January 2025

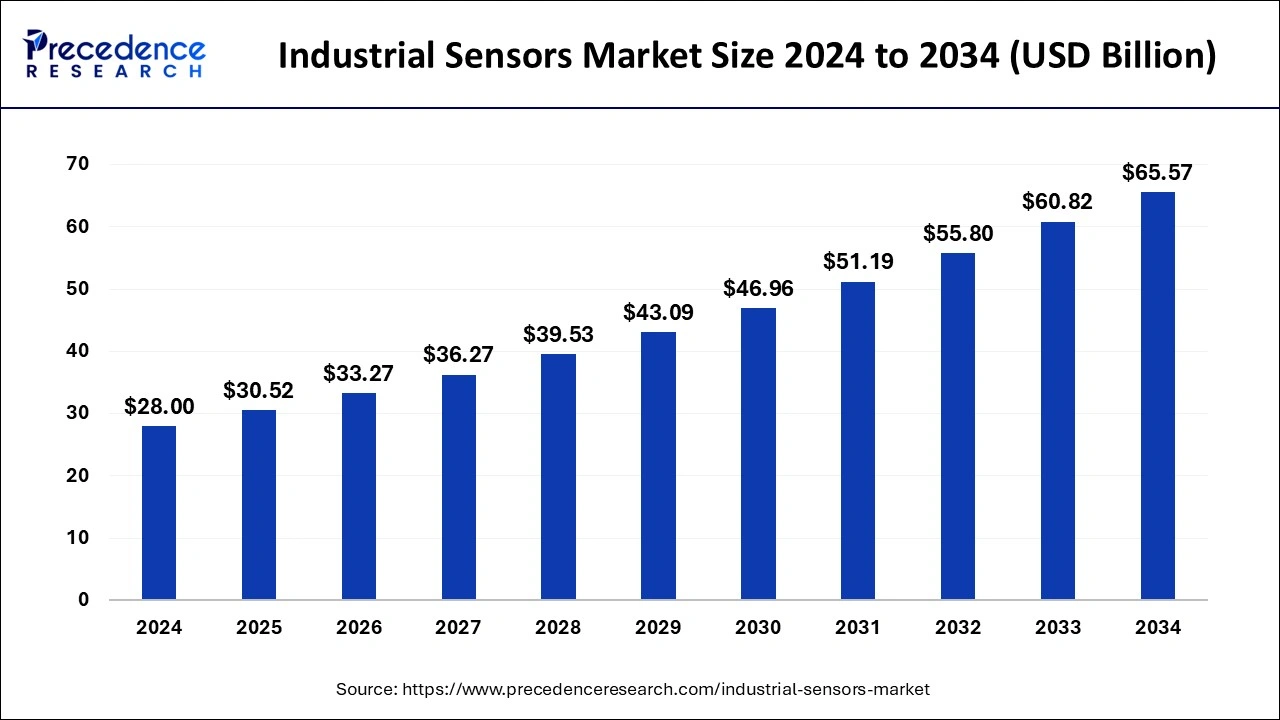

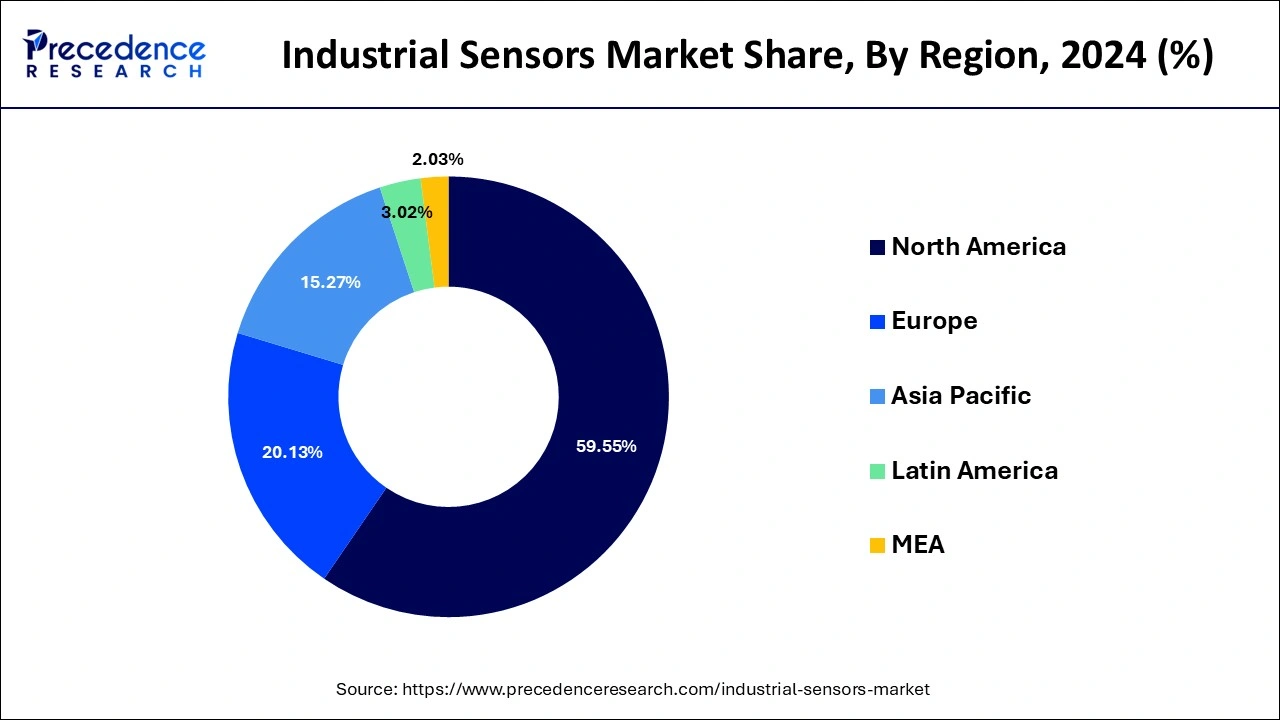

The global industrial sensors market size is accounted at USD 30.52 billion in 2025 and is forecasted to hit around USD 65.57 billion by 2034, representing a CAGR of 8.88% from 2025 to 2034. The North America market size was estimated at USD 16.67 billion in 2024 and is expanding at a CAGR of 8.89% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial sensors market size accounted for USD 28.00 billion in 2024 and is expected to exceed USD 65.57 billion by 2034, growing at a CAGR of 8.88% from 2025 to 2034.

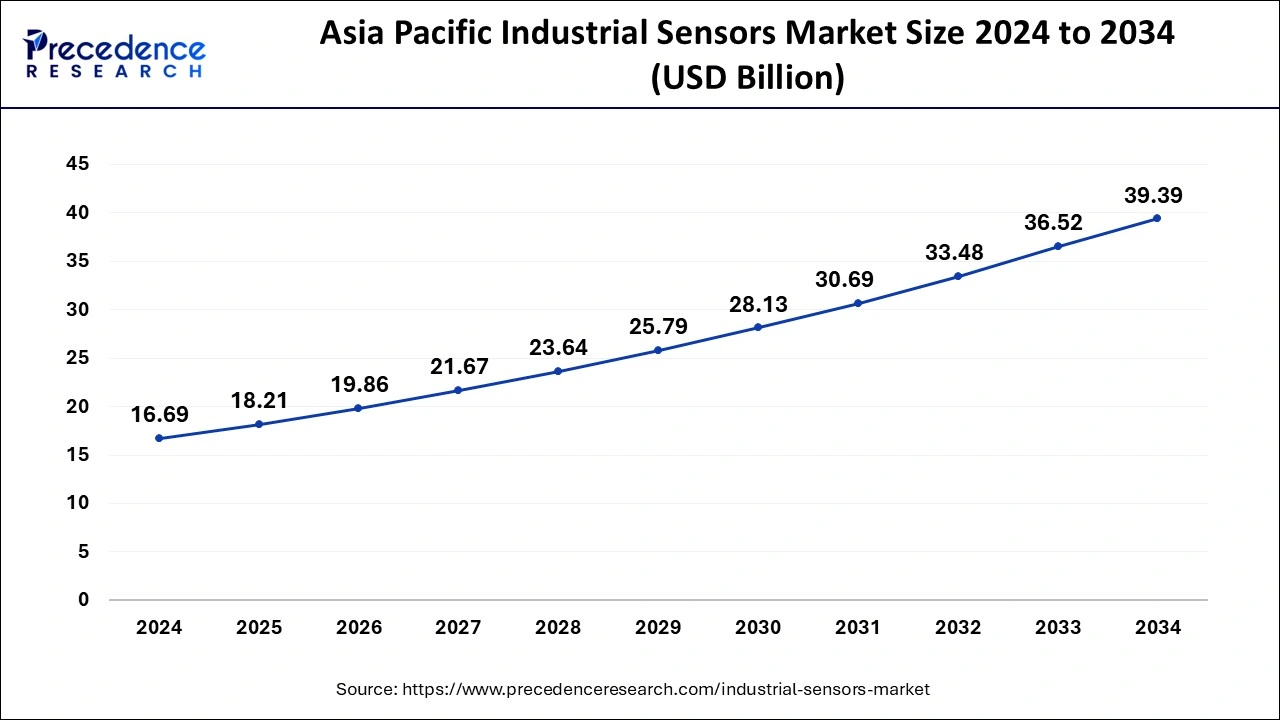

The Asia Pacific industrial sensors market size was exhibited at USD 16.69 billion in 2024 and is projected to be worth around USD 39.39 billion by 2034, growing at a CAGR of 8.97% from 2025 to 2034.

During the anticipated period, particularly in the industrial sensing market is anticipated to occupy the second-largest market. Due to the widespread adoption of Industry 4.0 and the Industrial Web of Things in manufacturing facilities, as well as the existence of sensor producers in the region, particularly in the US, North America is predicted to hold the second-largest market for sensing devices. The US government is implementing several initiatives to advance Industry 4.0 across the nation.

