April 2025

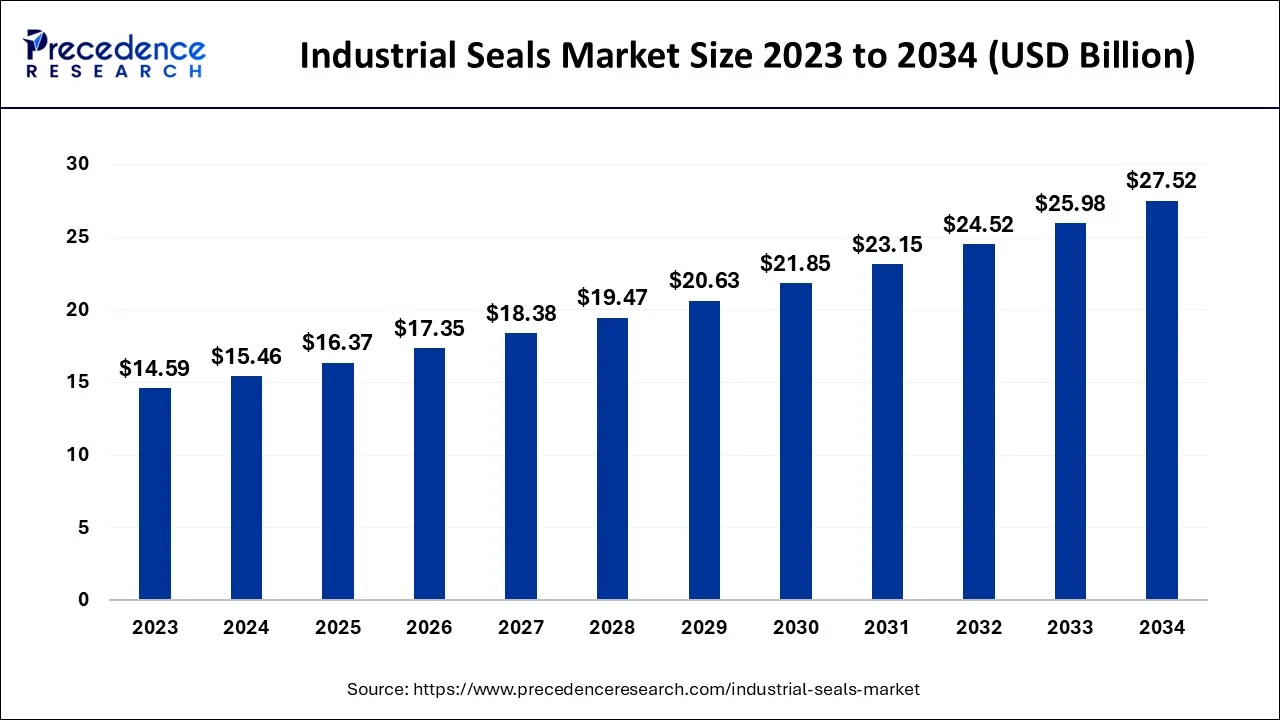

The global industrial seals market size is estimated at USD 15.46 billion in 2024, grew to USD 16.37 billion in 2025 and is predicted to surpass around USD 27.52 billion by 2034, expanding at a CAGR of 5.94% between 2024 and 2034.

The global industrial seals market size accounted for USD 15.46 billion in 2024 and is anticipated to reach around USD 27.52 billion by 2034, expanding at a CAGR of 5.94% between 2024 and 2034.

