January 2025

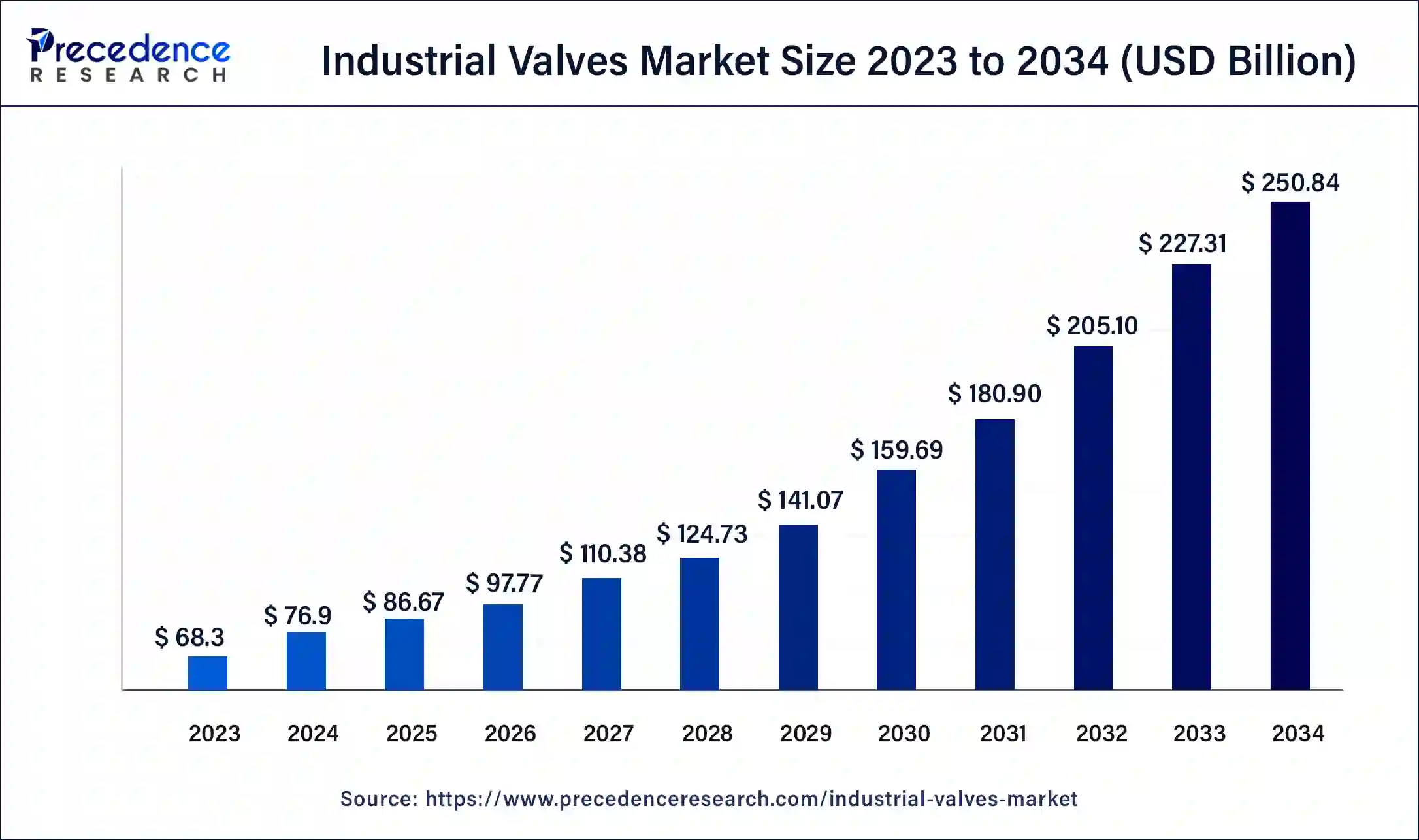

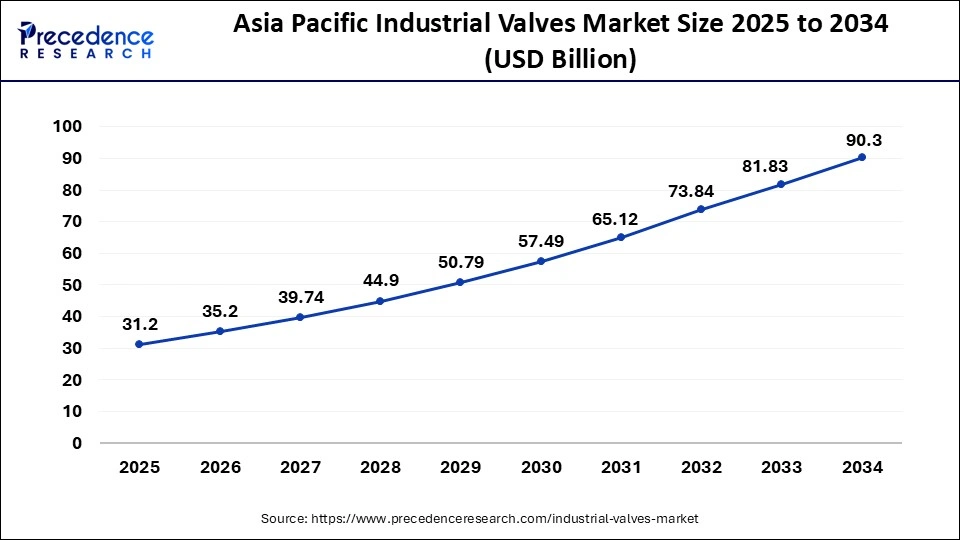

The global industrial valves market size is calculated at USD 86.67 billion in 2025 and is predicted to reach around USD 250.84 billion by 2034, accelerating at a CAGR of 12.55% from 2025 to 2034. The Asia Pacific industrial valves market size surpassed USD 31.20 billion in 2025 and is expanding at a CAGR of 12.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial valves market size was estimated at USD 76.90 billion in 2024 and is predicted to increase from USD 86.67 billion in 2025 to approximately USD 250.84 billion by 2034, expanding at a CAGR of 12.55% from 2025 to 2034.

The Asia Pacific industrial valves market size was estimated at USD 27.68 billion in 2024 and is predicted to be worth around USD 90.30 billion by 2034, at a CAGR of 12.58% from 2025 to 2034.

In 2024, Asia Pacific dominated the global industrial valves market owing to booming consumption of chemicals coupled with escalating construction activities. Furthermore, the region witnesses the capacity expansions of petroleum refining plants along with the construction of new nuclear power stations that again fuel the demand for industrial valves in the region.

On the other side, North America exhibits the fastest growth over the analysis period owing to the replacement of inefficient and old valves with more efficient industrial valves for gas transportation. Further, increasing production of shale gas and oil sands offers huge growth potential for the market across this region. The region witnesses a revolution in the oil & gas sector with rising investment in the sector to transform the old pipelines into smarter along with the deployment of new pipelines.

Implementation of automation in the control valves owing to increasing emphasis on precise monitoring is a key factor that drives the industrial valve market growth. Control valve uses a valve positioner that convert the electrical signal into pneumatic signal for controlling the actuator of the valve. Thus, automation in the valve positioner provides more reliability, reduced energy consumption, and high efficiency. Besides this, oil & gas industry is one of the largest consumers of industrial valve that uses industrial valve in upstream, midstream, and downstream process applications. Rising demand of pipeline monitoring in the oil & gas stream expected to fuel the growth of automated industrial valves.

Moreover, with the outbreak of corona virus the application of industrial valves in medical and healthcare industry has significantly fostered as it plays an important role in the manufacturing of various types of medical devices. To overcome the pandemic situation many industry players have grabbed the opportunity to fight against the deadly virus, thus the market seeks a spike in the production of critical medical devices to cure the patients suffering from the virus.

