January 2025

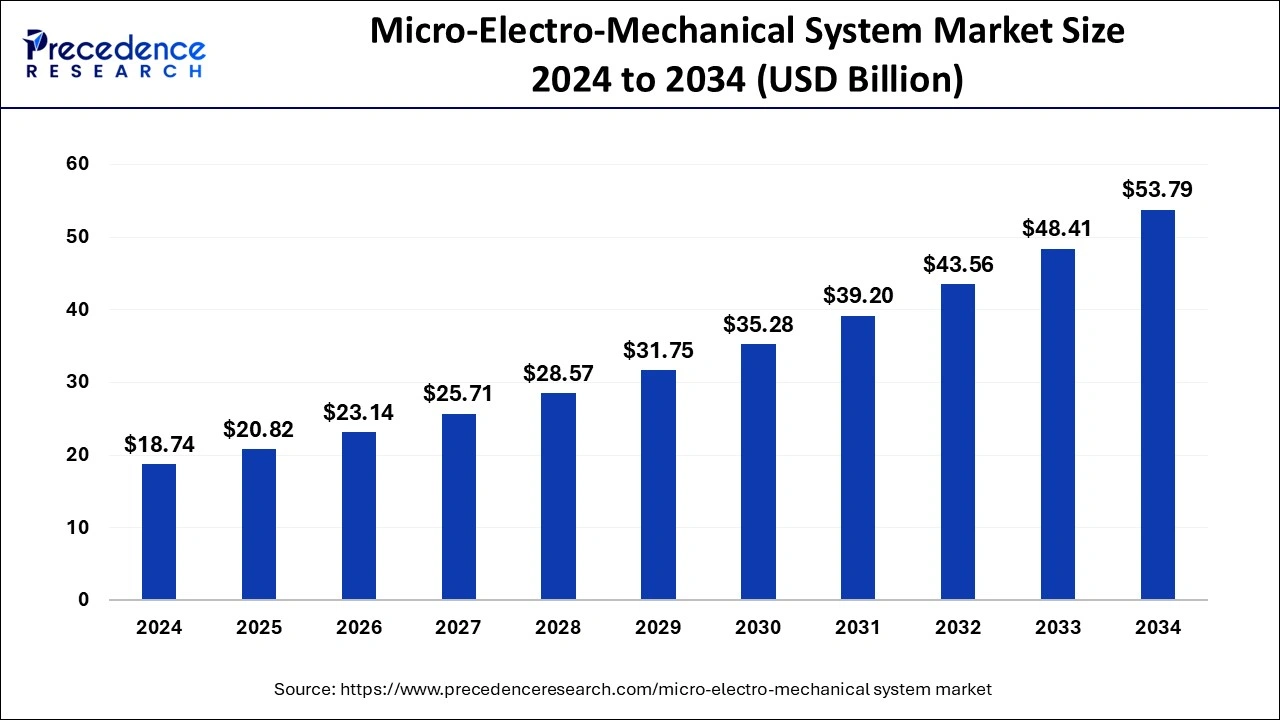

The global micro-electro-mechanical system market size is evaluated at USD 20.82 billion in 2025 and is forecasted to hit around USD 53.79 billion by 2034, growing at a solid CAGR of 11.12% from 2025 to 2034. The North America market size was accounted at USD 676.51 billion in 2024 and is expanding at a CAGR of 11.27% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global micro-electro-mechanical system market size accounted for USD 18.74 billion in 2024 and is expected to exceed around USD 53.79 billion by 2034, growing at a CAGR of 11.12% from 2025 to 2034. The micro-electro-mechanical system market growth is attributed to the increasing demand for miniaturized, energy-efficient sensors and actuators across various industries.

Artificial intelligence in data analysis improves precision and increases the efficiency of operations. The micro-electro-mechanical system market has improved by using AI in various manufacturing industries, such as the healthcare industry, automotive manufacturing industry, and consumer electronics manufacturing industries, due to their important role in using sensors and actuators. In healthcare, they improve MEMS-based diagnosing instruments, making the diagnoses more accurate and faster. MEMS sensors are used in real-time tracking of various patients' conditions, hence enhancing diagnostic results. Moreover, AI integrates MEMS devices with automotive systems, which helps reduce risks and achieve better and more efficient autonomous driving assistance technologies.