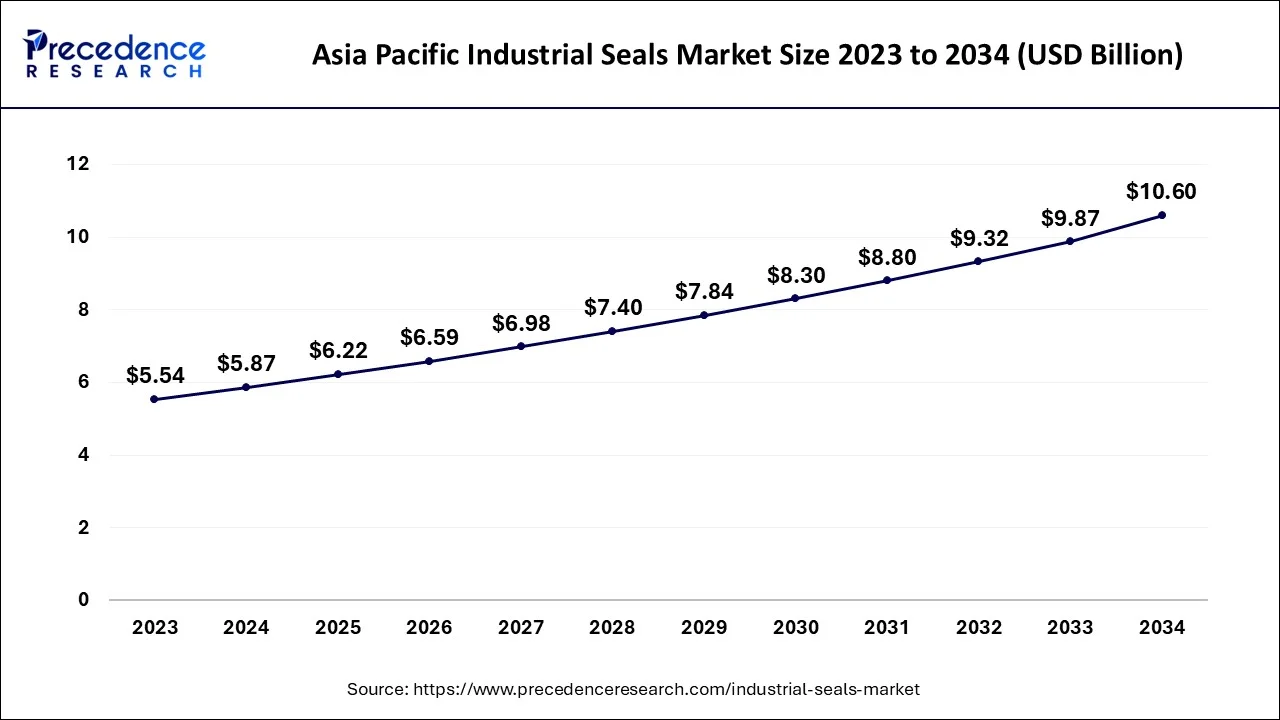

The Asia Pacific industrial seals market size is estimated at USD 5.87 billion in 2024 and is predicted to be worth around USD 10.60 billion by 2034, growing at a CAGR of 6.08% from 2024 to 2034.

