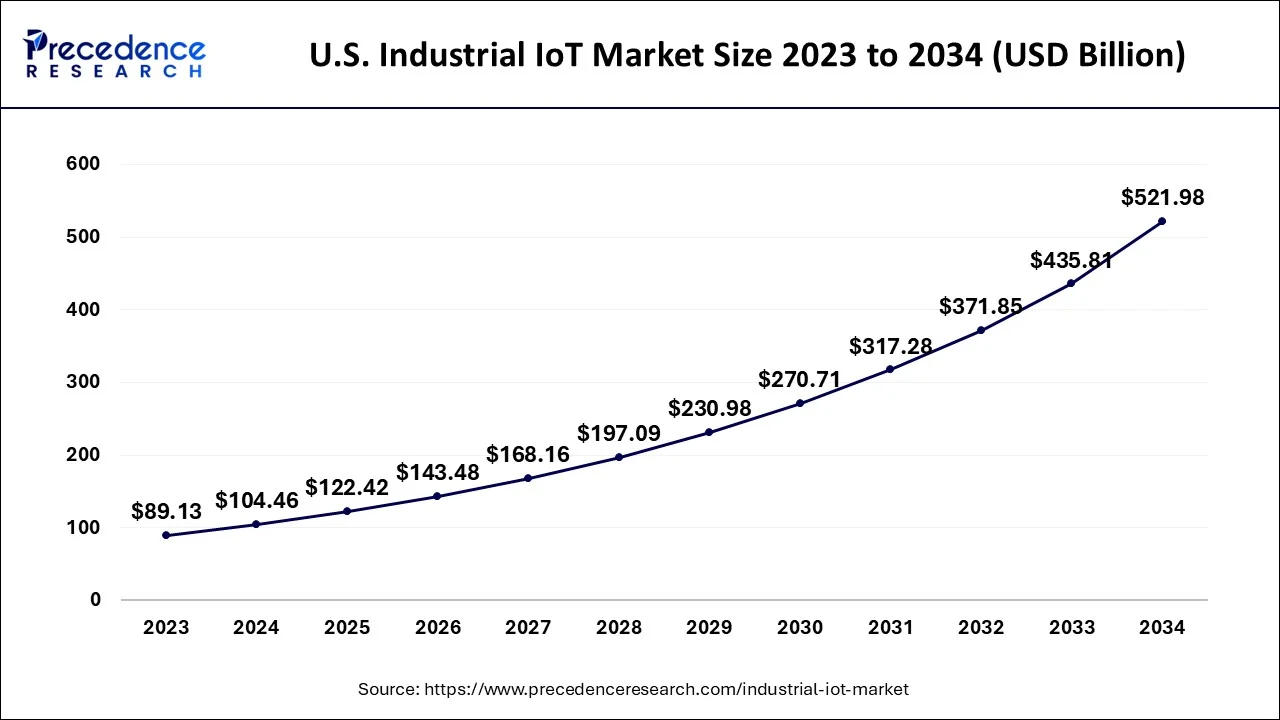

The U.S. industrial IoT market size is evaluated at USD 104.46 billion in 2024 and is predicted to be worth around USD 521.98 billion by 2034, rising at a CAGR of 17.43% from 2024 to 2034.