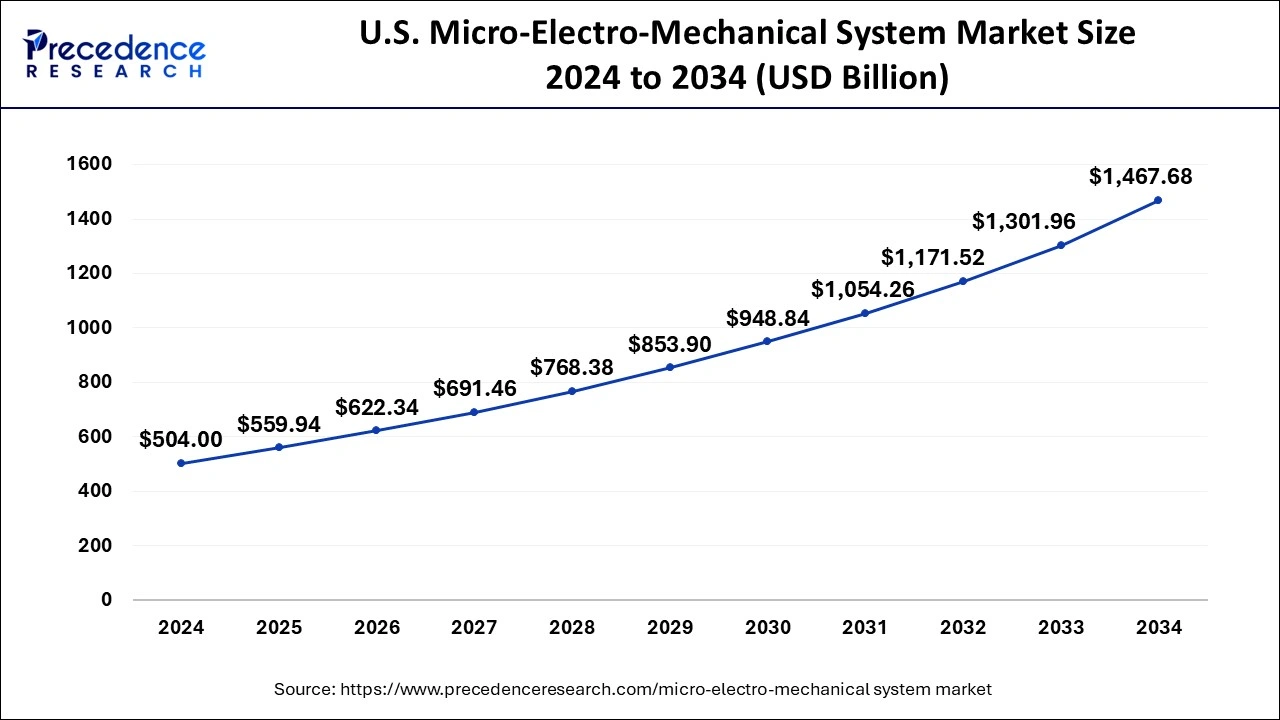

The U.S. micro-electro-mechanical system market size was exhibited at USD 540.00 billion in 2024 and is expected to be worth around USD 1,467.68 billion by 2034, growing at a CAGR of 11.28% from 2025 to 2034.