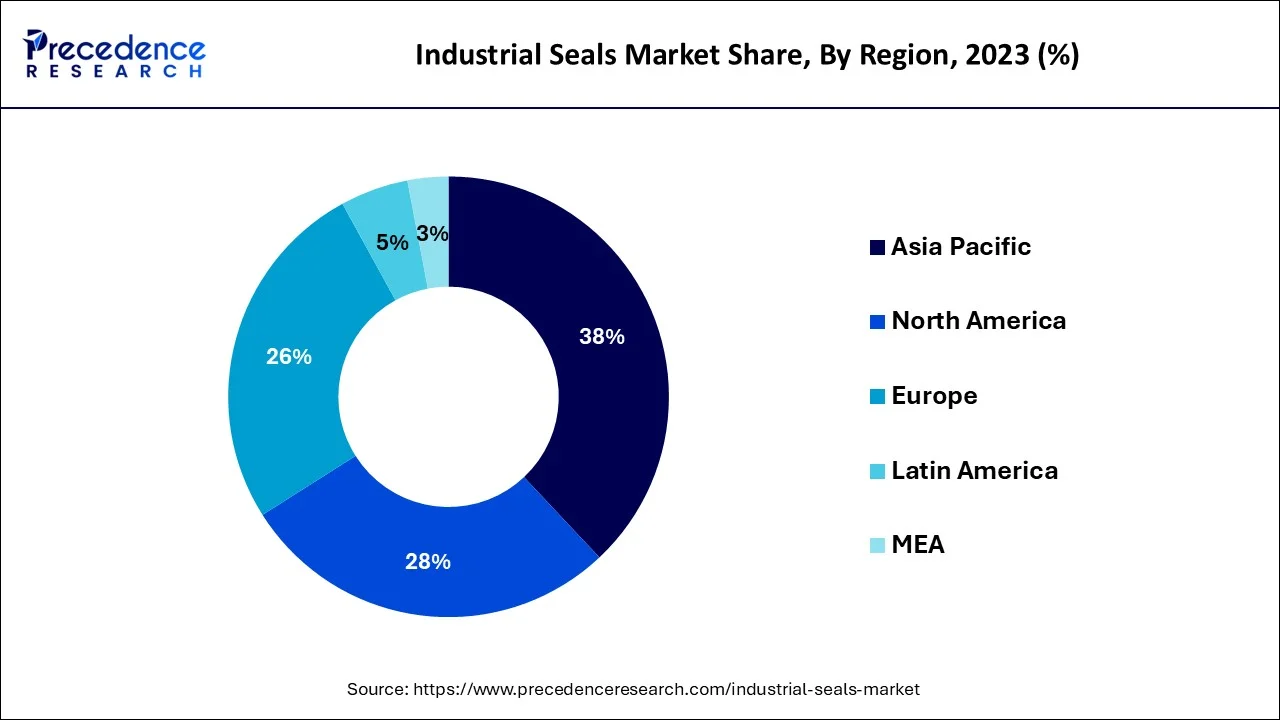

The Asia Pacific is expected to dominate the market during the forecast period. The market size is driven by the presence of major industries, such as manufacturing, automotive, chemical processing, oil and gas, and food and beverage, which require a wide range of sealing solutions. The region's rapid industrialization, economic growth, and increasing investments in infrastructure projects contribute to the growth of the industrial seal market. For instance, for the development of transportation infrastructure, China aimed to construct a 15-year plan in 2021. The nation intends to increase the size of its high-speed rail network by 2035.

Additionally, Beijing intends to increase the length of the country's high-speed rail network by more than 84% from 2020 to 70,000 km (43,500 miles) by 2035. The plan includes requiring the construction of a 25,000 km network of excellent inland waterways, a 460,000 km network of national expressways, and regular highways. The railroad network in China working length, however, expanded to 150,000 km in 2021, up 2.5% from the previous year. Thus, the growing infrastructural projects in the region drive the growth of the industrial seals market over the forecast period.

North America is expected to hold a substantial market share over the forecast period. The market size is influenced by the presence of various industries, including manufacturing, oil and gas, chemicals, automotive, and pharmaceuticals, which have a significant demand for sealing solutions. The region's focus on advanced technology, innovation, and stringent safety regulations drives the growth of the market. The North American region is known for its significant presence in the oil and gas industry, particularly in the United States and Canada. This industry demands high-performance industrial seals for critical applications, including pumps, compressors, valves, pipelines, and refineries.

The exploration and production activities, as well as the shale gas boom, drive the demand for reliable sealing solutions in this sector. For instance, according to the Monthly Crude Oil and Natural Gas Production report, U.S. crude oil output increased by 5.6%, or 0.6 million barrels per day (b/d), from 2021 to 2022, averaging 11.9 million b/d. Texas and New Mexico, the two states that make up the Permian Basin, contributed most to the increase in U.S. crude oil output in 2022. Therefore, driving regional growth.

Industrial seals are devices used to prevent the leakage of fluids, gases, or contaminants in various industrial applications. They are designed to create a barrier between two or more surfaces, such as between two machine parts or between a rotating shaft and its housing, to ensure proper functioning and prevent any loss or contamination of the substances being contained. Seals are typically made from materials that exhibit resistance to the specific substances they will come into contact with, such as rubber, metal, or synthetic materials like PTFE (Polytetrafluoroethylene). The choice of material depends on factors such as the type of fluid or gas being sealed, the operating temperature and pressure, and the environmental conditions of the application. There is a different types of seals used in various industries including O-rings, gaskets, mechanical seals, leap seals and others. The industrial seal market is being driven by various factors such as the growing power industry, increasing product launches, the rising automotive industry, increasing technological advancements and the growing food & beverages industry.