On the other hand, lack of global standard and norms in the manufacturing process of valves are restrict the market growth. Policies and certifications related to industrial valves differ by regions this creates diversity in the demand of industrial valves due to its wide range of applications in different industries that include food & beverages, oil & gas, chemicals, energy & power, pharmaceuticals, building & construction, water & wastewater treatment, and pulp & paper. This diversity in the product offering creates difficulty for the valve manufacturers to attain an ideal cost of installation, thereby restricts the market growth.

| Report Highlights | Details |

| Market Size in 2024 | USD 76.90 Billion |

| Market Size in 2025 | USD 86.67 Billion |

| Market Size by 2034 | USD 250.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.55% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Valve Type, By Material Type, and By Application Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Steel industrial valves garnered the maximum revenue share in the global industrial valve market in 2024. Presently, increasing demand for high-quality valves in pharmaceuticals, chemicals, food & beverages, and metals & mining industries to reduce the threat of contamination fuels the demand for steel valves and a similar trend of steel materials in industrial valve expected to be observed during the analysis period.

Stainless steel is tougher than other valve materials that include brass, ductile iron, cast iron, and copper pertaining to temperature tolerance and pressure rating. Thus, the demand of stainless steel valve is likely to witness high demand in water & wastewater treatment plants owing to their longer-lasting nature. In addition, they can withstand harsh chemicals, temperatures, and pressures coupled with hard water conditions due to its corrosion resistance quality.

Oil & gas sector accounted for the largest market value share in the year 2024 pertaining to increasing demand of energy along with flourishing growth of transportation sector. Further, rising drilling activities in the gulf countries also primarily boosts the growth of the segment. In addition, rising demand for longer pipelines, deeper wells, and lower production costs coupled with the technological enhancement in production, processing, and transportation have positively influenced the industrial valves market growth. Increasing pipeline installation and rising need for controlling & monitoring them from a centralized location propel the demand for smart valves in the oil & gas industry.

However, water & wastewater application encountered the fastest growth close to 6% over the forecast period. Increasing need for waste water treatment plants and need for isolating the equipment & pumps predicted to trigger the demand of industrial valves in the segment.

By Valve

By Material

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

November 2024