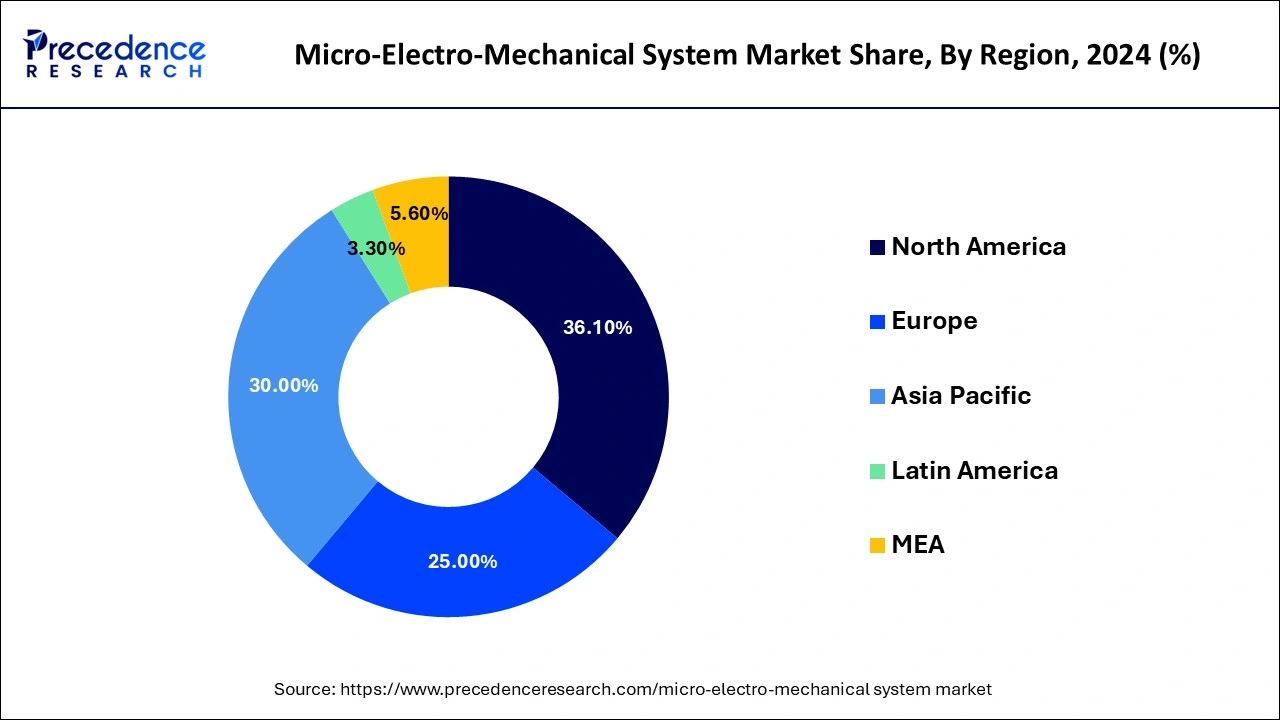

North America dominated the micro-electro-mechanical system market in 2024 due to the advancement of technologies in automotive, healthcare, and telecommunication. Its high concentration in automotive applications, especially in the U.S. and Mexico, is supposed to boost MEMS sensor consumption owing to its importance in self-driving cars and electric cars. Furthermore, the leadership of the North American market, especially in the healthcare and telecommunications sectors.

Asia Pacific is projected to host the fastest-growing micro-electro-mechanical system market in the coming years, owing to the industrialization and new technology networks from countries including China, Japan, and South Korea. It has established itself as one of the leading regions of electronics manufacturing globally, with a special focus on consumer electronics, automobile, and telecommunication industries, where MEMS devices are vital. China’s commitment to moving up the technology value chain and developing advanced semiconductor and MEMS industries, the demand for MEMS sensors and actuators has significantly increased across production sectors.

The micro-electro-mechanical system market is fuelled by the rising usage of IoT devices in various fields. Micro-electro-mechanical system (MEMS) technology combines mechanical and electrical structures, transducers, control circuitry, and actuators on a silicon base, providing solutions for miniaturized, reliable, and low-cost devices. This integration is very important for many IoT applications since the cost of space and power is always a major issue for designers. MEMS sensors have proven to expand the safety aspects of automobiles, optimize energy efficiency, and drive the advancement of ADAS and self-driving technologies. Furthermore, the accelerometers and gyroscopes made using MEMS technology are widely used in ADAS to provide information on the stabilities of the cars and the control systems in operation.

| Report Coverage | Details |

| Market Size by 2024 | USD 18.74 Billion |

| Market Size in 2025 | USD 20.82 Billion |

| Market Size in 2034 | USD 53.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.12% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sensor, Actuator, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption in automotive applications

The growing adoption of the micro-electro-mechanical system market in the automotive sector is anticipated to boost the market in the coming years. MEMS technology, widely adopted in the automotive industry, is the key concern in improving the safety, performance, and connectivity capabilities of vehicles. Micro-electro-mechanical system sensors, comprising accelerometers, gyroscopes, and pressure sensors, are critical components of modern ADAS and autonomous vehicles, providing instant data on the vehicle and driving environment. Such features include, but are not limited to, a collision sensor, adaptive cruise control, and lane-keeping assistance. Automotive applications are also benefiting from stiff safety standards being set by governments across the world.