| Report Coverage | Details |

| Market Size in 2024 | USD 15.46 Billion |

| Market Size by 2034 | USD 27.52 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.94% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Material, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing industrialization

The increasing industrialization and infrastructure development across various regions are driving the demand for industrial seals. As more industries are being established and existing facilities are expanding, there is a greater need for reliable sealing solutions to prevent leaks and ensure the smooth operation of machinery and equipment. For instance, according to United Nations Sustainable Development Goals Report 2022, in 2021, the number of manufactured goods produced worldwide increased by 7.2% and surpassed its pre-pandemic level. Global manufacturing value added climbed from 16.2% in 2015 to 16.9% in 2021 as a percentage of total GDP. Thus, the growing industrialization across the globe is expected to drive the growth of the market during the forecast period.

Technological complexity

Industrial seals need to meet stringent performance requirements and operate in diverse and challenging environments and operate in diverse and challenging environments. Designing and manufacturing seals that can withstand high pressures, extreme temperatures, corrosive chemicals, and other demanding conditions can be technologically complex. Developing and producing specialized seals may require substantial research and development investments, limiting the entry of new players and increasing the barriers to innovation.

Technological advancements

The continuous advancements in materials science, manufacturing processes, and seal designs offer opportunities for innovation and improvements in industrial seals. The development of new materials with enhanced properties, such as better resistance to extreme temperatures, chemicals, and wear, opens up new applications and markets. Innovative seal designs that provide superior performance and durability can also gain a competitive advantage. For instance, in July 2022, wheel seals from the Endurance Series have been introduced for commercial vehicles by Amsted Seals, the global leader in wheel-end and sealing solutions. The seal has a special rubber bumper design that gives them a longer service life even under the most adverse conditions. Thus, these type of innovative product launches in the market is expected to offer a lucrative opportunity for market growth over the forecast period.

Based on the type, the global industrial seal market is segmented into axial seals, radial seals and mechanical seals. The radial seals segment is expected to capture the largest revenue share over the forecast period. The growth in the segment is attributed to the wide range of applications of radial seals in various industries including automotive, industrial machinery, aerospace and power generation. Moreover, the growth of this segment is driven by factors such as increased investment in infrastructure projects, rising demand for energy-efficient machinery, and the need for reliable sealing solutions in numerous industries. Additionally, the focus on minimizing environmental impact and compliance with regulations drives the demand for seals that offer low friction, reduced emissions, and sustainable performance. On the other hand, mechanical seals are expected to grow significantly during the forecast period because they are suitable for a range of applications, mechanical seals are the favored sealing technology for most pump manufacturers. Additionally, the benefits offered by these seals such as reduced friction and loss of power, zero product leakage, elimination of excessive wear and others propels the market segment expansion.

Based on the material, the global industrial seal market is segmented into Fiber, Fluorosilicone, PTFE, Rubber and Others. The PTFE segment is expected to hold the largest market share during the forecast period. The growth in the segment is attributed to its advantages such as chemical resistance, low friction, wide temperature range and non-stick characteristics. Moreover, the growing usage of PTFE seals in the food & beverages industry is expected to propel the market growth during the forecast period. These seals are employed in food & beverage processing equipment, ensuring the hygienic and leak-free operation of pumps, mixers, valves, and other components. They offer compliance with food safety regulations and resistance to food ingredients and cleaning agents. Furthermore, the increasing utilization of PTFE seals in the pharmaceutical and medical industry is expected to fuel the segment expansion. These seals are utilized in pharmaceutical and medical applications, such as pharmaceutical processing equipment, medical devices, and laboratory instruments. They offer compatibility with a variety of drugs and fluids and meet stringent quality and regulatory requirements. Thus, the increasing use of PTFE seals in different industries for specific requirements is expected to drive market growth over the forecast period.

Based on the end user, the global industrial seals market is divided into food & beverage, mining, oil & gas, energy & power, aerospace, marine, construction and others. The food & beverage segment held the largest revenue share and is expected to continue the same pattern during the forecast period. The segment growth is driven by the increasing food & beverage production, stringent hygiene and safety regulations and the growing demand for reliable sealing solutions in various processing and packaging applications.

Segments Covered in the Report:

By Type

By Material

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

December 2024