The Nationwide Network for Industrial Innovation is one such initiative. The nation is creating the NNMI as part of this program, which will be made up of regional centers that will hasten the acceptance of slashing production technology for the production of novel products that are competitive on a worldwide scale.

An industry sensor is a tool that detects environmental events or changes and then produces related output. These sensors are crucial to Industry 4.0 and manufacturing automation. Equipment condition is checked using motion detectors and monitoring devices for linear or rotational positioning, leveling, tilt detection, and shocks or accident detection. They react by producing output on a display or sending the information and data for further processing when they detect physical input including temperature, motion, light, wetness, tension, or other entity. These give an overview of the primary uses for artificial illumination energy conservation, environmental control, and hardware fault diagnosis. For almost any industrial need, a wide range of sensors is readily available. Commercial sensors can improve operations for mission-critical commercial processes and offer unrivaled asset protection. Sensor technology and its many uses are always changing to meet new technical developments and commercial demands. Sensors pick up on a variety of physical characteristics, including heat, pressure, and distance. Industrial sensors can also be used to precisely and repeatedly measure a variety of chemical, mechanical, and biological parameters. Because of their dependability, they are widely used in the manufacturing, construction, and healthcare sectors. The Internet of Things, which makes extensive usage sensors, also connects network infrastructure including smart grids, home automation, water-efficient systems, and navigation systems.

Industrial sensors are tools that may identify environmental changes and produce additional signals or outputs as a result. They are able to detect inputs including light, temperature, pressure, heat, voltage, humidity, and motion, and produce outputs on a display screen for sending data for additional processing. Proximity, velocity, capacitive, inductive, photoelectric, and magnetic ultrasonic sensors are a few of the frequently utilized industrial sensors.

They are crucial for machine automation since they help to ensure precise alignment of mechanical parts and give information about how well they are working. As a result, such sensors are widely used in many different industries, including mining for chemicals, petroleum & gas, manufacturing, healthcare, power generation, and water and sewage treatment. One of the main factors boosting the market is the increased digitization and demand for factory automation.

In keeping with this, the widespread use of wireless technology and the expanding desire for increased productivity at industrial facilities have led to an increase in the use of industrial sensors. Such sensors are also being used by businesses to increase productivity, keep an eye on plant assets, diagnose equipment problems, and boost worker safety. Additionally, a large-scale industrial sensing deployment to track flood and sea levels, ecological factors, and energy usage is promoting market expansion. Other growth-promoting elements are being acted upon by numerous technological developments, including the introduction of automation and a Network of Things-enabled sensing devices. These sensors have the ultimate decision, processing software, and on-chip processing capacity, which help to enhance a variety of industrial operations. Additional reasons, such as the growth of Industry 4.0 and intensive research and development programs, are predicted to fuel the market even more.

| Report Coverage | Details |

| Market Size in 2024 | USD 28.00 Billion |

| Market Size in 2025 | USD 30.52 Billion |

| Market Size by 2034 | USD 65.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.88% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sensor Type, Type, and End-User Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

During the anticipated period, the industry sensor market of sensor technology is anticipated to develop at the greatest CAGR. Machine vision applications are what are essentially driving the market expansion for industrial sensor technology. Image sensors are also predicted to play a crucial role in new areas like the Internet of Things, system infrastructure, smart cities, smart manufacturing, smart cars, and intelligent medical devices. Additionally, more and more important biometric techniques—like fingerprint and iris scanning—are using picture sensors. Manufacturing, oil & gas, pharmaceutical, chemical, and energy & electricity are a few sectors that use sensor technology.

The non-contact commercial sensor market is anticipated to expand at the greatest CAGR during the anticipated period. Due to the several benefits, non-contact sensors provide over contact devices, including spontaneity, dependability, lifespan, and performance uniformity, this market is expected to increase. Non-contact sensors are employed in a variety of operations, including process control, engineering, automation, manufacturing, and others, which is fuelling the expansion of this market. The best option for maintaining corrosive media is generally thought to be the non-contact approach. The technique utilized determines the type of sensor. For example, the most popular non-contact level detection systems include ultrasonic, optical, microwave/radar, laser, nuclear, MEMS, capacitance, conductivity, and loading cells. Non-contact thermocouples track temperature changes by using the principles of radiation and convection. They pick up infrared radiation, which is the heat radiation emitted by an object. Infrared and fiber optics thermocouples are examples of non-contact temperature measurements.

During the projection period, the automobile segment is anticipated to develop at the greatest CAGR. This market's expansion is driven by the growing adoption of IoT technology in processing and manufacturing facilities. Additionally, IoT-based automated production sensors enable firms to remotely monitor plant locations, enhance worker & asset security, and maximize operational effectiveness. By accomplishing early fault detection, incorporating these industry sensors into production services helps reduce maintenance expenses.

By Sensor Type

By Type

By End-User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

July 2024

January 2025