High manufacturing costs

High manufacturing costs of MEMS devices are expected to impede the growth of the micro-electro-mechanical system market. MEMS technology incorporates photolithography, micro-machining, and etching cost factors and adds to the general cost of production. These processes are not easy and simple, and since they require special materials and are processed in clean rooms, the cost of the MEMS components is relatively high. These high manufacturing costs are expected to inhibit the use of MEMS technology, especially in price-sensitive markets and applications in which price is a major factor in end-product selections.

Demand for MEMS in Internet of Things (IoT) applications

High demand for MEMS in Internet of Things (IoT) applications represents a significant opportunity for the micro-electro-mechanical system market. MEMS sensors are essential in IoT gadgets, enabling action, such as movement sensing, climatic sensing, and measurement. This expansion highlights the increasing demand for low-power MEMS sensors and drivers for IoT systems enabling across various networks.

As the IoT environment broadens, especially in the scope of smart homes, smart cities, and industry, the need for MEMS solutions is likely to increase in various segments. Moreover, improvements in MEMS fabrication processes, such as soft lithography, transfer printing, and 3D integration packaging, have also helped bring MEMS devices to the commercial markets and have also contributed to the increasing stability of these devices, making them viable for use in IoT applications.

The micromachined inertial sensors segment dominated the micro-electro-mechanical system market during the forecasting period due to their application in automobiles, portable electronics, consumer electronics, and industrial uses. These sorts of sensors are used for sensing motion, acceleration, and orientation and are thus must-have components in devices, including smartphones, game consoles, and advanced driver-assistance systems (ADAS). The growth in demand for wearable devices with the additional fitness tracking and navigation capability has increased the demand for inertial sensors.

The optical sensors segment is projected to lead the market in the future years, owing to the increasing usage in telecommunication, medical-related, and environmental fields. These sensors are used mostly in optical communication technology, fiber optic technology, and medical imaging devices for their high accuracy characteristics. Growing concerns about the environment have also made it possible for optical sensors to track the quality of air and features of pollution. Additionally, these sensors are useful in the development of more sophisticated health diagnostic instruments and noninvasive health instruments.

The optical segment held the largest revenue share in the micro-electro-mechanical system market during the forecasting period. Optical microelectromechanical systems are mostly used in optical switches and tunable filters and are vital in telecommunication or data centers as well as most networking equipment. They allow the design of high-speed integrated optical devices that offer superior performance and low energy consumption due to well-defined light signal control. Pursuing the adoption of 5G systems and fiber optic communication systems increases the need for enhanced optical solutions in the form of optical MEMS.

Radiofrequency sub-segment is projected to lead the market in the coming years. Low power consumption, high performance, and size compatibility also make the RF MEMS suitable for integration into portable devices. The progressive developments in wireless communication technology, especially with the growth of 5G, clearly place RF MEMS on the trajectory of growth due to the increasing demands for high-speed frequency systems.

The automotive segment dominated the micro-electro-mechanical system market due to the rising use of MEMS sensors in automobiles. Small, lightweight, low-power MEMS devices, including accelerometers, gyroscopes, and pressure sensors, are used to monitor the vehicle dynamics to help safety features, including collision detection, adaptive cruise control, and lane departure systems. EVs and autonomous driving technologies require high-quality MEMS sensors to meet all the requirements of highly sophisticated systems. Furthermore, the increased spending on improving the vehicle’s performance, safety, and integrated communication systems further facilitates the market.

The healthcare sub-segment is projected to lead the micro-electro-mechanical system market in the coming years, owing to the growing need for tiny, precise medical instruments. MEMS sensors are finding their application in medical diagnostics, patient monitoring systems, drug delivery systems, and wearable health care devices. These sensors guarantee non-invasive methods, great accuracy, and continuous measurement, which are essential in today’s health care. Moreover, membrane electronics and Nanogap technology have raised the demand for MEMS in healthcare sectors due to increased chronic disease cases, the aging population, and the increased use of personalized medicine.

By Sensor

By Actuator

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

October 2023