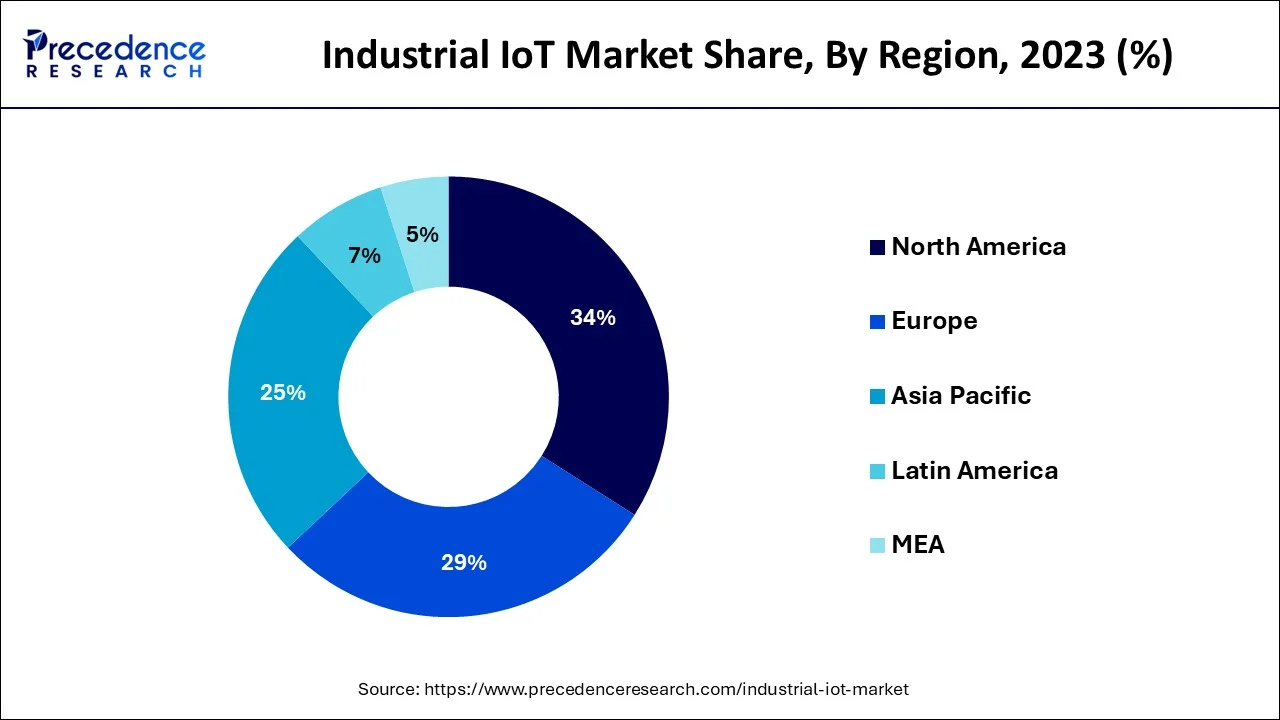

North America dominated the Industrial IoT market in 2023. The U.S. dominated the Industrial IoT market in the North American region. This can be attributed to the increase in IoT spending across countries in the region. For instance, the U.S. spent around USD 421 billion on IoT in 2021. Additionally, the early adoption of IoT across the industrial segment in different countries in the region is further expected to support the market growth during the forecast period. Also, the presence of a large number of well-established market players in the region further supports segmental growth. Besides, an increasing number of new emerging players providing industrial IoT solutions will create lucrative opportunities for market growth in the next few years. For instance, as of 2021, Canada had around 98 companies providing industrial IoT solutions.

On the other hand, APAC, is expected to develop at the fastest rate during the forecast period. Countries in the Asia Pacific region, especially China have emerged as a global manufacturing hubs. Similarly, India is having great opportunities for the manufacturing sector, in terms of availability of land, labor, and machinery at an affordable cost for setting up manufacturing units. As a result of this various companies are expanding in the region. Also, the governments across various countries in the region especially in China and India are providing incentives and relaxations in taxes to various companies expanding in the region, thereby creating opportunities for market growth in the next few years.

In the European market for the internet of things, solutions are accelerating the growth of the market. The UK, Germany, and the Netherlands are leading the European internet of things adoption. Although, Eastern European countries and the Nordics are succeeding thoroughly. The home, finance sectors, health, and manufacturers are accepting the internet of things adoption while enhancing the growth in the retail as well as the agricultural sector. European IoT spending was predicted to reach $ 184 billion in 2023 during the forecast period. Moreover, is expected to reach double-digit growth through 2034.

The Industrial internet of things is generally focused on big data, machine-to-machine communication, and ML to provide better efficiency and reliability to support industries and businesses in their operations. The industrial internet of things offers industrial applications such as software-defined production processes, medical devices, and robotics. Additionally, to increase efficiency and reliability of industries operations, IIoT support in terms of modern industrial workers, industrial internet, advanced predictive, brings together critical assets, and prescriptive analytics. IIoT helps to monitor, analyze, deliver, exchange, and deliver valuable new insights like never before. One of the most significant driving factors to the growth of the global industrial IoT market due to the new insights can support in terms of faster business decision-making for industries and helps to drive smarter.

| Report Coverage | Details |

| Market Size in 2024 | USD 438.90 Billion |

| Market Size by 2034 | USD 2146.07 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End-Use, and Geography |

One of the significant factors driving the growth of the global Industrial IoT market is the increasing awareness related to IoT solutions and widespread adoption of different IoT solutions in various industrial applications such as robotics, medical devices, and software-defined production processes, among others. Industrial IoT has incorporated IoT with a number of industrial processes such as automation, optimization, maintenance, and networking, among others. Industrial IoT helps in providing enterprises and industries to have better efficiency and reliability in their operations. Henceforth, the Industry Internet of things is rising the growth of the market owing to the high level of efficiency, and performance offered by IIoT during operations.

The global Industrial IoT market is expected to benefit significantly from the technological advancements and new product launches in semiconductors and electronic devices. Additionally, the easy availability of low sensors and processors at an affordable cost helps in providing real-time access to the information. This in turn is expected to positively influence the growth of the global industrial IoT market. For instance, according to the CBI Ministry of Foreign Affairs In 2019, nearly 35 % of the internet of things market was estimated to reach due to hardware, 22% from connectivity, 27% from IoT services, and 16% from software.

Another factor driving the growth of the global Industrial IoT market is the growing adoption of artificial intelligence (AI) and IoT in the manufacturing sector. AI and IoT help in the optimization of industrial processes along with providing quality control, forecasting equipment failure, and sending emergency alerts, among others. This has in turn increased investment in AI and IoT in the U.S. In the U.S., private investment in AI reached USD23.6 billion in 2021. This has also increased the use cases of AI and IoT across various industries.

The growth of the global Industrial IoT market is also being driven by supportive government policies, schemes, and initiatives across the globe. Different governments across the globe are focusing on strengthening the company’s capacities for change and competitiveness to cope with the industry 4.0 revolution. The governments are also focusing on improving the skillset and efficiency of the workforce thereby benefiting industrial IoT solution providers.

The industrial 4.0 companies are providing endpoints such as devices, automation, industry machinery OEMs, gateways for IoT automation, cellulars such as AGV/AMR, industrial equipment, sensors, and infrastructure providers are driving the growth of the IIoT market. The Industrial Internet of things rising the growth of the market with the help of new trends including the rising popularity of the IIoT digital twin, the development of an intelligent IIoT Edge, working with persona-based IIoT, improved Functional Safety for IIoT equipment, and addressing the expanded IIoT cyber-attack surface.

Furthermore, several research and development organizations are developing new potential usage of Industrial IoT. Major prominent vendors are investing in research and development for increasing productivity in operations is an important factor for the Industry Internet of Things. Additionally, involving operation technology on the internet could make industries or businesses more feasible. The Industrial Internet of Things opens many opportunities for the convergence of IT and OT. Moreover, many government bodies have also declared their investments in IIoT 4.0. This investment helps business planning to reach the highest proportion of their IT budgets on IoT projects. In August 2019, the South Korean government declared WON 4.7 trillion is investing in innovative sectors nearly up to USD 3.2 billion.

COVID-19 Impact:

The effects of Covid-19 on business and society are yet unprecedented. All over the world healthcare authorities, governments, and business leaders are more focused on protecting live. During the pandemic, various supply and demand have suddenly reduced production volumes and closed operations. Additionally, major key players are also not Investment in research and the development of IoT is continuously declining as well as Manufacturers and industries have faced numerous difficulties as a result of Covid-19. As the pandemic continues to expand across North America and developing Asian nations, the demand for industrial IoT is facing significant difficulties.

Although, industrial IoT has advanced technological devices that increase the productivity and quality of work. The industrial IoT market after post-pandemic gradually increases to overcome with the help of a trending 3D printing for additive manufacturing to sensors and semiconductors and hardware varying from assistive industrial robots. This supports the coordination of factory processes.

Furthermore, Industry 4.0, helps startup companies and major companies to proceed on this journey to overcome the pandemic situation. Industrial leaders have needed to improve and maintain their operations. IIoT support during this crisis to improve business, enhance liquidity, and reduce short-term costs, executed in a plug-and-play mode can be involved in confirming business continuity, reducing economic damage by confirming employee safety and security.

Industrial IoT applies various tactics to increase the power of IIoT in challenging times with the help of strong connectivity and cybersecurity. This help in better visibility within the supply chain as well as industries to respond more rapidly to troubles.

While during the pandemic, the government did the shutdown all over the world, the challenges related to the pandemic that result in 84% of the respondents in the survey accelerated to increase in the adoption of the internet of things.

The solution segment dominated the Industrial IoT market in 2023 since solution providers are focusing on bringing innovative information systems to various end-user industries. The solution providers are putting emphasis on integrating sensors into equipment and machinery to get real-time information and enhance operational efficiencies. Integration and deployment of these solutions across different industries would help in automating the manufacturing processes.

The services segment is the fastest-growing segment of the Industrial IoT market in 2023. The segment’s expansion is aided by the growing number of connected devices which generate voluminous data.

The manufacturing segment dominated the Industrial IoT market in 2023. This can be attributed to the widespread adoption of IoT solutions and digital manufacturing technologies across different manufacturing facilities.

The logistics and transport segment is the fastest-growing segment of the Industrial IoT market in 2023. This can be attributed to the emphasis and focus the logistics and transport service provider companies are putting on the adoption of smart transportation and asset management. Additionally, the use of internet-connected trackers over RFID tags in the logistics industry is further supporting segmental growth.

Industry Internet of things is rising the growth of the market due to the IIoT helps to provide productivity, performance, and effectiveness in industrial companies for power generation, utilities, oil and gas, aviation, manufacturing, and many more firms. Additionally, IoT 4.0 technology is driving the growth of the market with new mergers and acquisitions in the technology sector. On the basis of end-user, technology like AI, big data analytics, machine learning, and sensors are important hotspots across a variety of industry verticals such as fintech, high-tech industrial applications, automotive, and health tech.

The implicating and automating operations signify the largest opportunity for industries spread across the globe. By 2034, approximately $0.4 trillion to $1.7 trillion globally input with the help of IoT technologies in the Work Sites set. Thus, this represents 7% to 14 % of the total industrial potential of the industrial internet of things in 2032. For Instance, construction at 0.12 trillion to $0.84 trillion, oil and gas at $0.15 trillion to $0.54 trillion, and mining at $0.13 trillion to $0.35 trillion.

By Component

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

November 2024

November 2024